As more and more investors prioritize ESG factors in their decision-making process, it’s becoming increasingly important for companies to understand and communicate their ESG performance. However, navigating the world of ESG taxonomy can be overwhelming and confusing, especially for those new to the field. That’s where this comprehensive guide comes in. In this guide, we’ll break down the key components of ESG taxonomy, providing you with a clear understanding of the terminology and frameworks used in ESG reporting. We’ll also explore the benefits of ESG reporting for businesses, investors, and society as a whole. By the end of this guide, you’ll be equipped with the knowledge and tools you need to effectively navigate the world of ESG taxonomy and communicate your ESG performance to stakeholders. Whether you’re a seasoned sustainability professional or just starting out, this guide is an essential resource for anyone looking to stay ahead of the curve in the rapidly evolving world of ESG.

Table of Contents

ToggleUnderstanding ESG Taxonomy: Key Terms and Concepts

ESG is a term that is used to describe a set of criteria that investors use to evaluate companies based on their environmental, social, and governance performance. ESG criteria are often used in investment decision-making to identify companies that are likely to perform well over the long term. There are several key terms and concepts that are important to understand when it comes to ESG taxonomy.

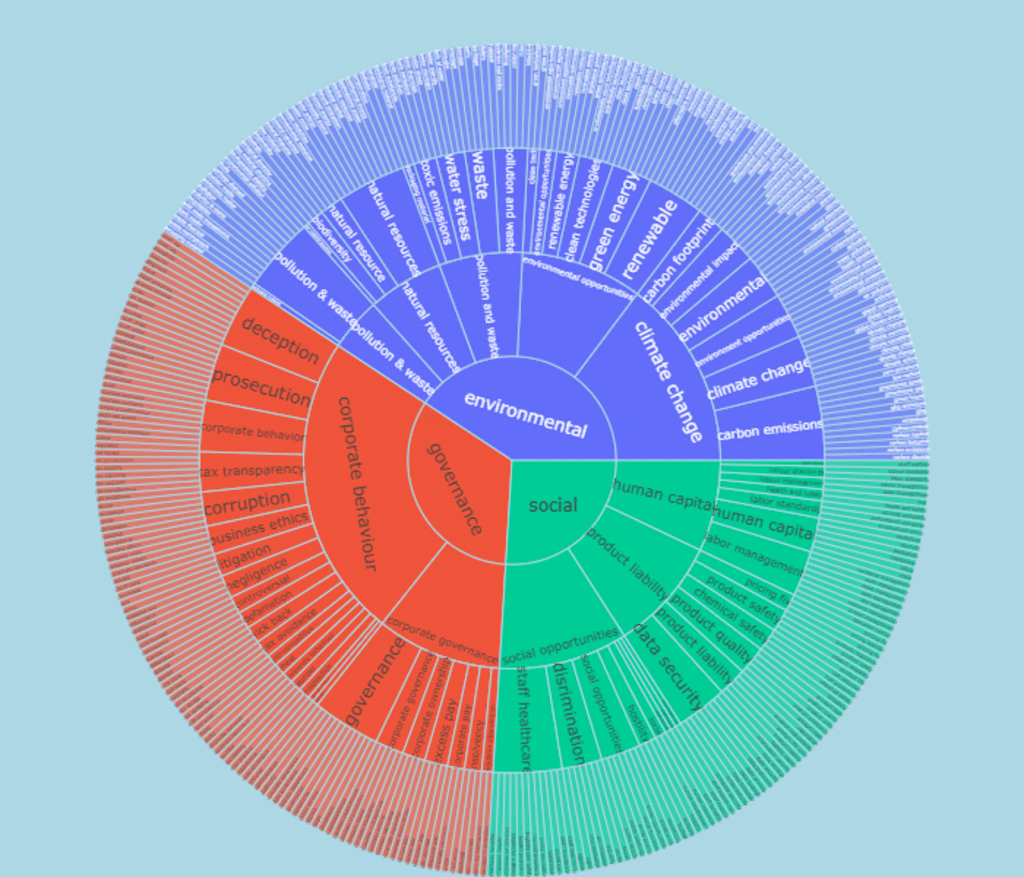

Firstly, E refers to environmental criteria, which can include issues like carbon emissions, water usage, and waste management. S refers to social criteria, which can include issues like labour practices, human rights, and community engagement. Finally, G refers to governance criteria, which can include issues like executive pay, board composition, and shareholder rights.

ESG criteria can be used to evaluate a company’s overall sustainability performance, as well as its potential financial performance. Companies that perform well on ESG criteria are often seen as more sustainable and more likely to deliver long-term financial value to investors.

The Importance of ESG Taxonomy for Businesses

ESG taxonomy is becoming increasingly important for businesses, as investors are placing more emphasis on sustainability performance when making investment decisions. In addition, many customers, employees, and other stakeholders are also prioritizing sustainability when choosing which companies to do business with.

By understanding and communicating their ESG performance, companies can enhance their reputation, build trust with stakeholders, and attract investment. ESG reporting can also help companies identify areas where they can improve their sustainability performance, and develop strategies to address these issues.

In addition, ESG reporting can help companies stay ahead of the curve when it comes to regulatory compliance. As governments around the world implement new regulations to address environmental and social issues, companies that are already reporting on their ESG performance will be better positioned to comply with these regulations.

ESG Taxonomy Frameworks and Standards

There are several frameworks and standards that are commonly used in ESG reporting. These include the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-related Financial Disclosures (TCFD) and the Task Force on Nature-related Financial Disclosures (TFND).

