TRADING CO-PILOT: SECTOR SENTIMENT ANALYSIS

Access real-time market events, sentiment analysis, and AI-powered insights for institutional investment decisions

Overview

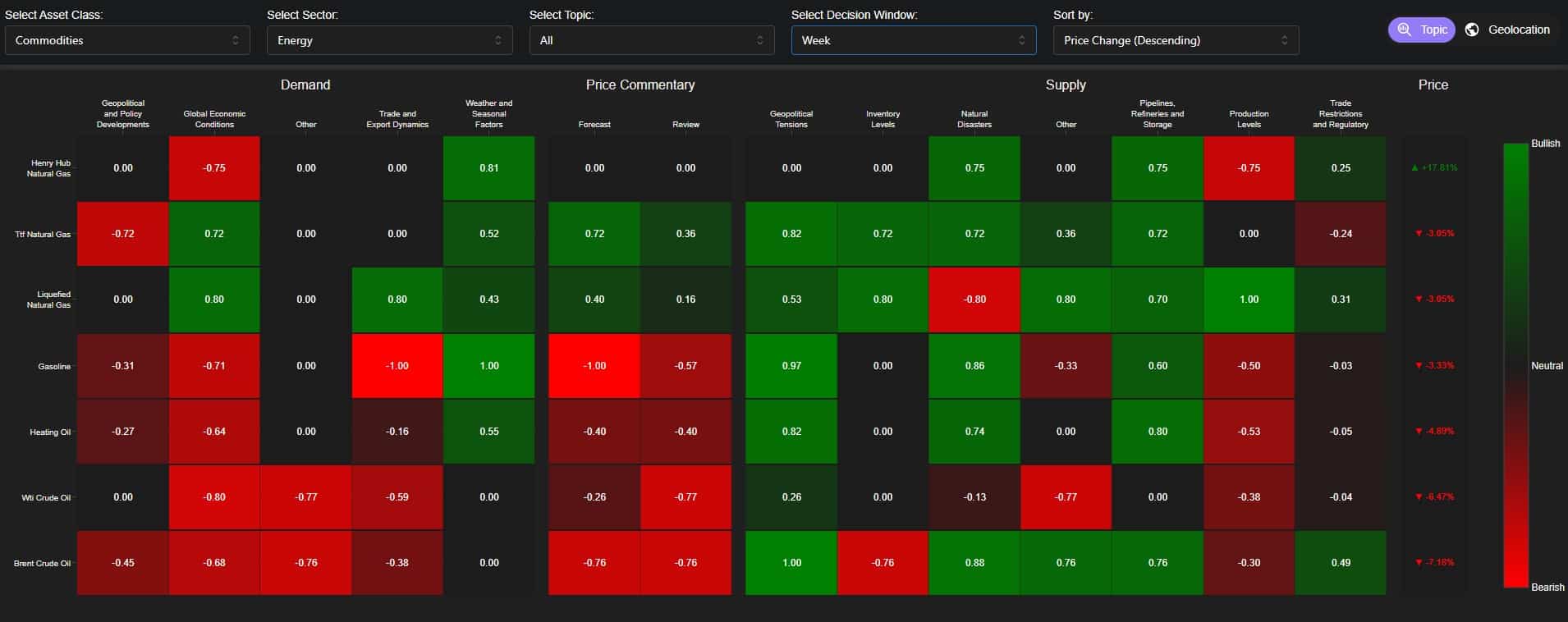

Trading Co-Pilot delivers a quantitative decision engine by transforming vast, real-time market intelligence and NLP-driven sentiment into actionable insights. Our interactive heatmap displays precisely calibrated factor scores (–1.00 to +1.00) for energy commodities, quantifying the directional impact of geopolitical events, macroeconomic indicators, trade flows, weather, and more. Our system continuously ingests and normalizes global news, economic releases, and trade reports, applying consistent, rigorous scoring to correlate factors with price movements, enabling users to identify significant relationships, backtest signals, and make data-validated trading decisions.

Implementation Use Cases

Comprehensive Market Coverage

Access real-time factor scores and insights across diverse asset classes and geographical regions.

Multi-Horizon Strategy Analysis

Analyze strategies over multiple timeframes with quantified insights into market drivers and price movements.

Persistent Theme Extraction

Leverage NLP-powered sentiment scoring to automatically detect enduring bullish or bearish market drivers.

Permutable Co-Pilot API enables programmatic access to structured news data with millisecond latency and enterprise-grade reliability. Full documentation is available at https://copilot-api.permutable.ai/redoc, including Python, R, and Java client libraries with webhook support.

API Reference

GET /v1/sentiment/aggregate/sector/{sector_id}

Provides the latest aggregated sentiment data for a specified market sector. Supports various sentiment metrics based on lookback period and data types.

GET

/v1/sentiment/aggregate/sector/{sector_id}

Parameters

| Name | Description |

|---|---|

sector_idstring (path) |

Sector id to filter tickers. Get these sector ids from GET /sector |

has_eventsboolean (query) |

Whether to include hours with no events in returned aggregation. Default value: true |

version_idstring (query) |

Version id to filter sentiment data. Defaults to latest production version. |

lookback_periodinteger (query) |

Lookback period in days for sentiment analysis. Default is 7 days, max is 30 days. Default value: 7 |

signal_typestring (query) |

Type of signal to use in the sentiment analysis. Options are 'Combined', 'Asset', 'Macro', 'Sector' Default value: Combined |

sentiment_typestring (query) |

Type of sentiment to analyze. Options are 'topic' or 'geolocation' Default value: topic |

Request Example (Python)

import requests # Replace with your actual credentials API_KEY = "your-api-key" # Headers headers = { "x-api-key": API_KEY, } # Query parameters params = { 'lookback_period': 7, 'signal_type': 'Combined', 'sentiment_type': 'topic', 'has_events': 'true' } # Make the request response = requests.get( "https://copilot-api.permutable.ai/v1/sentiment/aggregate/sector/ENRG_SEC", headers=headers, params=params ) # Check for errors response.raise_for_status() # Get the response data data = response.json() print(data)

Response Example

{ "sentiment": [ { "ticker": "BZ_COM", "topic": "Supply-Geopolitical Tensions", "event_type": "Combined", "avg_sentiment": -0.7, "median_sentiment": -0.7, "min_sentiment": -0.7, "max_sentiment": -0.7, "std_dev": 0 }, { "ticker": "BZ_COM", "topic": "Supply-Production Levels", "event_type": "Combined", "avg_sentiment": -0.7, "median_sentiment": -0.7, "min_sentiment": -0.7, "max_sentiment": -0.7, "std_dev": 0 }, { "ticker": "BZ_COM", "topic": "Supply-Inventory Levels", "event_type": "Combined", "avg_sentiment": -0.7, "median_sentiment": -0.7, "min_sentiment": -0.7, "max_sentiment": -0.7, "std_dev": 0 } ] }

Sample Data (Implied Impact on Price)

Request Enterprise Demo

Please fill out the form below and we\'ll get back to you within 24 hours.