In the dynamic and ever-changing world of finance, understanding the key factors that impact stock prices is essential for investors. Microsoft, one of the giants in the tech industry, is no exception. Unveiling the secrets behind the fluctuations in Microsoft stock price can provide valuable insights into the company’s performance and the stock market as a whole.

From macroeconomic trends to industry-specific developments, numerous factors influence the value of Microsoft stock. Market competition, technological advancements, and regulatory changes are just a few examples of the dynamics that shape the stock price. Additionally, financial indicators like earnings reports, revenue growth, and new product launches also play a significant role in influencing investor sentiment.

In this article, we will explore the key factors that impact Microsoft stock price, providing investors with a deeper understanding of the company’s outlook and potential investment opportunities. By analyzing these factors, investors can make more informed decisions and navigate the stock market with confidence. Stay tuned to discover the secrets behind Microsoft’s stock price and gain insights into this tech giant’s future prospects.

Economic factors affecting Microsoftstock price (nyse msft)

The performance of the broader economy has a significant impact on the stock price of Microsoft. Economic factors such as GDP growth, inflation rates, and interest rates can influence investor sentiment and the overall demand for stocks. During economic downturns, investors may be more cautious and pull back on their investments, leading to a decline in stock prices across the board, including Microsoft.

Additionally, exchange rates and geopolitical events can also impact Microsoft’s stock price. As Microsoft operates globally, changes in exchange rates can affect its revenue and profitability. Political instability or trade tensions between countries can create uncertainty, which may lead to fluctuations in stock prices.

Furthermore, investor confidence is closely tied to economic factors. Positive economic indicators, such as low unemployment rates and robust consumer spending, can boost investor confidence and drive up stock prices. Conversely, negative economic news can have the opposite effect, causing stock prices to decline.

Industry-specific factors impacting Microsoft stock price

The tech industry is known for its rapid pace of innovation and fierce competition. As a major player in the industry, Microsoft’s stock price is influenced by various industry-specific factors.

One critical factor is market competition. Microsoft faces intense competition from other tech giants like Apple, Google, and Amazon. Product launches, market share gains or losses, and innovative breakthroughs by competitors can impact investor sentiment towards Microsoft and subsequently affect its stock price.

Technological advancements and disruptions also play a significant role in shaping Microsoft’s stock price. Innovations in cloud computing, artificial intelligence, and other emerging technologies can present both opportunities and challenges for the company. Being at the forefront of technological advancements can drive investor confidence and lead to a rise in stock price, while falling behind can have the opposite effect.

Moreover, changes in consumer preferences and trends within the tech industry can impact the demand for Microsoft’s products and services. Consumer adoption of new technologies, shifts in software preferences, and changes in business models can influence Microsoft’s revenue growth and ultimately its stock price.

Company-specific factors influencing Microsoft stock price

Internal factors specific to Microsoft’s operations and performance also have a significant impact on its stock price. Financial indicators, such as earnings reports, revenue growth, and profit margins, provide insights into the company’s financial health and growth prospects.

Microsoft’s ability to generate consistent revenue growth is closely monitored by investors. Strong revenue growth indicates a growing customer base and successful product offerings, which can drive up investor confidence and lead to a higher stock price. Conversely, a decline in revenue growth or missed earnings expectations can result in a decrease in stock price.

The success of new product launches is another important factor in Microsoft’s stock price. Major product releases, such as new versions of Windows or Office, can generate excitement among investors and drive up stock prices. On the other hand, if new products fail to meet expectations or face significant challenges, it can lead to a decline in stock price.

Furthermore, Microsoft’s strategic partnerships and acquisitions can impact investor sentiment and stock prices. Collaborations with other companies, especially in emerging technology areas, can be seen as positive signals by investors. Conversely, if strategic partnerships fail or acquisitions do not deliver expected results, it can negatively impact investor confidence and stock prices.

