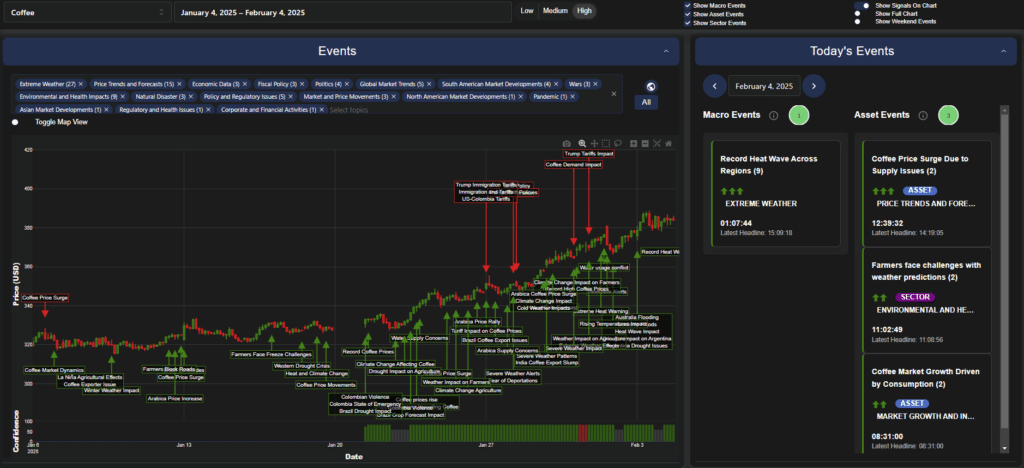

Understanding the factors affecting coffee prices has never been more key, especially as we look at the recent coffee market rally when coffee prices began their ascent towards 400 USD. According to our Trading Co-Pilot’s analysis, multiple interconnected factors drove this surge, creating a complex web of market influences that continues to shape the coffee trading landscape. Understanding these dynamics offers valuable insights for commodity traders, producers, and industry stakeholders alike. In this article we’ll take a closer look at the events that led to this historic milestone.

Climate and weather: A primary factor affecting coffee prices

This year has brought unprecedented weather challenges to major coffee-producing regions. The trail of blood between severe weather events and price volatility has never been more apparent. A record heat wave across key growing areas marked a turning point in market sentiment, pushing prices above key resistance levels, whilst drought conditions in Brazil, the world’s largest producer, exacerbated supply concerns. Traders monitoring these weather patterns will have found significant predictive value in tracking regional climate anomalies.

For the initiated, these weather patterns represent more than temporary disruptions amongst the factors affecting coffee prices. Whether it is these factors or longer-term climate change impacts, the coffee market faces structural challenges that could reshape pricing dynamics for years to come. Around the same time, flooding in parts of South America further complicated the supply picture, creating opportunities for traders who could accurately forecast weather impacts on production.

Supply chain dynamics and trade policy

The rivalry between major coffee-producing nations has intensified amid supply constraints, emerging as another crucial factor affecting coffee prices. In contrast to previous years, trade policies have taken centre stage. This is not a new revelation, but the impact of Trump-era tariffs and immigration policies looming over the market has added new complexities to coffee trading, requiring stakeholders to develop more sophisticated risk management strategies.

For some, this represents a fundamental shift in how coffee supply chains operate. The narrative picked up momentum when labour shortages began affecting harvesting operations. And there it sat, creating a bottleneck in the supply chain that rippled through to prices, offering opportunities for traders who could anticipate these disruptions.

Market demand: A key factor affecting coffee prices

Despite the challenges on the supply side, demand has played an equally key role among factors affecting coffee prices. Sometimes the problem lies in the changing consumption patterns across different markets. There is debate about whether these shifts represent temporary or structural changes in coffee consumption habits, with important implications for long-term price trends.

It is viewed as a potential game-changer that developing markets are showing increased appetite for premium coffee varieties. Will this last? Sentiment around coffee consumption remains strong, particularly in emerging markets where coffee culture continues to evolve, creating new opportunities for market participants.

Agricultural and production dynamics

Then there is what some would regard as the core issue: agricultural productivity as a factor affecting coffee prices. It is an experience that included both technological advances and setbacks. In the past few years, we have had a real-life experiment in how climate change affects coffee farming practices. And this is the other thing about modern coffee production: sustainability has become inseparable from pricing discussions, influencing investment decisions and risk assessments.

Economic and currency impacts

There may be something in that old saying about commodity prices and dollar strength. As we write, currency fluctuations continue to influence coffee trading patterns. There is the good, the bad, and the ugly about how exchange rates affect producer revenues and market pricing, making currency risk management an essential skill for market participants.

Both are on the radar screens of traders: inflation concerns and monetary policy shifts. It used to be the case that coffee prices moved primarily on supply-demand fundamentals. Anyway, despite all this, macroeconomic factors now play an increasingly important role, requiring a more sophisticated approach to market analysis.

Practical applications and trading strategies

These factors affecting coffee prices provide several key insights for market participants. To recap:

- Weather pattern monitoring has become key for predicting price movements

- Supply chain disruptions offer opportunities for prepared traders

- Currency risk management is increasingly important

- Sustainability considerations affect long-term price trends

- Emerging market demand creates new trading opportunities

Analysing the factors affecting coffee prices requires a holistic understanding of multiple variables. From weather events to geopolitical tensions, from supply chain disruptions to changing consumption patterns, the coffee market continues to evolve in response to both traditional and emerging influences. Understanding and monitoring these dynamics whilst developing appropriate risk management strategies is crucial for success in today’s coffee trading environment.

Ready to improve your cross-commodity trading strategy?

Discover how our Trading Co-Pilot can improve your commodity trading operations by incorporating sophisticated coffee market insights into your portfolio. Our advanced platform seamlessly integrates real-time analysis of weather events, supply chain disruptions, and market sentiment, providing you with the competitive edge needed in today’s complex trading environment. By combining our coffee asset insights with your existing commodity strategies, you’ll unlock powerful cross-market correlation opportunities and gain access to early warning signals that can enhance your decision-making process.

We invite you to experience these capabilities firsthand through a personalised demo tailored to your institution’s specific trading requirements where we’ll show you how our AI-driven market intelligence can complement your existing operations and strengthen your risk management framework. For qualified institutional traders, we’re currently offering a 14-day trial to demonstrate the full potential of our platform in your trading environment.

Take the first step towards maximising your trading potential by contacting our enterprise team at enquiries@permutable.ai or fill in the form below to schedule your demo and join the leading trading houses already leveraging our next-generation market intelligence to stay ahead in the evolving commodity trading landscape.