Those seasoned among us already know that trading technology has become the linchpin of successful investment strategies. What we’ve found is that the key to staying ahead lies not just in data accumulation, but in the intelligent interpretation and application of that data. This realisation led us to develop our groundbreaking trading technology Co-Pilot system, a tool that’s reshaping how financial decisions are made in real-time.

The data backbone behind our trading technology

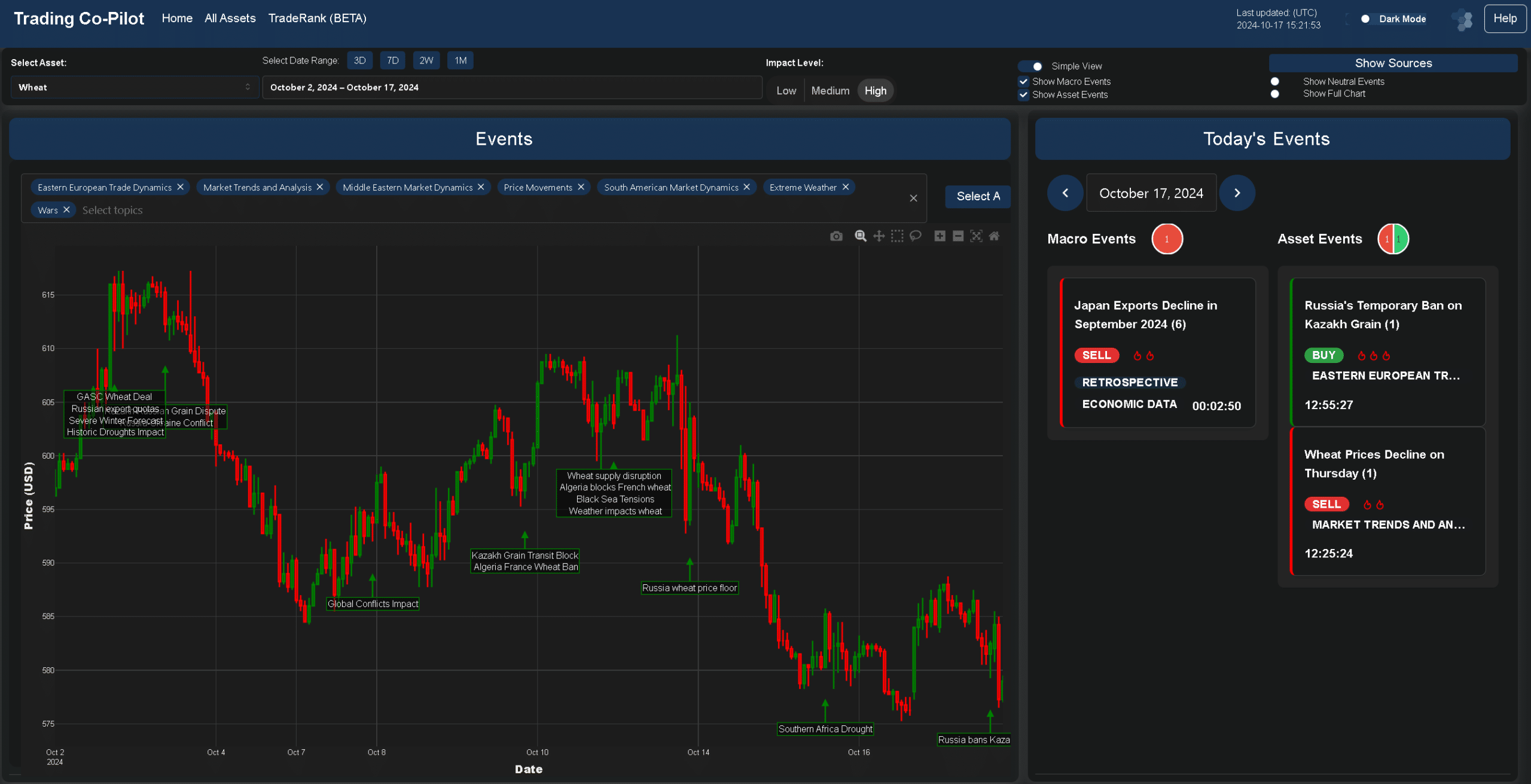

At least 20,000 global sources form the foundation of our Trading Co-Pilot‘s knowledge base. We’re talking about a system that voraciously consumes information, scraping data via RSS feeds every 30 seconds. This method applies to both freely accessible and paywalled content, ensuring a comprehensive view of the market landscape.

