In today’s increasingly interconnected yet fractious global economy, the impact of tariffs extends far beyond the targeted industries, creating ripple effects that reshape entire market ecosystems. Our real-time Geopolitical Market Sentiment Dashboard, which updates every 15 minutes, is currently capturing these seismic shifts with striking clarity. Our data reveals some fascinating patterns that merit closer examination, particularly in how tariff announcements and implementations are affecting various asset classes differently.

Fact: We’re witnessing a new wave of geopolitical dynamics coming from key economic players, with tariff policies at the forefront of market-moving events. The challenge we consistently hear from traders, analysts and risk managers is distinguishing between short-term noise and genuine market drivers, especially with tariff announcements creating significant statistical noise in the markets.

Here, our Trading Co-Pilot has the ability to isolate news fade patterns has been particularly valuable in this context, identifying when markets have already priced in tariff threats versus when they respond more strongly to actual implementations.

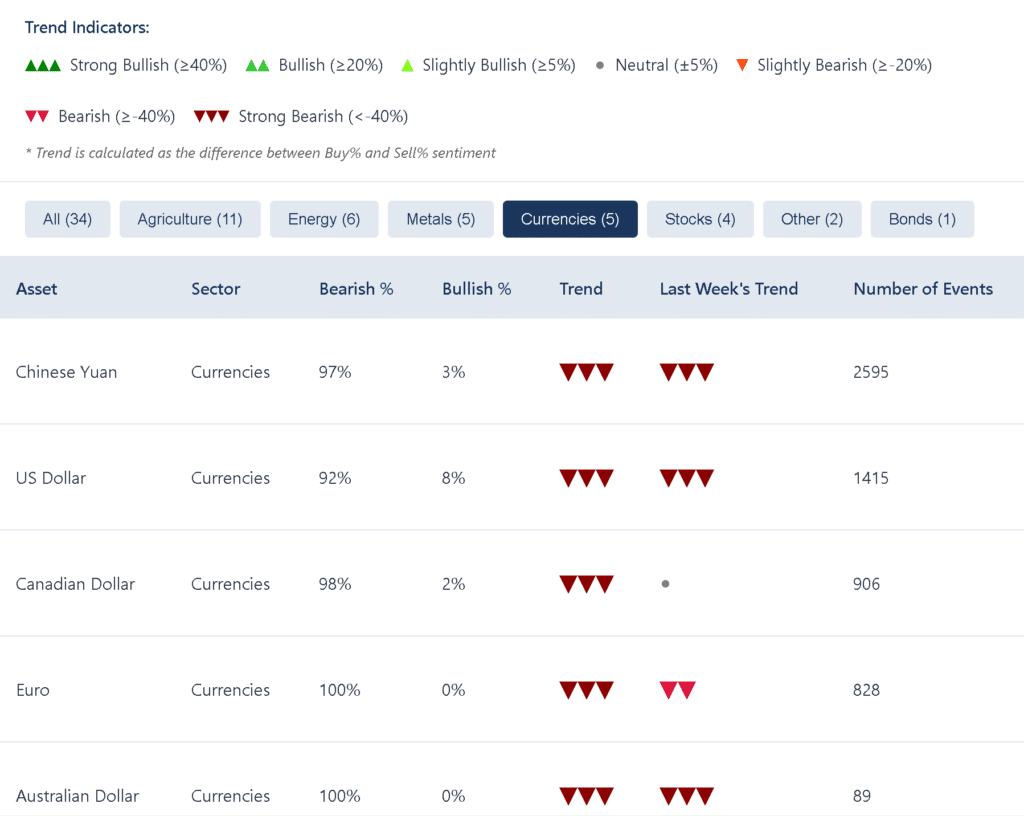

The impact of tariffs on currency markets

Perhaps the most striking insight from our current data is the extreme bearish sentiment across all major currencies. At time of writing (but please note, as it updates every 15 minutes it must be directly referenced for the most up-to-date data) our dashboard shows the Chinese Yuan at 96% bearish vs 4% bullish, but even more remarkably, the US Dollar (100% bearish), Canadian Dollar (100% bearish) and Euro (100% bearish) are showing unanimous negative sentiment. This pattern suggests that the impact of tariffs is creating a scenario where traders aren’t fleeing to any major currency as a safe haven – a highly unusual situation that speaks to the pervasive uncertainty in global markets.

