In this article, we will take a look at Lloyd’s Banking Group ESG rating. Lloyd’s Banking Group is a UK-based financial institution that has been operating for over 250 years. With over 30 million customers, it is one of the largest banks in the UK. In recent years, Lloyd’s has made a concerted effort to promote sustainability and social responsibility throughout its operations. Some of the key initiatives that Lloyd’s has implemented include reducing its carbon footprint, promoting diversity and inclusion, and supporting local communities. For example, the bank has set a target to reduce its operational carbon emissions by 50% by 2030 and has launched a £100 million fund to support green businesses.

Lloyd’s Banking Group’s ESG rating and how it was achieved

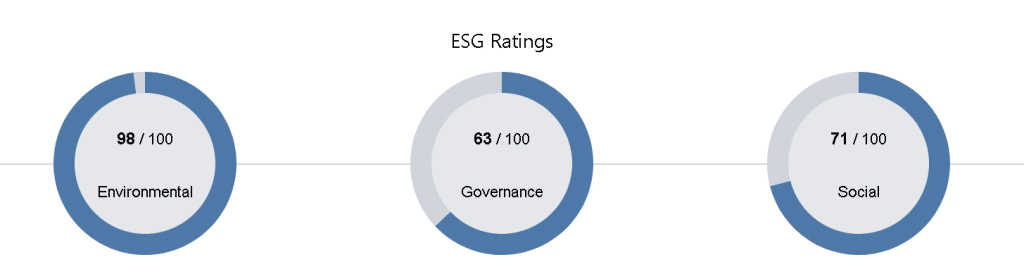

Lloyd’s Banking Group’s commitment to sustainability has is recognized within its ESG ratings, with the bank recently earning a top rating according to Permutable’s ESG data which shows a high score in environmental (98), social (71) and governance (63). This rating reflects Lloyd’s strong performance across a range of ESG criteria, including carbon emissions, diversity, and human rights. The bank’s commitment to sustainability is reflected in its governance structure, with a Sustainability Committee overseeing the bank’s ESG strategy. The committee includes senior executives from across the organization, ensuring that sustainability is integrated into all aspects of the bank’s operations.

A closer look at Lloyd’s Banking Group ESG rating

Lloyd’s Banking Group has earned a good ESG rating due to several factors:

Commitment to environmental sustainability

Lloyd’s Banking Group has made substantial efforts to mitigate its environmental impact. It has set ambitious targets to reduce its carbon emissions, increase renewable energy usage, and improve energy efficiency across its operations. The bank also supports projects and initiatives that promote environmental sustainability.

Social responsibility

Lloyd’s Banking Group places emphasis on social responsibility by actively supporting communities and addressing social issues. It invests in programs that promote financial inclusion, education, and social development. The bank also encourages employee volunteerism and philanthropic activities.

Strong Corporate Governance

The bank prioritizes strong corporate governance practices, ensuring transparency, accountability, and ethical conduct. Lloyd’s Banking Group adheres to regulatory requirements, maintains a robust risk management framework, and demonstrates responsible governance practices at all levels.

Stakeholder Engagement

Lloyd’s Banking Group engages with its stakeholders, including customers, employees, investors, and communities. By actively listening to their concerns and feedback, the bank incorporates stakeholder perspectives into its decision-making processes and strategic planning.

ESG Integration

Lloyd’s Banking Group integrates ESG considerations into its business operations and decision-making. It incorporates environmental and social risk assessments into its lending and investment practices and actively seeks sustainable financing opportunities.

These factors contribute to Lloyd’s Banking Group’s good ESG score, indicating its dedication to sustainable practices, responsible governance, and positive social impact. The bank’s commitment to ESG principles aligns with the growing demand for sustainable and socially responsible banking services.

Is there room for improvement in Lloyd’s Banking Group ESG rating?

