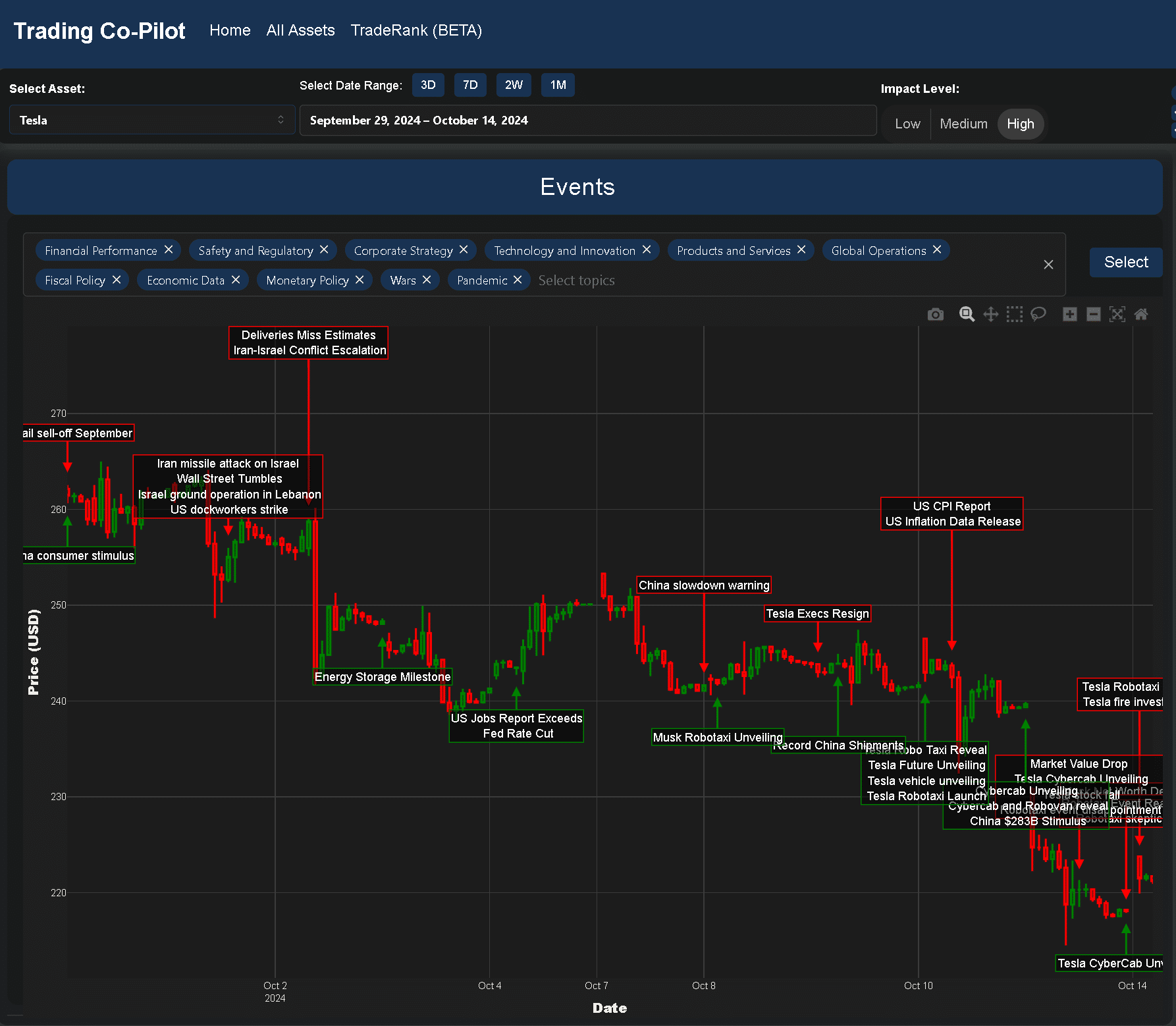

Why is Tesla stock dropping? Let’s start with the obvious: Tesla’s stock has been on a wild ride of late. Our Trading Co-Pilot chart paints a vivid picture of over the past month, with several dramatic dips and recoveries. This striking difference hints at a complex interplay of factors influencing investor sentiment. But what’s really driving these fluctuations? Get our latest thinking in this article with insights from our Trading Co-Pilot.