Meanwhile, and not surprisingly so, the United States and China dominate our Event Distribution by Country chart, highlighting the centrality of their trade relationship – and the impact of their respective tariff policies – to global market sentiment. The ongoing tariff tit-for-tat between these economic superpowers continues to generate significant volatility, with ripple effects visible across nearly every asset class we track.

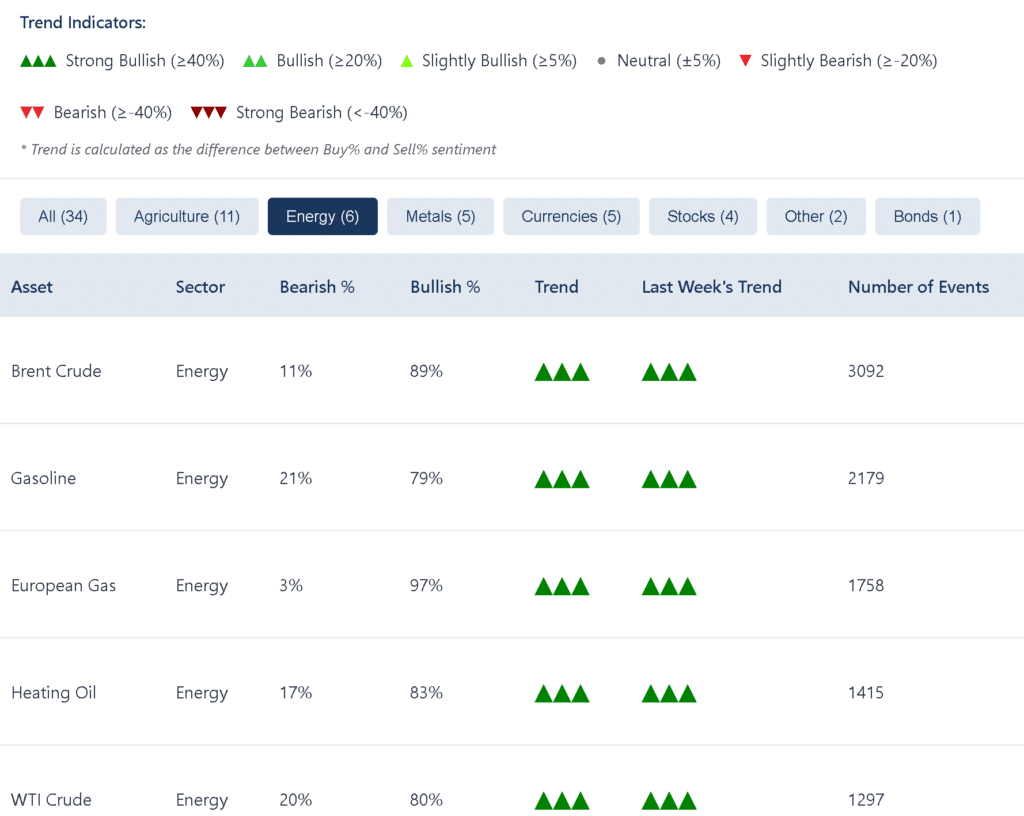

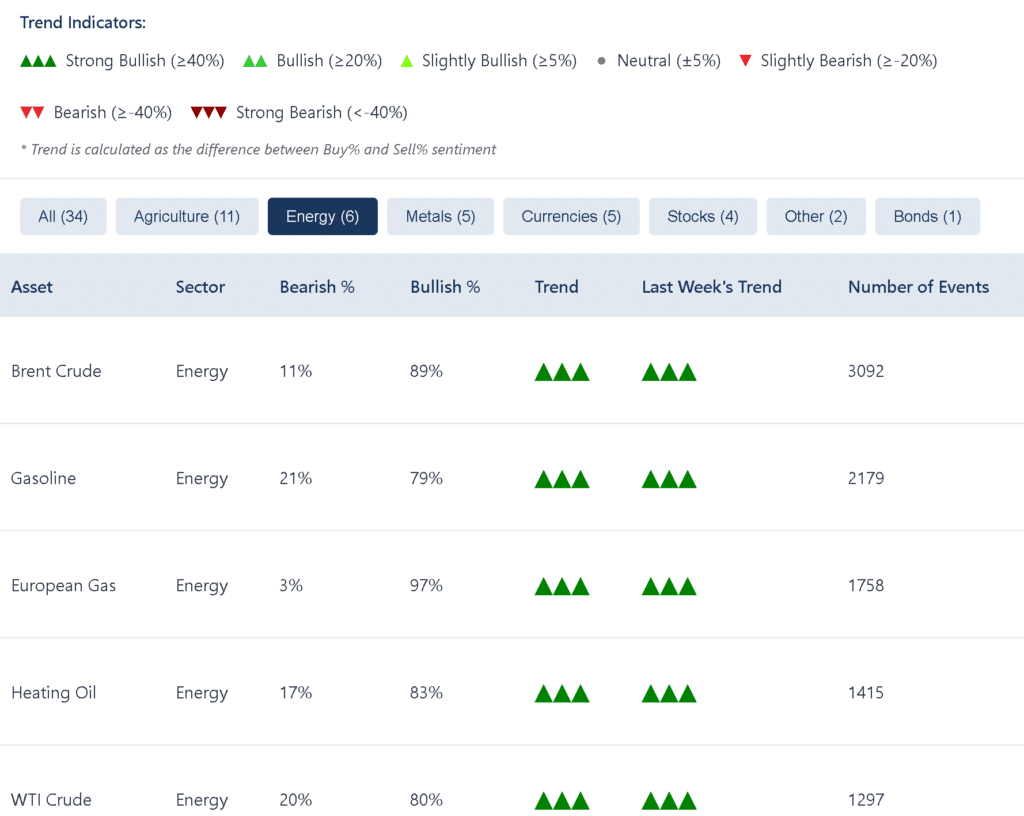

The impact of tariffs on energy markets

When we examine the energy sector, our data shows strong bearish pressure across the board, with Brent crude and heating oil both at 90% bearish sentiment. Even more telling is the consistency of these bearish trends, as evidenced by the Last Week’s Trend column showing these weren’t temporary reactions. The impact of tariffs on energy markets operates primarily through anticipated demand destruction – as tariffs increase manufacturing costs and potentially slow economic activity, energy consumption forecasts are revised downward, creating persistent selling pressure.

WTI Crude shows a slight improvement from bearish last week to strong bearish this week at 88% bearish sentiment, which might indicate that traders are pricing in even harsher tariff impacts in the immediate term. With 463 events linked to WTI in our system, there’s clearly no shortage of market-moving news affecting this critical benchmark.

