This article provides an in-depth analysis of recent TTF price movements and underlying market dynamics within the European gas sector, utilising real-time intelligence from Permutable AI’s Trading Co-Pilot to decode the drivers behind the LNG market’s recent resilience. It is written for energy commodity traders, portfolio managers, institutional investors, and energy market analysts seeking comprehensive intelligence on European gas market fundamentals and LNG trading opportunities.

The European energy landscape has undergone significant transformation throughout recent months, with the LNG market demonstrating continued strength amid persistent geopolitical uncertainties and evolving regulatory frameworks. As institutional traders increasingly recognise the strategic importance of liquefied natural gas within their energy portfolios, understanding the nuanced drivers behind recent price movements becomes paramount for successful positioning strategies.

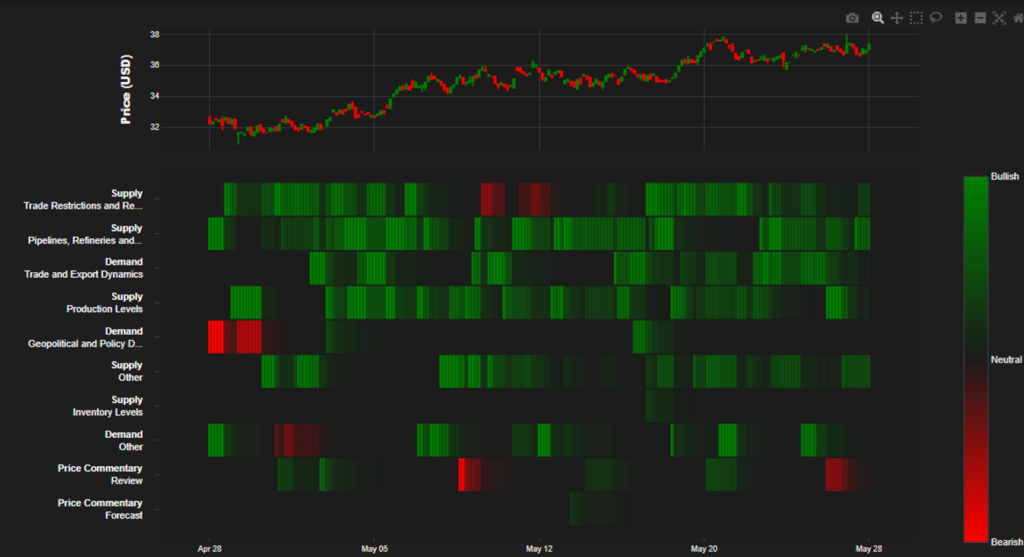

Through comprehensive analysis using our Trading Co-Pilot news intelligence feeds, we have identified distinct patterns emerging within the European gas complex that warrant careful examination. The steady climb in TTF prices from approximately $32 to $37 over the past thirty days reflects more than simple supply-demand rebalancing – it represents a market finding its equilibrium amid complex fundamental crosscurrents that require sophisticated analytical frameworks to decode effectively.

What emerges from this analysis is a picture of structural strength within the LNG market that extends beyond short-term price volatility. The underlying drivers supporting this upward trajectory suggest that European gas markets are entering a phase of sustained optimism, supported by robust demand fundamentals and increasingly stable supply infrastructure.

Supply-side dynamics shape market trajectory

Examining the supply-side factors influencing recent price movements reveals a complex interplay between regulatory pressures and infrastructure resilience that has characterised the LNG market throughout May. Our Trading Co-Pilot analysis indicates that whilst trade restrictions and regulatory changes created some early volatility, the underlying supply infrastructure has demonstrated remarkable stability.

Pipeline and refinery supply chains have maintained consistent operational status, with our monitoring systems indicating predominantly green signals across critical infrastructure networks. This stability represents a significant departure from the supply disruption concerns that plagued markets throughout previous quarters, suggesting that European gas infrastructure has adapted effectively to evolving geopolitical realities.

Production levels have maintained steady output despite ongoing geopolitical uncertainties, reflecting the resilience of global LNG production capacity and the effectiveness of supply chain diversification strategies implemented by major producers. This consistency in production output has provided a stable foundation for price discovery within the LNG market, enabling more predictable trading conditions for institutional participants.

The regulatory environment, whilst introducing some complexities, has not fundamentally disrupted the operational dynamics of European gas markets. Instead, our analysis suggests that market participants have successfully adapted to evolving compliance requirements, maintaining operational efficiency whilst navigating the changing regulatory landscape.