Why is event Tesla stock dropping – insights from our Trading Co-Pilot

Geopolitical tensions and market jitters

For starters, the chart highlights a significant sell-off in late September, coinciding with an escalation in geopolitical tensions. The Iran-Israel conflict escalation spooked investors, leading to a broader market tumble. You might say that Tesla, being a high-profile and volatile stock, often amplifies broader market movements. Yet here’s the rub: while geopolitical events certainly play a role, they don’t tell the whole story of Tesla stock dropping. There is also evidence that company-specific factors are at play, which we’ll get into in more detail below.

Product launches and market reception

One thing is clear, the problem isn’t a lack of innovation at Tesla including developments in energy storage and of course, the recent Robotaxi unveiling which failed to impress investors. But we must remember the bigger picture here, which is that Tesla is consistently pushing the boundaries of electric vehicle technology and energy solutions. Nonetheless, the market’s reaction to these announcements has been mixed at best with Tesla stock dropping continues to be the prevailing trend at the moment. This suggests that the market believes that these innovations may not translate into immediate revenue growth or profitability

Corporate shake-ups and internal challenges

Another bone of contention is the recent resignation of Tesla executives – indicated on our Trading Co-Pilot chart as “Tesla Execs Resign” as a significant event. This internal turbulence could be contributing to investor unease. There is broad consensus that leadership stability is crucial for a company as innovative and disruptive as Tesla. The expectation that top talent might be leaving the company could be weighing heavily on investor confidence.

Macroeconomic factors

Again and again, you can see the same pattern: macroeconomic events having a significant impact on Tesla’s stock price. The US Jobs Report exceeding expectations and a potential Fed Rate Cut initially gave the stock a boost. However, this was followed by concerns about a China slowdown, which likely contributed to Tesla stock dropping once more.

It has now emerged that Tesla’s fortunes are closely tied to both US and Chinese economic health. The catalyst for many of the stock’s movements can be traced back to these broader economic indicators.

Competition and market saturation

Little wonder that investors are keeping a close eye on Tesla’s market position. The present state of play in the electric vehicle market is one of increasing competition. While our Trading Co-Pilot chart doesn’t explicitly mention competitors, the overall downward trend in Tesla stock dropping could reflect growing concerns about market saturation and rivalry from both established automakers and new EV startups.

Supply chain and delivery challenges

Now look to where our Trading Co-Pilot highlights “Deliveries Miss Estimates” as a significant event. This is at the core of Tesla’s recent struggles. Achieving its ambitious production and delivery goals is crucial for maintaining investor confidence. This requires a finely tuned supply chain and manufacturing process.

By leveraging its world-class production capabilities, Tesla has historically been able to ramp up deliveries quarter after quarter. However, the recent miss suggests that the company may be facing headwinds in this area.

Investor sentiment and future outlook

So much of the past, what of the future? Insights from our Trading Co-Pilot chart shows several events related to future products and innovations, such as the Robotaxi. These announcements are clearly aimed at shaping investor perceptions of Tesla’s long-term potential, despite investors being less than impressed by the recent unveiling.

However, the continued pattern of Tesla stock dropping suggests that investors may be adopting a “show me” attitude. They’re looking for concrete results rather than future promises. In fact, some say the expectation that Tesla can maintain its astronomical growth rates indefinitely may be waning. Nonetheless, it’s important to note that the company still enjoys a significant market cap and brand loyalty that many competitors envy.

Why is Tesla stock dropping: Final thoughts

Much has changed since Tesla’s early days as an EV pioneer. The company now faces the challenges of being an industry leader in a rapidly evolving market. The good news is there’s a big wheel moving in the right direction in terms of global EV adoption, but Tesla must navigate carefully to maintain its pole position in face of competition that is fiercely hotting up.

In a bizarre twist, the very success that Tesla has had in popularising electric vehicles has created a more competitive landscape that now challenges its market dominance. This trend has ramped up significantly in recent years with the likes of Nio and Lucid hot on Tesla’s heels.

Beyond the fanfare of product launches and ambitious goals, Tesla must grapple with the realities of production scaling, market competition, and delivering on its promises to maintain investor confidence.

Over the past month, Tesla stock dropping has been the prevailing narrative. But in the fast-paced world of tech and automotive innovation, fortunes can change quickly and it is likely this trend will reverse at any given time. For investors and industry observers alike, Tesla remains a company to watch closely, as its trajectory could well indicate the future direction of the entire electric vehicle market.