In response to the increasingly volatile geopolitical landscape that has rattled global markets in recent months, we are proud to announce the launch of our Real-Time Geopolitical Insights & AI Market Sentiment Analysis Dashboard. This free, publicly available resource represents a significant leap forward in our mission to make institutional-grade market intelligence easily accessible.

What becomes immediately apparent when examining today’s markets is the stark impact of geopolitical events on asset prices. Trade tensions, policy shifts, and regional conflicts create ripple effects that traditional analysis often struggles to quantify. Our new dashboard bridges this critical gap, providing traders and portfolio managers with a clear window into how these developments are influencing market sentiment across multiple asset classes.

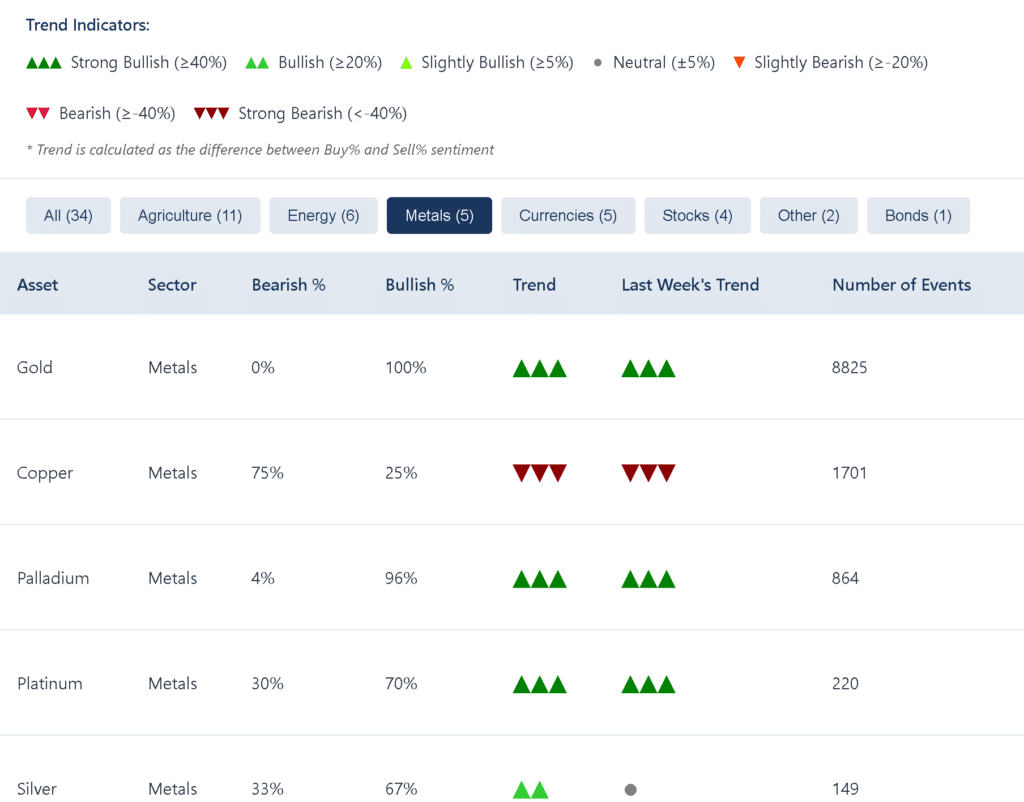

Above: Metals market sentiment table from our Real-Time Geopolitical Insights & AI Market Sentiment Dashboard showing contrast between precious metals and industrial metals

Continuous market sentiment analysis in a volatile environment

Our system continuously monitors geopolitical developments including tariffs, sanctions and wars, processing vast amounts of data from thousands of sources with updates every 15 minutes. Through intuitive visualisations and sentiment analysis, our dashboard transforms complex global events into actionable and easily digestible trading intelligence.

“We’re witnessing a new wave of geopolitical dynamics coming from key economic players,” explains Wilson Chan, our Founder and CEO. “Our system has been specifically designed to help traders navigate through these events with confidence. As trade tensions escalate and policy shifts create market volatility, we’re providing an essential tool that transforms complex geopolitical developments into clear, actionable intelligence for market participants.”

