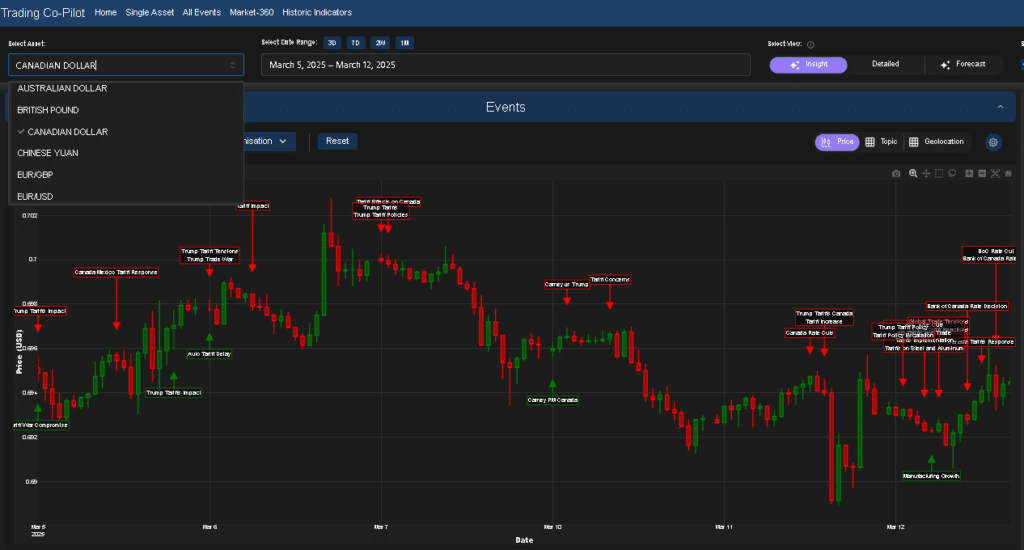

As global trust continues to be undermined by Trump’s second coming, the Canadian dollar is faltering under a triple threat of geopolitical tensions, monetary policy shifts, and leadership transitions. Our Trading Co-Pilot’s sentiment analysis reveals a disconcerting marriage of factors driving Canadian dollar market sentiment to its most volatile state in years, with significant implications for financial markets.

In the hectic news cycle and slew of erratic announcements coming out of the Whitehouse, we’ve seen oscillations between 0.69 and 0.70 against the US dollar, reflecting deep-seated concerns about the future of North American trade relations. When you consider the dollar’s position as Canada’s primary trading partner currency, these movements take on an importance for the Canadian economy that can not be understated, which derives approximately 75% of its export value from US-bound goods and services.

Above: Canadian dollar market sentiment Analyst Insight View

Trump 2.0 and the tariff tempest

We know all too well that markets do not like instability and they don’t like uncertainty. The implementation of a 25% tariff on Canadian imports represents precisely the type of disruptive force that creates currency volatility. The most glaring prospect, however, came on March 11th when President Trump announced plans to double tariffs on Canadian steel and aluminum to an eye-watering 50% (having now backtracked on those tariff threats), sending shockwaves through markets and intensifying concerns about Canadian dollar market sentiment.

This is why the question of retaliatory measures has become central to understanding broader market dynamics. The danger of this shift is particularly acute for a trading nation like Canada, where currency stability directly impacts economic prosperity. The hard truth is that currency volatility rarely remains contained – instead, it spreads across asset classes, creating correlated disruptions in equity, bond, and commodity markets of the kind we are seeing at time of writing.

As our analysis shows, each announcement and policy shift sends tremors through interrelated markets, creating ricochets that amplify volatility. This rightly causes worries about long-term stability in Canadian dollar market sentiment and the broader North American economic relationship, among other things.

Above: Canadian dollar market sentiment heatmap

Political leadership and the monetary policy response

In this new world (dis)order shaped by America’s rising protectionism, Canadian dollar market sentiment has become inextricably linked to political developments. The market’s reaction to Mark Carney’s election as Canada’s new Prime Minister on March 10th demonstrated this connection emphatically, with the CAD declining from 0.70 to 0.69 as traders digested the implications of his expected confrontational stance on trade issues with the Trump administration.

The slew of negative indicators continued through March 12th, when the Bank of Canada delivered its seventh interest rate cut as inflation trends lower. Experts say these monetary policy adjustments reflect a growing recognition that trade-induced disruptions could push an already-fragile economy toward recession. The central bank’s actions demonstrate how Canadian dollar market sentiment has become a primary concern for policymakers attempting to navigate increasingly treacherous economic waters.

You may say that economic fundamentals ultimately determine currency values, but in today’s fast-paced markets, sentiment often leads fundamentals rather than following them. This is a difficult truth for traditional forex analysts who rely on macroeconomic models that assume rational market behavior. The danger posed by sentiment-driven volatility is that it can become self-reinforcing, creating the very economic conditions that justify the initial concerns.

Sectoral impacts and temporary reprieves

Cracks are appearing in various sectors of the Canadian economy as they adjust to this new reality. The automotive industry, which operates on deeply integrated cross-border supply chains, received a temporary reprieve on March 6th when the Trump administration announced a one-month delay on tariffs for automakers. Canadian dollar market sentiment responded positively to this development, but the relief proved short-lived as broader tensions continued to dominate market psychology.

This is why the question of sector-specific exemptions has become increasingly important for forecasting Canadian dollar market sentiment. The Trumpian backlash against established trading relationships has introduced systemic uncertainty that traditional economic models struggle to quantify. When industries that represent significant portions of cross-border trade face existential threats, currency markets inevitably reflect these concerns.

Navigating Canadian dollar volatility

The current volatility reflects genuine uncertainty about Canada’s economic trajectory under new trade policies and political leadership – uncertainty that will only resolve as real economic impacts become measurable rather than theoretical. For traders and investors navigating these choppy waters, our Trading Co-Pilot continues to monitor Canadian dollar market sentiment alongside a constellation of related indicators in real-time. The coming weeks will be crucial in determining whether recent volatility represents a correction within established parameters or signals a more fundamental realignment of North American economic relationships as many are fearing. Request an enterprise trial of our Trading Co-Pilot and watch the market sentiment unfold in real-time. Simply email us at enquiries@permutable.ai or fill in the form below.

Request enterprise demo/trial

Read associated currency market sentiment analysis

Japanese Yen market sentiment March 2025

US Dollar market sentiment March 2025