In recent weeks, China economy news has been dominated by reports of slowing growth and recently announced aggressive stimulus measures, leading many to ask: Is China’s economy in trouble? The world’s second-largest economy, long considered an engine of global growth, appears to be sputtering. But what’s really going on beneath the surface? Get our thinking in this article which covers the latest developments and their implications.

Is China’s economy in trouble? China’s economic challenges

When you take a step back, the data shows a concerning picture. Is China’s economy in trouble? The signs are certainly there. China’s post-pandemic recovery has been lacklustre, with key indicators like retail sales, industrial production, and property investment all underperforming expectations. The property sector, which accounts for about 25-30% of China’s GDP, has been particularly hard hit, with major developers facing debt crises and declining home sales. Meanwhile, youth unemployment has reached record highs, and consumer confidence remains subdued. These factors have created a perfect storm of economic challenges for Beijing, further fueling concerns about whether China’s economy is in trouble.

Is China’s economy in trouble? Beijing responds with stimulus measures

Amid the furor surrounding China’s economic woes, the government has not stood idle. On September 24, 2024, China’s central bank announced a series of broad stimulus measures aimed at boosting the flagging economy. These include:

1. Cutting reserve requirements for banks

2. Lowering interest rates

3. Implementing fiscal policies to support key industries

The good news is that these measures are expected to inject liquidity into the market and stimulate lending. However, some economists question whether they’ll be enough to address the underlying structural issues facing China’s economy. Is China’s economy in trouble despite these interventions? The answer remains unclear.

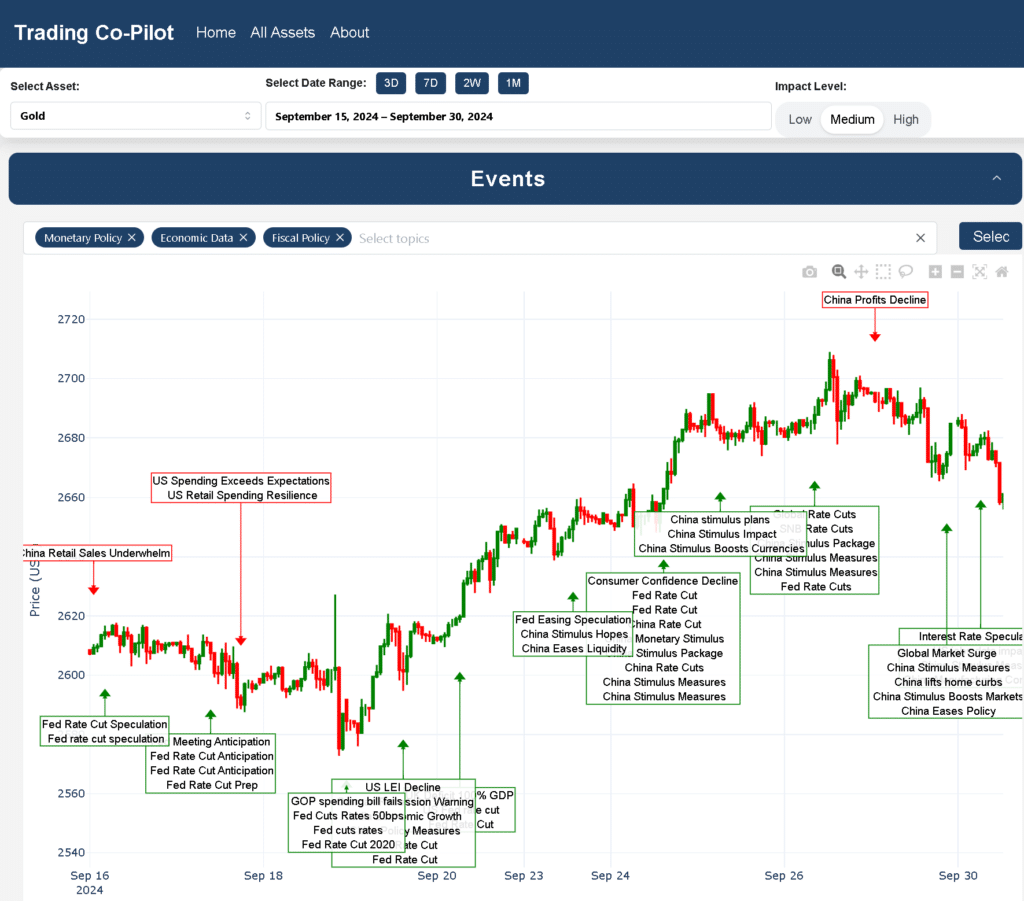

Above: Permutable’s Trading Co-Pilot in action: A snapshot of gold price movements and key economic events impacting China and global markets from September 15-30, 2024. This powerful tool correlates price action with major economic indicators and policy decisions, providing traders with crucial context for market analysis.

