The impact of weather on commodity prices can be seen across various sectors including but not limited to agriculture, energy, and mining. The relationship between weather events and commodity prices is complex, with both direct and indirect effects. In this article, we will delve into the connection between weather and commodity prices, exploring how different types of weather events influence the prices of agricultural, energy, and metal commodities. We will also discuss the importance of weather forecasting for commodity traders and strategies for mitigating risks associated with weather-related price fluctuations.

The impact of weather on commodity prices: Agriculture

Agricultural commodities are highly susceptible to weather conditions, as they directly depend on factors like rainfall, temperature, and sunlight. Droughts and floods can substantially impact crop yields, leading to fluctuations in commodity prices. For example, a prolonged drought can cause a decrease in grain production, resulting in a shortage of supply and a subsequent increase in prices.

Conversely, excessive rainfall can lead to waterlogging and crop diseases, further affecting agricultural commodities. Additionally, extreme weather events such as hurricanes and cyclones can cause physical damage to crops, leading to supply disruptions and price volatility. Therefore, the relationship between weather and agricultural commodity prices is intertwined, making it crucial for traders and investors to monitor meteorological patterns and anticipate potential price movements.

The impact of weather on commodity prices: Energy

Weather conditions have a direct impact on energy commodities, especially those related to natural gas, crude oil, and electricity. For instance, extremely cold winters can increase the demand for heating, leading to a surge in natural gas prices. Similarly, hot summers can prompt higher electricity consumption, driving up prices in regions heavily reliant on air conditioning.

In addition to seasonal variations, severe weather events like hurricanes and storms can disrupt offshore oil and gas production, causing supply disruptions and subsequent price spikes. Furthermore, weather conditions can affect transportation infrastructure, hindering the distribution of energy commodities. Therefore, weather forecasting becomes crucial for energy traders, enabling them to make informed decisions and manage risks associated with weather-related price fluctuations.

The impact of weather on commodity prices: Metal and mining commodities

While the connection between weather and metal commodities may not be as direct as in agriculture or energy, it still plays a significant role. Weather events can impact mining operations, affecting the supply of metals such as gold, silver, copper, and iron ore. For example, heavy rainfall can lead to landslides and flooding, disrupting mining activities and causing production delays.

Extreme weather conditions can also impact transportation routes, making it challenging to deliver metal commodities to market. Moreover, weather-related events can influence demand for certain metals. For instance, an increase in construction activity during warm weather may drive up the demand for steel, impacting its price. Therefore, weather conditions must be considered by traders and investors in the metal and mining sectors to anticipate potential price fluctuations and manage risk effectively.

The role of weather in determining commodity supply and demand

Weather is a crucial factor in determining both commodity supply and demand. As we have discussed earlier, extreme weather events can disrupt production and transportation, leading to supply shortages and subsequent price increases. On the other hand, favorable weather conditions can result in abundant harvests or increased energy production, leading to an oversupply and downward pressure on prices.

Weather also influences consumer demand for certain commodities. For instance, during hot weather, the demand for beverages like soft drinks and beer tends to increase, impacting the prices of commodities such as sugar, corn, and barley. Similarly, cold weather can lead to higher demand for heating fuels like natural gas and heating oil. Therefore, accurately forecasting weather patterns becomes essential for traders and investors to anticipate changes in commodity supply and demand dynamics.

Weather forecasting and its importance for commodity traders

Accurate and timely weather forecasting is critical for commodity traders as it helps them make informed decisions and manage risks associated with price fluctuations. With advancements in technology, weather forecasting has become more precise, providing traders with valuable insights into potential weather-related impacts on commodity markets.

By analysing weather patterns, commodity traders can anticipate supply disruptions, identify opportunities for price arbitrage, and adjust their trading strategies accordingly. For example, if a weather forecast predicts a heatwave in a specific region, traders can anticipate increased demand for cooling commodities like electricity or natural gas and position themselves accordingly.

Moreover, weather forecasting allows traders to monitor the progress of planting and harvesting seasons, thereby gaining insights into potential impacts on agricultural commodities. This information helps traders to anticipate price movements and adjust their positions accordingly, mitigating potential risks.

Examples of notable weather events and their impact on commodity prices

Over the years, several notable weather events have had a significant impact on commodity prices. The 2012 drought in the United States, for instance, caused a severe reduction in corn and soybean yields, leading to a surge in prices. This event highlighted the vulnerability of agricultural commodities to weather extremes, emphasising the need for effective risk management strategies.

Similarly, the 2017 hurricane season in the Atlantic disrupted oil and gas production in the Gulf of Mexico, causing supply shortages and price volatility in energy markets. The impact of these weather events serves as a reminder of the interconnectedness between weather patterns and commodity prices, urging traders and investors to closely monitor meteorological developments.

Strategies for mitigating risks associated with the impact of weather on commodity prices

To mitigate risks associated with weather-related price fluctuations, commodity traders can employ various strategies. One approach is to diversify their portfolios by investing in a range of commodities across different sectors. This helps to offset potential losses caused by adverse weather conditions in a specific commodity or sector.