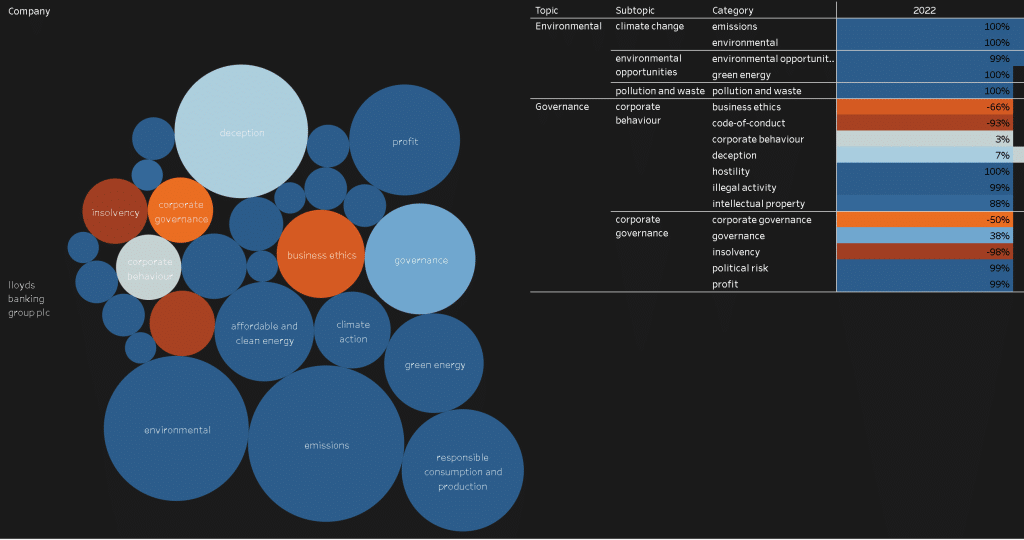

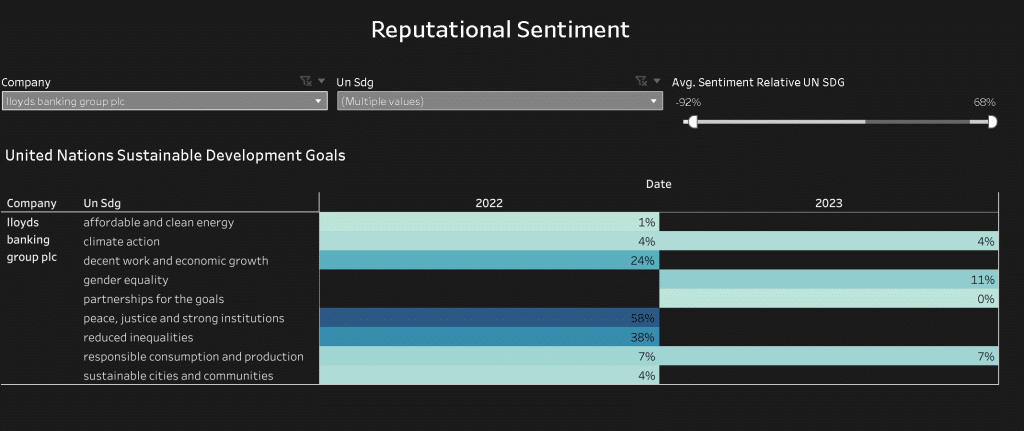

Within the Lloyd’s Banking Group ESG rating however and according to our data, the weakest link in the chain remains around governance, business ethics and code of conduct as highlighted below.

To enhance its governance score, Lloyd’s Banking Group can focus on strengthening its business ethics and code of conduct. by clearly defining and communicating its ethical principles to all employees and stakeholders and establishing a robust and comprehensive code of conduct that outlines expected behaviours, integrity standards, and guidelines for ethical decision-making. Effective compliance and risk management systems to ensure adherence to legal and regulatory requirements could also be a way of fostering a culture of integrity and accountability, thereby enhancing its governance score.

Sustainable finance and the future of banking

Sustainable finance is an emerging trend in the banking industry, with more and more banks offering green products and services. Sustainable finance refers to financial products and services that promote environmental and social sustainability. This can include green bonds, which finance environmentally friendly projects, or sustainable loans, which offer lower interest rates for businesses that meet certain sustainability criteria. As the demand for sustainable finance continues to grow, it is likely that we will see more banks incorporating sustainability into their business models.

Examples of other sustainable banks

Lloyd’s Banking Group is not the only bank that is prioritizing sustainability. There are many other banks around the world that are making significant efforts to promote sustainability and social responsibility. One example is Triodos Bank, a Dutch bank that only invests in sustainable projects and businesses. Another is Amalgamated Bank, a US-based bank that is a certified B Corporation and has a strong focus on social and environmental impact. These banks demonstrate that sustainability can be a key differentiator in the banking industry.

The impact of sustainable banking on society and the environment

Sustainable banking has the potential to have a significant positive impact on both society and the environment. By financing sustainable projects and businesses, banks can support the transition to a more sustainable economy. This can include financing renewable energy projects, supporting sustainable agriculture, and promoting sustainable transportation. Additionally, by prioritizing diversity and inclusion, banks can help to create more equitable societies. For example, by offering loans and other financial products to underserved communities, banks can help to reduce inequality and promote economic development.

Challenges and opportunities for sustainable banking

While there are many opportunities for sustainable banking, there are also significant challenges. One of the main challenges is the lack of standardization in ESG metrics. This can make it difficult for investors and consumers to compare the sustainability performance of different banks. Additionally, there is a risk that some banks may engage in greenwashing, where they make misleading or exaggerated claims about their sustainability performance. To address these challenges, there is a need for greater transparency and accountability in the banking industry, as well as increased collaboration between banks and other stakeholders.

Peer comparison

Alongside Lloyd’s Banking Group, the bank’s competitors all play a crucial role in the sustainable finance transition. Take a look at their ESG ratings below:

– Barclays

Conclusion and call to action for consumers and businesses to support sustainable banking

In conclusion, sustainable banking is an emerging trend that has the potential to have a significant positive impact on society and the environment. Lloyd’s Banking Group is one example of a bank that is making significant efforts to promote sustainability and social responsibility. However, there is still much work to be done to ensure that sustainability is integrated into all aspects of the banking industry. As consumers and businesses, we have a role to play in supporting sustainable banking by choosing to do business with banks that prioritize sustainability and by advocating for greater transparency and accountability in the banking industry. By working together, we can create a more sustainable and equitable financial system for the future.

Find out more

As we delve deeper into the topic of sustainable banking and the remarkable ESG rating achieved by Lloyd’s Banking Group, it becomes increasingly important to access comprehensive and accurate data. To further enhance your understanding and gain valuable insights, why not get in touch to request additional ESG data pertaining to Lloyd’s Banking Group’s sustainability efforts.