In recent years, environmental, social, and governance (ESG) factors have become increasingly important for investors and stakeholders when evaluating companies. ESG measures how well a company is managing its impact on the environment, society, and its governance practices. In the real estate industry, ESG is becoming a critical factor in assessing a company’s sustainability and overall impact on society. CBRE Group, a global commercial real estate company, has recently been recognized for its outstanding ESG performance. The CRBE Group ESG rating is not only a testament to the company’s commitment to sustainability but also a game-changer for the entire real estate industry.

What is ESG and why is it important for real estate?

ESG is a set of criteria used to evaluate a company’s performance in three areas: environmental, social, and governance. Environmental issues include a company’s carbon footprint, waste management, and energy efficiency. Social factors include employee relations, community involvement, and diversity. Governance factors include board structure, executive compensation, and shareholder rights.

ESG is important for the real estate industry because of its significant impact on the environment and society. Real estate is responsible for a large portion of global greenhouse gas emissions, and companies in the industry have a responsibility to reduce their impact. Additionally, the real estate industry has a significant impact on local communities, and companies must ensure that their practices are socially responsible and sustainable.

CBRE Group’s ESG performance and rating

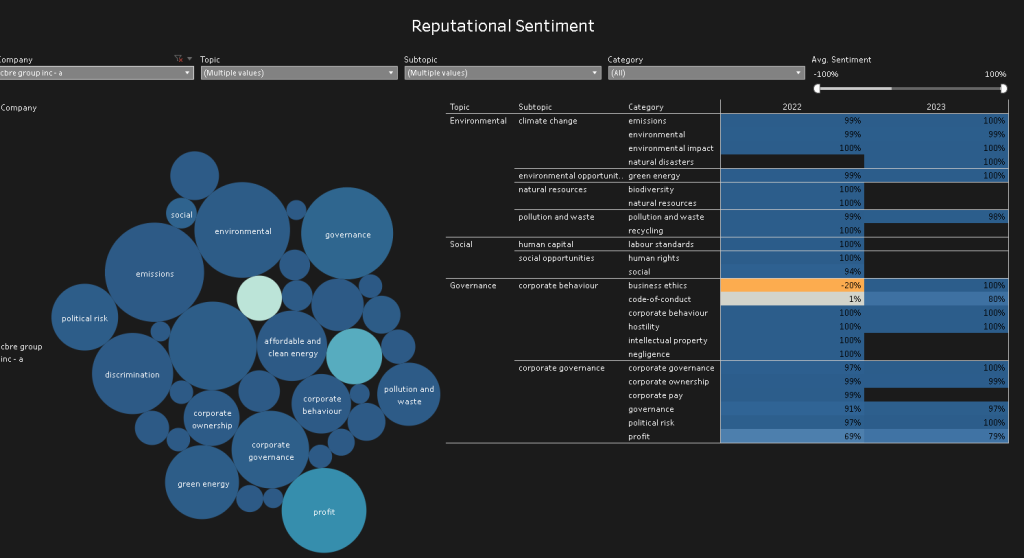

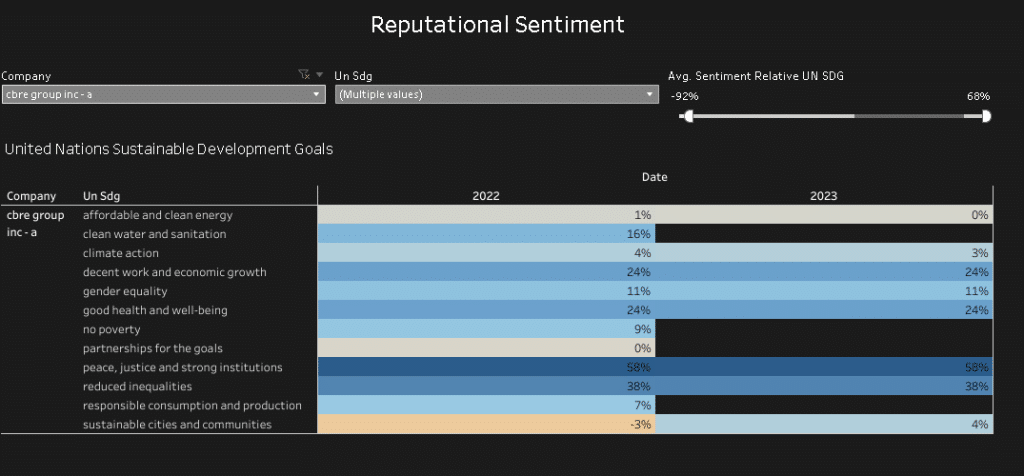

CBRE Group has been recognized as a leader in ESG performance, with a score of 99 out of 100 for environmental performance, 95 in social performance and 85 in governance according to our data. This rating places CBRE Group in the 92nd percentile of its industry peers. The CBRE Group ESG rating is a result of its strong performance in all three areas: environmental, social, and governance.

