Investor transcript analysis is a key component of corporate strategy communictions. One of the biggest challenges a company faces is its obligations towards achievening net-zero carbon emissions by 2050 .

To address this, we have taken a novel approach by searching for climate change and other ethical issues within the questions asked by institutions of each investor. Who were posing the big, uncomfortable yet necessary questions on climate change policies? Who were the first to rate these points as

important as profits? Our findings are based on analysing transcripts of investor meetings for the top 1000 companies.

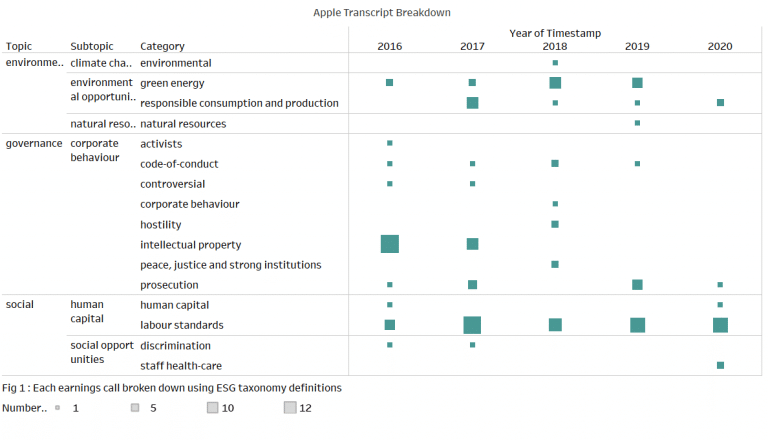

For example, here is the investor transcript analysis breakdown for Apple 2016 – 2020.

Investor transcript analysis: Who is asking the tough questions and what is being asked?

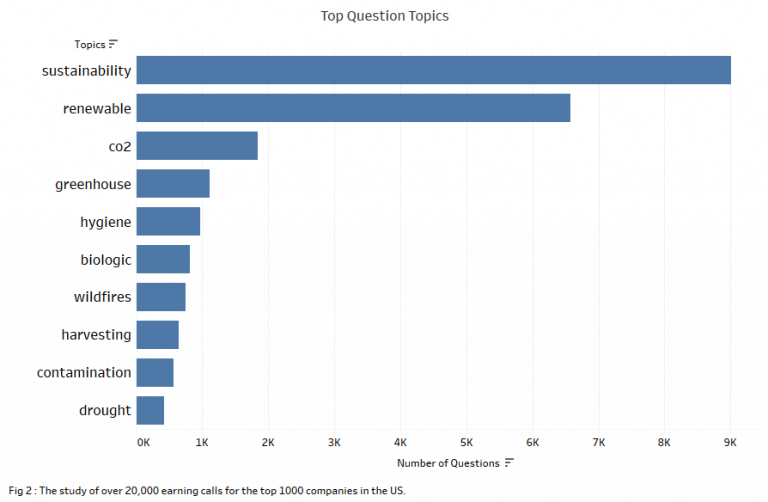

As part of our investor transcript analysis research, we reviewed over 20,128 transcripts. We found that words such as “sustainability” and “renewable” are the most frequently used. While this is good, we must be careful of the problem of greenwashing (we will cover this in another article). More focused terms such as “CO2” that feature in the top 5 words used is a promising sign.

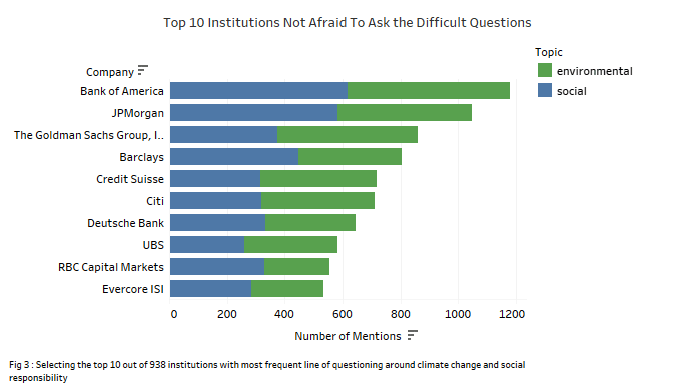

We reviewed 938 institutions, big banks are the leaders in terms of number of questions asked about climate change action and social opportunities. The split is close to 50/50 between these two topics.

The role of machine learning technology in investor transcript analysis

The analysis was produced by our RnD team specialising in natural language processing (NLP) and in particular name entity recognition (NER / GENRE). This allows us to do things like matching speakers with their employers (e.g. Barclays), creating single groups allowing us to identify exactly which company is speaking. We then ran all transcripts analysis on a graphical processing unit (GPU) server.

For more information or to register contact wilson@permutable.ai.