Global implications

To understand just how important this is, we need to consider China’s role in the global economy. As the world’s largest exporter and second-largest importer, China’s economic health has far-reaching consequences. A slowdown in China can ripple through global supply chains, affect commodity prices, and impact financial markets worldwide.

Indeed, the recent stimulus announcements have already sparked reactions in global markets. Asian stocks rallied, and commodity prices saw a boost. But there’s a broader point of view here: while short-term market reactions may be positive, the long-term implications of China’s economic challenges are more complex. The question “Is China’s economy in trouble?” is not just a domestic concern but a global one.

Is China’s economy in trouble – beyond the stimulus

While the stimulus measures are a step in the right direction, they don’t address some of the deeper structural issues facing China’s economy. Consider that:

1. China’s population is ageing, which could lead to labour shortages and increased social spending.

2. The country faces significant environmental challenges that require substantial investment.

3. Geopolitical tensions, particularly with the West, could impact trade and investment.

These are not idle concerns. They represent long-term challenges that stimulus alone cannot solve. The question remains: can China transition to a more sustainable economic model that relies less on debt-fuelled growth and more on domestic consumption and innovation?

Is China’s economy in trouble: A look at the property sector

Central to the answer to this question is the property sector. The recent troubles of major developers like Evergrande have sent shockwaves through the Chinese economy. The property market’s health is crucial not just for economic growth but also for social stability, as many Chinese citizens have significant portions of their wealth tied up in real estate.

The government’s attempts to deleverage the sector while preventing a market crash have been a delicate balancing act. Recent measures to support the property market, including easing restrictions on home purchases in some cities, show that Beijing recognises the urgency of the situation. But do these measures adequately address the question: Is China’s economy in trouble?

Innovation and technology: China’s future?

Amid the challenges, there are also opportunities. China has made significant strides in areas like artificial intelligence, renewable energy, and advanced manufacturing. These sectors could be key to future growth and help China move up the value chain.

However, geopolitical tensions and technology restrictions from the West pose challenges to China’s tech ambitions. The ongoing “tech war” with the United States, in particular, could have long-lasting impacts on China’s innovation landscape. As we ponder whether China’s economy is in trouble, the tech sector’s resilience will be a crucial factor to watch.

Is China’s economy in trouble? A look at consumer confidence

One of the questions levelled at China’s economic strategy is whether it can successfully transition to a consumption-driven economy. Despite years of effort, household consumption as a percentage of GDP remains relatively low compared to other major economies.

The recent economic challenges have further dented consumer confidence. Boosting this confidence will be crucial for China’s long-term economic health. Measures like improving social safety nets and increasing disposable income could help, but they require significant policy shifts. The success of these measures will be a key indicator in determining if China’s economy is in trouble in the long term.

The road ahead: Challenges and opportunities

As we look to the future, one thing that is undeniable is that China’s economic path remains uncertain. The government’s ability to navigate these challenges will have profound implications not just for China but for the global economy as a whole. Fact check: While China’s growth has slowed, it’s important to note that it’s still growing at a rate that many developed economies would envy. The challenge is whether this growth is sustainable and of high quality.

To be clear, China’s economy is not on the brink of collapse. The country has significant resources and policy tools at its disposal. However, the transition to a new economic model will likely be bumpy and require difficult reforms. When all is said and done, China’s economic future will depend on its ability to address structural issues, boost innovation, and maintain social stability. The recent stimulus measures are a start, but they’re just one piece of a much larger puzzle.

While the question “Is China’s economy in trouble?” continues to dominate headlines, it’s premature to sound the death knell. The country has shown remarkable resilience and adaptability in the past. However, the road ahead will require careful navigation and potentially painful reforms. As the world watches China’s economic evolution, one thing is certain: the outcome will have far-reaching consequences for the global economic landscape. Whether China can successfully transition to a new growth model will be one of the defining economic stories of the coming decades.