But there is no doubting that raw data alone is insufficient. The hardest part is transforming this torrent of information into actionable insights. Our trading technology employs sophisticated transformers and language models to digest and interpret this vast sea of data. The present outlook for this approach is highly promising, as it allows for a granular understanding of market forces that goes beyond simple price movements.

Custom models: The heart of our trading technology

What about the role of custom models in our Trading Co-Pilot system? We can be reasonably confident that our bespoke macro, sector, and fundamental models are at the cutting edge of financial analysis. These models summarise news and events into topics automatically, creating a machine-generated taxonomy for each asset. You can’t argue with the fact that this approach provides a depth of analysis that was previously unattainable.

Despite this technological prowess, we must acknowledge that the human element remains crucial. The keys to successful implementation of our trading technology lie in the careful design and oversight of these systems by our talented and committed team of machine learning experts and engineers.

Signals and systematic trading: Our Trading Co-Pilot’s decision engine

Our signal layer recommends buy, sell, or neutral positions based on the aggregated and analysed data. Again and again, we see the power of these signals in guiding trading decisions when using our Trading Co-Pilot in-house to trade our own basket.

Another big area of opportunity will be to offer these signals via an API to strategic partners. This opens up new avenues for collaboration and innovation in the trading technology space and one which we’re carefully considering.

Navigating information overload

Where our Trading Co-Pilot really holds court is tacking the challenge of information overload. With data being scraped every 30 seconds and stored for five years, the volume of historical information is staggering. Our Trading Co-Pilot doesn’t just process this data; it makes it accessible, understandable and actionable by curating it and providing directionals. Defining what is classed as relevant information is a crucial task that our system performs with increasing accuracy over time.

If experience tells us anything it’s that the financial markets are constantly evolving. And with that said, our clients can expect our trading technology to adapt and grow, with continued advancements in natural language processing and machine learning further enhancing its capabilities, along with constant fine-tuning in the pursuit of innovation by our dedicated team talented machine learning experts.

The human-machine partnership

For the avoidance of doubt, it’s important to stress that our trading technology is not about replacing human decision-makers. Rather, it’s about augmenting human intelligence with powerful analytical tools. The truth is more complicated than simply letting machines take over; the most effective strategies combine technological prowess with human insight and experience.

In addition, there are several areas where human oversight remains critical. Ethics, risk management, and strategic decision-making are just a few examples where human judgement is irreplaceable. As for the future of trading, we can expect a continued blending of human and machine intelligence, with our co-pilot technology taking on more of the heavy lifting in data analysis and pattern recognition.

Geopolitical awareness in our trading technology

If narratives shape politics which in turn go onto influence the markets, then our Trading Co-Pilot must be adept at interpreting geopolitical events and their potential market impacts. We live in an age of highly volatile geopolitics, but thankfully, our system is designed to parse complex global situations and their financial implications.

We know that geopolitical events often have cascading effects across multiple sectors and asset classes. Our Trading Co-Pilot employs advanced natural language processing to detect subtle shifts in political discourse and turbulence, correlating these changes with real-time and historical market data to predict potential outcomes. This method applies not only to major headline events but also to the nuanced interplay of international relations that might escape human analysts. When using our Trading Co-Pilot in-house to trade our own basket, this has enabled us to stay ahead of the curve when others may be caught out, through the provision of invaluable insights into the complex relationship between global politics and market movements.

The future of our trading technology

Everywhere you look in the financial world, trading technology is making its mark. In a way, our Trading Co-Pilot is at the forefront of this technological arms race within the space. It’s true that we’re still in the early stages of this technological revolution in finance with plenty more to come. However, we can be reasonably confident that the trends we’re seeing – towards more data-driven, automated, and intelligent trading systems – will continue to shape the industry for years to come and that this is just the tip of the iceberg.

Fundamentally, what is needed is a balanced approach that leverages the best of what our trading technology has to offer while maintaining a critical human element in the decision-making process. And so, the question is not whether our trading technology will continue to evolve, but how we can harness its power responsibly and effectively. All of which suggests that the future of finance will be shaped by those who can best navigate the intersection of data, technology, and human insight. We believe that the most exciting developments in our trading technology are still to come, as we continue to push the boundaries of what’s possible in financial analysis and decision-making.

Harness the power of our next-generation trading technology

The future of trading is here, and it’s powered by intelligent, data-driven technology. Our Trading Co-Pilot represents the cutting edge of financial analysis and decision-making, offering unparalleled insights into market dynamics and geopolitical impacts. Discover how our trading technology can give you the competitive edge you need to succeed in today’s volatile markets. Register your interest now to learn more about our Trading Co-Pilot and newly launched API for commodities trading by emailing enquiries@permutable.ai or filling in the form below.