Demand fundamentals underpin market strength

The demand side of the equation presents an equally compelling narrative, with our Trading Co-Pilot identifying strong and consistent demand patterns across trade and export channels that continue to support LNG market fundamentals. European gas consumption has demonstrated resilience, reflecting both economic recovery trends and structural shifts in energy consumption patterns.

Industrial demand has remained robust throughout the period, with manufacturing sectors maintaining steady gas consumption despite broader economic uncertainties. This consistency in industrial demand provides a stable base load for European gas markets, supporting price levels and reducing volatility compared to markets more dependent on volatile residential or power generation demand.

Export dynamics have also contributed significantly to demand strength, with European re-export capabilities providing additional market flexibility. The LNG market has benefited from Europe’s position as a global trading hub, where excess supplies can be redirected to alternative markets when domestic demand softens, creating natural price support mechanisms.

Geopolitical and policy developments have shown mixed signals but are trending positive overall, with our analysis indicating that policy uncertainty has not materially dampened underlying demand fundamentals. Instead, policy developments appear to be encouraging diversification strategies that ultimately strengthen long-term demand prospects for the LNG market.

Above: LNG fundamental intelligence – our Trading Co-Pilot’s multi-factor analysis indicates robust foundation behind LNG’s recent price appreciation. The above heat map visualisation reveals predominantly green signals across critical supply and demand vectors throughout May, with supply infrastructure maintaining exceptional stability (consistent green in Pipelines/Refineries), robust trade and export dynamics supporting demand fundamentals, and production levels sustaining output despite geopolitical headwinds. Notably, the early May red signals in geopolitical/policy developments quickly resolved into sustained green momentum, whilst inventory levels and price commentary remain overwhelmingly positive. This multi-dimensional fundamental strength validates our 85% bullish sentiment indicator and supports the structural case for continued LNG market strength.

Inventory dynamics signal balanced fundamentals

Storage levels across European gas markets suggest balanced supply-demand fundamentals that support continued price stability within the LNG market. Our Trading Co-Pilot monitoring indicates that inventory levels are tracking within normal seasonal ranges, avoiding both the oversupply concerns that could pressure prices downward and the shortage risks that might trigger extreme volatility.

The current inventory profile reflects successful supply management strategies implemented throughout the winter period, with storage facilities maintaining adequate reserves whilst avoiding the excessive stockpiling that characterised previous years. This balanced approach to inventory management has created more stable market conditions, reducing the extreme price swings that can complicate trading strategies.

Injection patterns during the spring period have followed typical seasonal trends, with storage operators taking advantage of lower spring prices to build reserves for the upcoming winter season. This predictable seasonal pattern provides market participants with clearer visibility into future supply-demand dynamics, supporting more confident trading decisions within the LNG market.

Market sentiment reflects structural optimism

Our Trading Co-Pilot’s sentiment analysis reveals predominantly bullish trends throughout May, with market commentary and forecast indicators showing continued optimism regarding European gas market prospects. This positive sentiment extends beyond short-term price movements to encompass broader structural themes supporting long-term LNG market growth.

Price commentary from industry participants has been largely positive, reflecting growing confidence in European gas market stability and long-term demand prospects. Analysts and traders increasingly view recent price movements as reflecting genuine fundamental strength rather than speculative positioning, creating a more sustainable foundation for continued market development.

Forecast indicators compiled from multiple analytical sources show continued optimism regarding European gas market prospects, with most projections indicating sustained demand growth and stable supply conditions. This forward-looking optimism provides important context for understanding current price movements within the broader trajectory of LNG market evolution.

Strategic implications for summer period

As European gas markets transition into the summer period, looking forward, the implications of recent price movements become increasingly important for strategic positioning decisions. The steady upward trajectory in TTF prices reflects a market finding its equilibrium amid robust demand fundamentals, stable supply infrastructure, and positive sentiment despite occasional policy headwinds.

Watching inventory builds and maintenance schedules will be crucial for Q3 price direction, with our analysis suggesting that summer storage injection patterns will provide important signals regarding autumn and winter price prospects. The seasonal dynamics of European gas markets mean that summer price movements often provide early indicators of future market tightness or oversupply conditions.

Market participants should therefore pay particular attention to the relationship between summer injection rates and available storage capacity, as this balance will significantly influence autumn price discovery within the LNG market. Additionally, planned maintenance schedules for key infrastructure components may create temporary supply disruptions that could support prices during typically softer summer demand periods.

Gain competitive advantage in your energy trading strategy with our Trading Co-Pilot data feeds

Access real-time LNG market intelligence, comprehensive sentiment analysis, and predictive analytics that deliver superior trading performance across global energy markets. To request a demo simply email enquiries@permutable.ai or fill in the form below to speak to one of our team.