As responsible investing continues to gain momentum, investors are seeking more insights into companies’ environmental, social, and governance practices. Wells Fargo, one of the largest banks in the United States, is no exception. With growing scrutiny on its ESG credentials, it’s important to understand the Wells Fargo ESG score and how it impacts responsible investing.

In this article, we dive into the metrics that determine our Wells Fargo ESG score according to our data, and shed light on its implications for investors. We explore the bank’s approach to environmental sustainability, social impact, and corporate governance. By analyzing Wells Fargo’s performance in each category, we uncover the strengths and weaknesses of its ESG practices. Moreover, we examine how investors can use the Wells Fargo ESG score as a tool to align their investment decisions with their values. Understanding the bank’s ESG performance not only provides insights into its sustainability efforts but also helps investors make more informed choices.

Join us as we delve into the world of ESG metrics and discover the significance of Wells Fargo’s ESG score in responsible investing.

Importance of ESG scores in responsible investing

ESG scores play a crucial role in responsible investing as they help investors evaluate the sustainability and societal impact of their investment choices. Traditionally, financial performance has been the primary consideration for investors. However, the increasing recognition of the interplay between environmental, social, and governance factors and long-term financial performance has shifted the focus towards ESG considerations.

Investors are increasingly realizing that companies with strong ESG practices are better equipped to navigate future challenges and generate sustainable long-term returns. ESG factors can directly impact a company’s reputation, operational efficiency, regulatory compliance, and risk management. Therefore, incorporating ESG scores into investment decisions can provide investors with a more holistic understanding of a company’s overall performance and its potential for long-term value creation.

Additionally, ESG scores also serve as an accountability mechanism for companies. By making ESG performance transparent, companies are incentivized to improve their sustainability practices and address any deficiencies. This transparency fosters a culture of responsible business practices and encourages companies to consider their impact on the environment and society.

Wells Fargo ESG score: Understanding the importance

To understand Wells Fargo’s ESG score, we need to delve into the components that contribute to it. Wells Fargo’s ESG score is determined by various metrics related to environmental sustainability, social impact, and corporate governance.

