*This article examines how geopolitical tensions are reshaping currency markets in 2025 with insights taken from our Trading Co-Pilot, specifically designed for forex traders, institutional investors, and financial professionals seeking to navigate today’s volatile trading environment.

In light of recent geopolitical developments, currency markets have experienced heightened volatility as traders navigate an increasingly complex global landscape. Geopolitical risk on FX markets has emerged as a dominant theme in 2025, reshaping traditional trading patterns and challenging conventional market wisdom. Our analysis of major currency pairs through our Trading Co-Pilot reveals how political tensions, trade negotiations, and economic policy shifts are fundamentally altering market dynamics in ways that demand sophisticated understanding and nimble strategy adjustment.

Table of Contents

ToggleHow geopolitical risk on FX markets manifests across major currency pairs

The impact of geopolitical events varies significantly across different currency pairs. With growing uncertainty in global politics, there are distinct patterns of volatility and resilience which have been emerging.

USD/JPY: Volatility amid trade tensions

The USD/JPY pair exemplifies how geopolitical risk on FX markets can create dramatic price swings. Initially facing downward pressure as the IMF warned about global growth concerns, the pair declined from 142.78 to 140.56. Notably, FX markets reacted swiftly to these announcements, demonstrating the sensitivity of this pair to macroeconomic outlook shifts.

However, the subsequent rally from April 22 to April 23 – climbing from 140.21 to 143.48 – reflects a strong market reaction to positive developments in US-China trade talks. This has led to heightened volatility in currency markets, particularly for the yen, which typically serves as a safe-haven during periods of uncertainty.

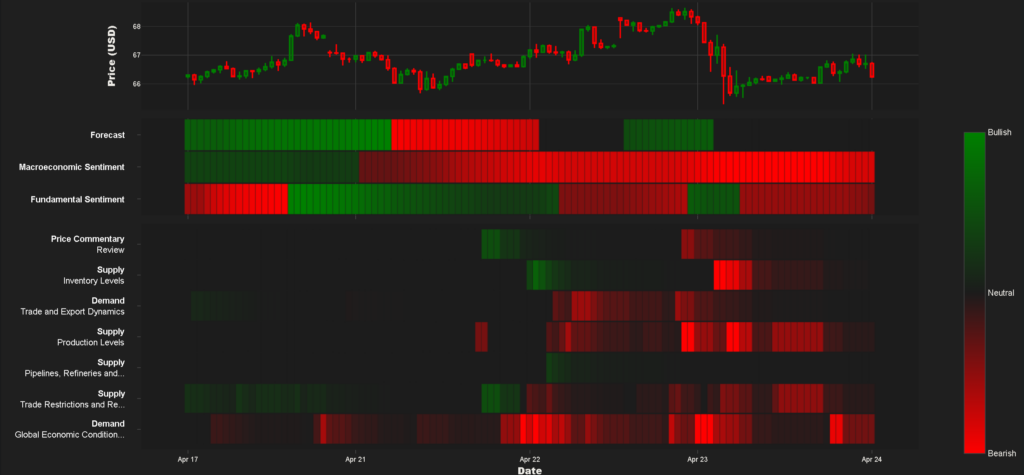

Above: USD/JPY market sentiment amid geopolitical uncertainty

GBP pairs: The Brexit legacy continues

Despite temporary relief from positive earnings reports, the pound has shown persistent vulnerability across multiple pairs. As a direct consequence of political instability and economic concerns, GBP/USD has declined to 1.33 after briefly touching 1.34. Although historically stable, the pound now faces significant challenges due to contracting private sector activity and a substantial budget deficit.

In contrast to earlier expectations, EUR/GBP has strengthened to 0.86, demonstrating the euro’s relative resilience against the backdrop of British economic concerns. This geopolitical event significantly altered investor sentiment, reinforcing the notion that geopolitical risk on FX markets often manifests through regional economic disparities.

Above: GBP/USD market sentiment heatmap amid geopolitical uncertainty

EUR/USD: Bearish sentiment amid global recalibration

While some currencies have remained resilient, others have faltered. The EUR/USD pair has displayed a clear bearish trend, moving from 1.15 to 1.13 as investors processed the IMF’s downgraded global growth forecast. Amid escalating tensions surrounding European corporate profits, the common currency has struggled to maintain its position against the dollar.

What’s more, the ripple effects were felt across emerging markets, which often take cues from EUR/USD movements. Consequently, central banks have adjusted their strategies, particularly in light of differing monetary policy trajectories between the Federal Reserve and the European Central Bank.

The neutral territory: When geopolitical forces balance

Unlike previous cycles where clear trends could be identified, certain currency pairs now exist in a state of balanced tension. Against this backdrop, the USD/CAD and AUD/USD pairs demonstrate how competing geopolitical factors can create extended periods of price stability.

The USD/CAD has exhibited a series of fluctuations influenced by a mix of economic sentiments, yet consistently returned to the 1.38 level. Due to shifting alliances and sanctions, particularly regarding US tariff policies and their impact on Canadian exports, neither currency has gained decisive momentum.

Similarly, the AUD/USD pair has shown a notable lack of volatility, consistently trading around the 0.64 mark. Building on this trend of stability, traders appear to be balancing concerns over US tariffs with optimism surrounding trade negotiations, creating a neutral sentiment that has persisted throughout April.

Strategic implications

Regional tensions can amplify currency pressure in ways that traditional economic indicators might not fully capture. To illustrate this further, consider the reaction to the IMF’s warnings about global growth and trade tensions – while economic data suggested modest impact, currency markets demonstrated heightened sensitivity to these geopolitical risk factors.

Despite short-term fluctuations, the underlying impact of geopolitical risk on FX markets reveals deeper structural shifts in the global financial system. Significantly, safe-haven currencies gained immediate traction during periods of heightened tension, with the Japanese yen strengthening against most major currencies except the dollar, which benefited from positive US-China trade developments.

Adapting to the new normal of geopolitical influence

With the increasing prominence of geopolitical risk on FX markets, traders and investors must develop more sophisticated frameworks for analysis and decision-making. The traditional focus on interest rate differentials and economic fundamentals, while still relevant, must now be supplemented with a deeper understanding of geopolitical dynamics. The interplay between trade tensions, political instability, and monetary policy divergence creates a complex landscape that requires detailed analysis and strategic patience.

Gain the market sentiment edge with our market intelligence

Don’t let geopolitical uncertainty derail your trading strategy. Our AI-powered Trading Co-Pilot provides real-time analysis of how political events are impacting major currency pairs, helping you stay ahead of market movements before they happen. Request a demo today to see firsthand how our sentiment analysis can transform your approach to geopolitical risk on FX markets. Simply email us at enquiries@permutable.ai or fill in the form below to speak to one of our team.