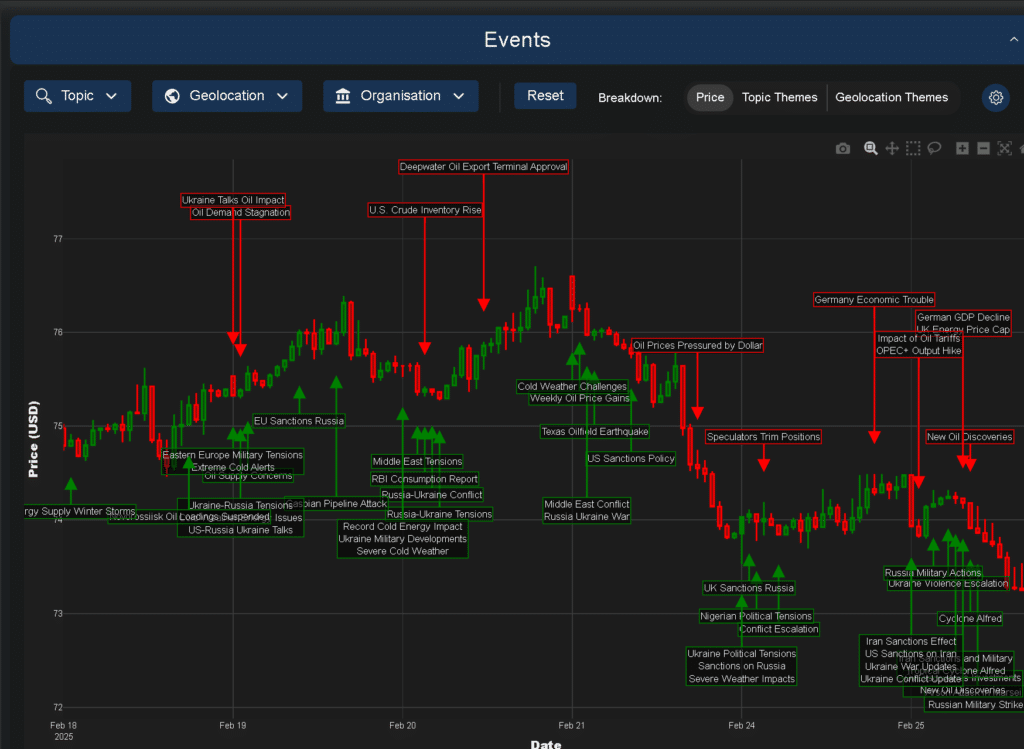

Understanding the complex interplay of factors affecting crude oil price forecast is become increasingly vital for energy traders and investors amid increasing geopolitical and supply-demand tensions. The latest insights surfaced by our Trading Co-Pilot are signalling a consistent bearish trend for Brent crude oil, with prices experiencing notable pressure throughout February, culminating in significant declines by month-end.

One cannot escape the reality that this latest crude oil price forecast has been dominated by supply-side pressures. Our Trading Co-Pilot processes vast amounts of market data allows us to identify how rising US crude inventories have combined with increased output from Iraq and Nigeria to create substantial downward pressure on prices. By February 25th, Brent crude had fallen to 73.26, reflecting the market’s growing concern about potential oversupply.

Table of Contents

ToggleGeopolitical crosscurrents: Mixed signals impacting crude oil price forecast

The financial and geopolitical forces shaping crude oil markets are sending mixed signals to traders. After a spell of modest gains around February 18th when prices closed at 74.89, the market experienced increasing volatility. This includes the significant impact of drone attacks reducing oil flow from the Caspian Pipeline Consortium by up to 40%, which initially supported prices before broader demand concerns reasserted themselves.

One of the really remarkable things over the last year is how quickly market sentiment can shift when geopolitical developments intersect with fundamental supply-demand dynamics. Fresh US sanctions against Iran and concerns over potential oil tariffs introduced additional uncertainty into our crude oil price forecast, yet these typically bullish factors failed to overcome the bearish momentum established by oversupply concerns.

Economic indicators turn crude oil price forecast bearish

Navigating the complex relationship between macroeconomic factors and energy markets is becoming increasingly challenging for energy traders. Part of the battle here is understanding how a stronger US dollar and weak economic news have contributed to the downward pressure reflected in our crude oil price forecast. The very significant upside is that our Trading Co-Pilot can quantify this impact, assigning an 85% confidence level to its bearish assessment based on current market dynamics.

By February 21st, these economic headwinds had pushed Brent crude to a low of 73.30, with our Trading Co-Pilot analysis indicating that trader sentiment had shifted decidedly negative. This includes the dramatic reduction in speculative bullish positions observed in market data, further confirming the bearish trajectory in our crude oil price forecast.

Supply-demand imbalance: The core driver behind our crude oil price forecast

The tactics used by successful traders often involve identifying the fundamental drivers behind price movements. But it is almost always the case that these relationships are complex and intertwined. In our crude oil price forecast, our Trading Co-Pilot’s analysis has identified that despite ongoing geopolitical tensions that would typically support prices, supply concerns have overwhelmingly dominated market sentiment.

In the previous era, traders might have expected geopolitical risk premiums to provide stronger price support. However, our crude oil price forecast has demonstrated that supply fundamentals were more prevalent in determining price direction. The rise of increased production from multiple regions, combined with inventory builds, has created persistent bearish pressure.

Our Trading Co-Pilot’s technical crude oil price forecast

The most frustrating thing about traditional market analysis is its tendency to provide conflicting signals without clear guidance. Our Trading Co-Pilot goes beyond mere observation to offer actionable insights in our crude oil price forecast. With Brent trading below key support levels at 73.26, our analysis suggests implementing a stop loss at approximately 74.34 (1.5% above current price) and targeting profits around 70.83 (3% below current price).

This approach provides a reward-to-risk ratio of 2:1, allowing traders to capitalise on the continued bearish momentum reflected in our crude oil price forecast while maintaining disciplined risk management. After a spell of volatility, this clear directional bias offers valuable perspective for navigating uncertain market conditions.

Looking Ahead: Factors influencing our crude oil price forecast

As our crude oil price forecast extends toward March, several key factors deserve continued attention. The financial and geopolitical forces currently pressuring prices could shift if OPEC+ signals potential production cuts in response to falling prices. However, the persistent theme of oversupply suggests any recovery may be limited without significant production discipline or unexpected supply disruptions.

It is a good example of how complex the energy markets have become that even substantial geopolitical tensions have failed to provide lasting price support. The tactics used by market participants now emphasize fundamental supply-demand balances over geopolitical risk premiums, marking an important evolution in how our crude oil price forecast is developed.

Navigating forward with our data-driven crude oil price forecast

The leap into the unknown always characterises energy trading, and that’s where our LLM-driven market intelligence comes in. Experience the power of our Trading Co-Pilot‘s capabilities for yourself with a personalised demonstration. See how our platform can help you identify trading opportunities before they become obvious to the broader market.

Simply contact our team at enquiries@permutable.ai today or fill in the form below to schedule your complimentary session and discover how our AI-driven market sentiment analytics can enhance your trading decisions in these volatile energy markets. For qualified institutional traders and energy firms, we also offer limited trial access to experience the full capabilities of our platform.