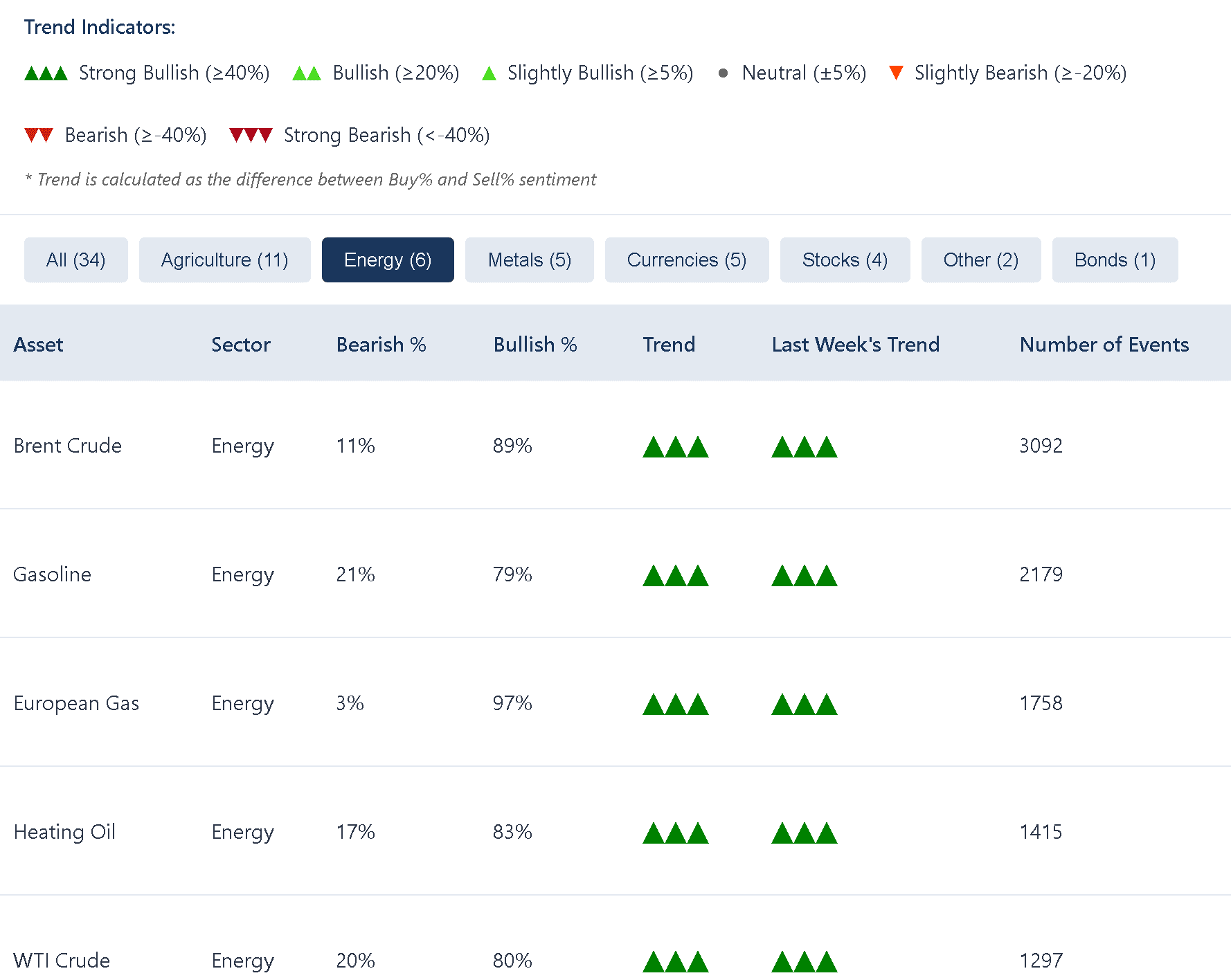

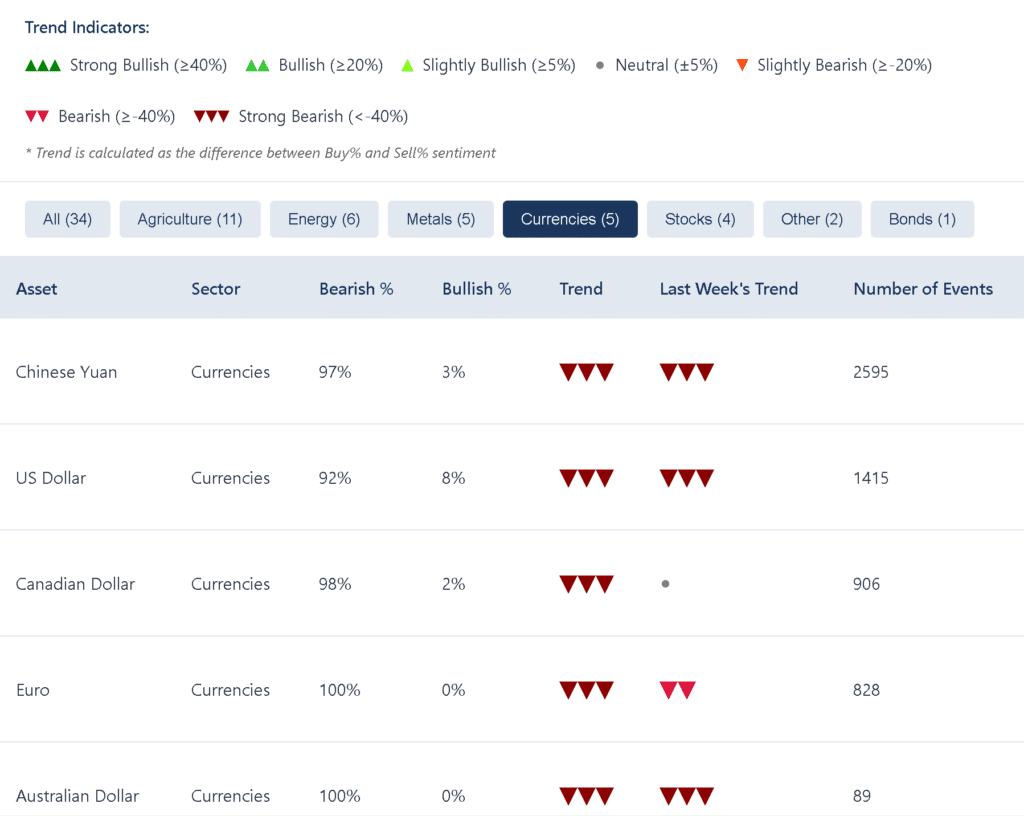

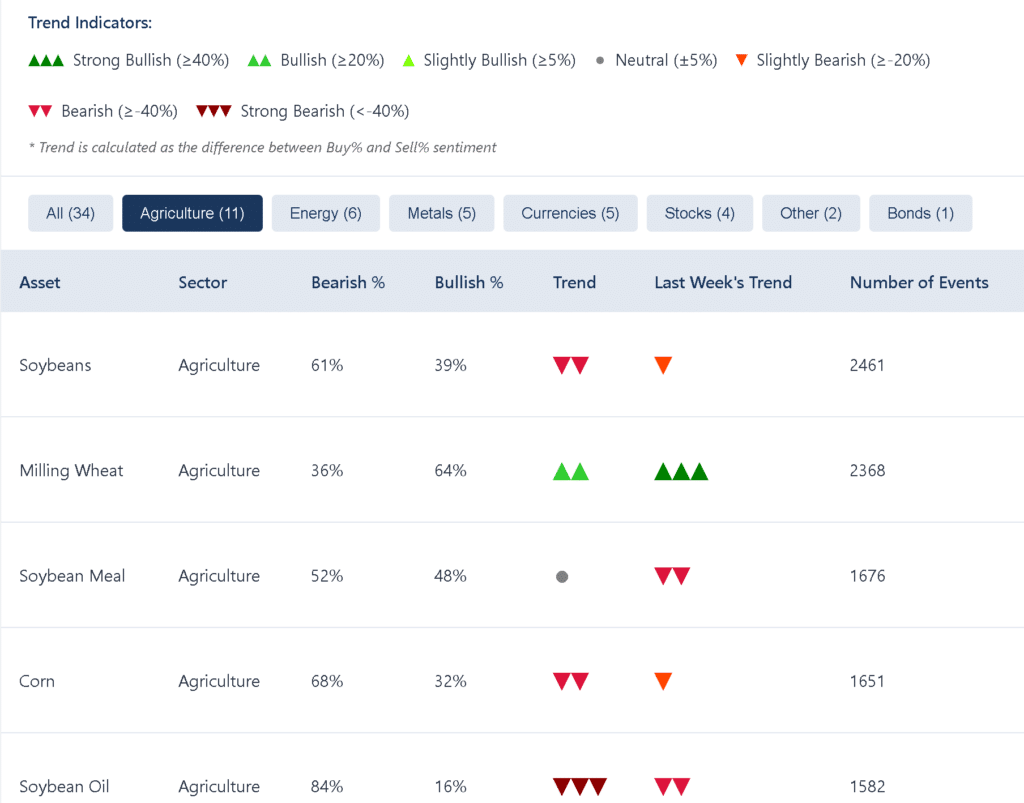

Indeed, the rapid evolution of global trade relationships demands a similarly responsive analysis toolkit. With this in mind, our dashboard’s geopolitical pressure indicators provide users with clear trend signals ranging from strong bullish to strong bearish, calculated as the difference between buy and sell sentiment.

Above: Currency market sentiment table from our Real-Time Geopolitical Insights & AI Market Sentiment Dashboard showing strong bearish trends across all major currencies

Cross-asset geopolitical insights at your fingertips

The uniform variation in sentiment across different asset classes tells a compelling story about how various sectors of the global economy are being impacted by current geopolitical developments. Our dashboard captures these nuances through:

- Real-time tracking of geopolitical events with impact assessment across multiple asset classes

- Easy-to-digest sentiment analysis of currencies, energy, agricultural and precious metals commodities, US bonds, Bitcoin and select equities with clear trend indicators

