BlackRock, the world’s largest asset manager, is at the forefront of ESG (Environmental, Social, and Governance) investing. With a deep understanding of the importance of sustainability and ethical practices, the company is increasingly using ESG factors to inform its investment decisions. This article will explore BlackRock’s ESG rating, what ESG means to companies and investors, and how BlackRock is shaping the future of responsible investing.

What is ESG with BlackRock?

ESG refers to the three key factors that determine a company’s commitment to sustainability and ethical practices: Environmental, Social, and Governance. ESG investing is a growing trend in the financial sector, as more investors recognize the need for responsible investment practices that take into account a company’s long-term impact on society, the environment, and its stakeholders.

As a leader in the investment world, BlackRock has committed itself to integrating ESG factors into its investment process. But does BlackRock have ESG? The answer is a resounding yes. The company offers a wide range of ESG-focused investment products and has adopted a proactive approach to responsible investing.

How does BlackRock use ESG?

BlackRock uses ESG data to evaluate companies’ performance and make informed investment decisions. By analyzing ESG factors, BlackRock can better understand the risks and opportunities associated with a particular investment. This approach allows the company to select companies with strong ESG practices, which are more likely to succeed in the long term.

Who runs ESG at BlackRock? The company’s ESG efforts are led by a dedicated team of experts, who work together to develop and implement ESG strategies across the organisation. This team collaborates closely with BlackRock’s broader investment teams to ensure that ESG factors are integrated into the investment decision-making process.

What does ESG mean to companies and investors?

For companies, ESG represents a commitment to responsible business practices and long-term value creation. A strong ESG rating can help companies attract investors, reduce risk, and improve their reputation. For investors, ESG investing is about aligning their investments with their values and supporting companies that contribute positively to society and the environment.

ESG is increasingly important in various areas of finance, such as private equity and investing. In private equity, ESG factors are being used to assess potential investments, while ESG investing is a growing trend among retail and institutional investors.

Is BlackRock ethical?

BlackRock’s commitment to ESG investing reflects its belief in the importance of ethical and responsible investment practices. The company has been recognised for its efforts in this area, with a strong ESG rating that places it among the leaders in sustainable investing.

However, it is essential to understand that ESG ratings are not the only way to evaluate a company’s ethical standing. There are other factors to consider, such as the company’s supply chain emissions. For instance, nearly 60% of companies fail to report on a supply chain emission category, according to Permutable AI.

Who ranks ESG companies?

Several organisations and agencies provide ESG ratings for companies, including MSCI, Sustainalytics, and Permutable AI. These agencies analyse a company’s ESG performance based on various criteria, such as environmental impact, social responsibility, and corporate governance.

Permutable AI offers detailed ESG reports for numerous companies, including Apple, Microsoft, Amazon, Alphabet (Google), Facebook, and Nike. These reports provide valuable insights into a company’s ESG performance and help investors make informed decisions.

The Future of ESG and BlackRock

With ESG investing becoming more mainstream, it is crucial for companies to stay ahead of the curve and address the challenges and opportunities associated with sustainable business practices. BlackRock, as an industry leader, plays a vital role in shaping the future of ESG investing.

As we look forward to ESG trends in 2023, we can expect to see continued growth in sustainable investing, as well as increased focus on areas such as carbon risk management and the role of carbon offsetting in addressing climate change. To learn more about these topics, check out the following resources from Permutable AI:

- Carbon Risk Management: How to Identify and Minimise Carbon Risk in Your Business Operations

- Is Carbon Offsetting Greenwashing?

- ESG Trends 2023: Outlook, Opportunities & Challenges

The Importance of ESG Ratings and Scores

With the growing interest in ESG investing, ESG ratings and scores have become an essential tool for investors to evaluate a company’s commitment to sustainability and ethical practices. These ratings and scores are based on a wide range of criteria, which vary depending on the rating agency. Some common factors include a company’s environmental impact, social responsibility, and corporate governance practices.

An ESG rating or score provides investors with a benchmark to compare companies within the same industry and make more informed investment decisions. A high ESG rating is an indication that a company is managing its environmental, social, and governance risks effectively and is likely to perform better in the long term. Conversely, a low ESG rating may signal potential risks and vulnerabilities that could affect the company’s performance. Public sentiment is increasingly becoming a driver in investment opportunities and success.

ESG Integration: A Growing Trend in Asset Management

BlackRock’s focus on ESG investing is part of a broader trend in the asset management industry. Increasingly, asset managers are recognising the value of integrating ESG factors into their investment processes to make better-informed decisions, manage risks, and generate long-term value for their clients.

As more institutional and retail investors demand sustainable investment options, asset managers must adapt and develop new strategies to meet these changing preferences. By incorporating ESG factors into their investment process, asset managers can provide clients with a more comprehensive understanding of a company’s long-term prospects and identify potential risks and opportunities that traditional financial analysis may not capture.

The Role of ESG Ratings in Investment Decision-Making

When considering an investment in a company, BlackRock uses ESG ratings to assess the company’s performance across a range of sustainability and ethical criteria. This allows the asset manager to make more informed decisions and select companies with strong ESG practices that are more likely to succeed in the long term.