In terms of environmental performance, CBRE Group has set ambitious sustainability targets. The company has committed to reducing its greenhouse gas emissions by 68% by 2035, and it has achieved a 25% reduction in emissions since 2015. CBRE Group also has a comprehensive waste management program and has implemented energy-efficient measures in its buildings.

Socially, CBRE Group has demonstrated its commitment to diversity and inclusion. The company has a Diversity & Inclusion Council and has set targets for increasing diversity in its workforce. CBRE Group also has a strong community engagement program, with initiatives focused on education, health, and affordable housing.

Governance is another area where CBRE Group has excelled. The company has a transparent and accountable board of directors, with a majority of independent directors. CBRE Group also has a robust ethics and compliance program, with a Code of Business Conduct and Ethics that applies to all employees.

Impact of CBRE Group’s high ESG rating on the real estate industry

The CBRE Group ESG rating is a game-changer for the real estate industry. It sets a new standard for responsible business practices in the industry and demonstrates that sustainability and profitability can go hand in hand. CBRE Group’s performance shows that companies can reduce their environmental impact, improve their social practices, and maintain good governance without sacrificing financial performance.

The real estate industry is a major contributor to global greenhouse gas emissions, and companies in the industry have a responsibility to reduce their impact. CBRE Group’s commitment to reducing its emissions sets an example for other companies in the industry to follow. By reducing their emissions, companies in the industry can contribute to the global effort to combat climate change.

CBRE Group’s community engagement programs also set an example for other companies in the industry to follow. The real estate industry has a significant impact on local communities, and companies must ensure that their practices are socially responsible and sustainable. CBRE Group’s initiatives focused on education, health, and affordable housing demonstrate the company’s commitment to making a positive impact on the communities where it operates.

CBRE Group’s ESG initiatives and practices

CBRE Group’s ESG initiatives and practices are comprehensive and cover all three areas: environmental, social, and governance. The company has set ambitious sustainability targets, including reducing its greenhouse gas emissions, improving energy efficiency in its buildings, and reducing waste. CBRE Group also has a strong community engagement program, with initiatives focused on education, health, and affordable housing.

In terms of governance, CBRE Group has a transparent and accountable board of directors, with a majority of independent directors. The company also has a robust ethics and compliance program, with a Code of Business Conduct and Ethics that applies to all employees. CBRE Group’s commitment to good governance ensures that the company operates in an ethical and responsible manner.

How CBRE Group’s ESG rating benefits stakeholders – investors, tenants, and communities

The CBRE Group ESG rating benefits its stakeholders in several ways. For investors, CBRE Group’s strong ESG performance demonstrates that the company is committed to sustainable and responsible business practices. This can lead to increased investor confidence and a higher valuation for the company.

For tenants, CBRE Group’s ESG initiatives can improve the quality of their workspace. Energy-efficient buildings can lead to lower energy bills, and waste reduction programs can create a cleaner and healthier work environment. Additionally, tenants may prefer to lease space from a company that is committed to sustainability and responsible business practices.

For communities, CBRE Group’s community engagement programs can have a positive impact on local residents. Initiatives focused on education, health, and affordable housing can improve the quality of life for residents in the communities where CBRE Group operates.

Comparison with other real estate companies’ ESG ratings

The CBRE Group ESG rating places it in the top tier of its industry peers. However, other companies in the real estate industry are also making progress in improving their ESG performance. Real estate companies such as Prologis and Boston Properties have also received high ESG ratings and have set ambitious sustainability targets.

The real estate industry as a whole is making progress in improving its ESG performance. Average GRESB scores increased by a point to 74 for the Standing Investments Benchmark and by two points to 81 in the Development Benchmark.

Take a look at our ESG ratings for CBRE Group’s competitors below:

Future outlook for CBRE Group’s ESG rating and the real estate industry

The CBRE Group ESG rating is a testament to the company’s commitment to sustainability and responsible business practices. The company’s ambitious sustainability targets and comprehensive ESG initiatives set an example for other companies in the real estate industry to follow.

The real estate industry is facing increasing pressure to improve its ESG performance, and companies that do not prioritize sustainability and responsible business practices may be left behind. CBRE Group’s high ESG rating demonstrates that sustainable and responsible business practices can lead to financial success and stakeholder satisfaction.

Conclusion – CBRE Group leading the way in sustainable real estate

CBRE Group’s high ESG rating is a game-changer for the real estate industry. The company’s commitment to sustainability and responsible business practices sets an example for other companies in the industry to follow. CBRE Group’s comprehensive ESG initiatives and strong performance in all three areas – environmental, social, and governance – demonstrate that sustainability and profitability can go hand in hand.

CBRE Group’s high ESG rating benefits its stakeholders in several ways, including increased investor confidence, improved quality of workspace for tenants, and positive impact on local communities. The real estate industry as a whole is making progress in improving its ESG performance, and CBRE Group is leading the way in sustainable real estate.

Find out more

Take your ESG analysis to the next level by accessing granular data on CBRE Group and its competitors. Gain valuable insights into their environmental, social, and governance practices. Make informed investment decisions and drive positive change. Request detailed ESG data now and stay ahead in the pursuit of sustainable investments by getting in touch below.