Environmental

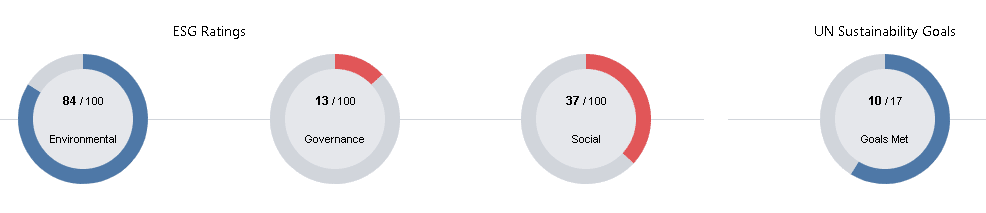

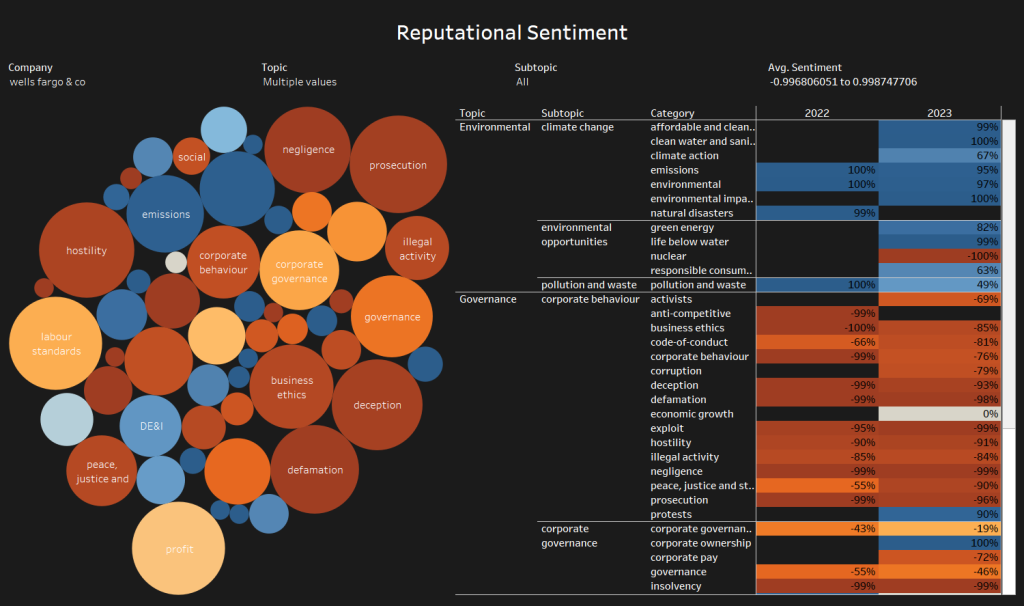

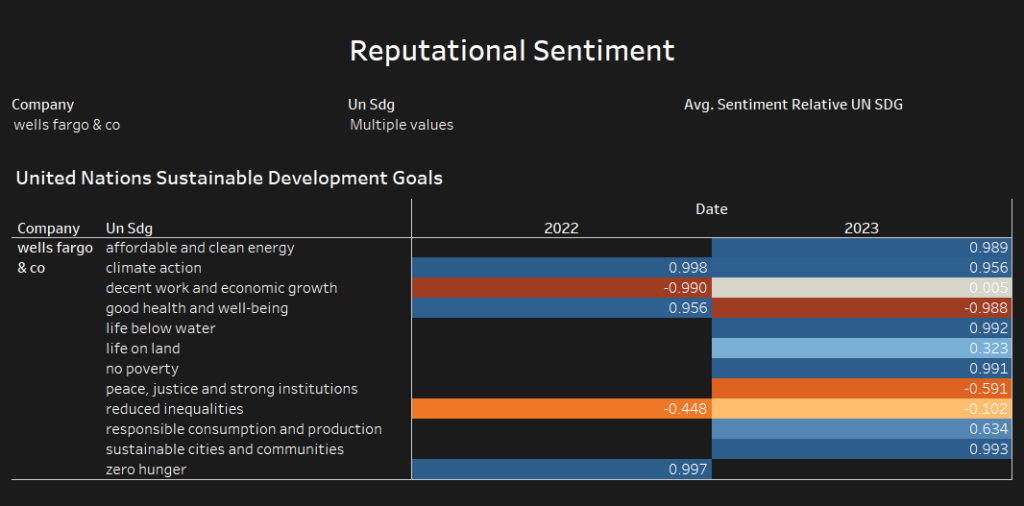

In terms of environmental sustainability, Wells Fargo is evaluated on factors such as its carbon emissions, energy usage, waste management, and efforts to mitigate climate change. The bank’s environmental score at 84 is regarded as mixed. Although it has made a commitment to reducing its environmental footprint, and transitioning towards renewable energy sources the bank has been called out for greenwashing because of their continued commitment to funding fossil fuel projects.

The latest report last week from Banking on Climate Chaos, an organization that tracks bank financing for companies in the fossil fuel industry, found that US banks – of which Wells Fargo is one – had loaned over $4.6tn to the fossil fuel industry since 2016, the year the Paris climate agreement was struck.

Additionally Wells Fargo’s greenhouse gas emissions are high. The bank’s emissions are more than twice the average for large banks. Meanwhile the institution has been criticized for its involvement in the construction of the Dakota Access Pipeline, which is a controversial oil pipeline that crosses Native American land.

Social

Social impact is another crucial component of Wells Fargo’s ESG score, though the bank scores poorly compared to other banks at only 37 according to our data. The Wells Fargo ESG score on social factors is relatively low compared to other large banks due to a number of factors, including:

- Past scandals. Wells Fargo has been involved in a number of high-profile scandals in recent years, including the fake accounts scandal and the overcharging of mortgage customers. These scandals have damaged the bank’s reputation and have led to increased scrutiny from regulators.

- Discrimination allegations. Wells Fargo has also been accused of discrimination in its lending practices. In 2021, the bank agreed to pay $1 billion to settle a class-action lawsuit alleging that it discriminated against Black and Hispanic borrowers.

- Weak labour practices. Wells Fargo has been criticized for its labour practices, including its use of temporary and contract workers. The bank has also been accused of union-busting and of retaliating against employees who speak out about problems.

In addition to these specific factors, Wells Fargo’s social ESG score is also lower than some other large banks because of its overall size and complexity. Large banks are more likely to have ESG risks than smaller banks, simply because they have more operations and more employees.

Governance

Corporate governance is the third pillar of Wells Fargo’s ESG score. This encompasses factors such as board composition, executive compensation, transparency in financial reporting, and risk management practices. Evaluating Wells Fargo’s adherence to good governance principles helps gauge its commitment to accountability, ethical behaviour, and responsible decision-making.

Wells Fargo scores poorly on governance factors with a score of 13 according to our data for a number of reasons, including:

- Weak board oversight. Wells Fargo’s board of directors has been criticized for its weak oversight of management. This was particularly evident during the fake accounts scandal, when the board failed to take action to stop the fraudulent activity.

- High executive compensation. Wells Fargo’s CEO and other executives are paid significantly more than their peers at other large banks. This is particularly concerning in light of the bank’s recent scandals and poor performance.

- Related party transactions. Wells Fargo has a history of engaging in related party transactions, which are transactions between the bank and its affiliates or insiders. These transactions can create conflicts of interest and can raise concerns about self-dealing.

- Lack of transparency. Wells Fargo has been criticized for its lack of transparency on ESG issues. For example, the bank has not publicly disclosed its greenhouse gas emissions or its workforce diversity data.

