First, let’s get the obvious point out of of the way as we start this article. For the uninitiated among us, when we refer to S&P Global stock we’re referring to the S&P Global 100 Index not as a single stock, but a measure of the performance of multinational, blue chip companies of major importance in the global equity markets. Now that we’ve established that, the next important point is that there is no doubting that understanding the factors affecting this index is crucial for investors and analysts alike. You could even go so far as to make the argument that this index serves as a barometer for the health of the global economy and the performance of leading international corporations.

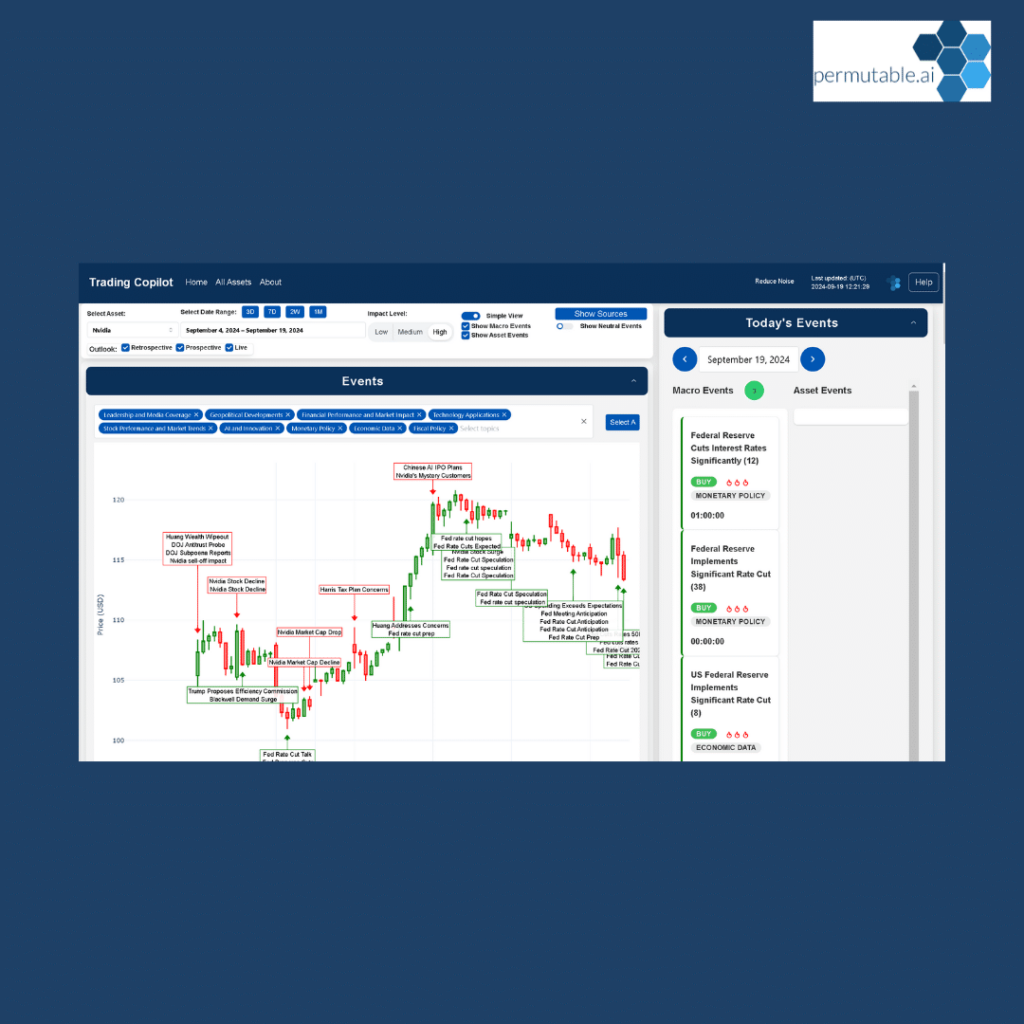

In this article, using recent insights from our Trading Co-Pilot, we take a look at the myriad of factors affecting S&P Global stock. So let’s get started.