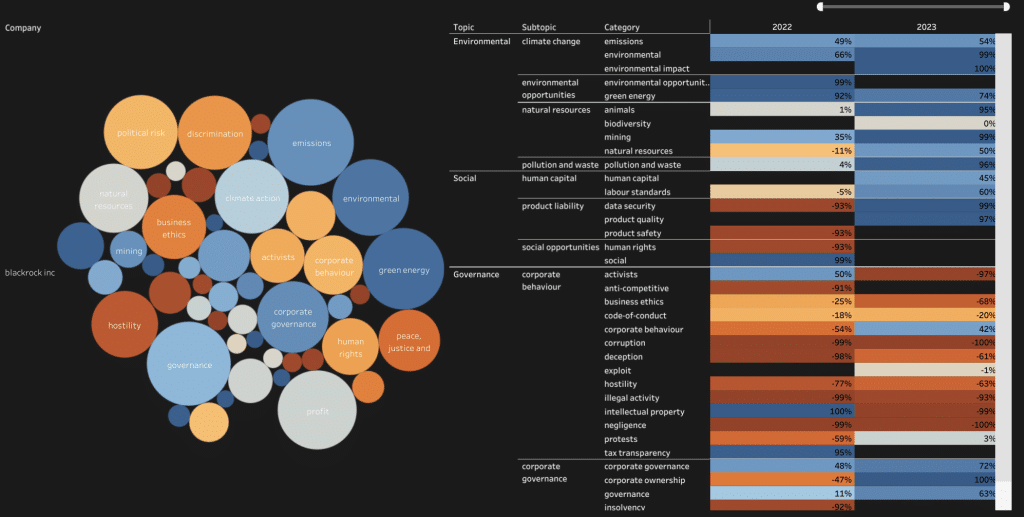

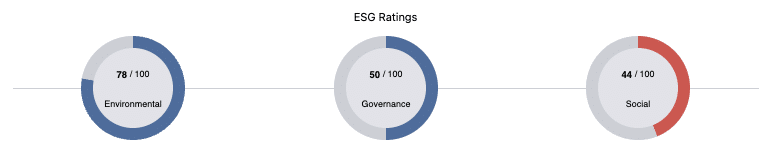

In addition to using ESG ratings to guide investment decisions, BlackRock also engages with companies on ESG issues to encourage improvements in their practices. This proactive approach helps BlackRock build a more sustainable and resilient investment portfolio, while also contributing to positive change in the companies it invests in. Following is Permutable’s ESG ratings for BlackRock:

Challenges and Opportunities in ESG Investing

While ESG investing presents a wealth of opportunities for investors and companies alike, it is not without its challenges. One of the most significant challenges is the lack of standardized ESG reporting and metrics. This makes it difficult for investors to compare companies’ ESG performance accurately and assess the true impact of their investments.

Despite these challenges, there are several opportunities for companies and investors to capitalize on the growing demand for ESG investments. Companies that demonstrate strong ESG practices can attract more investment, reduce risks, and improve their reputation. Investors, on the other hand, can support companies that contribute positively to society and the environment while generating long-term value for their portfolios.

The Future of ESG Ratings and Reporting

As ESG investing continues to gain traction, there is a growing need for more transparent and standardized ESG reporting. Investors, regulators, and other stakeholders are increasingly calling for companies to disclose their ESG performance more consistently and comprehensively.

In response to these demands, several initiatives are underway to develop standardized ESG reporting frameworks and metrics. These initiatives aim to improve the quality and comparability of ESG data, making it easier for investors to assess a company’s ESG performance and make more informed investment decisions.

As the largest asset manager in the world, BlackRock has a unique opportunity to drive change in ESG reporting and promote the adoption of best practices across the industry. By advocating for more transparent and standardized ESG reporting, BlackRock can help ensure that ESG investing continues to grow and evolve in a way that benefits both investors and society as a whole.

Conclusion: BlackRock’s ESG Commitment and the Future of Sustainable Investing

BlackRock’s strong ESG rating is a testament to its dedication to sustainable investing and incorporating ESG factors into its investment decisions. As the world’s largest asset manager, BlackRock has the power to shape the future of responsible investing and drive meaningful change in the investment industry.

The continued growth of ESG investing presents both challenges and opportunities for companies and investors. As the demand for ESG investments increases, companies must adapt their practices and reporting to meet the evolving expectations of investors and other stakeholders. Investors, in turn, must refine their approach to evaluating companies’ ESG performance and ensure they are making informed decisions based on reliable and comparable data.

By actively promoting ESG integration and advocating for more transparent and standardized ESG reporting, BlackRock is well-positioned to lead the industry in sustainable investing. As the company continues to build on its ESG commitments and expand its range of ESG-focused investment products, it will play a crucial role in shaping the future of responsible investing and creating long-term value for both its clients and society as a whole.

In summary, BlackRock’s ESG rating demonstrates the company’s commitment to responsible investing and the integration of ESG factors into its investment process. As the importance of sustainability and ethical practices continues to grow, BlackRock will undoubtedly remain at the forefront of the ESG investing movement, setting the standard for ethical and responsible investment practices. With ongoing developments in ESG reporting and the increasing demand for sustainable investment options, BlackRock’s commitment to ESG integration is set to drive meaningful change in the investment industry and contribute to a more sustainable and resilient global economy.