*This article is for investment or financial analysis professionals focused on the silver market. It’s specifically analysing the recent trend of silver being viewed as a safe haven”asset (similar to gold) during times of economic uncertainty and geopolitical tensions.

As we write, the precious metals market is witnessing a significant shift as silver emerges from gold‘s shadow, establishing itself as a formidable safe haven asset. First, the obvious point is that silver has been holding impressive gains near the $33.00 mark despite turbulent market dynamics, signalling what many analysts are calling a silver safe haven demand breakout. In this article, we’ll look at the events that have led to this recent market development, with insights taking from our Trading Co-Pilot.

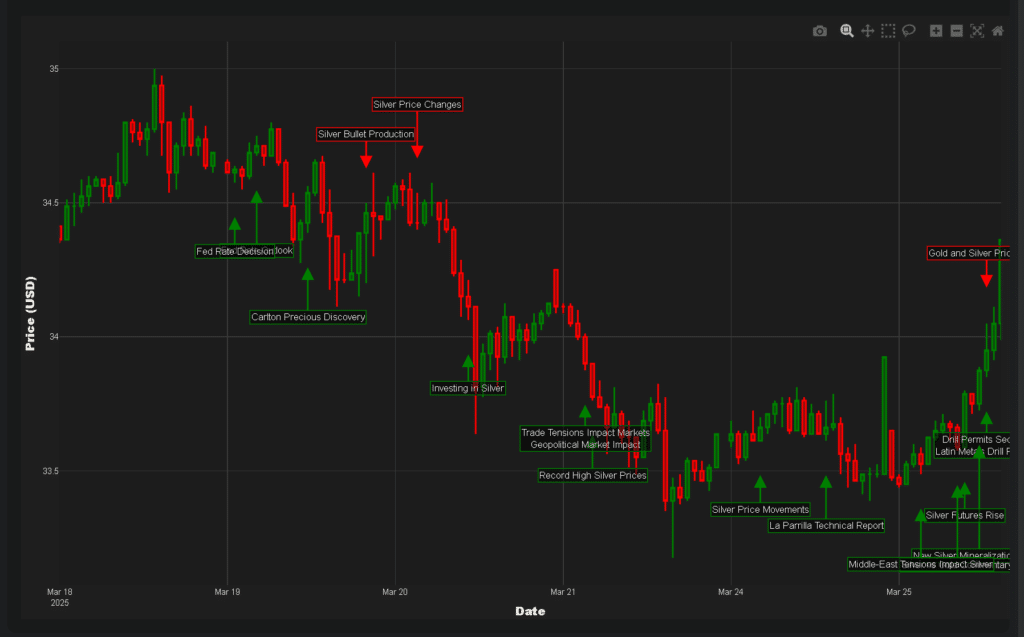

Above: Insight Analyst View across silver from our Trading Co-Pilot

Market performance amid geopolitical uncertainty

Here’s a truth we all know very well – we live in an age of highly volatile geopolitics, and it is silver’s recent performance that reflects this reality. The metal has demonstrated remarkable resilience, maintaining price stability even as tensions in the Middle East escalate. Silver opened at $33.64 and closed at $33.93 on March 24, driven primarily by global volatility and growing economic concerns in the United States.

But there is no doubting that silver’s trajectory has not been entirely smooth. The market has shown mixed signals, with futures experiencing periodic declines amid the overall upward trend. This is not to say that silver’s position as a safe haven asset is diminishing; rather, these fluctuations represent natural market corrections in an otherwise bullish environment.

Industrial demand meets investment appeal

The hardest part is distinguishing between silver’s dual roles as both an industrial metal and an investment asset. Unlike gold, silver’s value proposition extends beyond mere wealth preservation, with approximately 50% of demand coming from industrial applications. In a way, this dual nature creates a unique market dynamic that strengthens silver’s position during times of economic uncertainty.

You can make the argument that silver offers superior upside potential compared to gold, a sentiment recently echoed by Anuj Gupta of HDFC Securities. We can be reasonably confident that this perspective is gaining traction among institutional investors who are increasingly allocating capital to silver as part of their diversification strategies.

Supply constraints fuelling the silver safe haven demand breakout

The present outlook for silver supply remains constrained, with mining output struggling to keep pace with growing demand. There are several areas where production challenges are particularly acute, including declining ore grades and increasing extraction costs. The truth is more complicated than simple supply and demand equations, as geopolitical factors also influence mining operations in key silver-producing regions.