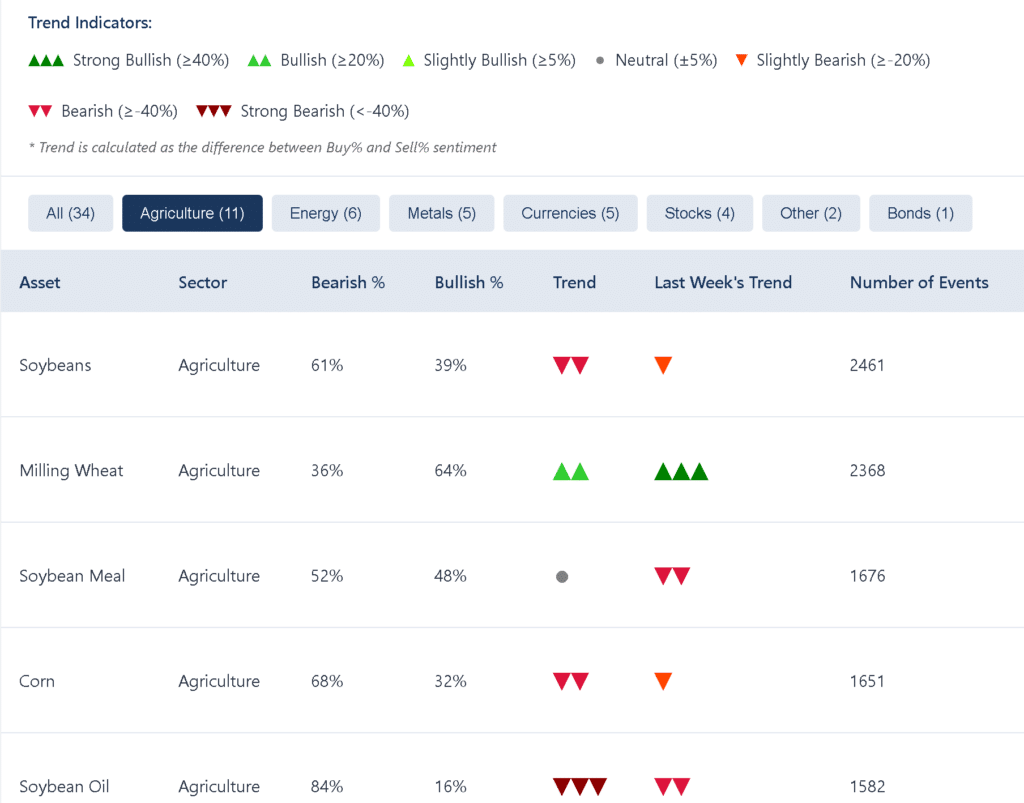

The impact of tariffs on agricultural commodity markets

Agricultural products often find themselves on the front lines of trade disputes, and our sentiment data confirms the significant impact of tariffs on this sector. Lean hogs and soybean oil both show 100% bearish sentiment – a likely reflection of how agricultural exports are frequently early targets in tariff escalations. The historical use of agricultural tariffs as political tools makes these commodities particularly sensitive to trade tension headlines.

Soybeans present a slightly more nuanced picture at 67% bearish/33% bullish, perhaps reflecting their complex role in global trade networks and the varying impact of tariffs based on origin and destination markets. With 3,980 events linked to soybeans in our system – the second-highest number for any commodity after lean hogs – it’s clear that tariff-related news is creating substantial market activity in this space.

The impact of tariffs on metal markets

In stark contrast to almost every other asset we track, gold is showing 100% bullish sentiment with a strong positive trend that has remained consistent from last week. This remarkable divergence illustrates the classic role of gold as a safe haven during periods of geopolitical uncertainty – including those created by the impact of tariffs. With 5,700 events linked to gold, it’s generating significant market attention as traders seek shelter from tariff-induced volatility.

Industrial metals tell a different story, with copper (98% bearish), platinum (75% bearish), and palladium (96% bearish) all exhibiting strongly negative sentiment. The impact of tariffs on these metals reflects their close ties to manufacturing activity – as tariffs potentially reduce industrial output, demand for these key inputs faces downward pressure.

