Extreme weather events are driving agricultural prices higher, and one asset class which is particularly affected by this is wheat. Our data, as surfaced by our Trading Co-Pilot makes this abundantly clear and offers an insightful look at how extreme weather events across the globe can significantly influence wheat prices. By examining the events log and the corresponding price chart, we can discern clear patterns of how various weather phenomena affect the wheat market. In this article, we’ll break down key observations specific weather events and their impacts, and take a wider view of how all of this affects price movements.

The impact of extreme weather events on wheat prices: Key trends

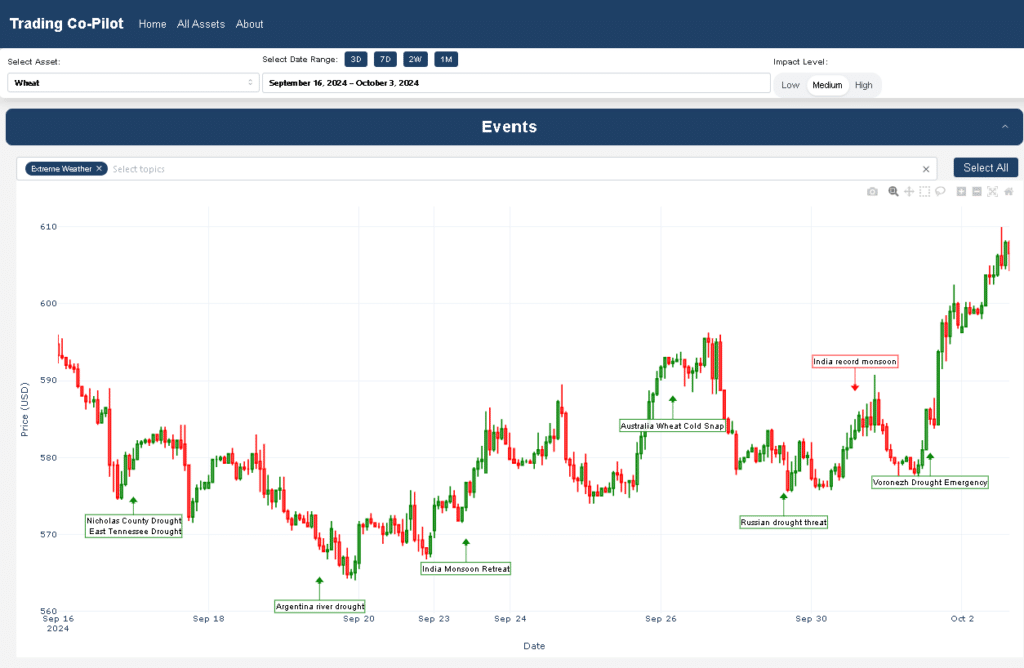

Above: Extreme weather events affect on wheat prices – insights from our Trading Co-Pilot

Price volatility

Looking at wheat, our Trading Co-Pilot showed considerable volatility throughout September into October 2024 with key changes in price around extreme weather events, but of course, geopolitical factors also come into play at certain junctures (but that’s another article!). All in all, this volatility highlights the sensitivity of wheat prices to external factors, particularly extreme weather events. The rapid fluctuations within this relatively short timeframe highlight the challenges faced by traders and analysts in predicting and responding to market movements.

Global impact

Weather events affecting wheat prices are not confined to a single region but span across continents, including Australia, India, Europe, and the Americas. This global impact demonstrates the interconnected nature of the wheat market and emphasises the need for a comprehensive, worldwide approach to weather monitoring and analysis. Events occurring in one part of the world can have ripple effects on wheat prices globally, illustrating the complexity of modern agricultural commodity markets.

The impact of extreme weather events on wheat prices by event type

Unsurprisingly, most prevalent weather events impacting wheat prices are droughts and excessive rainfall, with occasional mentions of cold snaps. These events can significantly affect wheat production at various stages of crop development. Droughts can lead to reduced yields or crop failures, while excessive rainfall can damage crops, delay harvests, or create conditions favorable for disease. Cold snaps, particularly if they occur at critical growth stages, can also severely impact wheat production. The variety of impactful weather events highlights the need for diverse and comprehensive weather monitoring systems.

