Geopolitics and international relations are some of the biggest factors that affect the stock market. With high levels of globalization and integration of financial markets, changes in geopolitical landscapes can significantly affect financial systems and subsequently, the global economy. This article will explain how geopolitics affects the stock market, revealing the various geopolitical factors that affect financial markets.

Historical examples of geopolitical events affecting the stock market

There are several events that have happened in the world that have led to geopolitical factors affecting the stock market. For example, in 1962, during the Cuban Missile Crisis, the S&P 500 declined more than 6% due to conflicts of interest between the US and the Soviet Union. Similarly, the Gulf War in 1991 also affected the stock market because investors could not handle the situation and responded negatively to the uncertainty and risks of the disruption in the supply of oil in the global market. In the recent past, the Russian annexation of Crimea in 2014 and the sanctions by the West had a significant effect on the Russian stock market and further implications for global financial markets. Trade relations between the United States of America and China have also been another event that has had a negative impact on the stock market, especially because investors are frequently paying attention to trade negotiations between the two largest economies in the world and the impact they will have on global value chains and investment flow.

Understanding the global forces driving financial markets

The stock market is a complex structure involving numerous factors, including domestic and international. Geopolitical events are one of the many global forces that have an impact on financial markets. Other factors include macroeconomic factors like GDP, inflation rates, and interest rates, as well as corporate earnings, technology, and investor sentiments. To fully grasp this, it is expedient to understand how exactly geopolitics influences the stock market and how the world economy is interconnected. It has also become apparent that what happens in one part of the world can significantly affect other parts due to the interconnected nature of financial markets. This implies that investors need to keep abreast of any changes in the geopolitical landscape and what this would mean to their investment portfolios.

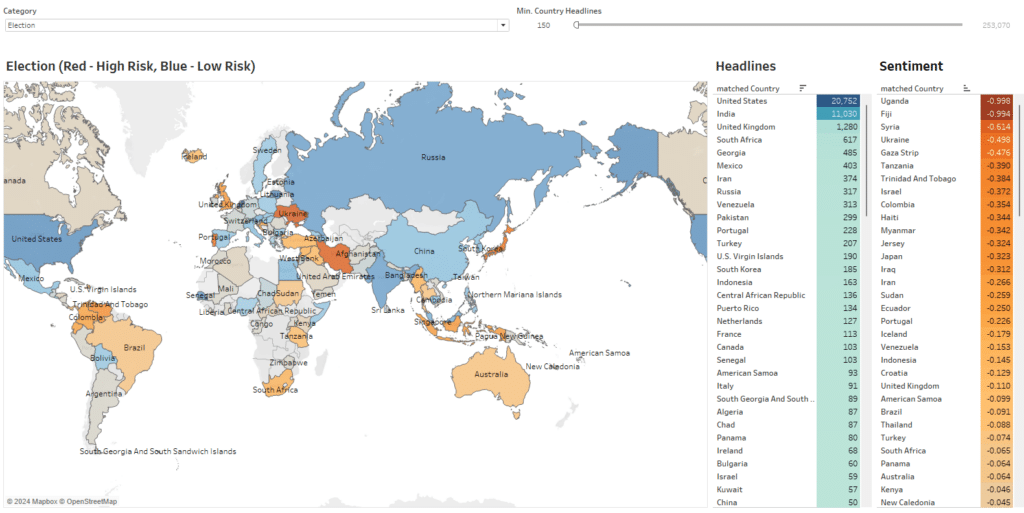

This chart above shows the geopolitical risk associated with elections worldwide, as analyzed by our AI-driven news sentiment analysis. The map and accompanying data offer insights into the current sentiment towards elections in various countries, with colour coding to indicate levels of risk. Countries highlighted in red indicate high-risk sentiment towards elections. This suggests significant concerns or negative sentiment in news coverage related to elections in these areas. Countries in blue signify low-risk sentiment towards elections, indicating a more stable and positive sentiment in the news.

The role of political instability in stock market volatility

Domestic and international political instabilities are some of the leading causes of fluctuations in the stock market. This may be attributed to unstable elections, the formation of new governments, or even new policies that may lead to instabilities in the market. Due to this, investors may face risks, which they attempt to avoid as much as possible, hence leading to low risk-taking and decreased stock prices. The recent political issues in some nations, such as the United Kingdom, with the Brexit crisis or Hong Kong with the pro-democracy protests, have greatly affected their respective stock markets. Hence, the political environment must be closely observed by investors, who must also be ready to bring changes to their investment decisions as the need arises.