The GRI is a widely recognized framework for sustainability reporting, and provides guidance on how to report on a wide range of environmental, social, and governance issues. The SASB provides industry-specific guidelines for reporting on sustainability issues, and the TCFD provides guidance on how to report on climate-related risks and opportunities.

In addition, there are several other ESG reporting frameworks and standards that are used by companies and investors around the world. These include the Principles for Responsible Investment (PRI), the Carbon Disclosure Project (CDP), and the United Nations Sustainable Development Goals (SDGs).

Choosing An ESG Data Provider

There are several ESG data providers that offer research and analysis on companies’ sustainability performance, including Permutable. These providers use a variety of methodologies to evaluate ESG performance, and provide a range of services to investors and companies.

When choosing an ESG data provider, it’s important to consider factors like the provider’s methodology, the scope of their coverage, and the quality of their data which can vary greatly from provider to provider.

Our solution tracks all public and private companies (or 1.1m companies) in the world, providing global insights into sustainability performance across industries and regions. Real-time tracking of data ensures that our clients have access to the most up-to-date and accurate sustainability information, enabling them to make informed decisions quickly.

Permutable’s high granular taxonomy for ESG and UN SDG markers provides a more nuanced understanding of sustainability performance and helps organizations to focus their sustainability efforts on areas of greatest impact. Our net-zero profiles of companies, including carbon targets and actual emissions, enable organizations to track their progress towards carbon neutrality and our carbon modelling of data provides accurate and actionable insights.

Our solution has been recognized by the industry for its unique capabilities, winning numerous awards and government grants for innovation and excellence in sustainability tracking and reporting. We are proud to be at the forefront of this field, enabling organizations to make meaningful progress towards a more sustainable future.

ESG Integration in Investment Strategies

ESG integration is the process of incorporating ESG criteria into investment decision-making. This can involve using ESG ratings to identify companies that are likely to perform well over the long term, or using ESG data to identify risks and opportunities in a company’s sustainability performance.

ESG integration can be used in a variety of investment strategies, including active management, passive management, and impact investing. In active management, ESG integration can be used to identify companies that are likely to outperform their peers over the long term. In passive management, ESG integration can be used to construct ESG-focused indices that track companies with high sustainability performance. Finally, in impact investing, ESG integration can be used to identify companies that are aligned with specific social or environmental goals.

ESG Taxonomy in Corporate Governance

ESG taxonomy is also becoming increasingly important in corporate governance. Companies are expected to have strong ESG policies and practices in place, and to report on their sustainability performance to stakeholders.

In addition, investors are increasingly using their voting power to influence corporate governance decisions. This can involve voting on issues like executive compensation, board composition, and shareholder rights, with a focus on promoting sustainability and long-term value creation.

ESG criteria can also be used to evaluate the sustainability performance of suppliers and other business partners. By working with suppliers and partners that have strong sustainability performance, companies can enhance their own sustainability performance and reduce their environmental and social impact.

ESG Reporting and Disclosure: Best Practices

When it comes to ESG reporting and disclosure, there are several best practices that companies should follow. These include:

- Identifying material sustainability issues: Companies should identify the sustainability issues that are most material to their business and stakeholders.

- Setting goals and targets: Companies should set ambitious goals and targets for improving their sustainability performance.

- Providing relevant and reliable data: Companies should provide relevant and reliable data on their sustainability performance, using recognized frameworks and standards.

- Engaging with stakeholders: Companies should engage with stakeholders on sustainability issues, and seek input and feedback from a wide range of stakeholders.

- Integrating ESG into decision-making: Companies should integrate ESG criteria into their decision-making processes, including investment decisions, risk management, and strategy development.

ESG Taxonomy and Regulatory Compliance

Finally, it’s important to note that ESG reporting and disclosure is becoming increasingly important for regulatory compliance. Governments around the world are implementing new regulations to address environmental and social issues, and companies that are already reporting on their ESG performance will be better positioned to comply with these regulations.

In addition, investors are increasingly using ESG criteria to evaluate companies, and companies that are not reporting on their sustainability performance may be at a disadvantage when it comes to attracting investment.

By understanding and communicating their ESG performance, companies can enhance their reputation, build trust with stakeholders, and attract investment. ESG reporting can also help companies identify areas where they can improve their sustainability performance, and develop strategies to address these issues.

Conclusion

ESG taxonomy is becoming increasingly important for businesses, investors, and society as a whole. By understanding and communicating their ESG performance, companies can enhance their reputation, build trust with stakeholders, and attract investment. ESG reporting can also help companies identify areas where they can improve their sustainability performance, and develop strategies to address these issues.

In this guide, we’ve broken down the key components of ESG taxonomy, providing you with a clear understanding of the terminology and frameworks used in ESG reporting. We’ve also explored the benefits of ESG reporting for businesses, investors, and society as a whole.

Whether you’re a seasoned sustainability professional or just starting out, this guide is an essential resource for anyone looking to stay ahead of the curve in the rapidly evolving world of ESG. By following best practices for ESG reporting and disclosure, and integrating ESG criteria into decision-making processes, companies can enhance their sustainability performance and create long-term value for stakeholders.

Find our more

Our ESG data can help your company to make informed decisions, mitigate risks, and unlock opportunities that drive sustainable growth. By analysing and utilizing our comprehensive ESG datasets, you can identify areas of improvement, optimize your operations, and align your company’s values with the expectations of your stakeholders, including investors, customers, and employees.

Moreover, incorporating ESG factors into your company’s decision-making process is crucial to ensure long-term success and resilience in an ever-changing business landscape. By prioritizing sustainability and responsible business practices, you can enhance your company’s reputation, attract and retain top talent, and create value for your stakeholders.