Trading Co-Pilot exclusive access

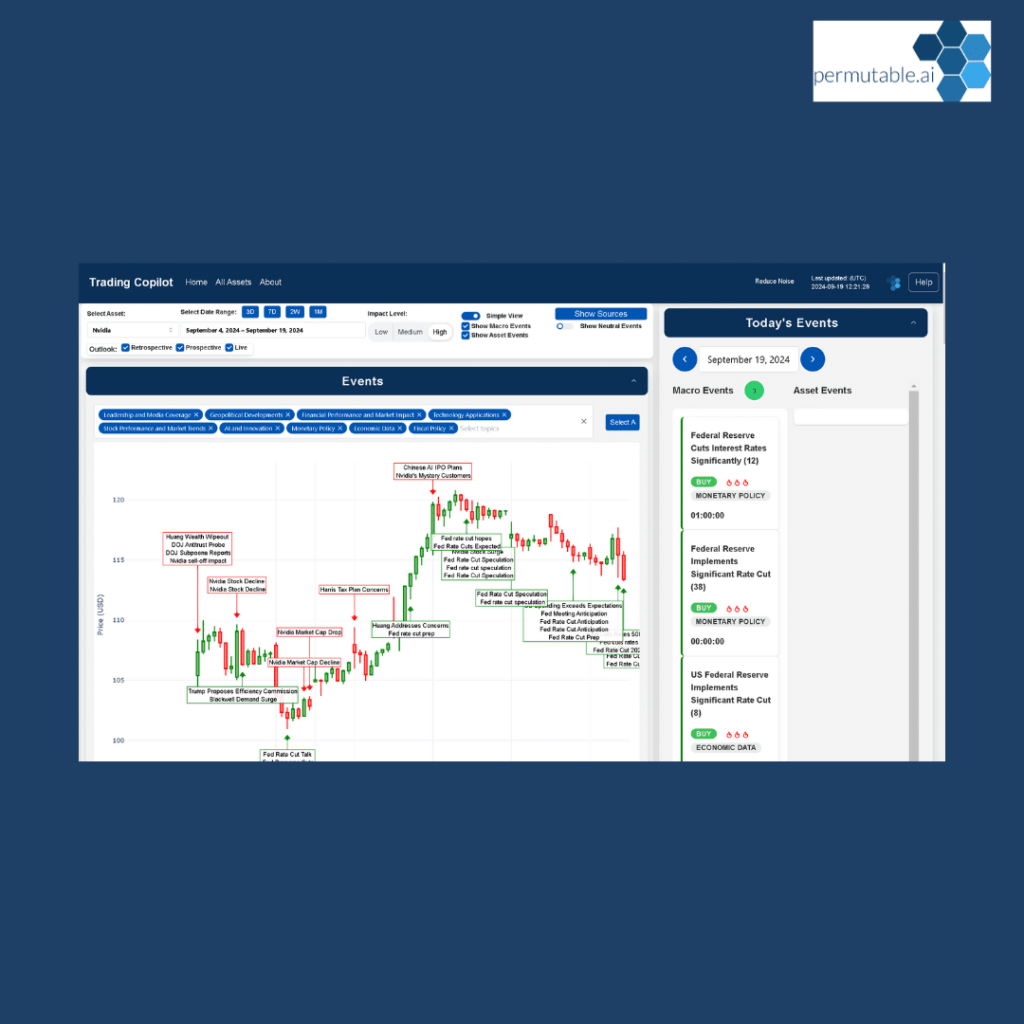

Are you ready to be part of the future of trading? At Permutable AI, we’re extending an exclusive opportunity to a select group of corporate partners to gain early access to our advanced Trading Co-Pilot, powered by cutting-edge machine learning for contextual understanding.

This is a rare chance to stay ahead of the competition by leveraging AI that not only processes data but also grasps the global context—analysing real-time sentiment and market-shaping events to deliver more precise and risk-aware trading strategies.

If your firm is ready to lead the way in AI-driven trading innovation, get in touch today to explore this limited opportunity and discover how our Trading Co-Pilot can transform your approach to the market by contacting us at enquiries@permutable.ai.

Your trading is about to take off

Schedule a free enterprise demo to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.