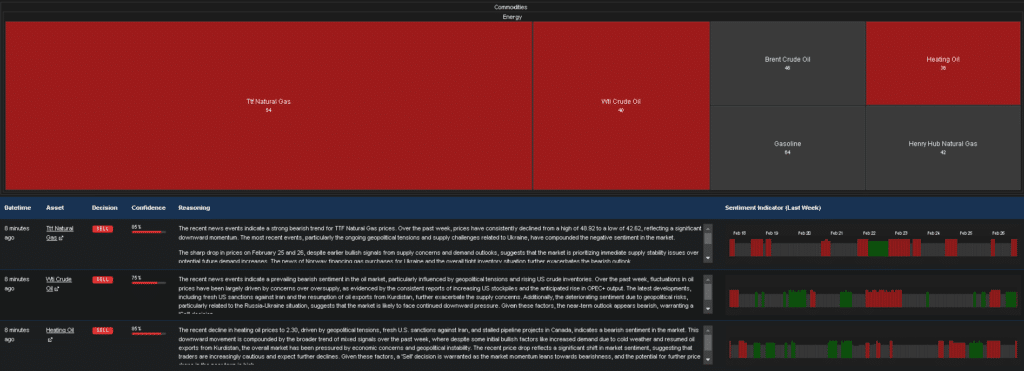

As this hectic month comes and International Energy Week come to an end, our Trading Co-Pilot has captured significant shifts in energy market sentiment this week through its Market 360 thematic analysis. It is a tale of predominantly bearish signals across several key energy commodities, with TTF Natural Gas, WTI Crude Oil, and Heating Oil all displaying strong sell indicators at 85% confidence levels.

Within the current landscape of energy markets, we’re observing a complex interplay of supply concerns, geopolitical tensions, and inventory fluctuations that have collectively shaped trading patterns. This week, the TTF Natural Gas market has shown consistent price declines from 48.92 to 42.62, reflecting substantial downward momentum despite earlier bullish signals from supply concerns.

This backdrop adds layers of complexity, as seemingly contradictory factors influence different segments of the energy complex. The view that immediate supply stability issues are outweighing potential future demand increases appears to be gaining traction among traders, particularly in European gas markets where Norway’s financing of gas purchases for Ukraine has further contributed to the bearish outlook.

Above: Our Market 360 thematics showing energy market sentiment at time of writing

Crude oil markets: Supply concerns and geopolitical pressures

In fact, WTI crude oil has experienced similar downward pressure, falling from 70.16 to 68.89 in recent trading sessions. The divisive figure Trump looms large over energy markets, with potential tariff risks adding another layer of uncertainty to already volatile conditions. On the face of it, it seems that fresh US sanctions against Iran would typically support prices, but market reactions have been counterintuitive.

The problem, of course, is that rising US crude inventories and concerns over increased OPEC+ output have compounded the bearish sentiment. Optimists may say that geopolitical tensions should provide price support, but this has not materialised as expected. This, doubtless, reflects traders’ lack of confidence in a near-term recovery despite the ongoing conflicts that traditionally boost energy prices.

Meanwhile, heating oil markets are no longer threatened by short-term supply disruptions, as the initial price spike following the drone attack on the Caspian Pipeline Consortium quickly reversed. On one end of the spectrum, increased oil production from Nigeria and resumed exports from Iraq’s Kurdish region have contributed to downward price pressure. At the other end of the spectrum, the consistent decline to a low of 2.30 suggests persistent bearish sentiment that shows little sign of reversing in the immediate future.

Mixed signals in gasoline and brent markets

Embedded in this is a more nuanced picture for gasoline and Brent crude oil, both of which our Trading Co-Pilot has assigned neutral ratings with 65% confidence levels. The energy market sentiment this week for these commodities reflects a balancing act between bullish and bearish factors.

For gasoline, the stabilisation of prices following reports alleviating some supply concerns represents a positive development. However, there is terror in the hearts of traders regarding potential tariff risks and ongoing geopolitical tensions that continue to create uncertainty. Now, even though Brazil’s record oil production might typically pressure prices downward, the mixed inventory reports have left the market in a state of cautious neutrality.

Brent crude oil displays similar characteristics, with the market appearing to be in a wait-and-see mode on the grounds that conflicting signals make directional betting particularly risky. If the chaos will resolve toward a bullish or bearish trend remains unclear, as supply concerns from the Caspian Pipeline incident and Iran sanctions are counterbalanced by inventory builds and potential OPEC+ supply increases.

Natural gas: Weather-driven volatility

Henry Hub natural gas presents perhaps the most weather-dependent narrative in the energy complex this week. The Arctic blast that initially drove prices higher has given way to warmer forecasts, creating significant price volatility. The price journey from 4.35 to 3.89 and back to relative stability around 4.12-4.15 demonstrates how quickly sentiment can shift in this market.

It’s too soon to judge whether stability has been restored to the natural gas market, as the interplay between weather patterns, inventory levels, and production plans from major players like Chevron continues to drive day-to-day fluctuations. Our Market 360 heatmap indicates that this balance between supply and demand factors has immeasurable value for traders looking to navigate the current uncertainty.

Looking forward: Navigating uncertain energy market sentiment

Our Trading Co-Pilot’s energy market sentiment analysis this week suggests that caution remains the prudent approach across the energy market complex. While TTF natural gas, WTI crude, and heating oil display clear bearish signals, the neutral outlook for Gasoline, Brent crude, and Henry Hub natural gas indicates potential for movement in either direction.

Of course, understanding these market dynamics has immeasurable value in today’s volatile environment. Our Market 360 tool continues to monitor real-time developments, providing institutional traders with comprehensive insight into how geopolitical events and supply-demand factors ripple across different energy commodities.

As we look toward March, the cross-asset implications of these energy market movements will be key to watch. In short, the correlation between energy prices and broader market sentiment remains strong, with potential knock-on effects for currencies and other commodity classes.

The energy market sentiment this week reflects a sector very much in transition, balancing immediate supply concerns against longer-term structural changes. Our Trading Co-Pilot will continue to track these developments 24/7, in real-time, providing the analytical edge that institutional investors need to navigate these complex market conditions effectively and confidently.

Experience Market 360 for your institution

If your trading desk or investment team is struggling to make sense of increasingly interconnected energy market sentiment, now is the time to experience how our Market 360 Thematics can transform your decision-making process. This innovative solution from our Trading Co-Pilot platform delivers LLM-driven cross-asset market analysis with unprecedented clarity and depth.

Our enterprise clients tell us that the energy market sentiment insights surfaced by Market 360 has is creating powerful value in their approach to energy trading. On the grounds that market intelligence should be both comprehensive and actionable, we’ve designed Market 360 to deliver insights that translate directly to trading opportunities. And so, we invite you to request a personalised enterprise demonstration, tailored specifically to your institution’s trading focus and analytical requirements. Our team will walk you through how Market 360 can:

- Visualise complex cross-asset relationships in real-time

- Track sentiment shifts across energy markets as they develop

- Identify emerging correlations before they become obvious to the broader market

- Deliver tailored alerts based on your specific trading parameters

- Integrate seamlessly with your existing trading infrastructure

To arrange your personalised demon or to apply for your enterprise trial, please contact our team at enquiries@permutable.ai or simply fill in the form below.