The impact of tariffs on major stocks

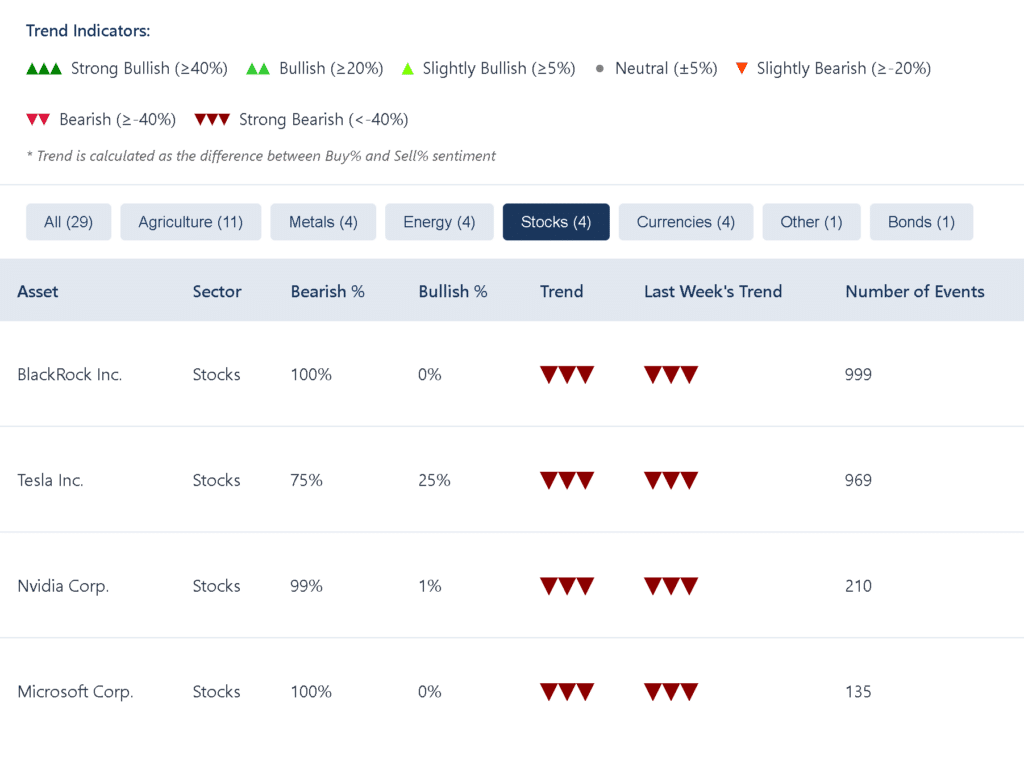

Our analysis of key stocks reveals extreme bearish sentiment across the board, with Microsoft and BlackRock at 100% bearish and Tesla and Nvidia at 75% and 99% bearish respectively. The tech sector’s complex global supply chains make it particularly vulnerable to the impact of tariffs, with component costs, manufacturing locations, and market access all potentially affected by trade policy shifts.

The sustained nature of this bearish sentiment – as indicated by the Last Week’s Trend column – suggests that markets are pricing in longer-term structural impacts rather than simply reacting to headlines. This could indicate that traders believe the current tariff environment represents a meaningful shift in the operating landscape for these companies rather than a temporary political posture.

The pervasive impact of tariffs

Our dashboard reveals the remarkably diverse yet universally significant impact of tariffs across the financial landscape. From currencies to commodities to equities, very few assets are escaping unscathed from the current trade tensions. The unique exception of gold highlights the market’s search for stability amid the uncertainty that tariffs create.

For institutional traders navigating these challenging waters, distinguishing between short-term noise and genuine market drivers becomes increasingly critical. As tariff announcements continue to create significant market volatility, our Trading Co-Pilot platform’s ability to identify news fade patterns and sentiment divergence provides essential context for informed decision-making.

The impact of tariffs clearly extends far beyond the specifically targeted industries, creating systemic effects that reshape risk premiums and trading strategies across the investment landscape. As these policies continue to evolve, real-time intelligence will be increasingly valuable for those seeking to stay ahead of market movements rather than simply reacting to them.

Navigate intensifying geopolitical uncertainty with our Trading Co-Pilot

Want deeper insights into the true market impact of tariffs? While our Geopolitical Dashboard provides a valuable overview, institutional traders require more granular intelligence. Our full Trading Co-Pilot platform delivers advanced analytics that help you identify causation patterns missed by conventional analysis, detect when markets have already priced in geopolitical events, spot news fade patterns before they affect your positions, and distinguish genuine market drivers from short-term noise. For enterprise and institutional clients, request a Trading Co-Pilot demo or trial below or simply contact our team: enquiries@permutable.ai.