Another strategy is to hedge against weather-related risks by using derivative instruments such as futures contracts or options. For example, an agricultural trader can use futures contracts to lock in prices for crops, protecting against potential price declines resulting from unfavorable weather conditions.

Additionally, commodity traders can use advanced weather forecasting models and data analytics to gain a competitive edge. By leveraging these tools, traders can anticipate weather-related price movements more accurately, enabling them to execute trades at optimal times and manage risk effectively.

The future of weather forecasting and its implications for commodity markets

The future of weather forecasting holds immense potential for the commodity markets. Advancements in technology, such as improved satellite imagery, machine learning algorithms, and big data analytics, are enhancing the accuracy and timeliness of weather predictions.

With these advancements, commodity traders can expect more precise and reliable weather forecasts, enabling them to make more informed trading decisions. This will help them better navigate the risks associated with weather-related price fluctuations and capitalise on emerging opportunities.

Moreover, the integration of weather data with other relevant information, such as market trends and geopolitical developments, will provide traders with a holistic view of the commodity markets. This integrated approach will further enhance their ability to anticipate price movements, manage risks, and optimise trading strategies.

Adding to the insights on how weather influences commodity prices, leveraging high-quality data sets is crucial for deepening our understanding and refining predictive models. Permutable AI has compiled extensive datasets encompassing extreme heat and cold weather, as well as natural disasters from global news sources spanning from 2018 to the present. This comprehensive collection offers a treasure trove of information that can be instrumental for analysts and traders alike.

The impact of weather on commodity prices: Permutable AI’s data sets

Adding to the insights on how weather influences commodity prices, leveraging high-quality data sets is crucial for deepening our understanding and refining predictive models. Permutable AI has compiled extensive datasets encompassing extreme heat and cold weather, as well as natural disasters from global news sources spanning from 2018 to the present. This comprehensive collection offers rich information that can be instrumental for analysts and traders alike.

Enhanced weather forecasting accuracy: By analysing detailed historical data on extreme weather events and natural disasters, forecasters can refine their predictive models, leading to more accurate and timely forecasts. This improvement is critical for commodities trading, where the timing of buying and selling can significantly impact profitability.

Better risk assessment and management: Access to Permutable AI’s extensive datasets allows traders to perform more nuanced risk assessments. For instance, understanding the frequency and impact of past extreme weather events on specific commodities can guide more informed decisions on risk management strategies, such as insurance and hedging options.

Informed strategic planning: Companies and investors can use insights derived from historical weather data to plan more effectively for future scenarios. This could involve adjusting supply chain logistics, modifying storage solutions, or even rethinking investment portfolios to better align with anticipated changes in commodity availability and pricing driven by weather trends.

Dynamic pricing models: With a comprehensive view of how past weather events have affected commodity prices, traders can develop dynamic pricing models that more accurately reflect the probability of future weather impacts. This capability allows for more strategic buying and selling decisions, optimising financial outcomes.

Sector-specific analyses: Different commodities react differently to specific weather conditions. For example, agricultural commodities like wheat and corn are directly affected by rainfall and temperature, while metals and energy commodities may be more influenced by natural disasters disrupting production or logistics. By tapping into diverse data sets, analysts can tailor their market forecasts and strategies to the specific characteristics of each commodity sector.

Incorporating Permutable AI’s datasets into commodity trading strategies offers a competitive edge by enabling more precise forecasts, improved risk management, and better-informed strategic decisions. This approach not only mitigates the risks associated with weather-related price fluctuations but also exploits opportunities arising from these variations, thereby maximising the potential for profit in volatile markets.

