TRADING CO-PILOT: MARKET FORECAST

Powered by Permutable's Co-Pilot API

enquiries@permutable.aiOverview

Our platform delivers 24-hour forecasting with analyst-level outlooks, providing clear price predictions supported by well-reasoned arguments. We offer full market coverage across energy, agriculture, metals, and currencies, with forecasts updated every hour based on insights extracted from hundreds of sources reviewed over the past week. With real-time, hourly updates available via our API, our data is designed to empower systematic decision-making at speed and scale.

Request Enterprise Demo

Please fill out the form below and we'll get back to you within 24 hours.

Implementation Use Cases

24 Hour Forecasting

Receive analyst-level outlooks and clear price predictions for the next 24 hours, with supporting arguments for each forecast.

Full Market Coverage

Forecasts are updated every hour and are based on analysis of hundreds of sources from the past week.

Real-Time

Stay ahead with live hourly updates from our API, designed for systematic and quantitative workflows.

Reasoning

Our forecasts are supported by well-reasoned arguments, providing clear insights into market movements.

API Reference

Provides a human-readable analyst summary and associated event IDs for a specific financial ticker, offering qualitative insights into market drivers.

GET

/v1/insights/analyst/{ticker}

Analyst-Style Insights for a Ticker

Parameters

| Name | Description |

|---|---|

ticker

required

string (path)

|

Ticker of the entity to fetch insights for |

show_ids_in_summary

boolean (query)

Default: false

|

Whether to show event IDs in the summary |

Request Sample (Python)

import requests

# Replace with your actual credentials

API_KEY = "your-api-key"

# Headers

headers = {

"x-api-key": API_KEY,

}

# Query parameters

params = {'ticker': 'BZ_COM'}

# Make the request

response = requests.get(

"https://copilot-api.permutable.ai/1/insights/forecast",

headers=headers,

params=params

)

# Check for errors

response.raise_for_status()

# Get the response data

data = response.json()

print(data)

Responses

{ "summary": "May 17, 2025: Ongoing Concerns Following Credit Downgrade:\n No data available for this day as of the current time. However, the market continues to react to Moody's downgrade of the U.S. credit rating, which has raised concerns about the government's management of its debt.\n May 16, 2025: Dollar Reacts to Credit Rating Downgrade:\n The dollar opened at 100.76 and closed at 100.85. Moody's downgraded the United States' credit rating from AAA to AA1 due to concerns over rising government debt and increasing interest costs. This development contributed to a slight rally in the dollar towards the end of the day.\n May 15, 2025: Dollar Fluctuates Amid Economic Concerns:\n The dollar opened at 100.76 and closed at 100.67. Walmart's announcement of price increases due to tariff costs raised concerns about inflationary pressures. Additionally, Fed Chair Jerome Powell's comments on potential supply shocks indicated a more volatile economic outlook.\n May 14, 2025: Dollar Stabilizes After Recent Declines:\n The dollar opened at 100.76 and closed at 100.90, showing slight recovery after previous declines. The market reacted to ongoing trade negotiations and the potential for further tariff adjustments, which provided some support for the dollar.\n May 13, 2025: Dollar Declines Amid Market Adjustments:\n The dollar opened at 101.48 and declined to close at 100.82. The market reacted to a temporary truce in the trade war, which reduced tariffs on Chinese shipments. Additionally, fund managers reported being the most underweight on the U.S. dollar since 2006, indicating a significant shift in investment trust.\n May 12, 2025: Dollar Climbs on Tariff Reductions:\n The dollar opened at 100.44 and closed at 101.69, buoyed by a 90-day tariff reduction agreement between the U.S. and China, which saw tariffs on Chinese goods cut to 30%. The positive sentiment from this agreement led to a significant rally in the morning hours.\n May 11, 2025: Dollar Steady as Trade Progress Reported:\n The U.S. dollar opened at 100.46 and closed at 100.44, reflecting a minor decline despite positive developments in U.S.-China trade talks, where a substantial trade deal was reached in Geneva. This sentiment supported the dollar, although it peaked at 101.73 earlier in the day.", "event_ids": [ "1", "2" ] }

