You would be hard-pressed to find a more intricate market situation than current natural gas markets signaling complex winter ahead. Let’s examine how our Trading Co-Pilot’s AI analysis of natural gas market news has uncovered several important patterns suggesting we are entering a new market interesting and potentially volatile phase in the natural gas market.

Why natural gas market news is signalling a complex Winter ahead

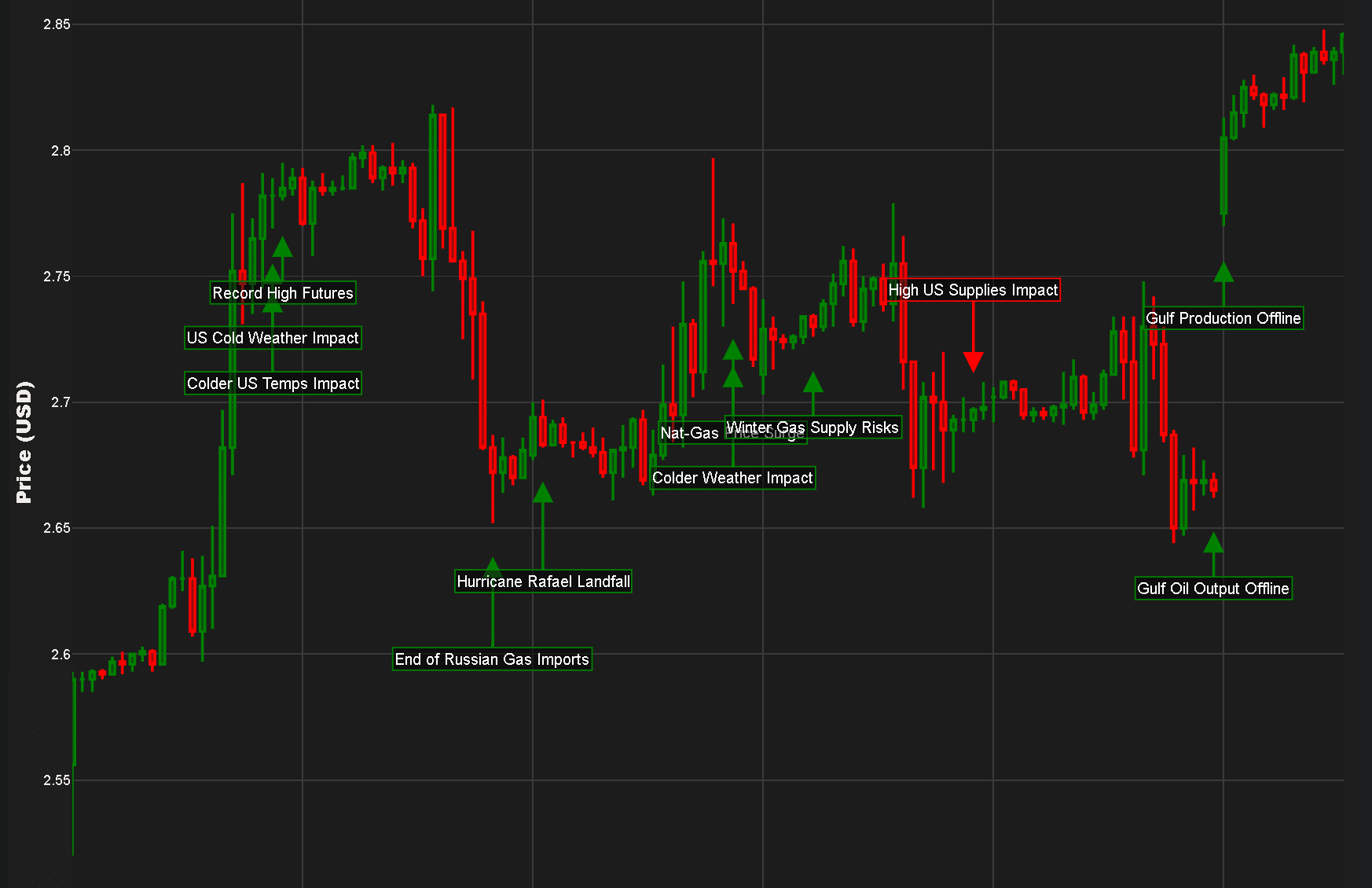

Multiple catalysts and headlines across natural gas market news

Some time ago, traditional analysis might have focused solely on temperature forecasts. Instead, our Trading Co-Pilot has detected a more nuanced picture. While mild autumn temperatures initially exerted downward pressure, Hurricane Rafael’s Category 3 impact on the Gulf Coast created unexpected supply disruptions. More broadly, when over 16% of US Gulf natural gas production remained offline, the market faced immediate supply constraints.

Supply chain dynamics revealed by natural gas market news

The aforementioned isn’t the only example of complex market forces at play. The problem is that Gulf disruptions are coinciding with infrastructure constraints. More to the point, with the reports of supply disruptions, this caused cascading effects across energy markets, with combined factors creating a supply squeeze that perhaps many traders hadn’t factored into their analyses.

Natural gas market news highlight global pressures

For those looking for the answer to why it’s likely to be a complex Winter ahead for global natural gas markets, the answer to this can be found in recent developments in European natural gas markets. Few now believe that European energy dependence on Russian gas will return to previous levels. Indeed, from looking at the new EU energy commissioner’s commitment to eliminating Russian gas reliance, coupled with ADNOC’s new LNG supply deal with Germany, this means that new demand patterns are emerging.

Mixed signals across natural gas market news

Let’s examine what else our Trading Co-Pilot has highlighted. There is also the question of price action, which has shown recovery signs while remaining below key resistance levels. Meanwhile, the daily and weekly charts present mixed signals that require careful interpretation. Above all, though, what sets our Trading Co-Pilot’s analysis apart is the ability to synthesize these multiple factors simultaneously.

Connecting the global dots with natural gas market news

