If you’ve been asking yourself, “Why is Nvidia stock going down today?”, you’re not alone. The recent volatility from September 3 to September 9, 2024, highlights significant market events and broader macroeconomic factors. These events, while expected, led to Nvidia’s stock price facing dramatic fluctuations. Now, nearly a week later, we analyse why Nvidia stock went down and explore its future outlook. We’ve put together this analysis of recent events using insights from our Trading Co-Pilot which provided a confident, data-driven understanding of Nvidia’s movements in relation to world and macros events.

Why is Nvidia stock going down today?

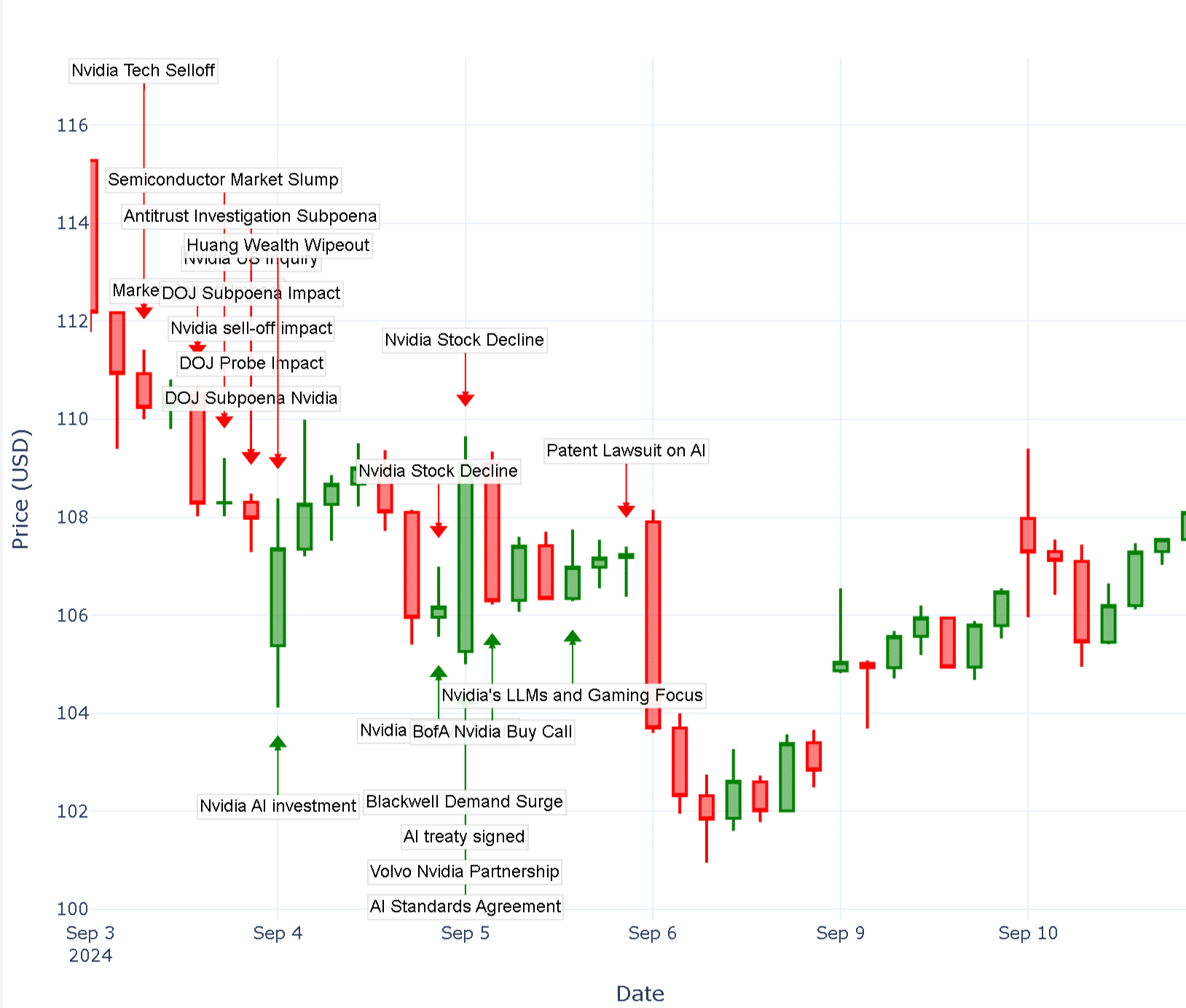

September 3: Market sell-off and semiconductor slump

It all started on September 3, when Nvidia stock witnessed a sharp decline. Why is Nvidia stock going down today? This isn’t just because of Nvidia’s internal affairs, but rather a market-wide sell-off, compounded by a semiconductor market slump. In stark contrast to Nvidia’s previous steady growth, the market faced global economic fears of a recession. This highlighted the tech sector’s sensitivity to macroeconomic factors, with Nvidia being particularly vulnerable.

But look how our Trading Co-Pilot immediately flagged the downturn, warning investors about the potential ripple effects of the broader market decline. The reality is that Nvidia’s stock reacted as part of a natural correction phase following months of bullish sentiment.

September 4 – 5: A brief recovery

Initially, September 4 brought a small rebound, with news of Nvidia’s partnership expansion announcement with Volvo to boost AI and autonomous driving. September 5 saw news about Nvidia’s push further into LLMs and gaming. But while these announcements were positive, they weren’t enough to completely calm investor nerves. So, why is Nvidia stock going down today despite these efforts? The answer came from a Patent Lawsuit on AI, which introduced legal challenges for Nvidia’s cutting-edge technologies.

September 6: Nvidia stock tanks

By September 6, the concern for investors asking why is Nvidia stock going down today became even more apparent. Macroeconomic factors—particularly US job growth slowing and concerns around Fed rate cuts introduced further uncertainty. In this scenario, Nvidia, alongside other tech giants, became vulnerable to rate-related volatility. So despite broader market trends, macroeconomic concerns outweighed Nvidia’s positive fundamentals and ultimately, took their toll on the stock.

September 9: Stabilisation beckons

