In the wake of recent geopolitical tensions, price drivers for crude oil have shown remarkable sensitivity to Middle Eastern developments. Over the last month, our Trading Co-Pilot has tracked multiple significant events that shaped market movements. In this article, we’ll examine key price drivers for crude oil:

Price drivers for crude oil

Geopolitical tensions take center stage

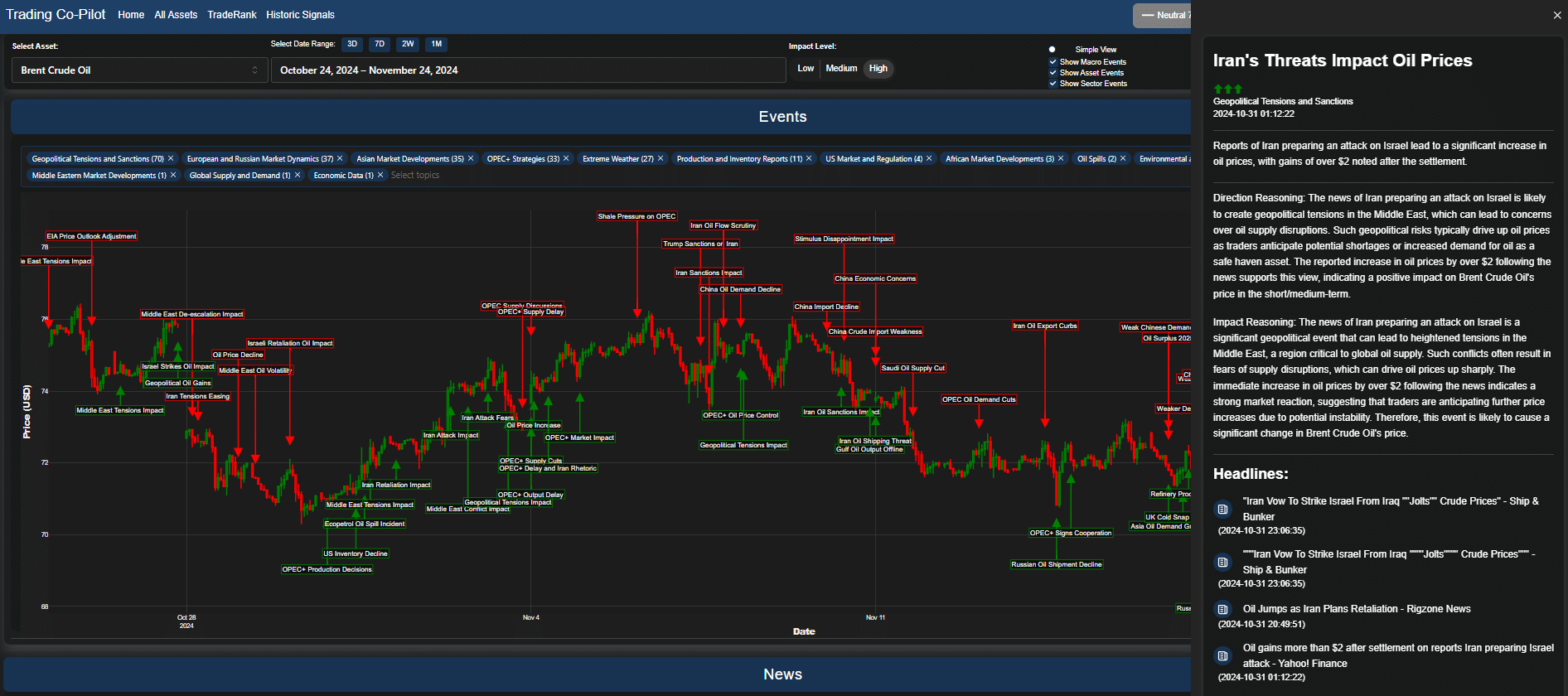

Everywhere one looks, geopolitical factors have dominated the price drivers for crude oil. The most significant impact came from Iran’s threats against Israel, which triggered an immediate price surge. This shift represents more than just regional tension – it’s a fundamental reassessment of supply risk in the Middle East.

OPEC’s strategic maneuvers

Superficially at least, OPEC’s influence appears straightforward, but we need to understand the nuanced impact of their decisions. The organization’s supply delay and subsequent production decisions created notable price fluctuations. This is nothing less than an attempt to upend the traditional market dynamics, with OPEC’s oil price control measures showing varying degrees of success.

Chinese demand dynamics

Given that it is still working its way through economic recovery, China’s demand patterns have emerged as crucial price drivers for crude oil, as highlighted by our Trading Co-Pilot. China’s demand decline and subsequent economic concerns created downward pressure, though recent import data shows signs of recovery.

Supply-side developments

There will doubtless be continued attention on supply-side factors. Saudi Arabia‘s strategic oil supply cuts have demonstrated significant market-moving potential, creating upward pressure on prices throughout the period. This coincided with a notable US inventory decline, which further tightened market conditions in the Western hemisphere. Adding another layer of complexity, changes in Russian oil shipment patterns have introduced new variables into the supply equation, particularly affecting European market dynamics.

Market impact assessment

Price drivers for crude oil: Looking forward

So let us finish here with two thoughts:

First, the price drivers for crude oil have become more complex and intertwined. Geopolitical events now create ripple effects that persist longer than traditional supply-demand imbalances. Second, market participants must remain vigilant to both macro events and regional developments. Just remember that in today’s interconnected markets, price drivers for crude oil can emerge from unexpected sources.

For the avoidance of any doubt, this analysis demonstrates how our Trading Co-Pilot captures and gives context to market-moving events in real-time, providing traders with crucial insights into price drivers for crude oil. Insiders say we’re entering a period of heightened volatility, and this of course is hard to contest. One could even say that we are, in a sense, witnessing a transformation in how oil markets react to global events. All of this means that understanding these complex interactions between different price drivers for crude oil has never been more important for navigating these turbulent waters and this is a trend that is set to continue well into 2025.

Experience our Trading Co-Pilot: Where AI meets market intelligence

In today’s rapidly evolving markets, staying ahead of price-moving events isn’t just an advantage – it’s essential. Our Trading Co-Pilot has already helped leading trading desks capture crucial market movements before they hit mainstream news, processing over 500,000 articles daily to deliver real-time, actionable insights.

We’re currently offering selected trading professionals an exclusive opportunity to experience our platform firsthand. This limited-time trial provides complete access to our suite of features, including real-time event detection, historic back-testing capabilities, and our proprietary signal generation system. Early adopters are already using our platform to enhance their trading decisions – now it’s your turn to discover the advantage of AI-powered market intelligence.

Ready to transform your approach to market analysis? Contact us at enquiries@permutable.ai or book a demonstration by filling in the form below.

Limited trial spots available for qualified trading professionals. Contact us today to secure your access.