Sure, some people think that individual market factors can be analysed in isolation, but to us, this is a fool’s game. Case in point – Australia’s East coast facing a gas crisis and Nigeria reporting low funding for domestic gas projects, the global supply picture becomes increasingly complex. Talk about a perfect storm of factors converging.

Looking ahead – what to expect

Before we look ahead, we invite you to think back to previous market shifts. Not only do current conditions mirror historical patterns, but they also present unique characteristics that our Trading Co-Pilot has identified. Think of that in the context of approaching upcoming winter demands, geopolitical pressures, and the fact that 2024 is projected to be the hottest year on record. Some might say it’s hard to get a handle on how these factors might play out without comprehensive AI analysis.

In short, while traditional analysts might focus on individual factors, we believe it’s crucial to take a holistic view of market dynamics. Our Trading Co-Pilot suggests watching natural gas market news in real-time for specific trigger points that could shift market sentiment. The key problem is that traditional analysis often misses these longer-term structural shifts or delivers it too late, which is precisely where our real-time AI-powered analysis proves invaluable.

Get the latest natural gas market news insights with our Trading Co-Pilot

What you’ve just read is just a snapshot of our Trading Co-Pilot‘s analytical capabilities. Whilst others are still catching up on the headlines, our AI is already analysing the next market-moving signals in natural gas in real-time. In an environment where every minute counts, having real-time intelligence can make the difference between profitable trading decisions and missed opportunities.

Our Trading Co-Pilot delivers instant analysis of breaking news impact, clear buy/sell signals backed by AI, and an early warning system for market shifts. From technical breakdowns to weather pattern impact assessment and real-time supply-demand dynamics, our AI processes it all instantly, giving you a clear edge in these volatile markets.

We’re opening limited places for our next cohort of enterprise trial users. Join leading energy traders who are already using our AI to cut through market noise, spot opportunities early, manage risk effectively, and make truly data-driven decisions. This winter’s natural gas markets are signalling complexity ahead – don’t trade them blind – get in touch to request a 2-week free trial for qualified corporate traders by getting in touch with us at enquiries@permutable.ai or filling in the form below.