By September 9, Nvidia’s stock began showing signs of stabilisation. After a week of volatility driven by broader market concerns and legal challenges, the stock found a temporary foothold. Our Trading Co-Pilot flagged this stabilisation, suggesting a pause in the downtrend. But as always, macroeconomic issues loom large, particularly with ongoing concerns about interest rates, inflation, and global growth slowing down. Despite Nvidia’s strong fundamentals and market leadership in AI, the stock remains sensitive to these larger economic forces.

The stabilisation seen on September 9 could mark the beginning of a more balanced trading period for Nvidia, but caution is warranted as macroeconomic uncertainties persist. Nonetheless, our Trading Co-Pilot continues to monitor these developments, providing real-time insights into how broader global factors may impact Nvidia’s stock price moving forward.

What’s next for NVIDIA stock?

Ultimately, the fluctuations seen over this period were driven by a combination of macroeconomic uncertainty, legal issues, and market speculation. Initially, a market sell-off and semiconductor slump led to the first significant decline, which was further exacerbated by legal challenges and macroeconomic concerns. It’s the same story on macroeconomic factors: uncertainty will likely persist in the short term, but Nvidia’s leadership in AI should provide stability over time.

These concerns also shape market sentiment, keeping the question of why is Nvidia stock going down today relevant, particularly for short-term traders. It’s important to remember that ever since Nvidia became an AI leader, it has faced challenges, however analysts believe Nvidia’s long-term growth potential remains solid, particularly in terms of its AI leadership, which continues to drive innovation across industries. If you’re navigating this complex market landscape, Permutable AI’s Trading Co-Pilot offers real-time insights and predictive analytics to help you stay ahead.

Unlock AI-powered market insights with Permutable’s Trading Co-Pilot

At Permutable AI, we’re excited to announce that we are inviting select corporate partners for a free trial of our Trading Co-Pilot – the cutting-edge AI-powered tool that provided the insights you just read. Limited spaces are available, so if you’re ready to take your market analysis to the next level powered by our advanced AI technologies, we encourage you to get in touch. Don’t miss your chance to be among the first to leverage this transformative tool. Reach out now to us at enquiries@permutable.ai to request a spec and secure your spot or fill in the form below.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.