uIn the blur of the last few weeks, energy sector sentiment has shifted dramatically as global markets grapple with intensifying pressures. Our Trading Co-Pilot’s latest insights reveal a market approaching critical inflection points across key commodities, with bearish trends dominating petroleum products while natural gas presents a more nuanced picture. As we navigate this landscape, one thing becomes increasingly clear: global trust is now under great duress, creating market fragmentation that is causing market volatility and challenges for existing energy trading strategies.

Table of Contents

ToggleFirst, the context: A market under pressure

When you consider the current state of energy markets, the data tells a compelling story. Heating oil and crude oil benchmarks are approaching three-year lows, with WTI falling below $65.50 and Brent closing at $68.56. This pronounced bearish sentiment stems from a confluence of factors that our LLM-driven Trading Co- has been meticulously tracking.

The most glaring prospect facing energy traders is that of oversupply. OPEC+ production increases continue unabated, whilst US crude stockpiles rise unexpectedly, creating a perfect storm for petroleum prices. And this is precisely why the question of demand destruction has moved to the forefront of market discussions, particularly as weak economic data from China compounds existing concerns.

Let us not forget that these market dynamics are unfolding against a backdrop of geopolitical upheaval. In this new world order, the Trumpian backlash against global trade norms has introduced tariffs affecting Canada and Mexico, with ripple effects across energy supply chains. We can’t help wondering whether the Whitehouse has any idea (or indeed, cares) what it’s currently unleashing on global energy markets (along with other markets too). All of which has sent shockwaves through traditional trading patterns, creating new inefficiencies and price distortions.

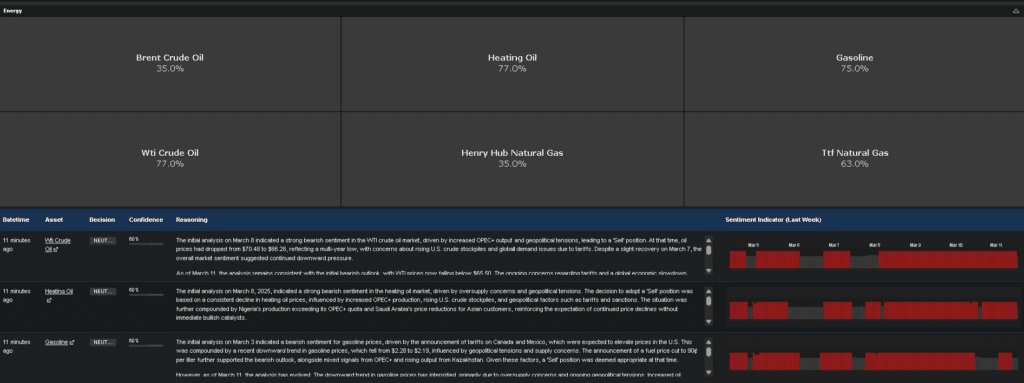

Above: Energy market sentiment according to our Trading Co-Pilot as of 13:00 on 11th March 2025

The shifting tides of energy market sentiment

Our Trading Co-Pilot’s energy market sentiment analysis reveals that previously strong ‘Sell’ positions across petroleum products now warrant a more measured approach. The hosepipe of negative indicators has hit so intensely that markets may be approaching oversold territory. Energy sector sentiment indicators suggest we’ve reached a critical junction where caution unsurprisingly becomes the watchword.

Now, this rightly causes worries about market stability and predictability. When market fundamentals become subordinate to geopolitical manoeuvring, traditional forecasting models lose efficacy. Experts say this decoupling creates a dangerous precedent for energy traders who rely on historical correlations and established patterns, which by the way, is where our Trading Co-Pilot‘s ability to help traders delayer themes really comes into its own.

The fact of the matter is that this dangerous shift is particularly acute for institutional investors with significant exposure to energy commodities. As Trump 2.0 policies begin to materialise, markets will need to work quickly to recalibrate expectations around global trade flows and energy diplomacy. Meanwhile, the IEA Chief’s recent comments regarding the need for increased investments in oil and gas fields highlight e the complex interplay between short-term price movements and long-term supply security.

Natural gas: A different narrative

While petroleum products languish under bearish pressure, natural gas markets tell a more complex story. Henry Hub prices spiked to $4.69 before stabilising around $4.44, while TTF Natural Gas exhibits significant volatility driven by supply concerns. The contrast between these commodities and their liquid counterparts highlights the fragmented nature of today’s energy landscape.

Here, supply disruptions, particularly the severe drop in Nigeria’s LNG output and operational delays at TotalEnergies’ North Sea gas hub, have introduced new uncertainties. This is a difficult truth for traders seeking clarity: the traditional correlations between energy commodities has gone up in smoke, requiring more nuanced and segmented trading strategies.

We must acknowledge that energy sector sentiment around natural gas is being shaped by both immediate supply concerns and longer-term questions about policy direction. As climate policies evolve and gas-fired power generation faces competing pressures, the market struggles to price these competing narratives effectively.

Navigating forward: Neutral positioning

You may say that markets eventually self-correct, and while we’d like to agree, there is a sense of danger posed by current levels of uncertainty which suggests a strategic retreat may be prudent. Our Trading Co-Pilot has shifted recommendations from definitive ‘Sell’ positions to ‘Neutral’ across the petroleum complex, recognising that cracks are appearing in the bearish narrative that could presage stabilisation.

This neutral stance represents neither capitulation nor conviction, but rather a tactical pause to reassess as new data emerges during this highly unpredictable time. Energy sector sentiment indicators are flashing warning signals, with multiple commodities approaching multi-year lows simultaneously, and the risk of sharp mean reversion increasing.

For traders who have benefited from the downtrend, this represents an opportunity to lock in gains and reset positioning. For those awaiting entry points, patience remains virtuous as markets search for equilibrium amid conflicting signals.

Navigating uncertainty in energy sector sentiment

As we look ahead, energy sector sentiment will likely remain hostage to both macroeconomic forces and escalating geopolitical tensions. The coming weeks will be critical in determining whether petroleum markets can pull back from the brink of further selloffs or whether additional downside pressure materialises. For energy traders and institutional investors, the watchword remains vigilance. While neutrality may feel unsatisfying in a market that rewards conviction, sometimes the wisest position is to acknowledge uncertainty rather than force a narrative that data doesn’t yet support.

Experience Our Trading Co-Pilot Today

Ready to navigate market volatility with the latest LLM-driven technology? For enterprise clients, take advantage of our free trial offer and discover how our Trading Co-Pilot’s real-time market sentiment analysis can help you navigate market volatility during these uncertain times. Our AI-driven platform delivers key insights on shifting asset correlations and geopolitical impacts – updated every 15 minutes—giving you the edge when markets are at their most unpredictable.

Simply drop us a line to enquiries@permutable.ai or fill in the form below to arrange a complimentary enterprise trial where you can explore the full suite of Trading Co-Pilot features for 14 days and see firsthand how institutional investors are using our technology to identify emerging opportunities and mitigate risks in today’s fragmented markets.