In addition to these specific issues, Wells Fargo’s governance ESG score is also lower than some other large banks because of its overall size and complexity. Large banks are more likely to have governance risks than smaller banks, simply because they have more operations and more employees.

It is important to note that Wells Fargo has taken steps to improve its governance in recent years. For example, the bank has added new independent directors to its board and has strengthened its risk management policies. However, the bank still has a long way to go to improve its governance ESG performance.

Wells Fargo ESG score: Comparison with other financial institutions

To evaluate Wells Fargo’s ESG score, it is helpful to compare it with other financial institutions in the industry. Below we have listed Wells Fargo’s key competitors and links to our ESG reports and scores for each financial institutions:

- JP Morgan Chase ESG score

- Bank of America ESG score

- Citigroup ESG score

- U.S. Bancorp ESG score

- Goldman Sachs ESG score

- Morgan Stanley ESG score

- PNC Financial Services ESG score

- Keycorp ESG score

Implications of Wells Fargo’s ESG score on responsible investing

Wells Fargo’s ESG score has significant implications for responsible investing. By analyzing the bank’s ESG performance, investors can determine whether it aligns with their own values and sustainability goals. If Wells Fargo’s ESG score reflects strong environmental sustainability practices, social impact initiatives, and robust corporate governance, it may attract investors who prioritize responsible investing.

On the other hand, a low ESG score may raise concerns among investors and prompt them to reconsider their investment decisions. A poor ESG score may indicate a lack of commitment to sustainability, ethical practices, or transparency. Investors who prioritize responsible investing may choose to divest from companies with low ESG scores or engage in shareholder activism to encourage positive change.

Understanding Wells Fargo’s ESG score allows investors to make more informed decisions that align with their values and contribute to a more sustainable and responsible financial system.

How investors can use Wells Fargo’s ESG score in their investment decisions

Investors can utilize Wells Fargo’s ESG score as a valuable tool in their investment decisions. By considering the bank’s ESG performance, investors can align their portfolio with their values and support companies that prioritize sustainability and responsible business practices.

Investors who prioritize environmental sustainability can evaluate Wells Fargo’s efforts to reduce its carbon footprint, transition to renewable energy sources, and manage its environmental impact. They can compare Wells Fargo’s ESG score with other banks that have a strong focus on sustainability and choose to invest in institutions that demonstrate a higher commitment to environmental stewardship.

For investors concerned about social impact, Wells Fargo’s ESG score provides insights into its diversity and inclusion initiatives, community engagement efforts, and customer satisfaction. By evaluating these social factors, investors can identify banks that prioritize social responsibility and support communities.

Corporate governance is another critical aspect for investors considering Wells Fargo’s ESG score. Investors can assess the bank’s board composition, executive compensation, and risk management practices to gauge its commitment to ethical behavior, transparency, and accountability.

By incorporating Wells Fargo’s ESG score into their investment decisions, investors can support companies that align with their values and contribute to a more sustainable and responsible financial system.

The future of ESG scores and responsible investing

ESG scores are likely to play an increasingly important role in responsible investing as sustainability considerations become more integrated into investment decision-making. As investors demand greater transparency and accountability from companies, ESG scores will continue to evolve and improve.

Standardization of ESG metrics and methodologies is a key area of development. Efforts are underway to establish consistent reporting standards and frameworks, enabling investors to compare ESG scores more accurately. This standardization will enhance the credibility and reliability of ESG scores and make them a more effective tool for responsible investing.

Additionally, advancements in technology and data analytics are expected to enhance the quality and depth of ESG scoring. Machine learning algorithms and natural language processing can help analyze vast amounts of data, identify relevant ESG factors, and provide more comprehensive assessments of a company’s sustainability practices.

The future of responsible investing is likely to be characterized by increased integration of ESG considerations into investment strategies, as well as greater collaboration between investors, companies, and regulators. ESG scores will continue to serve as a valuable tool for investors seeking to align their portfolios with their values and contribute to a more sustainable and responsible financial system.

Wells Fargo ESG score: Summing up

Understanding Wells Fargo’s ESG score is essential for investors interested in responsible investing. By delving into the metrics that contribute to Wells Fargo’s ESG score, investors can evaluate the bank’s environmental sustainability, social impact, and corporate governance practices. This evaluation allows investors to align their investment decisions with their values and support companies that prioritize sustainability and responsible business practices.

While ESG scores have limitations, they provide a valuable starting point for investors to assess a company’s sustainability performance. As ESG scores continue to evolve and become more standardized, they will play an increasingly important role in responsible investing.

Investors have the power to drive positive change by considering ESG factors in their investment decisions and supporting companies that prioritize sustainability, social responsibility, and good governance. By utilizing Wells Fargo’s ESG score as a tool, investors can contribute to a more sustainable and responsible financial system while potentially achieving their investment objectives.