The impact of the Middle East crisis on oil prices continues to be a dominant force in global energy markets. This year has seen a series of events that have sent tremors through the industry, with Brent Crude oil prices responding to geopolitical twists and turns. In this article we’ll track recent escalations in the region and the impact of the Middle East crisis on oil prices using insights from our proprietary Trading Co-Pilot.

The impact of the Middle East crisis on oil prices: Early tensions

Cast your mind back to mid-September, when the price of oil hovered around the $71 mark. The trail of blood between Israel and Hezbollah was already evident, with tensions simmering beneath the surface. Then, like a spark to kindling, Lebanon device explosions ignited, coinciding with Ukraine drone strikes. This marked a turning point, as the impact of Middle East crisis on oil prices began to manifest in an upward trajectory.

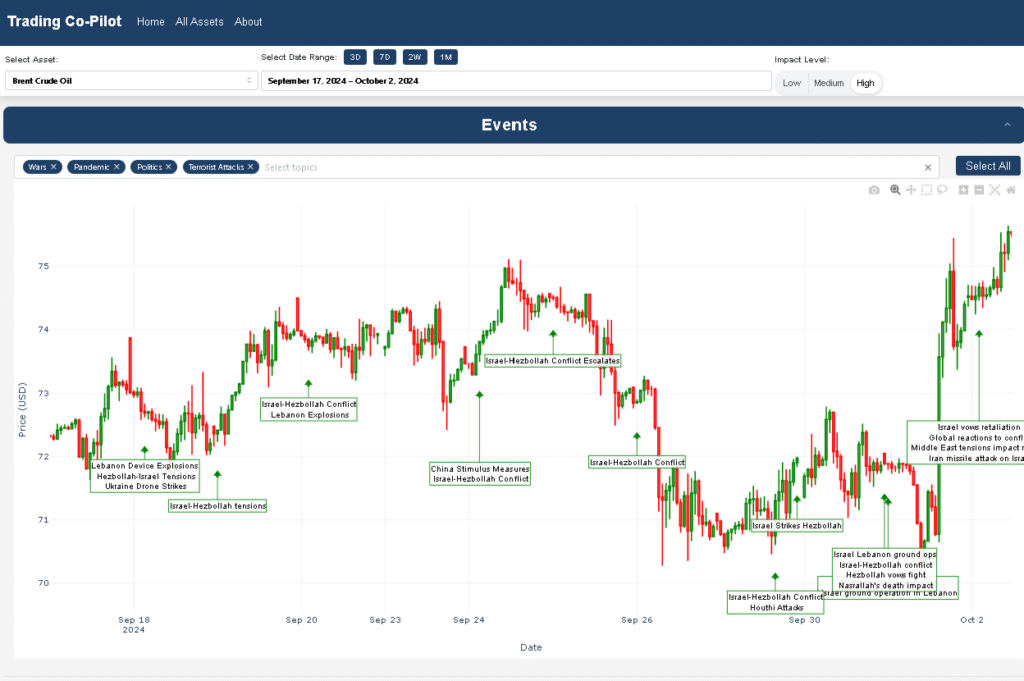

Above: Impact of the Middle East crisis on oil prices: Insights from our Trading Co-Pilot

The impact of the Middle East crisis on oil prices: Escalating conflicts

For the initiated in the oil markets, such events are not unfamiliar. The rivalry between regional powers has long been a factor in price fluctuations. And yet, the rapid succession of incidents in this period stands out. No matter the degree of preparedness, sometimes the problem lies in the unpredictability of these conflicts, amplifying the impact of Middle East crisis on oil prices.

Global Implications: Beyond regional borders

Looming over the entire situation is the spectre of wider regional instability. As we write, the Israel-Hezbollah conflict has escalated, with each new development sending ripples through the market. The narrative picked up momentum with Lebanon explosions, pushing prices above $74. Around the same time, China announced stimulus measures, adding another layer of complexity to the global economic picture and the impact of Middle East crisis on oil prices.

The crucial question

Why does this matter so much for oil prices? For some, this might seem like an overreaction. However, the Middle East remains a crucial oil-producing region, and any hint of supply disruption can send prices soaring. It is an experience that has been repeated countless times over the decades, highlighting the enduring impact of Middle East crisis on oil prices.

Correlation and causation

Our chart clearly shows a correlation between these events and price movements. Whether it is these factors alone driving the market is always up for debate, but their influence is undeniable. There is also debate about whether such price volatility is justified, given the global shift towards renewable energy. And yet, oil remains a critical resource, particularly in times of geopolitical uncertainty.

Market sentiment and the impact of the Middle East crisis on oil prices

Sentiment around the conflict appears to be an obvious ad significant driver in the impact of Middle East crisis on oil prices. As tensions escalated, we saw prices spike 5%. It is viewed as a potential harbinger of wider regional instability, which could threaten oil supplies. In contrast, moments of relative calm saw prices stabilise or even dip slightly.

However what everyone is currently mulling over is – will the current situation last? That’s the million-dollar question as Israel vows retaliation at time of writing and oil prices continue to jump. Then there is the issue of how other global events might intersect with this regional conflict. Our Trading Co-Pilot gives an indication of the complexity of factors at play,

The good, the bad, and the ugly

There is the good, the bad, and the ugly about how markets respond to such events. On one hand, price increases can spur investment in alternative energy sources. On the other, they can cause economic hardship for oil-dependent nations and consumers alike. Then there is what some would regard as opportunistic price gouging, taking advantage of market fears.

The impact of the Middle East crisis on oil prices: Lessons from the past

So, you say, all of this is not a new revelation, and indeed you would be correct. In the past few years, we have had a real-life experiment in how geopolitical events can impact oil prices, from the pandemic to the Ukraine war – not to mention everything else in-between. And this is the other thing about oil markets – they don’t exist in isolation but are part of a complex global economic ecosystem.

The bigger picture: Long-term trends

Despite all this, it’s important not to lose sight of the broader trends. These important factors should not obscure the long-term shift towards renewable energy and the gradual decoupling of economic growth from oil consumption in some regions, even as the impact of Middle East crisis on oil prices continues to be felt in the short term.

The impact of the Middle East crisis on oil prices: Final thoughts

Our Trading Co-Pilot insights provides a fascinating glimpse into the complex relationship between Middle East conflicts and oil prices. It serves as a reminder of the interconnectedness of global events and markets, and the challenges faced by investors, policymakers and citizens alike in navigating these increasingly turbulent waters. As we move forward, keeping a close eye on both the headlines and the price charts will be essential for anyone seeking to understand the true cost of conflict in our oil-dependent world and the ongoing impact of Middle East crisis on oil prices. Thankfully though, at Permutable, we do all of that for you easily in one seamless solution with our Trading Co-Pilot.

Ready to navigate volatile oil markets with confidence?

As an oil trader, you know that staying ahead of market-moving events is crucial. Our Trading Co-Pilot gives you the edge you need, providing real-time insights into how geopolitical events impact oil prices.

Don’t let another market-moving event catch you off guard. Try out Trading Co-Pilot free for 14 days and experience:

- Real-time event tracking and price correlation

- Customisable alerts for critical market shifts

- AI-powered analysis of global news and its potential market impact

Get the AI edge by using event-driven news and price insights in your trading. Click here to start your free trial now.