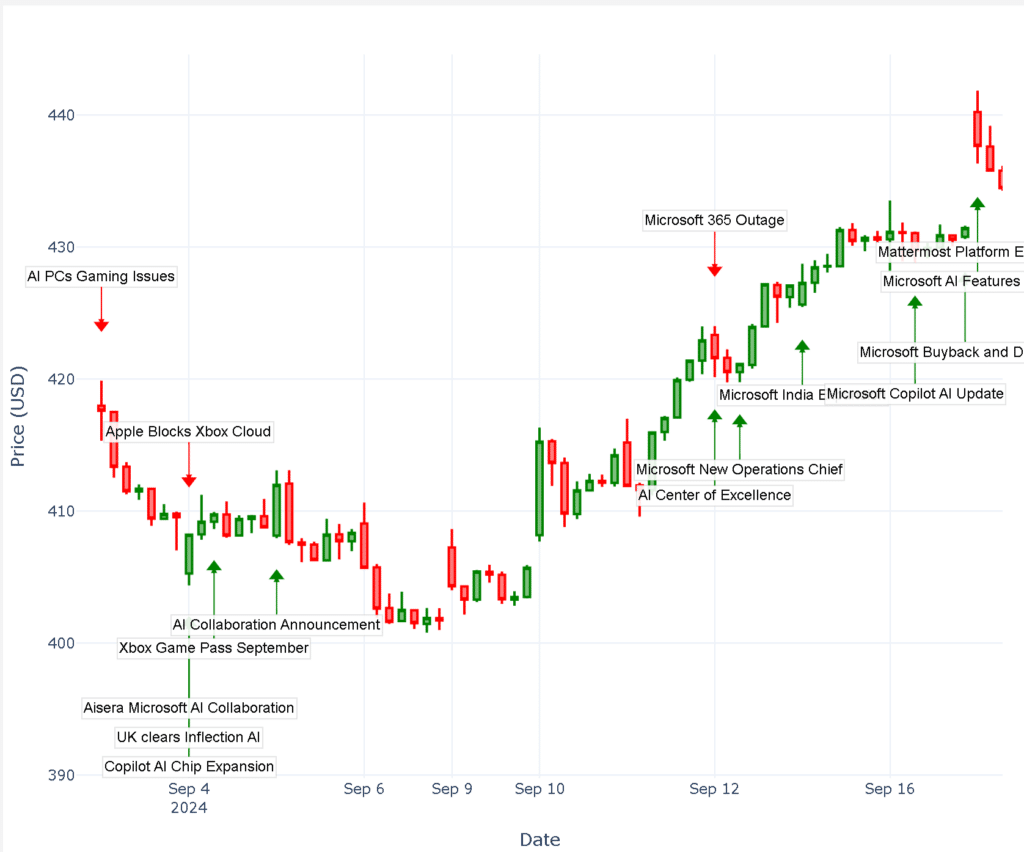

Asset events affecting Microsoft stock price performance – insights from our Trading Co-Pilot (BETA)

Microsoft’s diverse product ecosystem and its impact on stock performance

Microsoft’s stock price is intricately tied to its vast and diverse product ecosystem. The company’s ability to innovate across multiple sectors and maintain strong market positions in various product categories significantly influences investor sentiment and, consequently, its stock performance.

Productivity and collaboration tools

At the heart of Microsoft’s offerings are its productivity and collaboration tools. Microsoft 365 consumer subscriptions, which include popular applications like Word, Excel, and PowerPoint, continue to be a steady revenue stream. The enterprise version, previously known as Office 365, has seen substantial growth, particularly with the increased adoption of remote work solutions.

Exchange and SharePoint form the backbone of many corporate communication systems, while Microsoft Teams has emerged as a leading platform for virtual collaboration. These tools, integral to the operating system Windows commercial offerings, have become essential for businesses worldwide, contributing to Microsoft’s strong market position and stock stability.

Cloud services and enterprise solutions

Microsoft’s cloud services, anchored by Azure, have been a major driver of the company’s stock growth in recent years. Windows Server, Visual Studio, and System Center form a comprehensive suite of tools for developers and IT professionals, solidifying Microsoft’s position in the enterprise market.

The company’s commercial offerings, comprising volume licensing agreements and patent licensing, provide a steady revenue stream that investors view favorably. Additionally, Dynamics business solutions, including Dynamics 365, have gained traction in the competitive CRM and ERP markets, further diversifying Microsoft’s revenue sources.

Consumer products and gaming

On the consumer front, Windows OEM licensing remains a significant contributor to Microsoft’s revenue, despite the evolving PC market. The Xbox ecosystem, including Xbox Game Pass and other subscriptions, has positioned Microsoft as a major player in the gaming industry, adding another dimension to its consumer-facing offerings.

Security and compliance

As cyber threats continue to evolve, Microsoft’s focus on security and compliance across its product lines has become increasingly important. From Windows Defender to advanced threat protection services in Microsoft 365, the company’s commitment to security enhances its value proposition to both enterprise and consumer customers.