A look at specific weather events and their impacts during the specified time period

Droughts in multiple regions

Droughts were reported in Nicholas County, East Tennessee, Europe and South American rivers. These events generally corresponded with upward price movements. The widespread nature of these drought conditions across multiple wheat-producing and consuming regions likely contributed to significant concerns about global wheat supply, driving prices upward.

Monsoon in India

India’s monsoon season began to retreat, having delivered surplus rains. Interestingly, this event corresponded with an increase in white prices. Then later again, prices increased as India experiences a record monsoon season. This seemingly contradictory price movement could be due to complex factors. The initial retreat might have raised concerns about potential water scarcity for future crops, while the record monsoon later could have sparked worries about flood damage or delayed harvests. These events highlight the intricate impact of weather on crop expectations and market sentiment.

Cold snap in Australia

A cold snap in southern Australia negatively impacted the wheat crop, leading to an upward movement in wheat prices around this date. This event demonstrates how unexpected weather conditions in major wheat-producing regions can quickly influence global markets. The price increase likely reflects market concerns about potential reductions in Australian wheat supply, which is significant given Australia’s position as a major wheat exporter.

Impact of extreme weather events on wheat prices: Analysis of price movements

Upward pressure

Droughts and cold snaps generally exert upward pressure on wheat prices as shown in the above snapshot taken from our Trading Co-Pilot. This is likely due to their potential to reduce crop yields and overall supply. The consistent nature of this upward pressure across different regions and time periods underscores the significant threat that these weather events pose to wheat production globally.

Mixed effects of rainfall

While drought conditions consistently drive prices up, the impact of rainfall is more nuanced. The heavy rainfall in India led to a price spike, possibly due to immediate concerns about crop damage. Conversely, the monsoon retreat in India, associated with surplus rains, led to a price dip, which may be due to positive long-term effects on crop yield. These contrasting effects highlight the complexity of rainfall’s impact on wheat prices and the importance of considering both short-term and long-term consequences of weather events.

Cumulative effects

The above visual suggests that the cumulative effect of multiple weather events can amplify price movements. For instance, the concurrent droughts in Europe and South America around September 11 corresponded with a significant price increase. This observation emphasises the importance of considering the global context of weather events rather than viewing them in isolation.

Delayed reactions

Some price movements appear to lag behind the reported weather events, suggesting that the market takes time to fully assess and react to the potential impacts on wheat supply and demand. This delay in market reaction highlights the complexity of interpreting weather data and its potential effects on wheat production and prices, underscoring the value of advanced analytical tools in providing timely insights.

Impact of extreme weather events on wheat prices: Final thoughts

Our analysis of extreme weather events and their impact on wheat prices, as revealed by our Trading Co-Pilot, highlights the intricate relationship between global climate patterns and agricultural commodities. One thing is absolutely crystal clear – the data demonstrates that wheat prices are highly sensitive to a wide range of extreme weather events, from droughts and excessive rainfall to cold snaps and long-term climate patterns like La Niña.

And so, these extreme weather events create a complex web of influences on the global wheat market. With that, the resulting price volatility presents both challenges and opportunities for traders, analysts, and policymakers alike. It highlights the critical need for sophisticated tools that can monitor, analyse, and predict the potential impacts of weather events on wheat prices in real-time – as our Trading Co-Pilot is able to do.

As we write, climate change continues to intensify extreme weather events worldwide, the ability to quickly interpret and act on this data will become increasingly valuable. The upshot? Those who can effectively navigate these weather-driven market fluctuations will be better positioned to make informed decisions in an increasingly unpredictable global commodities market.

Leverage our advanced AI-drive insights and directional for event-driven trading edge

Don’t let unpredictable weather events catch you off guard. With real-time data analysis and AI-driven insights, our Trading Co-Pilot helps you stay ahead of market movements triggered by global weather patterns.

Experience the power of data-driven decision making with:

- Real-time monitoring of global weather events

- AI-driven analysis of potential market impacts

- Clear, actionable insights and directionals to inform your trading strategy

Request a free demo of our Trading Co-Pilot today and see how we can help you turn weather volatility into trading opportunity. Email us at enquiries@permutable.ai or fill in the form below.