Our Trading Co-Pilot has identified significant movements across major currency pairs over the past week, with geopolitical tensions emerging as the dominant market narrative. Our engine’s analysis reveals that Trump’s proposed tariff plan has created notable pressure on the US Dollar, particularly against the Japanese Yen and Euro. As a matter of fact, our sentiment analysis detected heightened market concerns immediately following the February 11 announcement, with ripple effects continuing throughout the trading week.

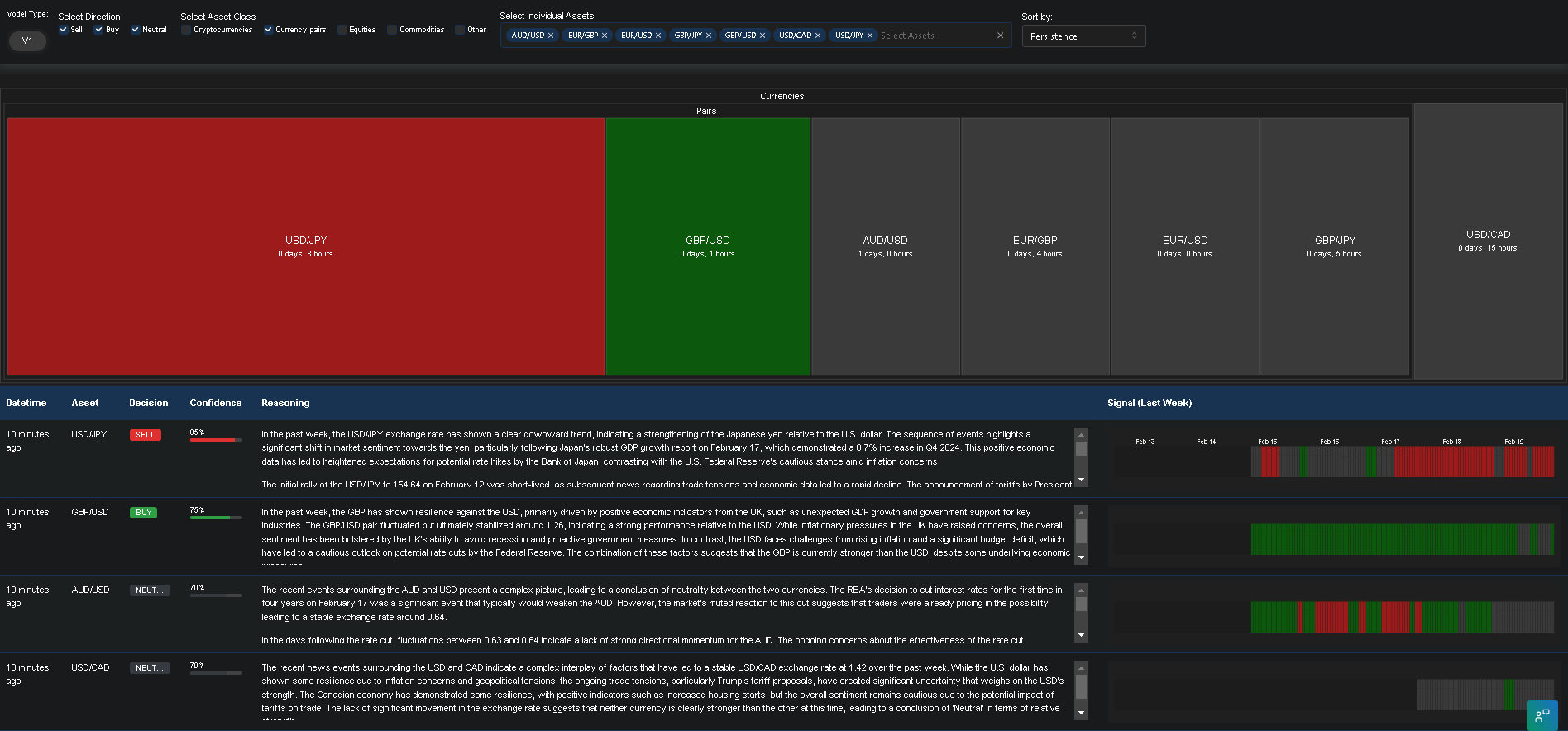

The dollar weakness observed across major currency pairs coincided precisely with escalating rhetoric around potential retaliatory measures from affected trading partners. Our signal heatmap indicated particular vulnerability in USD/JPY and EUR/USD pairs, with correlation patterns suggesting traders are actively positioning for sustained trade tensions.

