*This analysis explores the strategic dimensions of US Treasury yield movements in relation to Trump’s tariff policies and debt refinancing challenges, crafted for institutional investors, bond traders, macro strategists, and financial professionals seeking deeper insights into market-moving policy dynamic.

In this new world order of financial markets, the US Treasury yields impact extends far beyond simple interest rate indicators. The erraticism of the last few weeks has demonstrated how policy shifts can dramatically reshape the bond market landscape, with profound implications for global financial stability. And it’s become entirely obvious that recent developments surrounding President Trump’s tariff strategy appear to be directly influencing Treasury yields in ways that demand closer examination.

The strategic u-turn: More than meets the eye

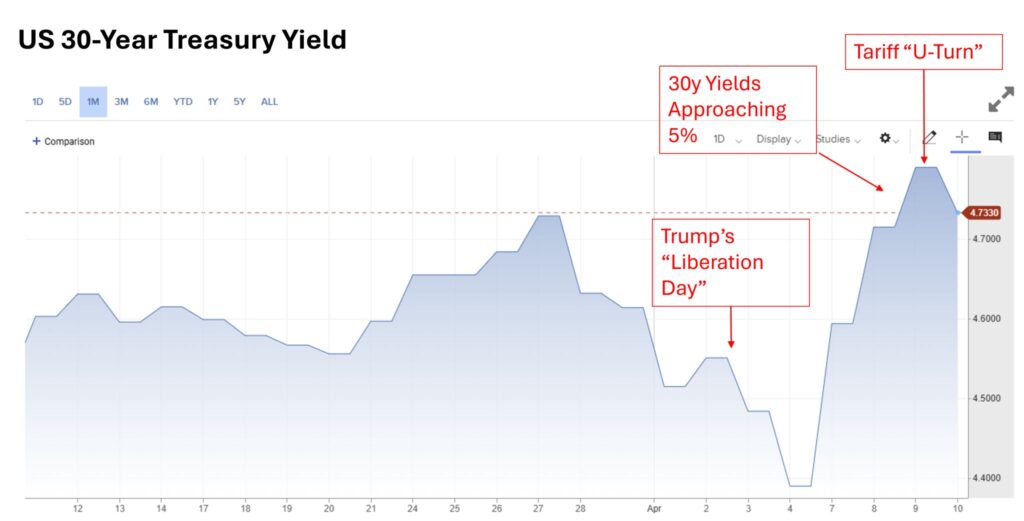

On “Liberation Day,” President Trump executed a dramatic tariff pivot – reducing duties to 10% for most countries while simultaneously imposing punitive 125% tariffs on China. The market reaction was swift and significant, with 30-year Treasury yields surging toward the psychologically important 5% threshold before settling slightly lower at 4.73%.

This draws a clear line between conventional trade policy and something more strategic. The most obvious prospect facing the market is that this tariff “U-turn” represents more than mere geopolitical posturing – it appears to be a calculated lever designed to inject market uncertainty, redirect global capital flows into US Treasuries, and ultimately suppress yields at a critically important moment.

The $9.2 trillion question

Let us not forget that the timing of these moves coincides with an unprecedented refinancing challenge. The Treasury faces the daunting task of refinancing approximately $9.2 trillion in US debt maturing in 2025, with an astonishing $6.5 trillion coming due by June. As we stand in front of the revolving doors of time, this refinancing wave represents one of the most significant fiscal challenges in American history.

The danger of this shift is that yields approaching 5% would dramatically inflate interest costs, potentially creating a fiscal spiral that could destabilize both the US economy and global financial markets. It should now be obvious that even small movements in yield have enormous implications – a mere 0.5% reduction in long-term rates could generate approximately $460 billion in savings over a decade.

Market sentiment: Reading between the lines

This is why the question of market sentiment becomes key when assessing the US Treasury yields impact. The Trumpian backlash against China through targeted tariffs, coupled with relative leniency toward other trading partners, creates a specific kind of market uncertainty that historically benefits Treasury bonds as safe-haven assets.

It’s hard to keep up with the cacophony of policy announcements, but experts say the pattern is becoming clearer. The US Treasury yields impact reflects not just economic fundamentals but also strategic policy objectives aimed at managing the national debt burden. This rightly causes worries about market manipulation, but also creates potential opportunities for those who can accurately predict the trajectory of yields.

The recession calculus: A tool for rate management?

Reaching even deeper into this strategic framework, we must acknowledge that if economic growth stalls, a recession could become a policy tool rather than merely an economic challenge. The future is in the balance as markets attempt to price in the possibility that economic contraction might be viewed as an acceptable trade-off if it triggers substantial rate cuts that ease the Treasury’s refinancing burden.

You may say this perspective seems cynical, but the evidence increasingly points toward a deliberate strategy. The US Treasury yields impact extends beyond immediate market reactions to shape longer-term fiscal sustainability. As Trump’s administration navigates these complex waters, the interplay between tariff policy, economic growth, and debt management reveals a sophisticated approach to addressing fiscal challenges.

Global implications of yield movements

As the world’s benchmark risk-free rate, US Treasury yields impact virtually every corner of the global financial system. The blur of the last few weeks has demonstrated how policy shifts in Washington can trigger ripple effects across international markets, influencing everything from emerging market debt to corporate borrowing costs worldwide.

As US yields approach 5%, the gravitational pull on global capital intensifies, with investors are reassessing risk-reward calculations with US Treasury yields impacting capital flows, currency valuations, and economic stability across the globe.

Looking Forward: Navigating Uncertainty

While the path forward remains uncertain. Will the tariff strategy successfully redirect capital flows into Treasuries? Can yields be managed downward in time for the massive refinancing wave? These questions will determine not just the trajectory of interest rates but potentially the stability of the global financial system.

The danger posed by this shift is that markets may become increasingly dependent on policy interventions rather than economic fundamentals. There is no shying away from the fact that such dependency creates its own vulnerabilities. Yet for investors who can accurately anticipate these moves, significant opportunities may emerge.

The era of Trump 2.0 is reshaping market dynamics in profound ways. By recognising the strategic dimensions of seemingly disparate policy moves, investors can better position themselves to navigate an increasingly complex financial landscape where the US Treasury yields impact extends far beyond conventional interest rate considerations.

Request access to our Treasury sentiment indicators on our Trading Co-pilot or integrate our specialised data feeds directly into your systems. Simply email enquiries@permutable.ai to request a demo or fill in the form below to request a trial.