Current forex market sentiment this week presents a complex picture of shifting power dynamics across major currency pairs. Amid the furor of tariff announcements and economic data releases, traders have been navigating a particularly challenging environment. Here, thankfully, our Market 360 analysis from our Trading Co-Pilot provides clear insights into the state of current forex market sentiment, offering clarity where FX markets seem increasingly opaque.

When you take a step back, the data shows a distinct pattern emerging across several key pairs. The Japanese yen has demonstrated remarkable strength against the dollar, while other major pairs reflect more ambiguous signals. We won’t waste time on superficial analyses – instead, let’s examine what’s truly driving current forex market sentiment.

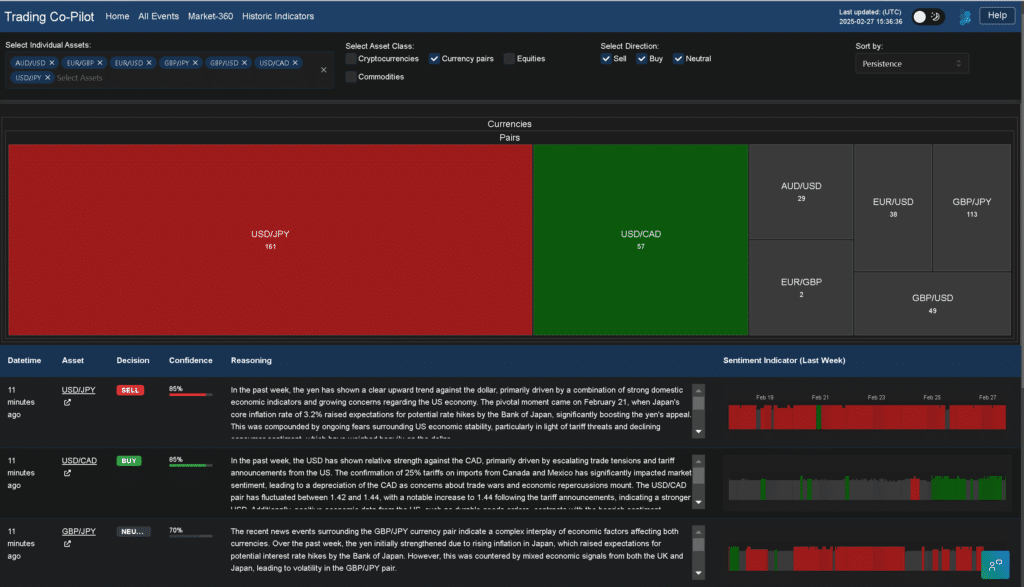

Above: Current forex sentiment this week, taken from our Market 360 feature, part of our Trading Co-Pilot

USD/JPY: The Yen’s remarkable rally

The answer seems obvious when looking at USD/JPY movements this week. The Japanese yen has established a clear upward trend against the dollar, driven primarily by Japan’s robust domestic economic indicators. The pivotal moment came on February 21st, when Japan’s core inflation rate of 3.2% sparked expectations for potential Bank of Japan rate hikes, significantly boosting the yen’s appeal.

We say this because the sequence of events clearly indicates a shift in investor sentiment towards the yen as a safer asset. This is particularly evident following the escalation of geopolitical tensions and trade disputes that have negatively impacted the USD. Although there was a brief dollar rally on February 26th due to positive US economic data, the overall sentiment remains bearish for the USD, especially after the tariff announcements on February 27th.

Consider that both domestic economic performance and external pressures on the dollar have reinforced the yen’s strength. And it is, we think, this last point that is most significant—the JPY is currently demonstrating itself as the stronger currency in this pairing.

Mixed signals across other major pairs

What about other significant currency pairs? The good news is that our analysis provides clear insights into these relationships as well.

To be clear, GBP/JPY has shown a complex interplay of factors affecting both currencies. Initially, the GBP showed strength due to positive retail sales and rising salaries. Alas, this was quickly overshadowed by declining consumer confidence in the UK and rising inflation in Japan. The result is something of a disparity between initial expectations and current performance, leading to a neutral outlook with a 70% confidence level.

Similarly, USD/CAD has demonstrated remarkable stability interspersed with fluctuations primarily driven by tariff threats and economic data releases. There still remains the question of which currency will ultimately prevail, as neither has shown consistent dominance. Actually, by February 27th, the price dropped back to 1.43, reflecting renewed tariff threats from the U.S. and ongoing uncertainty in trade relations.

Broader economic contexts shaping current forex market sentiment

The context for this week’s current forex market sentiment is multifaceted. There have been, broadly, three things driving market movements: inflation concerns, political uncertainties, and trade tensions.

Let’s say that GBP/USD provides an illustrative example. In the past week, the GBP has experienced a series of fluctuations influenced by both positive and negative economic indicators. But there’s a broader point of view here – while there have been moments of strength for the GBP, the compounded effects of economic uncertainty, inflation worries, and external trade pressures have led to a neutral outlook.

Meanwhile, EUR/USD faces its own challenges. Both currencies have been under pressure – the USD due to expectations of Federal Reserve rate cuts, and the EUR affected by economic concerns in Germany, particularly following elections that raised political tensions. These revelations will be a blow to traders hoping for clarity in this pair.

To understand just how important this is, consider AUD/USD’s position. The stability around 0.64 suggests a lack of significant movement in either direction, indicating a balance between the two currencies. But what about the future outlook? There has been speculation that ongoing tariff threats and economic concerns in both countries could maintain this neutral stance for some time.

Reading between the lines: What current forex market sentiment really tells us

Ultimately, this week’s current forex market sentiment reveals more about global economic interconnectedness than individual currency strength. Signs that all is not well in major economies continue to emerge, from Japan’s demographic challenges to Germany’s contracting economy. However, the prime ingredients for understanding market movements are found not just in economic data but in policy responses. Indeed, central bank positioning – particularly regarding interest rates—continues to play a crucial role in shaping trader expectations.

And this, we expect, is just the beginning of a potentially prolonged period of uncertainty. Because there’s no denying that geopolitical tensions, particularly regarding trade policies, have introduced significant volatility into the markets and we expect that these are likely to continue for the foreseeable.

So let’s go back to where we started – the current forex market sentiment this week reflects cautious positioning amid uncertain global conditions. In an ideal scenario, traders would have clear signals to guide their decisions. Naturally enough though, markets rarely provide such clarity, especially at times like these.

Consequently, this current forex market sentiment environment requires vigilance. However, for those taking a longer-term view, looking past immediate volatility to fundamental economic strengths remains the focus. Then, as now, patience may prove the most valuable trading strategy. But, to give you an idea of what might come next, we should perhaps say that monitoring central bank communications and economic data releases will be essential, which you can do 24/7 and with ease with our Trading Co-Pilot’s FX market sentiment analysis.

Navigating current forex market sentiment with our AI-powered trading intelligence

Navigating today’s forex markets requires more than just standard analysis tools. It demands the comprehensive, AI-powered insights that only our Trading Co-Pilot platform delivers. We invite you to experience the difference our Market 360 analysis can make to your trading decisions with an enterprise demo or trial. Our team will walk you through how our proprietary sentiment indicators can help you anticipate the market movements before they happen. There’s no obligation, just an opportunity to see if our approach aligns with your trading strategy and business goals. Request your personalised enterprise demonstration today by contacting our team at enquiries@permutable.ai or simply fill in the form below.