*This article provides a detailed analysis of the key geopolitical and economic events that shaped crude oil markets in April 2025, aimed at traders, investors, and energy analysts seeking insights to navigate a rapidly evolving landscape.

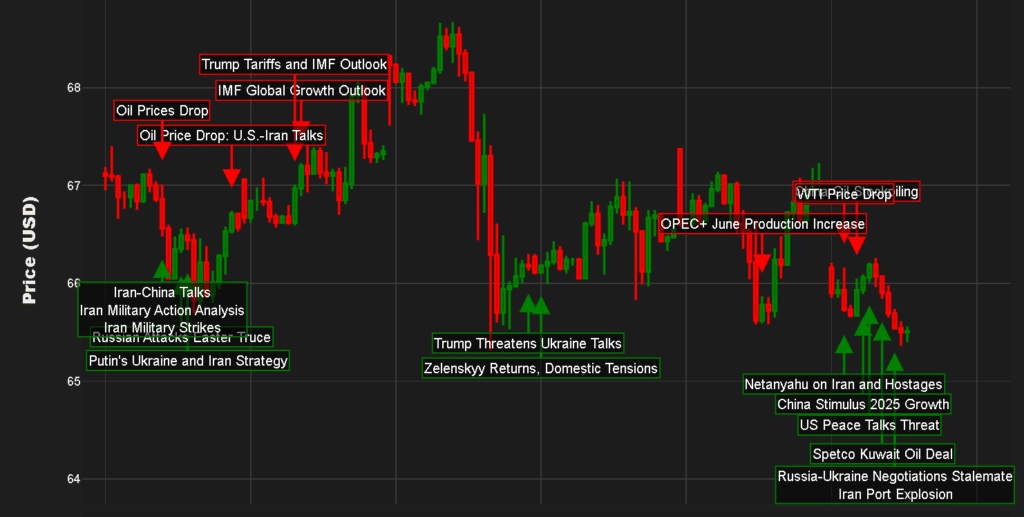

In the throes of what some have dubbed the Great Tariff Crisis, global oil markets experienced unprecedented turbulence throughout April 2025. WTI crude oil prices oscillated dramatically, falling near $62.50 by month-end as multiple forces converged to create what many analysts have called “uncertainty on steroids” in energy markets. The destruction of predictable trade patterns and diplomatic norms has left investors scrambling to position themselves amidst rapidly evolving scenarios. One thing is certain: the collective crude oil market watch has rarely been more challenging. Let’s examine the five most significant events that moved oil markets last month through the lens of our Trading Co-Pilot.

1. Trump’s tariff implementation and global economic reverberations

The upending of world economic order began when Trump imposed his 10% baseline global tariff in early April. The turbulence has been caused by both the direct impact on energy prices and the secondary effects on global growth projections. The International Monetary Fund responded by cutting global growth forecasts by 0.5%, specifically citing US tariffs as the primary factor.

China’s response was particularly noteworthy for crude oil market watch observers. By the end of April, China had significantly increased its crude oil stockpiles, reversing previous declines. This strategic move came as a direct response to tariff impacts on crude prices, with China taking advantage of temporarily depressed prices to build reserves. Overall, the general mood is for now gloomy with a great deal of fear that continued trade tensions will further depress global economic activity.

2. U.S.-Iran nuclear negotiations and supply concerns

The unpredictability of U.S.-Iran relations added another layer of complexity for those on the crude oil market watch in April. Oil prices experienced a sharp pullback following reports indicating progress in negotiations between the two nations. As well as these diplomatic developments, there were mounting concerns about potential military action against Iran’s nuclear programme.

Those who ask whether military strikes are a realistic possibility need only look at recent statements from Trump threatening action if Iran doesn’t agree to a nuclear deal. Conversely, any diplomatic breakthrough could quickly bring additional Iranian crude to market.

The question is whether these negotiations will ultimately result in de-escalation or further confrontation. Israeli Prime Minister Netanyahu’s statement that Iran’s nuclear programme must be dismantled added further pressure, as did Senator Marco Rubio’s warning that a potential war with Iran would be significantly more complicated than previous conflicts.

3. OPEC+ production increase considerations

For better or worse, OPEC+ is contemplating a significant increase in oil production for June. This brings us back to the perennial crude oil market watch focus on supply management.

The global economic tremors from tariffs have complicated OPEC+’s calculus. The era of careful market balance through production adjustments may be challenged if demand forecasts continue to deteriorate. Specifically, the cartel must weigh potential revenue increases from higher volumes against price declines from oversupply.

By month-end, WTI crude oil prices had fallen to near $62.50, influenced by this potential OPEC+ production hike alongside other factors. Market analysts remain divided on whether the production increase will materialise given the uncertain demand outlook.

4. Russia-Ukraine conflict and peace talk stalemate

As the reality of continued hostilities in Ukraine persists, those keeping a crude oil market watch will have been closely monitoring diplomatic developments. Negotiations between Russia and Ukraine remain at a stalemate as both sides await a breakthrough. But that outcome seems increasingly distant with the U.S. threatening to abandon Russia-Ukraine peace talks.

President Putin’s strategic moves regarding both Ukraine and Iran further complicate matters. Putin signed a law ratifying a strategic partnership treaty with Iran, solidifying ties between the two nations. And even then, Russian attacks have persisted through declared truces, including during the Easter period.

It seems likely that protracted conflict will continue to introduce risk premiums in crude oil markets, especially as U.S. diplomatic engagement appears to be waning. The former head of the British army stated that Donald Trump’s actions have undermined peace prospects for Ukraine, signalling continued instability.

5. China’s economic stimulus and demand outlook

China plans to implement additional stimulus measures and has expressed confidence in achieving its growth target for 2025. This announcement provided a rare bright spot in our crude oil market watch, partially offsetting negative sentiment from tariff impacts.

The prospect of Chinese demand growth offers some counterbalance to the broader economic concerns. However, IMF downgrade of China’s growth expectations as the trade war escalates suggests caution is warranted.

China remains the world’s largest crude oil importer, making its economic trajectory key for global energy markets. Its strategic decision to increase stockpiles demonstrates both the opportunity presented by lower prices and concerns about future market access amid deteriorating trade relations.

Crude oil market watch April 2025 – final thoughts

The confluence of tariff impacts, geopolitical tensions, and supply-demand recalibration has created one of the most challenging environments for crude oil traders in recent memory. For traders and investors, adapting to this new reality requires heightened attention to both macroeconomic indicators and geopolitical developments. The interplay between trade tensions and traditional supply-demand dynamics has created a multi-dimensional challenge that demands sophisticated analysis and nimble positioning.

Stay ahead with our crude oil market sentiment data

In a market defined by volatility and rapid change, having access to real-time intelligence is no longer optional – it’s essential. Our Trading Co-Pilot Terminal delivers crucial market-moving events directly to your workflow, ensuring you never miss a development that could impact your positions. Don’t let critical information reach you after markets have already reacted. Access our comprehensive data via API integration into your existing systems or through our intuitive Trading Co-Pilot Terminal. Our platform not only aggregates news but contextualises events with expert analysis and sentiment scoring, helping you distinguish signal from noise.

Ready to transform how you monitor the crude oil markets? Request a demonstration of our Trading Co-Pilot terminal or speak with team about integration via API access. Simply email enquiries@permutable.ai or fill in the form below. In markets where minutes matter, we ensure you constantly stay ahead.