Impact on microsoftstock performance

The diversity of Microsoft’s product ecosystem provides a buffer against market fluctuations, contributing to the relative stability of its stock price. When investors analyze Microsoft’s stock, they consider the performance across these various segments:

- Cloud services growth, particularly Azure adoption rates

- Microsoft 365 consumer subscriptions and enterprise adoption

- Windows commercial offerings and OEM licensing trends

- Xbox and gaming revenue, including subscription services

- Dynamics 365 and other business solution adoptions

Quarterly earnings reports often highlight the performance of these key areas, influencing the stock’s close price and short-term movements. For instance, strong growth in cloud services or better-than-expected adoption of Microsoft Teams can lead to positive stock momentum.

Moreover, Microsoft’s ability to cross-sell and integrate its products creates a robust ecosystem that can increase customer retention and lifetime value. This integrated approach, spanning from the operating system (Windows) to cloud services and productivity tools, presents a compelling narrative for long-term investors.

As Microsoft continues to innovate across its product lines, from Windows Server to Visual Studio, and from Xbox to Microsoft 365, the company’s stock remains an attractive option for investors looking for exposure to multiple tech sectors through a single, established entity.

Financial performance and its effect on Microsoft stock price

Financial performance is a key driver of stock prices, and Microsoft is no exception. Investors closely analyze financial indicators such as revenue growth, profitability, and cash flow to gauge the company’s financial health and growth prospects.

Consistent revenue growth is an important factor that can positively influence stock prices. It indicates that Microsoft is successfully attracting customers and generating increasing demand for its products and services. Additionally, improving profit margins and strong cash flow can further boost investor confidence and drive up stock prices.

On the other hand, declining revenue growth or profitability can have a negative impact on stock prices. Investors may interpret these indicators as a sign of weakening business fundamentals and lower growth prospects, leading to a decrease in stock price.

Furthermore, the management of Microsoft’s capital allocation can also influence stock prices. Share buybacks and dividend payments can signal to investors that the company is returning value to shareholders, which can have a positive effect on stock prices. Conversely, excessive capital expenditures or high debt levels may raise concerns among investors and result in a decline in stock price.

Regulatory and legal factors affecting Microsoft stock price

Regulatory and legal factors can significantly impact Microsoft’s stock price. Being a technology company operating in various jurisdictions, Microsoft is subject to regulatory scrutiny and potential legal challenges.

Antitrust regulations and investigations are a crucial area of focus for Microsoft. Any potential violation or adverse ruling in antitrust cases can have a substantial impact on the company’s stock price. For example, in the past, Microsoft faced significant legal challenges related to its dominant position in the operating system market, resulting in regulatory actions and negative market sentiment.

Moreover, privacy and data security regulations can also influence investor sentiment towards Microsoft. As the company deals with vast amounts of user data, any breach or failure to comply with privacy regulations can lead to reputational damage and a decline in stock price.

Changes in intellectual property laws, patent disputes, and licensing agreements can also impact Microsoft’s stock price. Legal battles or unfavorable rulings can lead to financial penalties, increased costs, or restrictions on the company’s ability to operate, which can negatively affect stock prices.

Microsoft highest stock price

One of the most notable milestones in Microsoft’s stock history came when the company achieved its highest stock price, showcasing the strength of its market position and growth potential. Reaching such a peak is a testament to the company’s innovation, strong financial performance, and its ability to navigate competitive pressures.

In 2023, Microsoft hit a new all-time high share price of $377.10, when the stock was up some 56% year-to-date, after hiring Ex-OpenAI’s Sam Altman This surge in stock price was driven by a combination of factors, including investor excitement over Microsoft’s deepening involvement in artificial intelligence and cloud computing. Altman’s hiring signaled Microsoft’s commitment to staying at the forefront of AI innovation, bolstering investor confidence in the company’s strategic direction.

Much of that is due to Microsoft’s collaboration with OpenAI and its significant investments in AI-related technologies, which were seen as game-changers for the company’s long-term growth. The stock’s performance in 2023 was reflective of broader market optimism surrounding AI and Microsoft’s ability to lead the next wave of technological advancements.

This milestone came at a time when Microsoft’s revenue from its cloud platform, Azure, continued to grow steadily, alongside strong performance in its productivity and business solutions segments. And yet perhaps what investors found particularly compelling was Microsoft’s ability to leverage AI to enhance its entire product ecosystem, positioning the company as a leader not only in tech but in shaping the future of AI-driven industries.

Analyst forecasts and market sentiment on microsoftstock

Market sentiment and the expectations of financial analysts can play a significant role in influencing Microsoft’s stock price. Analyst forecasts and recommendations are closely followed by investors as they provide insights into the company’s future prospects.

