It is not hard to see across Natural Gas price news that the natural gas market has emerged as a critical bellwether for global energy security, with its prices reflecting everything from geopolitical tensions to severe weather events. In this article, we’ll use insights from our Trading Co-Pilot to demonstrate the growing interconnectedness of global natural gas markets that makes the recent price movements across TTF and Henry Hub particularly fascinating. Our analysis of recent Natural Gas price news against price movements reveals a complex interplay between geopolitical tensions and extreme weather events, creating distinct yet related patterns in European and American natural gas pricing.

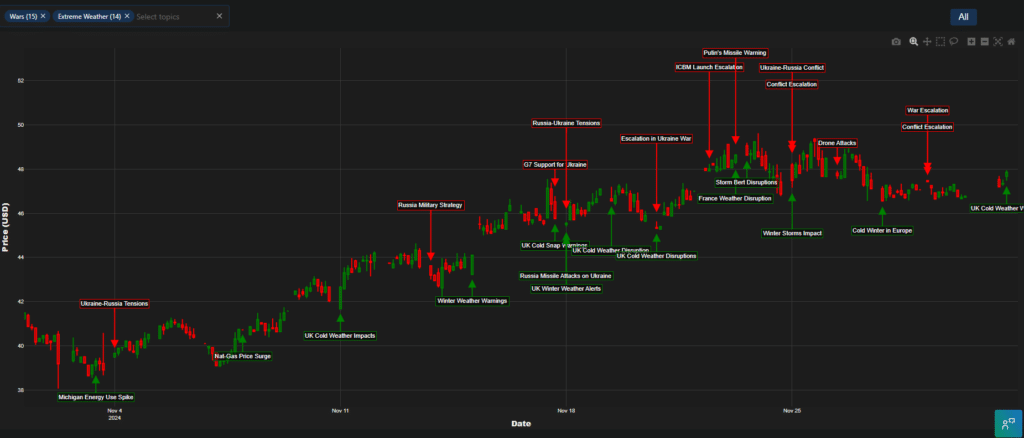

Above: Natural gas price news – European natural gas TTF analysis November 2024 insights taken from our Trading Co-Pilot

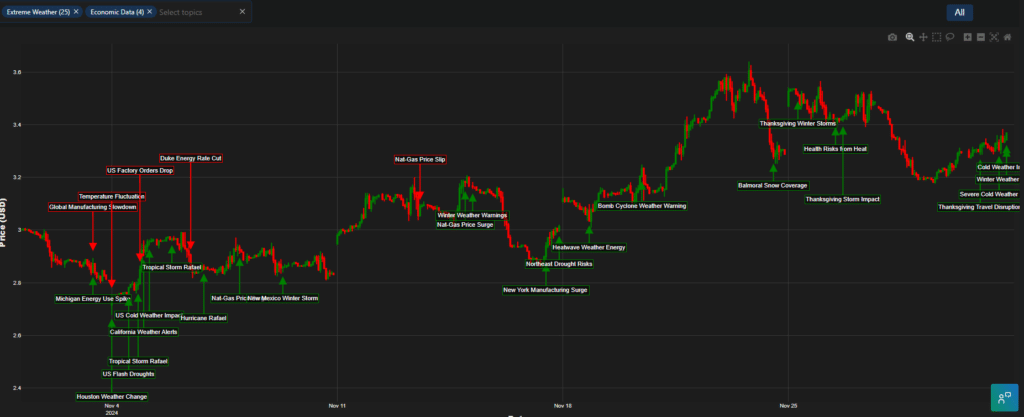

Natural gas price news – US natural gas Henry Hub analysis November 2024 insights taken from our Trading Co-Pilot

Weather impact on Natural Gas prices

Let’s start with the obvious – the direct link between weather and Natural Gas prices. From the above chart, it’s clear that Henry Hub prices show notable sensitivity to domestic weather patterns, as evidenced by the sharp responses to events like storm Rafael and the Thanksgiving winter storms. Meanwhile, the TTF market demonstrates a more pronounced reaction to geopolitical developments. Even though both markets operate independently, their price movements increasingly show correlation during major global events.

Natural gas price news: Key market dynamics

The key here appears to be the timing and severity of weather-related disruptions. What began as a relatively stable pricing environment in early November quickly transformed as multiple weather systems struck key consumption regions. Meanwhile, the escalating situation in Ukraine created additional pressure on European gas prices. This is hardly surprising, with TTF showing particular vulnerability to news of missile warnings and conflict escalation.

To add insult to injury, the markets are also worried about supply security, particularly in Europe, and quite rightly so. And if anyone ought to be concerned, it’s the industrial users facing potential supply disruptions during peak demand periods. Yet with some arguing that some of these concerns appear overblown it will be interesting to see how things truly play out across both regions.

Natural gas price news: Weather event analysis

Another big problem is the asymmetric impact of weather events. Although initially localised, weather disruptions like the recent Bomb Cyclone weather warning in the US created ripple effects across global natural gas markets. Which brings us back to the ticking time bomb of winter supply security, particularly in regions dependent on natural gas for both heating and power generation.

Infrastructure constraints highlighted across natural gas price news

As elsewhere, it’s clear that the situation has been made considerably worse by infrastructure constraints. Natural gas price news across both markets reflects these limitations, with price spikes occurring during periods of high demand and limited transportation capacity. It’s a uncomfortable fact that thanks to political and economic pressures, infrastructure development hasn’t kept pace with growing demand in key regions.

Natural gas price news and market interconnectivity

It’s easy to see from the above how the interconnected nature of these markets means that significant events in either region can create global ripple effects. The data essentially shows that while local weather patterns primarily drive short-term price movements, geopolitical events can fundamentally alter the pricing landscape, particularly in the more politically sensitive European market.

Stay informed with real-time Natural Gas price news intelligence

If you found the above insights and analysis valuable, why not access our real-time insights and granular market data through our Trading Co-Pilot and Commodities API? With comprehensive coverage of both TTF and Henry Hub markets, you’ll have the real-time insights needed to navigate these complex market dynamics. Contact us today to learn how our solutions can enhance your trading and risk management strategies by emailing enquiries@permutable.ai or filling in the form below to request your personalised demo.