Sample Data

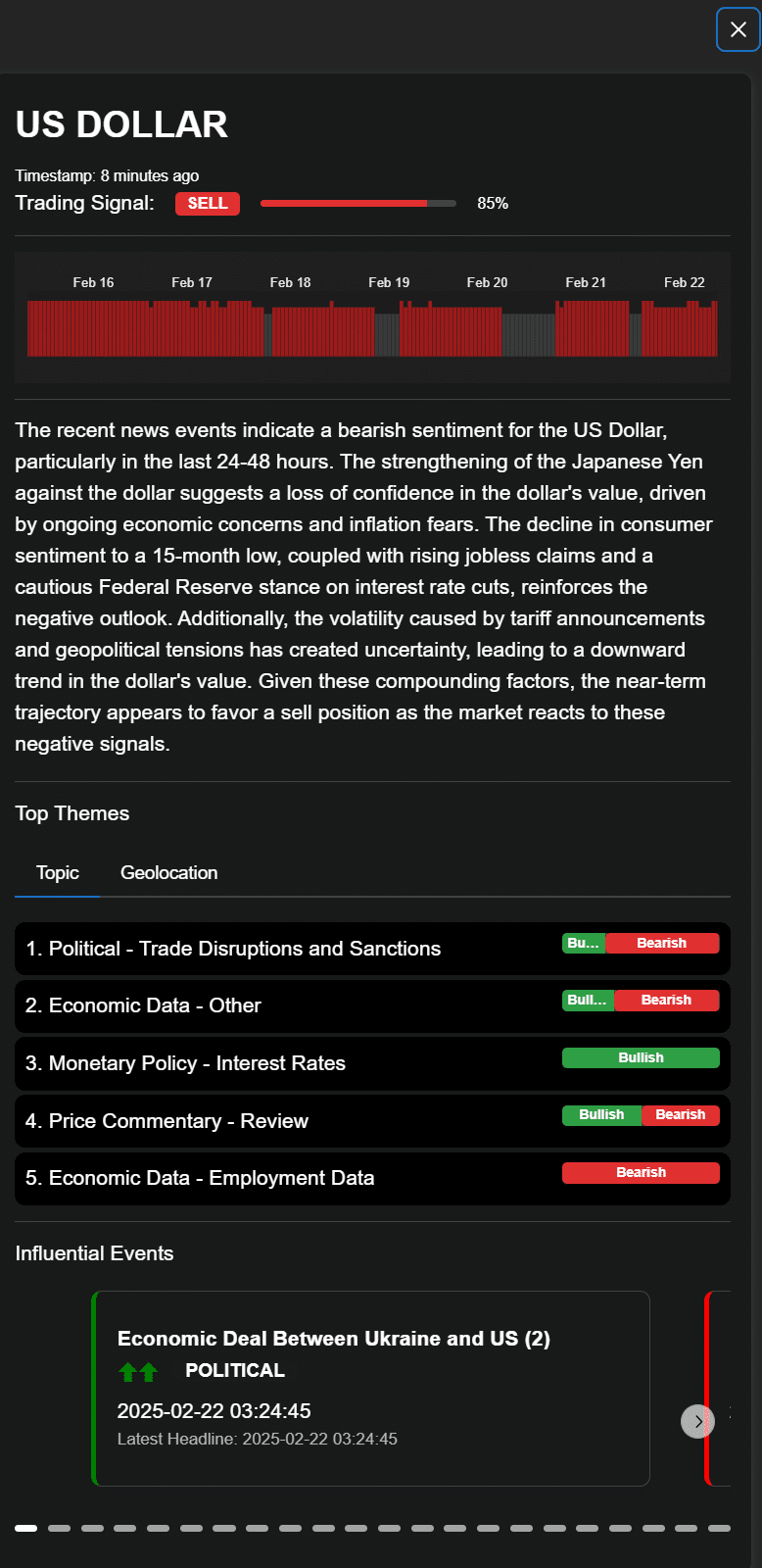

US Dollar

The recent news events indicate a bearish sentiment for the US Dollar, particularly in the last 24-48 hours. The strengthening of the Japanese Yen against the dollar suggests a loss of confidence in the dollar's value, driven by ongoing economic concerns and inflation fears. The decline in consumer sentiment to a 15-month low, coupled with rising jobless claims and a cautious Federal Reserve stance on interest rate cuts, reinforces the negative outlook. Additionally, the volatility caused by tariff announcements and geopolitical tensions has created uncertainty, leading to a downward trend in the dollar's value. Given these compounding factors, the near-term trajectory appears to favor a sell position as the market reacts to these negative signals.