Positive analyst forecasts, upgrades, or favorable recommendations can lead to increased investor confidence and higher stock prices. Analysts’ bullish views on Microsoft’s growth potential, new product launches, or market opportunities can drive up stock prices as investors align their investments with these positive expectations.

Conversely, negative analyst forecasts, downgrades, or unfavorable recommendations can have the opposite effect. Pessimistic views on Microsoft’s performance, concerns about market saturation, or potential risks can result in a decline in stock price as investors adjust their positions accordingly.

Market sentiment, which reflects the overall mood and perception of investors, can also impact Microsoft’s stock price. Positive market sentiment, characterized by optimism and confidence, can lead to higher stock prices as investors feel more comfortable taking on risk. Conversely, negative market sentiment, driven by economic uncertainties or geopolitical tensions, can result in a decline in stock price as investors become more risk-averse.

Mid-year update: Microsoft stock performance in 2024

As we reach the mid-year point of 2024, it’s time to reflect on the key factors influencing Microsoft Corporation’s (NYSE: MSFT) stock performance. Microsoft continues to solidify its position as a tech industry leader, developing and supporting software, services, devices, and solutions that drive significant value across multiple sectors.

Key segments driving growth

Intelligent Cloud: Microsoft’s Intelligent Cloud segment remains a crucial growth driver, bolstered by its Azure platform. The demand for cloud services continues to soar, contributing positively to Microsoft stock (NYSE: MSFT). This segment’s performance is critical as businesses increasingly migrate to cloud-based solutions, driving revenue and market confidence.

Productivity and business processes: The productivity and business processes segment, which includes Office Consumer and Dynamics 365, has shown robust growth. With the ongoing digital transformation, businesses and individuals continue to rely on Microsoft’s software solutions to enhance productivity and streamline business processes, further supporting the stock’s upward trajectory.

Personal computing: The personal computing segment, encompassing Windows, Surface devices, and gaming, remains a significant contributor. Although growth in this segment is more mature compared to cloud and business services, it still plays a vital role in maintaining Microsoft’s overall financial health and market position.

Market influences

The broader economic environment, marked by high inflation and fluctuating interest rates, has introduced some volatility into the market. Weak economic data in certain sectors has led to cautious investor sentiment. However, Microsoft’s diversified portfolio and strong performance across its key segments have helped it weather these challenges effectively.

Earnings season insights

As earnings season progresses, Microsoft has continued to deliver strong financial results, with revenue growth driven by its cloud and business processes segments. Investors should watch for updates on how Microsoft plans to navigate the second half of the year, particularly in light of potential interest rate adjustments by the Federal Reserve. These adjustments could influence market sentiment and stock prices.

Analyst forecasts and market sentiment

Analyst forecasts for Microsoft remain optimistic, with many continuing to recommend holding or buying MSFT stock. The positive sentiment is bolstered by Microsoft’s consistent performance and strategic investments in AI, cloud computing, and enterprise solutions. However, market sentiment can shift quickly, especially in a year with ongoing economic uncertainties and geopolitical tensions.

Looking ahead

As we move into the latter half of 2024, Microsoft’s ability to innovate and maintain its leadership in the tech sector will be crucial. Investors should keep an eye on developments in the Intelligent Cloud and Productivity and Business Processes segments, as these are likely to drive future growth. Additionally, any updates on strategic partnerships or acquisitions will be important indicators of Microsoft’s long-term strategy.

Conclusion: Understanding the complexities of Microsoft stock price fluctuations

The stock price of Microsoft is influenced by a multitude of factors, ranging from economic conditions and industry-specific developments to company-specific factors, technological innovations, financial performance, regulatory and legal factors, and analyst forecasts. Understanding and analyzing these factors is crucial for investors seeking to make informed decisions in the stock market.

By keeping a close eye on economic indicators, industry trends, and Microsoft’s financial performance, investors can gain valuable insights into the company’s outlook and potential investment opportunities. Monitoring technological advancements and regulatory changes can also provide a deeper understanding of the risks and opportunities that lie ahead for Microsoft.

Ultimately, unraveling the secrets behind Microsoft’s stock price requires a comprehensive analysis of various factors and a holistic view of the market and industry dynamics. Armed with this knowledge, investors can navigate the stock market with confidence and make sound investment decisions based on a thorough understanding of the key factors that impact Microsoft’s stock price.

