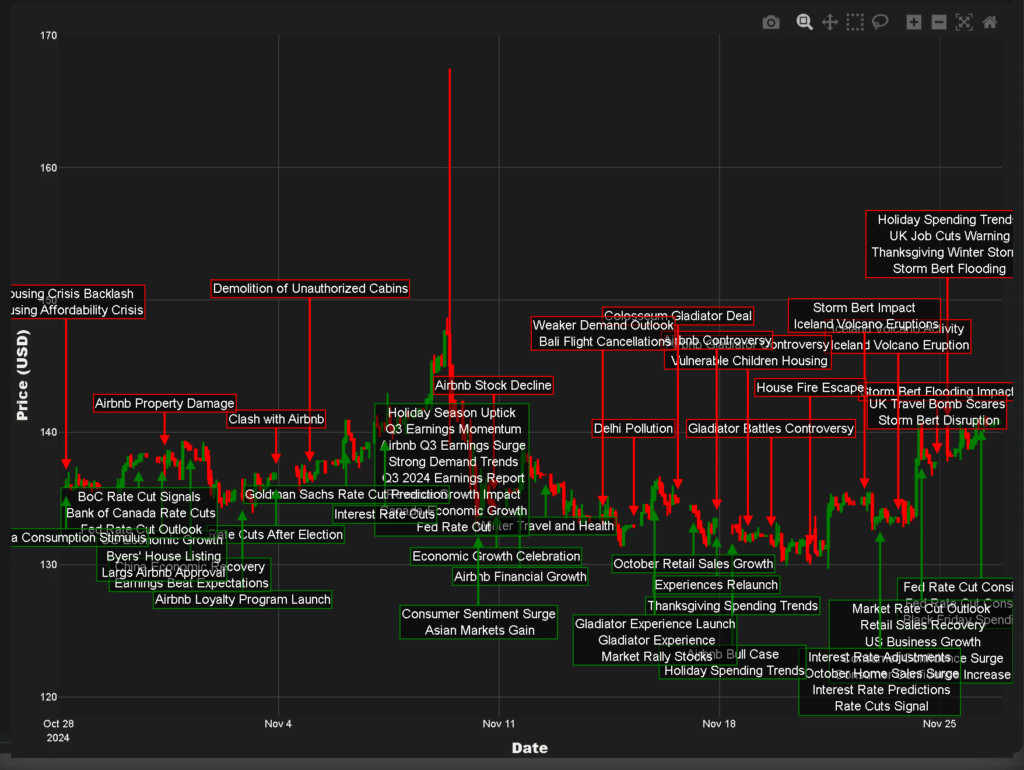

Airbnb share price movements over the past month have painted a fascinating picture of a company navigating through both strategic opportunities and challenging headwinds, with many commenting on its “stuck” status. Looking back at events highlighted by our Trading Co-Pilot, it’s been a mixed bag which has tested investor confidence in unprecedented ways. Here, we explore three major factors impacting Airbnb share price.

Earnings and core performance

Let’s start with the good news – namely, that Airbnb’s Q3 2024 earnings report showed promising signs of momentum. To be precise, the company reported revenue that narrowly beat estimates, driven by strong growth in international markets. One explanation is that travel demand remained resilient despite broader economic pressures. Still this, along with strong Q3 performance, initially supported the Airbnb share price, though subsequent events would introduce new complexities. What we are seeing is a market that remains cautious about growth prospects in the travel sector.

Controversial moves and public reception

Now let’s rip the bandaid off and address the company’s recent $1.5 million Gladiator experience deal at Rome’s Colosseum which generated mixed reactions. The question everyone is asking, then, is whether such high-profile initiatives will translate into sustained value for shareholders. These spikes happen whenever there is significant news about innovative offerings, though the Airbnb share price response has been muted, likely due to criticisms surrounding the initiative.

Consider the broader context of public relations challenges. By unhappy coincidence, the company faced backlash over housing affordability issues just as it launched this historic venue initiative. Adding insult to injury, concerns about unauthorised rentals and property damage cases have emerged in various markets.

Economic factors and market conditions

But alongside a complex internal narrative, external factors have significantly influenced the Airbnb share price. The prospect of Federal Reserve rate cuts has created an interesting dynamic in the market. There is a case for improved consumer spending if borrowing costs decrease, potentially benefiting Airbnb’s booking volumes.

As this sprawling set of events played out, the company’s stock showed remarkable resilience. What happened during the past month reveals a pattern of price movements closely tied to both company-specific news and broader market sentiment. This knotty situation demonstrates the interconnected nature of various factors affecting the Airbnb share price.

Looking ahead

It has been predicted that travel demand could see significant shifts in the coming months. The realisation that economic conditions are evolving has kept investors attentive to any signs of changing consumer behaviour. Day by day, the real world consequences of these shifts become more apparent in the Airbnb share price movements.

To put this in perspective, the company’s valuation reflects both immediate challenges and long-term potential. Though it’s also important to keep things in perspective, the solutions are obvious: Airbnb must continue balancing growth initiatives with stakeholder concerns.

Returning to where we began, let us not forget that the Airbnb share price tells a story of a company in transition. What this situation requires is an appreciation of the complexity and context within which the company operates. History has shown time and again that market leaders must adapt to survive and thrive, and Airbnb is no different.

Are we looking at a pivotal moment for Airbnb? The evidence suggests that while challenges persist, the company’s fundamental value proposition remains strong. This, we suspect, will continue to influence investor sentiment and, consequently, the Airbnb share price in the months ahead.

Read more articles in this series

Looking for more stock market insights? See our articles on the factors that determine:

– Advanced Micro Devices stock price

– Tencent Holdings stock price