Top Themes

-

1. Political - Trade Disruptions and Sanctions

Bullish Bearish

-

2. Economic Data - Other

Bullish Bearish

-

3. Monetary Policy - Interest Rates

Bullish

-

4. Price Commentary - Review

Bullish Bearish

-

5. Economic Data - Employment Data

Bearish

Influential Events

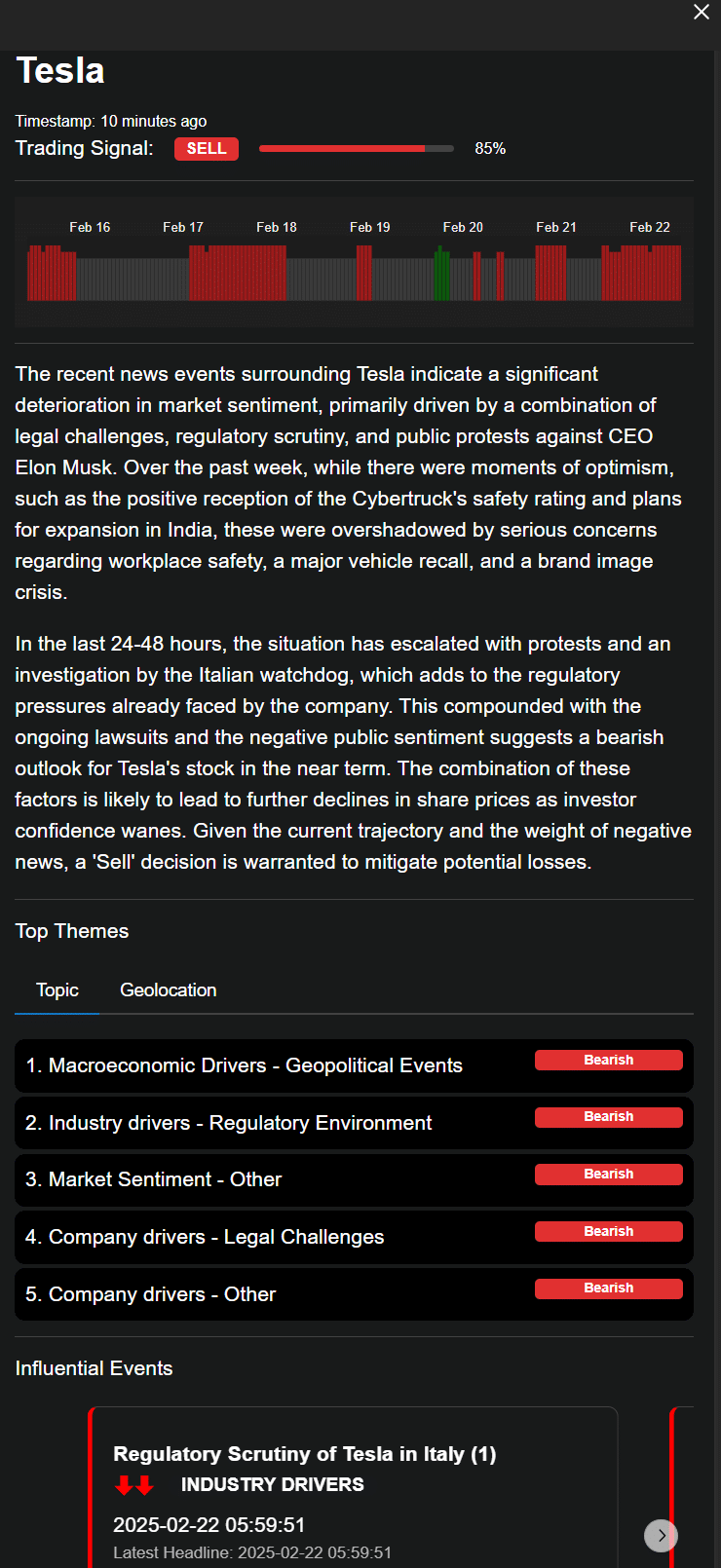

Tesla (Equities)

The recent news events surrounding Tesla indicate a significant deterioration in market sentiment, primarily driven by a combination of legal challenges, regulatory scrutiny, and public protests against CEO Elon Musk. Over the past week, while there were moments of optimism, such as the positive reception of the Cybertruck's safety rating and plans for expansion in India, these were overshadowed by serious concerns regarding workplace safety, a major vehicle recall, and a brand image crisis. In the last 24-48 hours, the situation has escalated with protests and an investigation by the Italian watchdog, which adds to the regulatory pressures already faced by the company. This compounded with the ongoing lawsuits and the negative public sentiment suggests a bearish outlook for Tesla's stock in the near term. The combination of these factors is likely to lead to further declines in share prices as investor confidence wanes. Given the current trajectory and the weight of negative news, a 'Sell' decision is warranted to mitigate potential losses.

Top Themes

-

1. Macroeconomic Drivers - Geopolitical Events

Bearish

-

2. Industry drivers - Regulatory Environment

Bearish

-

3. Market Sentiment - Other

Bearish

-

4. Company drivers - Legal Challenges

Bearish

-

5. Company drivers - Other

Bearish

Influential Events

Corn

The recent price movements in corn have shown a significant volatility pattern, with a surge to a 16-month high followed by a notable decline. The initial bullish sentiment from strong export demand and halted long buying streaks was quickly countered by profit-taking and market sensitivity to export data, leading to a downward trend. The fluctuations around the $515 mark indicate a market that is currently cautious and reactive to upcoming data, particularly export sales reports. Given the mixed signals from the last week, including resilience amid concerns and continued downward pressure, the market sentiment remains uncertain. Therefore, a Neutral stance is warranted as traders await clearer signals from forthcoming data, balancing the risk of further declines against potential recovery.

Top Themes

-

1. Price Commentary - Review

Bullish Bearish

-

2. Demand - Trade and Export Dynamics

Bullish Bearish

-

3. Demand - Consumer Market Trends

Bullish

-

4. Supply - Geopolitical and Policy Factors

Bullish

-

5. Supply - Technological and Farming Advancements

Bullish