In addition, environmental regulations are tightening globally, further restricting supply growth. We must reject the argument being made that these supply constraints are temporary as all evidence points to structural issues that will continue to support prices over the medium to long term.

Investment sentiment and market dynamics

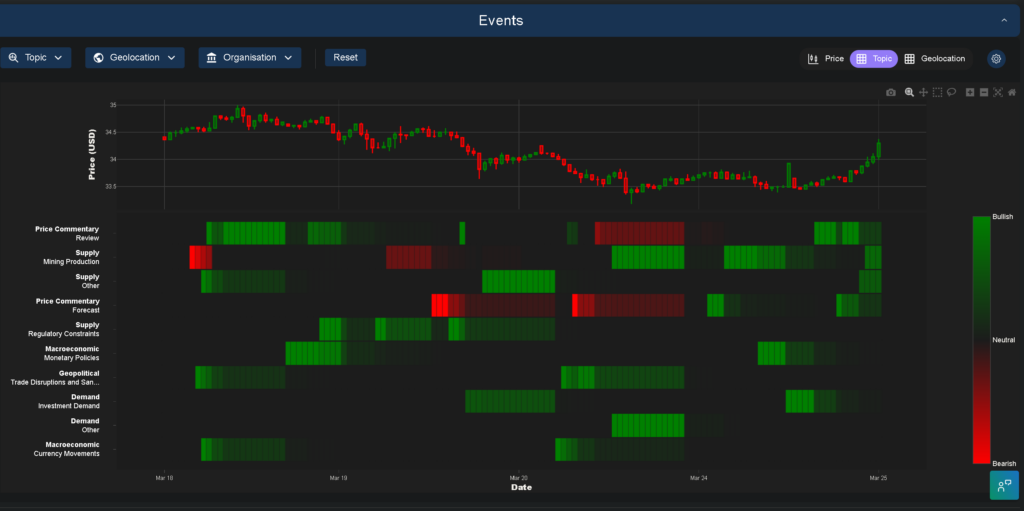

The question is whether the current silver safe haven demand breakout represents a fundamental shift in investor sentiment or merely a temporary reaction to market volatility. If experience tells us anything, it’s that precious metals typically perform well during periods of economic uncertainty and inflation concerns.

Everywhere you look, there are signs that investors are increasingly viewing silver as a legitimate alternative to gold for wealth preservation. It’s true that forecasts suggest a potential break north of $34-35 could attract significantly more capital inflows, potentially triggering a more pronounced silver safe haven demand breakout.

Above: Silver safe haven demand sentiment heatmap from our Trading Co-Pilot

Central bank policies and currency impacts

Then there is the challenge of navigating monetary policy decisions. Having gone through a period of weakening, the now strengthening US dollar, influenced by hawkish Federal Reserve policies, has periodically applied downward pressure on silver prices. For the avoidance of doubt, this inverse relationship between the dollar and precious metals is well-established in financial markets.

But the game changer will be any pivot towards more accommodative monetary policy. Should central banks begin cutting interest rates in response to economic slowdowns, the resulting currency devaluation could significantly accelerate the silver safe haven demand breakout.

Future outlook

As for price projections, analysts remain cautiously optimistic. But we must acknowledge that silver’s volatility is typically higher than gold’s, which presents both risks and opportunities for investors which would mean a focus on silver’s fundamental value proposition rather than short-term price movements would remain prudent.

Last but not least, the psychological aspects of market sentiment cannot be overlooked. If narratives shape politics, they certainly influence financial markets as well. Imagine too the potential impact of a sustained silver safe haven demand breakout on broader precious metals investment flows.

And so let us finish with debating it openly: could silver eventually challenge gold’s supremacy as the ultimate safe haven asset? While we believe that remains unlikely in the immediate future, the current silver safe haven demand breakout suggests the gap may be narrowing – for the time being, at least.

Find out when the silver market is about to turn

As we’ve seen with the above, timing is everything in this volatile market. Don’t rely on outdated information when making crucial investment decisions. Our Trading Co-Pilot delivers instant access to comprehensive silver market sentiment data, aggregated from thousands of sources and analysed through our proprietary algorithms.

Start identifying emerging trends before they appear on price charts, recognize market extremes that signal potential reversals, and gain the confidence to act decisively when opportunities arise. Experience our Trading Co-Pilot difference today – your first week is completely risk-free, with no obligation to continue. Simply email us at enquiries@permutable.ai or fill in the form below to arrange your personalised demo.