How trade wars and international conflicts impact the stock market

Trade disputes and global conflicts directly affect the stock market as they can potentially disrupt global supply chains, raise production costs, and result in countermeasures causing further problems in the global economy. For instance, the current trade dispute between the United States of America and China has led to imposing tariffs on numerous products, which creates high risks and fluctuations in the stock market. In the same vein, geopolitical conflicts in areas like the Middle East or the South China Sea also affect the stock market, especially the energy and technology sectors, which rely on international transactions. This means that investors need to pay particular attention to changes in relations between the countries and their possible impacts on their investment portfolios.

The influence of government policies on financial markets

Another factor that has an impact on the stock market is government policies, either at the local or international level. Various principles outlined in fiscal and monetary policies, such as changes in interest rates and tax policies, have a direct influence on the performance of the stock market. Also, government policies that have direct or indirect impacts on the financial sector or any other sector influence the stock market. An example is the recent events involving governments and central banks regarding the COVID-19 pandemic, which affected the financial markets. Although huge financial and monetary policies have been proposed to support and stabilize the economy, they have affected the growth of the stock market with long-term consequences.

Geopolitical risks and their effects on specific industries

Some industries are more vulnerable to the effects of geopolitical events than others. For instance, the energy industry is particularly sensitive to fluctuations in the global oil supply, which is influenced by political upheavals in major oil-exporting countries. However, the technology sector is more exposed to the effects of trade conflicts and risks of disruption in global supply chains. Thus, investors must always assess the various geopolitical risks that are unique to certain industries and sectors and adopt the best strategies. Analyzing geopolitical risks and opportunities will ultimately help investors manage their investing portfolios by strategically mitigating the geopolitical risks of an unpredictable global environment.

Strategies for investors to navigate geopolitical risks in the stock market

Dealing with geopolitical risks and opportunities requires effective strategies in light of the constantly shifting geopolitical environment. Some of these key strategies include:

- Diversification: Diversification in terms of asset classes, sectors, and geographical locations reduces the effect of geopolitical events on a portfolio.

- Monitoring geopolitical developments: It is always important to keep abreast of the current events happening in the geopolitical space and how they impact the financial markets.

- Adjusting investment strategies: The changing geopolitical situation may affect investors’ portfolios, and this may require investors to adjust their investment strategies by increasing their allocation to safe-haven assets or reducing their risk exposure to certain sectors.

- Seeking professional advice: People are advised to seek the services of financial experts who have adequate knowledge of how politics affects the finance market.

The importance of staying informed about geopolitical events

In the age of globalization, keeping abreast of world events and how they may affect the stock exchange is important for investors. This way, the investors can be in a better position to predict the changes in the stock market by following the current trends in politics, economy, and international relations.

Notably, our geopolitical data intelligence gives investors with access to real-time insights and analysis of global events. All of this is powered by our advanced algorithms that analyze news sentiment extensively in real-time, offering a nuanced understanding of how geopolitical factors influence financial markets.

These are the keys to keeping ahead of geopolitical developments by understanding how geopolitical events are likely to impact market trends. From insights into elections, to trade wars, or natural disasters, all of this can help you anticipate and react to market shifts effectively. What we’ve found from using our own data intelligence to inform our own in-house trading strategies is that staying informed helps mitigate unexpected risks and seize timely opportunities. With this knowledge in hand, investors can reduce the risks their portfolios are exposed to and prepare for the challenges of an unpredictable world economy.

The ongoing relationship between geopolitics and the stock market

Geopolitics is closely connected with the stock market since several global events cause fluctuations in the financial market. As such, it can be expected that geopolitical forces will continue to put more pressure on the stock market as the world becomes further integrated in the future. Those investors who can understand the interconnection between these two spheres and the impact of geopolitical factors on corresponding opportunities and risks will be able to reach their financial goals. Therefore, investors can avert the rough periods in the global financial market by getting informed, diversifying their portfolios, and employing other appropriate strategies. If you would like to have additional information on how geopolitical factors could influence your investment portfolio, you might need to speak to a financial analyst in geopolitics. They can give you some useful tips on how you can approach the dynamic relationship between global occurrences and the stock market.

Ready to see how AI-driven geopolitical risk intelligence can transform your decision-making? Contact us for a demo of our AI-driven news sentiment analysis which is available through our Trading Co-Pilot subscription, or to request a free trial. You can also access top-line geopolitical insights through our Real-Time Geopolitical Insights & AI Market Sentiment Analysis Dashboard which is publicly available to view.