Inflation concerns reshaping major currency pair dynamics

Overall, our Trading Co-Pilot identified inflation as a key factor influencing major currency pairs during the analysis period. Consumer price data released on February 12 triggered unexpected volatility, with our AI agents detecting significant repositioning across GBP/USD and USD/CAD pairs. The market reaction suggests traders are increasingly concerned about how tariff-induced inflation might impact central bank policy divergence.

Our proprietary LLM-driven market sentiment analysis revealed particularly strong correlations between inflation narratives and major currency pair movements on February 13, when trade tensions and inflation data created a complex market environment. Given the Federal Reserve’s current policy stance, these inflation concerns appear to be creating asymmetric effects across different major currency pairs, with commodity-linked currencies showing distinct reaction patterns.

Central bank policy divergence: Reshaping major currency pair trajectories

Our Trading Co-Pilot’s analysis of central bank policy implications is especially valuable for understanding major currency pair movements throughout the week. Our models identified notable shifts in interest rate expectations following the inflation data, with particular impact on EUR/USD and GBP/USD pairs. Speaking more broadly, the potential for divergent monetary policy paths appears to be creating new correlation patterns across major currency pairs.

Historical confidence metrics from our Trading Co-Pilot suggest the current market environment resembles previous periods of policy uncertainty, though with important distinctions in how major currency pairs are responding to mixed economic signals. To add to this, interest rate sensitive pairs showed particular volatility during the February 14-15 trading sessions, as market participants attempted to reconcile inflation concerns with growth implications.

Trade policy uncertainty: New risk premium across major currency pairs

In essence, our Trading Co-Pilot has identified a growing risk premium across major currency pairs directly attributable to trade policy uncertainty. The proposed tariff package appears to be creating significant hedging activity, with institutional positioning shifts detected across USD/JPY, EUR/USD and USD/CHF pairs. Our confidence metrics indicate high certainty regarding the correlation between tariff discussions and subsequent major currency pair movements.

To put it differently, major currency pairs are now pricing in potential supply chain disruptions and their implications for global trade flows. Our Trading Co-Pilot’s cross-asset correlation analysis reveals particularly strong linkages between industrial metal prices and certain major currency pairs, suggesting traders are anticipating sector-specific impacts from the proposed tariffs.

Regional economic resilience: Differential impact on major currency pairs

The final dimension of our Trading Co-Pilot analysis focused on how regional economic resilience is influencing major currency pair performance. Asian currencies demonstrated notable strength against the dollar following the February 17 trading session, with our sentiment indicators suggesting market participants are assessing varying degrees of exposure to potential trade disruptions across different economies.

Consumer spending resilience emerged as a particularly important factor for major currency pairs linked to consumption-driven economies, with stronger-than-expected retail activity providing support for certain currencies despite broader trade concerns, creating nuanced trading opportunities across major currency pairs.

Navigating major currency pair volatility: Strategic implications

For institutional traders monitoring major currency pairs, these findings highlight the importance of integrating geopolitical analysis with traditional economic indicators. The Trading Co-Pilot’s ability to quantify sentiment shifts and detect correlation patterns has proven particularly valuable during this period of heightened uncertainty for major currency pairs.

This analysis suggests continued volatility across major currency pairs in the near term, with particular sensitivity to trade policy developments and inflation data. It’s important to remember that historical precedent indicates similar periods of policy uncertainty which have typically led to extended realignment phases for major currency pairs as markets establish new equilibrium levels.

Experience our Trading Co-Pilot’s advanced FX analysis

Discover how our next generation Trading Co-Pilot can help your team navigate major currency pair volatility with confidence. Our Trading Co-Pilot provides real-time analysis of geopolitical factors, inflation impacts, and trade policy implications affecting FX markets. Qualified institutional users and FX providers can arrange a personalised demonstration of our platform, featuring our proprietary LLM-driven sentiment analysis specifically calibrated for major currency pairs. Select trading desks may also qualify for a limited 30-day trial to experience our analytical capabilities firsthand with your own trading data. Contact our team at enquiries@permutable.ai or fill in the form below.

Priority access available for institutional FX desks, macro hedge funds, and B2B2C currency trading platforms.