You would be hard-pressed to find a more complex commodity market than natural gas. In theory, natural gas pricing should follow simple supply-demand economics, but the problem is that multiple interacting factors that affect natural gas prices create a sophisticated price dance that challenges even seasoned commodities traders.

This complexity arises from the unique characteristics of natural gas as a commodity – it requires specialised infrastructure for transportation, storage is limited, and its demand is highly seasonal. The interplay between these fundamental characteristics and market forces creates a pricing mechanism that requires sophisticated analysis tools to understand and predict.

Table of Contents

Toggle7 factors that affect natural gas prices

1. Weather impact and seasonal patterns

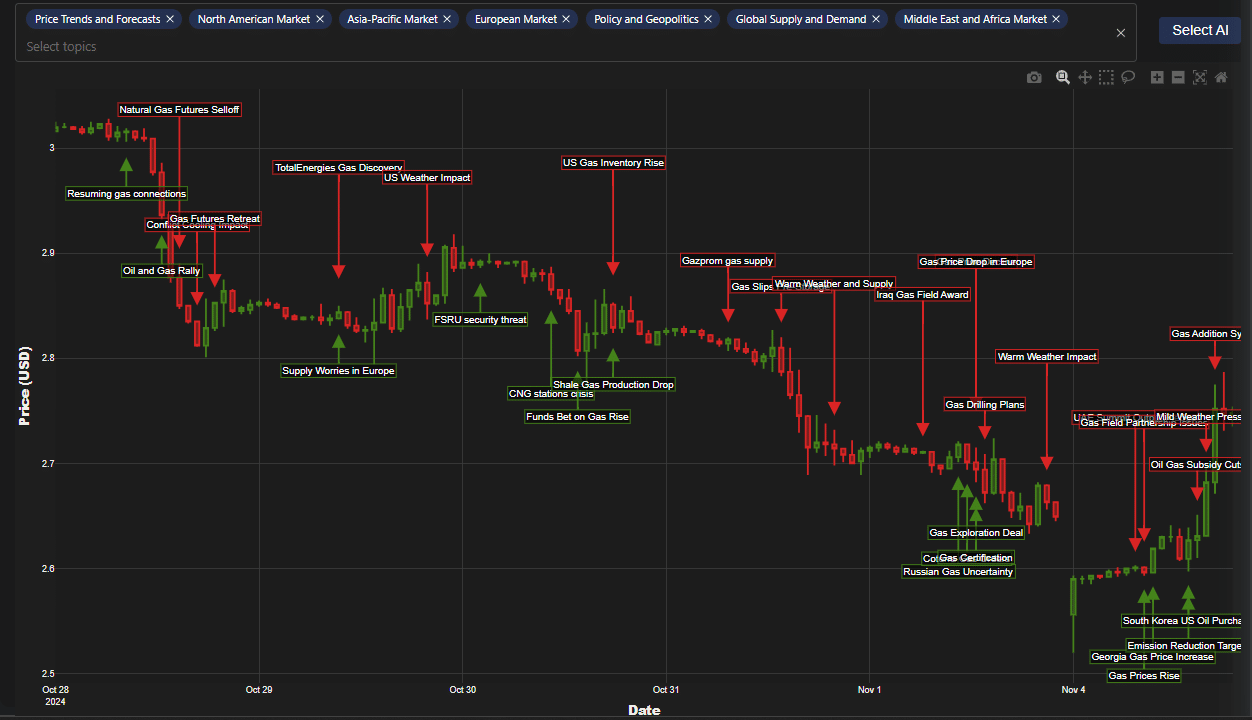

Let’s take an area like weather impact, which our Trading Co-Pilot recently tracked through the “US Weather Impact” event (see image above). We know that many people think that temperature is the primary driver, but there is also the question of seasonal patterns and extreme weather events. Indeed, from looking at the recent market movements, warm weather impacts have significantly influenced price trajectories.

Historical data shows that temperature deviations of just a few degrees from seasonal norms can trigger substantial price movements. Our platform has observed that weather-related events can account for up to 30% of short-term price volatility, particularly during peak demand seasons. The recent mild weather across key consumption regions has led to reduced heating demand, contributing to downward price pressure.

2. Supply-side dynamics

Let’s talk about supply dynamics –– our platform recently identified several crucial events that showcase how supply factors affect natural gas prices. The clue to this can be found in the “Shale Gas Production Drop,” “Supply Worries in Europe,” and “Gas Addition System” indicators our Trading Co-Pilot detected. Production capacity changes have become increasingly volatile, with shale gas producers showing greater flexibility in adjusting output levels. I

Meanwhile, infrastructure constraints, particularly in key production regions, can create bottlenecks that affect regional pricing. Storage levels serve as a crucial buffer between production and consumption, with our analysis showing that storage reports can trigger immediate price responses. Pipeline network efficiency remains a critical factor, with maintenance schedules and capacity limitations influencing regional price differentials. By our estimate, these supply-side factors account for approximately 40% of price movements in the natural gas market.