Looking for more stock market insights? See our articles on the factors that determine Advance Micro Devices stock price, Lucid stock price, Tencent Holdings stock price, Nvidia stock price, Google stock price, Apple stock price, Microsoft stock price, Walmart stock price and Amazon stock price with more added weekly.

Microsoft Stock price FAQ

What are the main factors influencing Microsoft's stock price?

Microsoft’s stock price is influenced by various factors, including:

- Economic conditions (GDP growth, inflation rates, interest rates)

- Industry-specific developments in the tech sector

- Company financial performance (revenue growth, profitability)

- Product innovations and launches

- Market competition

- Regulatory and legal factors

- Analyst forecasts and market sentiment

How does Microsoft's cloud business impact its stock price?

Microsoft’s cloud business, particularly Azure, has been a major driver of the company’s stock growth. Strong performance and increased adoption of cloud services often lead to positive stock movements, as investors see this as a key area for future growth.

What role does Microsoft's gaming division play in its stock performance?

While not as significant as cloud services, Microsoft’s gaming division, including Xbox and related subscriptions, contributes to the company’s diversified revenue stream. Strong performance in gaming can positively impact stock price, especially if it exceeds market expectations.

How do regulatory challenges affect Microsoft's stock?

Regulatory challenges, particularly antitrust investigations or privacy concerns, can negatively impact Microsoft’s stock price. Investors closely monitor these issues as they can lead to financial penalties or restrictions on the company’s operations.

What was Microsoft's highest stock price, and what drove it?

In 2023, Microsoft hit an all-time high of $377.10 per share. This peak was driven by investor excitement over Microsoft’s AI initiatives, particularly its collaboration with OpenAI and the hiring of Sam Altman, signaling the company’s commitment to leading in AI innovation.

How does Microsoft's dividend policy affect its stock price?

Microsoft’s dividend payments can positively influence its stock price, as they signal financial stability and return value to shareholders. Consistent dividend growth can attract income-focused investors and support the stock price.

What impact do new product launches have on Microsoft's stock?

New product launches, especially in key areas like Windows or Office, can significantly impact Microsoft’s stock price. Successful launches often lead to positive stock movements, while products that underperform expectations can negatively affect the stock.

How does global economic uncertainty affect Microsoft's stock?

Global economic uncertainty can lead to increased volatility in Microsoft’s stock price. However, the company’s diverse product ecosystem and strong market position often provide some stability during economic downturns.

How does Microsoft's stock typically perform during tech sector volatility?

While Microsoft’s stock can be affected by overall tech sector volatility, its diverse product lineup and strong market position often provide more stability compared to smaller, more specialized tech companies. However, significant sector-wide events can still impact Microsoft’s stock price.

How are Microsoft's investments in AI affecting its stock price?

Microsoft’s significant investments in artificial intelligence have become a major driver of investor sentiment and stock performance. Here’s how AI is impacting Microsoft’s stock:

- Strategic Partnerships: Microsoft’s partnership with OpenAI, including its $10 billion investment, has been viewed very positively by investors. This collaboration has positioned Microsoft as a leader in AI innovation, driving stock price growth.

- Product Integration: The integration of AI technologies into Microsoft’s existing products, such as ChatGPT features in Bing and Microsoft 365, has increased the perceived value of these offerings. Successful AI integrations often lead to positive stock movements.

- Future Growth Potential: Investors see AI as a significant growth area for Microsoft, potentially opening new markets and revenue streams. This optimism about future prospects tends to boost the stock price.

- Competitive Advantage: Microsoft’s strong position in AI is seen as a key differentiator from competitors, potentially leading to increased market share and profitability.

- Talent Acquisition: High-profile AI-related hires, such as bringing on OpenAI’s leadership, have signaled Microsoft’s commitment to AI, often resulting in positive stock reactions.

However, it’s important to note that AI investments also carry risks, such as regulatory scrutiny and the high costs of research and development. Investors should monitor both the opportunities and challenges presented by Microsoft’s AI initiatives when considering the stock’s potential.

Revolutionize your trading strategy with Permutable’s Trading Co-Pilot

Experience the power of instant analysis with our Trading Co-Pilot (BETA). This cutting-edge tool allows you to see the factors influencing Microsoft’s stock price in real time, providing you with a competitive edge in the market. Currently available for trial to select enterprise clients, our Trading Co-Pilot offers unparalleled insights into Tesla and other high-profile stocks. Don’t just follow the market – stay ahead of it. Contact us today to learn how you can be among the first to leverage this game-changing technology in your investment strategy.