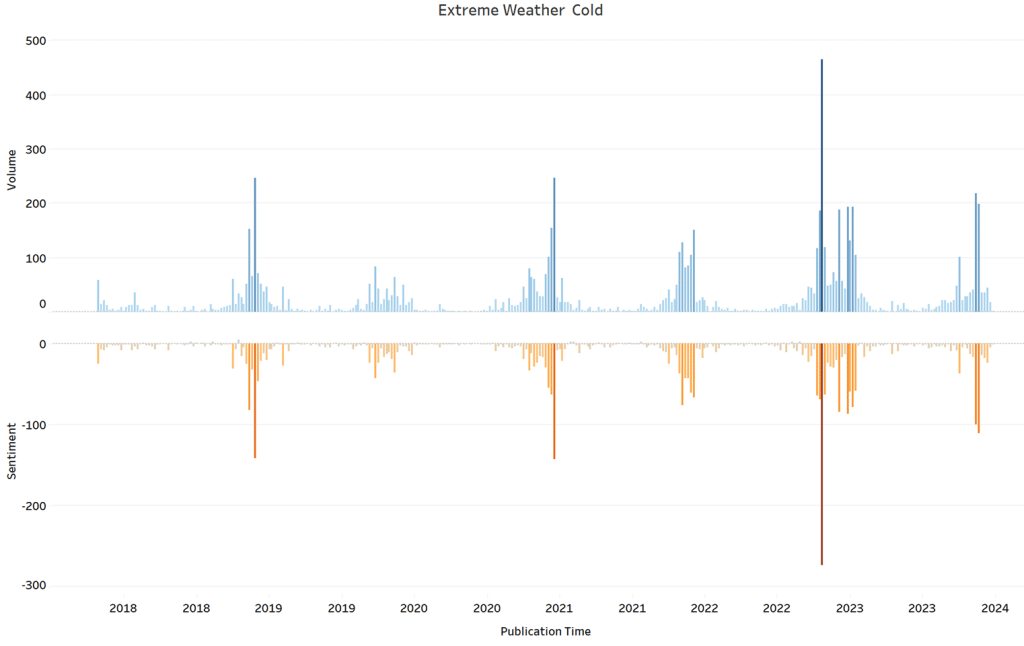

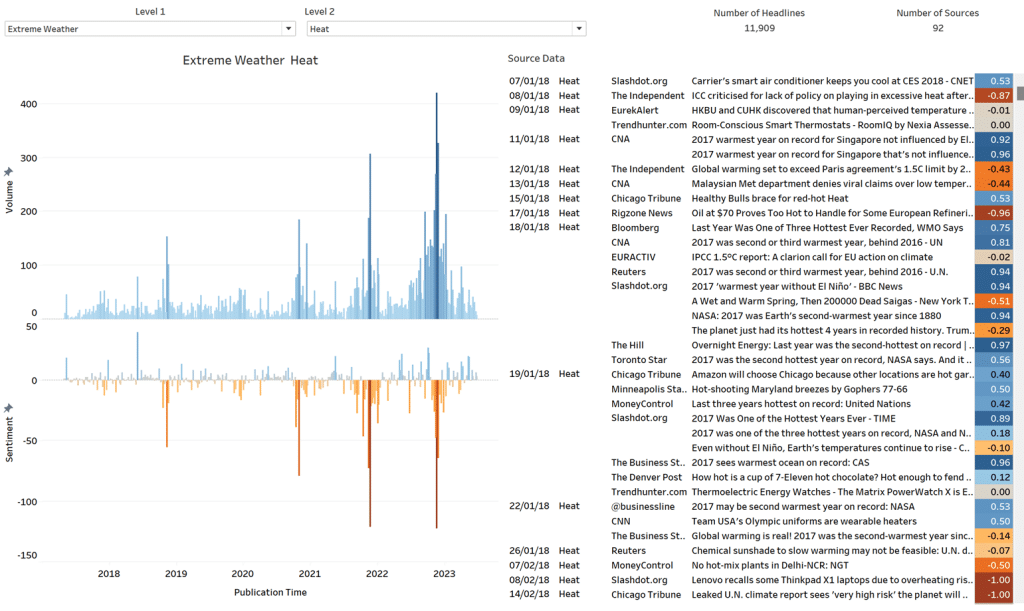

The impact of extreme weather on commodity prices: Our data sets at work

The graphs we have generated above from our data provides a visual analysis of the volume and sentiment of publications related to extreme cold weather events from 2018 to 2024. The X-axis, representing publication time, reveals the ebb and flow of media attention to cold weather phenomena over the years, with significant peaks and troughs corresponding to the occurrence and impact of these events. The Y-axis on the left measures the volume of publications, which shows notable spikes, particularly around the years 2021 through 2024, suggesting an increased frequency of events or heightened media focus during this period.

These spikes in publication volume could correlate with actual meteorological data indicating an uptick in extreme cold weather occurrences, or they might reflect a growing public or scientific concern about climate variability and its effects. Overlaying the publication volume, the sentiment analysis depicted by the line graph offers insights into the public or editorial tone of the coverage. Sentiment scores plunge deeply into negative territory at various points, especially pronounced in 2019 and between 2021 and 2022.

These negative sentiment dips could indicate the severe impacts of cold weather events on communities, economies, and infrastructures, eliciting responses ranging from policy discussions to humanitarian concerns in the media narrative. The sentiment analysis serves not only as a gauge of the severity of the cold weather events as perceived by the media but also as a reflection of societal reactions to these extreme conditions. Overall, the graph serves as a stark reminder of the increasing attention and concern regarding extreme weather patterns, and possibly, a call to action for preparedness and resilience in the face of such natural challenges and how this must be accounted for in trading strategies.

Understanding and navigating the weather-commodity price connection

Weather plays a crucial role in shaping commodity prices across various sectors. The connection between weather events and commodity prices is complex, with both direct and indirect effects. By understanding how weather impacts agricultural, energy, and metal commodities, traders and investors can better navigate the risks associated with price fluctuations.

Weather forecasting is of paramount importance for commodity traders, helping them anticipate potential disruptions, identify opportunities, and adjust their trading strategies accordingly. Moreover, employing risk mitigation strategies such as diversification and hedging can help mitigate the impact of adverse weather conditions on commodity portfolios.

As technology continues to advance, weather forecasting is expected to become more accurate and precise. We expect that this will empower commodity traders with valuable insights, enabling better-informed decisions and surfacing emerging opportunities in the dynamic and interconnected world of weather and commodity markets.

Find out more

Access the precision of our comprehensive datasets on extreme weather and natural disasters. Enhance your commodity trading strategies by incorporating detailed historical data and predictive insights. To find out more simply enquiries@permutable.ai or fill in the form below to get in touch.