All eyes have been on gold markets once again this week, with prices surging to an all-time high of 2902.50. As geopolitical tensions escalate, for traders seeking to navigate these volatile conditions, understanding the underlying drivers becomes increasingly key. In this article, we’ll take a lookback at the latest from the gold markets over the last week, with insights from our Trading Co-Pilot.

Table of Contents

ToggleTrade war tensions and gold markets

Safe to say, that all of this dovetails with growing concerns about Trump’s recent tariff announcements, which has been amplified by deteriorating US-China relations. Only a few days earlier, gold had been trading at 2849.75, but escalating trade tensions pushed prices to new records. It has come to something when even seasoned traders are surprised by the pace of these movements, suggesting a fundamental shift in market dynamics that requires careful analysis.

What is it about gold markets that makes them so sensitive to geopolitical tensions? Both feature in our analysis: safe-haven demand and inflation concerns. Incidentally, the European Central Bank’s recent rate cut has added another dimension to the bullish narrative, creating a perfect storm of supportive factors that continues to drive prices higher.

Market dynamics and supply constraints

For those of us who follow gold markets closely, the emergence of physical supply constraints is also another interesting factor in the mix. A significant shortage in London, driven by increased stockpiling in New York, has emerged. But still, the market continues on, albeit with increased volatility. Trading strategies must now account for these physical market dynamics, which can create unexpected price movements and arbitrage opportunities.

So what, you may think, about these supply constraints? But what’s important to note here is the potential for these shortages to create additional price pressures. These days, the interplay between physical and paper gold markets has become increasingly complex, requiring traders to maintain awareness of conditions in both markets to execute effective strategies.

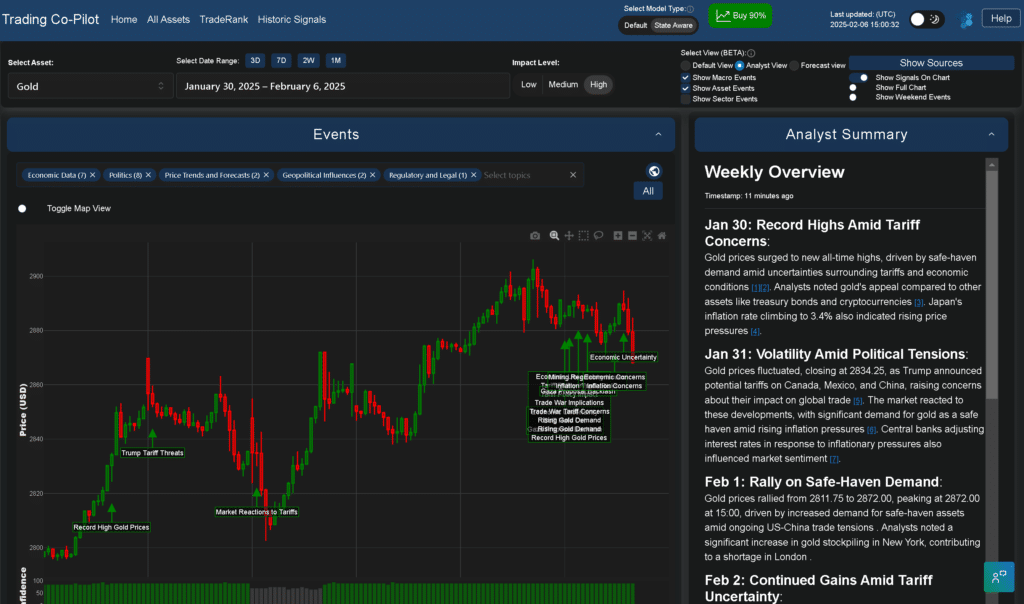

Above: Gold markets sentiment and price drivers using Analyst View of our Trading Co-Pilot

Central bank activity and market impact

And then there has been significant central bank purchases, which reveals an underlying shift in institutional attitudes toward gold. Many will still find it surprising that central banks are increasing their gold reserves at such a rapid pace, particularly given the elevated price levels. This institutional buying provides a strong fundamental underpinning to the market that simply cannot be ignored.

Obviously, this fact has contributed to the current price levels, principally because of the signal it sends to other market participants about deeper concerns regarding global economic conditions.

Trading patterns and market sentiment

There is, as ever, a strong correlation between geopolitical uncertainty and gold prices, Not merely because of safe-haven demand, but also due to currency market volatility. The answer, it turns out, lies in the complex interplay between various market factors that traders must monitor continuously. And so, understanding these correlations will continue to provide valuable insights for timing market entries and exits.

Interestingly, the market has maintained relatively orderly trading despite the record prices. And it will be fascinating to see how these patterns develop, particularly if trade tensions continue to escalate with Trump pressing down on nation states. Overall, gold traders will need to pay special attention to volume patterns and market depth, which can provide early warning signals of potential price movements.

Future outlook for gold markets

Looking ahead, gold traders should focus on several key areas. Ongoing trade tensions and tariff concerns continue to dominate sentiment, while physical supply constraints in key markets may create additional volatility. Meanwhile, strong central bank buying activity suggests sustained institutional interest, while increasing safe-haven demand could provide support during periods of market stress. And then there’s the potential for trade policies to generate inflation pressures adds another layer of complexity to the market outlook.

Suffice to say that successful trading in current gold markets requires a comprehensive understanding of all of these factors. Traders will be keeping a close eye on developments in US-China trade relations – and quite rightly so – as these continue to drive short-term price movements. Ultimately, changes in central bank buying patterns could signal shifts in institutional sentiment, while physical supply dynamics between London and New York may create arbitrage opportunities. All this means that currency market volatility and inflation indicators provide important context for price movements.

The current situation in gold markets reflects a complex interplay of geopolitical, economic, and market-specific factors. As prices continue to trade near record highs, understanding these dynamics becomes increasingly important for gold and precious metals traders. In the current scenario, the combination of trade tensions, safe-haven demand, and physical supply constraints suggests that volatility may continue in the near term, making careful risk management essential for successful trading outcomes.

Navigating the complexity of gold markets

And with that, we’d like to invite you to experience how our Trading Co-Pilot can improve your precious metals trading results. Our platform seamlessly integrates real-time analysis of geopolitical events, supply chain dynamics, and market sentiment to provide you with actionable insights across gold, silver, platinum, and palladium markets.

Over a personalised live demo, we’ll help you discover how our AI-driven platform can enhance your trading operations and how we’re already Our helping institutional traders identify emerging opportunities, manage risk more effectively, and stay ahead of market-moving events. For qualified enterprise clients, we’re currently offering a 14-day trial of our platform, allowing you to experience firsthand how our advanced analytics can complement your existing trading strategies.

Simply get in touch with us at enquiries@permutable.ai or scheduling a demonstration by filling in the form below and be part of a group of early adopter trading houses who are already using our next-generation market intelligence to navigate the evolving commodities trading landscape.