- Country-specific event distribution analysis to identify regional market drivers

- Tracking of political developments affecting Ukraine, China, and US trade relations

Our comprehensive monitoring and automated analysis enables traders to identify potential hedging strategies that pair exposed assets with those that have historically benefited during similar geopolitical scenarios.

“Our Real-Time Geopolitical Insights & AI Market Sentiment Analysis Dashboard represents a complete reimagining of how institutional market participants can leverage LLMs for market intelligence,” adds our CEO Wilson. “By fully automating geopolitical analysis that previously required dedicated research teams, we’re providing easy access to institutional-grade insights that drive more informed investment and trading decisions.”

Above: Agricultural market sentiment table from our Real-Time Geopolitical Insights & AI Market Sentiment Dashboard showing mixed trends

From geopolitical insights to action

The clear sectoral divergences revealed by our sentiment analysis highlight the importance of nuanced, cross-asset approaches to managing geopolitical risk exposure. Rather than making binary “risk-on” or “risk-off” decisions, sophisticated investors should consider how different types of geopolitical developments might impact various asset classes differently.

As geopolitical developments continue to unfold, the sentiment indicators on our dashboard will continuously shift, providing early signals of changing market assessment of risks and opportunities. By monitoring these shifts across different asset classes simultaneously, investors can gain deeper insights into evolving geopolitical risk exposure than would be possible from following any single market in isolation.

Experience the future of geopolitical market intelligence

Don’t let geopolitical uncertainty dictate your investment outcomes. Take control with our data-driven insights that transform complexity into clarity. Our newly released Geopolitical Insights Dashboard is available immediately at www.visuals.permutable.ai/geopolitics.

For more granular market insights, portfolio managers, hedge funds, institutional trading desks, and investment firms can schedule a personalised demonstration of our Trading Co-Pilot, from which the data featured within the dashboard is sourced. If you’d like to find out more, get in touch with us at enquiries@permutable.ai or simply fill in the form below.