Factors impacting S&P Global stock

How monetary policy affects S&P Global stock

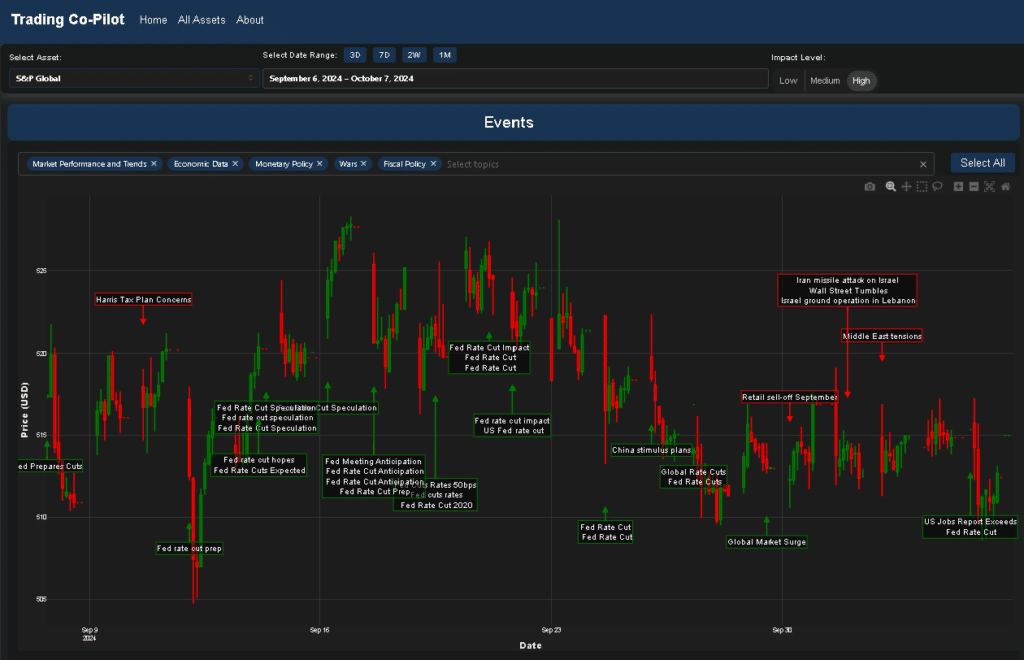

The hardest part is disentangling the complex web of monetary policy influences on the S&P Global 100 Index. Our Trading Co-Pilot data reveals a striking pattern of index fluctuations corresponding to Federal Reserve actions and speculations in recent times. There are things that can be done to anticipate these movements, such as closely monitoring central bank statements and economic indicators across major economies. But the game changer will be the ability to accurately predict policy shifts before they occur in multiple jurisdictions.

For the avoidance of doubt, let’s examine the cluster of events in mid-September, where we observe multiple instances of “Fed Rate Cut Anticipation” and “Fed Meeting Anticipation”, as highlighted in our chart. These periods often led to increased volatility in the index. And at least let’s debate it: does this hypersensibility to monetary policy make the S&P Global 100 Index more predictable or more volatile?

Then there is the challenge of global monetary policies. The question is: how do rate decisions in Europe, Asia, and emerging markets impact the performance of these multinational corporations? As for the “Global Rate Cuts” event highlighted in our data, you can’t argue with the fact that it preceded a noticeable uptick in the index.

How geopolitical turbulence impacts S&P Global stock

Everywhere you look, geopolitical events are shaping market dynamics. In a way, the S&P Global 100 Index serves as a barometer for global stability, given the international exposure of its constituent companies. It’s true that incidents like the “Iran missile attack on Israel” and subsequent “Middle East tensions” coincided with dips in the index. We can be reasonably confident that such events will continue to influence the index’s performance, given the global nature of the businesses it tracks.

The present outlook for geopolitical stability remains troublesome to say the least. If experience tells us anything, it’s that we must reject the argument being made that geopolitical risks can be easily predicted or mitigated. To reclaim strength in this area, investors must continue to refine their risk assessment models and global intelligence capabilities when analysing the S&P Global 100 Index.

How economic indicators affect S&P Global stock

And we must acknowledge that economic indicators play a pivotal role in the S&P Global 100 Index movements. This is not to say that all indicators carry equal weight. The truth is more complicated, with certain data points like the U.S. jobs report having outsized impacts due to the significant presence of American multinationals in the index. In addition, there are several areas where regional economic performance, particularly in emerging markets, can sway the index’s trajectory.

What is needed is a nuanced understanding of how these indicators interact with various sectors represented in the S&P Global 100 Index. Last but not least, we must consider the dual role of some index constituents as both market participants and market influencers, and how this affects overall index performance.

How technological advances influence S&P Global stock

Imagine too the impact of technological disruption on the future of the S&P Global 100 Index constituents. If narratives shape politics, then technology shapes markets. We live in an age of highly volatile geopolitics and rapid technological advancement. It is our strong belief that the ability of these blue-chip companies to innovate will be a key factor affecting the index’s performance in the coming years.

There are many kinds of technological challenges facing the companies in the index, from AI-driven analytics to blockchain-based financial systems. Some good examples are the rise of alternative data sources and the increasing sophistication of algorithmic trading. The reality of these technological shifts means that the companies in the S&P Global 100 Index must continually evolve to maintain their market positions.

Navigating regulatory waters

There are many very significant challenges in the regulatory landscape for the big hitter companies in the S&P Global 100 Index. But the motivation to overcome these challenges is very strong, given the potential rewards of operating on a global scale. For those that succeed in navigating these complex waters, the benefits can be substantial.

And you’ll hear lots of talk about potential regulatory changes, especially in the wake of financial crises or market disruptions. Everything starts and ends with trust and transparency in global markets. At this point, you might recognise that the role of S&P Global 100 Index constituents in shaping global business practices places them at the heart of these regulatory concerns. But here’s the inconvenient truth: increased regulation can sometimes benefit established players in the index by raising barriers to entry for potential competitors.

Competitive landscape and market trends

It’s a similar story with market trends and sector performance within the S&P Global 100 Index. The biggest flaw in many analyses is focusing solely on broad market movements without considering sector-specific trends. The key principle is to understand how different sectors within the index interact and influence overall performance.

It’s no surprise that events highlighted in our chart like “Retail sell-off September” can have ripple effects on the index, particularly for consumer-focused multinationals. But it’s critical that we also consider long-term trends in various industries, data analytics, and global markets when assessing the factors affecting the S&P Global 100 Index.

Ultimately, the factors affecting the S&P Global stock form a complex ecosystem of monetary policy, geopolitical events, economic indicators, technological disruption, regulatory pressures, and market trends. By closely monitoring these factors and understanding their interplay, investors and analysts can gain not just insights into a single index, but a deeper comprehension of the global financial landscape and the performance of the world’s leading multinational corporations.

Register interest for our Trading Co-Pilot

Are you ready to embrace the future of trading? Permutable AI’s Trading Co-Pilot, powered by advanced machine learning, provides real-time insights and context-aware strategies. Harness AI to analyse global sentiment and market events, giving your firm the edge with more precise, risk-aware trading decisions. Contact us at enquiries@permutable.ai or via the form below to explore how our Trading Co-Pilot can transform your trading approach.

Your trading is about to take off

Get in touch to register your interest to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.