3. Geopolitical influences and regional markets

Our Trading Co-Pilot identified key events like “Russian Gas Uncertainty,” which highlighted how political tensions can rapidly shift supply patterns. The “Iraq Gas Field Award” demonstrates how developments in energy infrastructure investment can signal long-term supply changes. European market dynamics have become particularly significant, with the region’s energy security concerns creating new price pressures and trade flows.

4. Market structure and trading patterns

Meanwhile, another core principle is the role of market structure in price formation. We invite you to think back to the recent “Gas Futures Retreat” event. More to the point, the “Funds Bet on Gas Rise” indicator shows how institutional positioning affects natural gas prices.

The key problem is that traditional analysis often misses these subtle market signals. Instead, our Trading Co-Pilot processes these indicators in real-time, providing traders with actionable insights. Ultimately, our algorithms detect changes in patterns, identifying potential trend reversals before they become obvious to the broader market.

4. Regional price disparities

Think of that moment when our system flagged the “Gas Price Drop in Europe” alongside “Georgia Gas Price Increase.” This is the fundamental story of how regional factors affect natural gas prices differently across markets. Despite increasing global integration, significant price differentials persist between regions due to transportation constraints and local market conditions.

North American market movements often diverge from Asian and European trends, creating arbitrage opportunities for traders. Asia-Pacific demand patterns, particularly from major importers like Japan, South Korea, and China, can drive global LNG prices. European storage levels have become a crucial indicator for winter price expectations. Meanwhile, Middle East supply dynamics increasingly influence global price patterns as the region expands its export capacity.

5. Environmental and regulatory factors

We are entering the age of environmental consciousness, creating new factors affecting natural gas prices. Emission reduction targets across major economies are reshaping energy policies and investment decisions. Carbon pricing mechanisms are becoming more prevalent, directly impacting the competitiveness of natural gas versus other fuels.

Renewable energy competition continues to intensify, though natural gas remains crucial for grid stability. To add to this, environmental regulations regarding methane emissions and fracking practices can impact production costs and available supply. That may well be the case for traditional fossil fuels, but on that front, natural gas positions itself as a transition fuel, potentially supporting medium-term demand despite long-term decarbonization goals.

6. Infrastructure and technical factors

Add the convenient fact that infrastructure plays a crucial role in price formation, we can probably all agree that pipeline capacity constraints can create significant regional price differentials. LNG terminal availability has become increasingly important as global trade expands. Then, storage facility efficiency affects the market’s ability to manage seasonal demand fluctuations.

Let’s not also forget that transportation networks, including both pipelines and LNG shipping capacity, can create temporary supply bottlenecks or oversupply situations, with technical factors like maintenance schedules and system upgrades causing potential short-term price volatility.

Use our Trading Co-Pilot to make better trading decisions

You’ve seen how complex the factors affecting natural gas prices can be. Want to stay ahead of these market movements without spending hours analysing news and data?

Our platform’s sophisticated algorithms continuously process real-time analysis of over 20,000 articles every hour, ensuring you never miss a market-moving event. We deliver instant alerts tailored to your trading strategy, backed by comprehensive cross-market correlation analysis. Our advanced pattern recognition technology draws from historical data to provide context for current market movements. You can customise your alerts based on impact levels – from Low to High – ensuring you only receive notifications that matter to your trading strategy. Multiple timeframe monitoring options, from 3-day to monthly views, give you complete control over your market analysis horizon.

Our Trading Co-Pilot and newly launched API for commodities delivers immediate notification of critical events affecting natural gas markets. From breaking news on detailed weather impact assessments that could affect demand, to sudden supply disruptions that might create pricing pressures, we keep you informed in real-time. Our platform tracks geopolitical developments that could impact international gas flows, monitors updates on infrastructure changes affecting distribution networks, and analyses regulatory shifts that could reshape market dynamics. We also provide real-time assessment of market sentiment shifts that often precede major price movements.

The results speak for themselves. Our users report a 90% reduction in their daily research time, allowing them to focus on strategy execution rather than information gathering. By eliminating 80% of market noise, traders can focus on truly significant events. Every alert comes with real-time market context, helping you understand not just what happened, but why it matters. Our clear directional signals help you make informed decisions quickly and confidently.

Limited time offer

Experience institutional-grade natural gas market intelligence with our 14-day free trial and explore our platform’s capabilities and it’s ability to help you make better trading decisions. Get in touch by filling in the form below.