The combination of global trade wars with geopolitical tensions along with commodity market fluctuations and evolving macroeconomic conditions together with shifting domestic policies draws investor attention towards the USD/CAD currency pair. In particular, the unfolding trade tariff disputes which remind traders of President Trump’s initial term have unsurprisingly prompted asset managers and FX traders to react.

In response to such uncertainty, our Trading Co-Pilot delivers instant and predictive market sentiment analytics with risk assessment, offering investors strategic advantages in unstable markets. Investors use both historical and real-time sentiment data to forecast significant currency movements. Our Trading Co-Pilot helps identify early indicators of volatility in pairs like USD/CAD, alerting users not only to potential risk events but also to quantifying sentiment shifts, enabling a deeper understanding of market direction. As a result, asset managers and FX traders gain a powerful edge in navigating the complex interplay of global forces impacting currency performance.

In this analysis, we examine insights on USD/CAD movements through the lens of our Trading Co-Pilot’s global sentiment signals alongside macroeconomic developments, and geopolitical risk factors. By analysing real-time data across thousands of global media sources, policy updates, and commodity trends, this enables institutional investors to identify and act on shifts in market psychology and policy direction before they are priced in. The resulting analysis combines sentiment forecasting with macroeconomic context to deliver a dynamic, data-driven framework for trading and risk management in a highly volatile FX environment.

Global risk sentiment and trade tensions

Given that 75% of Canada’s exports heading to the United States, the Canadian dollar (CAD) remains obviously vulnerable to changes in U.S. trade policies. Trump introduced harsh tariffs at the beginning of his term this year of a 25% tax on most Canadian imports and a 10% tax on Canadian oil and potash based on national security and immigration and drug trafficking issues, eventually walking some parts back. The implementation of tariffs during his 2018 presidency produced unstable USD/CAD currency movements while deteriorating bilateral relations.

In retaliation, Canada implemented a 25% tariff on $30 billion in U.S. exports including steel, aluminum, and consumer goods as retaliation. This has also led to a significant decrease, of over 20% in boarder crossings in the Golden Horse Shoe region, one of the busiest international boarder crossing areas. The Bank of Canada calls the situation a “once-in-a-century economic shock,” keeping its benchmark interest rate at 2.75%.

Taken together, these events highlight how susceptible the CAD is to protectionist moves by the U.S. Our sentiment analysis and policy monitoring tools ensure investors remain alert to such developments, offering early visibility into potential disruptions in USD/CAD exchange rate stability.

Above: Canadian dollar sentiment indicators were a leading indicator over the last month

Elections, economic agendas, and domestic policy uncertainty

The future direction of the CAD will also be heavily influenced by domestic political developments, particularly in the lead-up to the 2025 federal election. Under Mark Carney’s leadership, the Liberal Party has proposed modest tax cuts – reducing the income tax rate from 15% to 14% – and has already eliminated the consumer carbon tax, resulting in a 20-cent per litre drop in petrol prices.

By contrast, Conservative leader Pierre Poilievre is advocating for more aggressive tax cuts, aiming to reduce rates to 12.75%. While these proposals could spur higher GDP growth, they are also expected to double the annual cost compared to the Liberal plan – raising concerns over budget deficits and inflation.

These contrasting fiscal agendas reflect broader policy divisions. The Conservatives favour deregulation and increased resource exports, potentially benefiting the CAD in commodity-driven scenarios. However, their softer stance on climate policy could strain international trade relationships. Meanwhile, the Liberals remain committed to climate objectives and plan to push back against U.S. protectionism. While Carney’s strong fiscal track record has lent credibility to his leadership, his willingness to confront U.S. trade policy has introduced some market apprehension.

According to Ipsos polling, the Liberals currently lead the Conservatives 44% to 38%, with support growing daily. A clear parliamentary majority by either party would help reduce policy uncertainty, stabilising CAD sentiment. Conversely, a hung parliament could increase the risk of political deadlock and currency depreciation. In this context, macro investors are already using USD/CAD strangles to hedge electoral volatility, supported by Co-Pilot’s real-time tracking of sentiment and polling dynamics.

Commodities, rates, and domestic economic divergence

Oil prices – and commodity markets more broadly – continue to play a crucial role in shaping the CAD. Historically, the USD/CAD exchange rate has maintained a strong inverse relationship with oil prices, with a correlation near -93% between 2000 and 2016. This highlights Canada’s heavy reliance on natural resources, and traders often treat CAD as a “petro-currency.” While this correlation can vary in the short term, the current outlook for OPEC supply cuts has improved market sentiment toward CAD.

Our Co-Pilot system continuously monitors live commodity sentiment indicators, including OPEC actions and regional supply disruptions. A rise in oil sentiment typically presents an opportunity to go long on CAD before prices adjust accordingly.

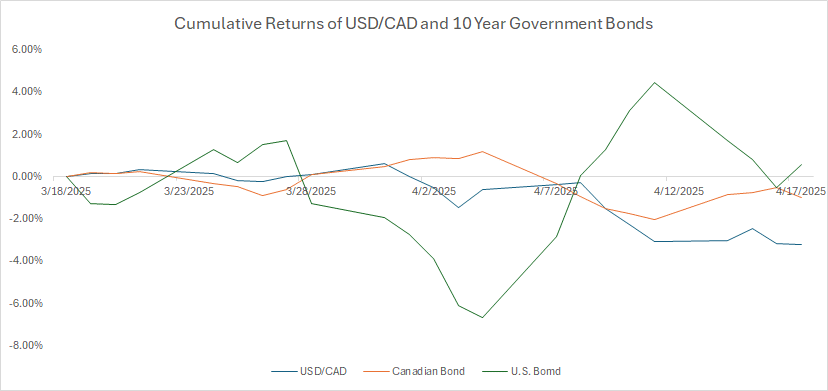

Interest rate differentials between the Bank of Canada (BoC) and the U.S. Federal Reserve also significantly influence the currency. After a series of coordinated rate hikes, the BoC turned dovish in 2024 due to weak GDP growth, a struggling housing sector, and ongoing trade concerns. In contrast, the Fed adopted a more cautious stance, noting steady U.S. employment and falling inflation. As the rate gap widens, investors increasingly favour USD-based assets, reducing CAD’s appeal.

Above: Cumulative Return of USD/CAD and 10-year Government Bonds from April 18, 2018

Market sentiment can shift rapidly when central banks make unexpected announcements. Our Trading Co-Pilot’s macroeconomic feed detects these shifts early, helping traders realign their CAD exposure before consensus expectations catch up.

Domestically, vulnerabilities remain post-election. Should economic conditions worsen, the BoC may opt for further easing, likely putting additional pressure on the CAD – particularly given housing market constraints and household debt burdens. Meanwhile, increased fiscal spending linked to wage growth and labour unrest could fuel inflationary risks. However, robust commodity revenues may help balance the budget while strengthening CAD.

Through our thematic filters, our Trading Co-Pilot keeps users informed on changes in budget balance, credit ratings, and debt outlooks. This level of real-time insight is crucial for formulating effective CAD strategies amid political and economic uncertainty.

Implementable trade ideas and positioning

Institutional investors can manage CAD exposure through tactical strategies, leveraging real-time analytics provided by our Trading Co-Pilot:

1. Trade-war hedge: Long USD/CAD or CAD puts

Position for potential CAD depreciation if U.S. tariffs escalate. Enter long USD/CAD positions via futures or buy CAD put options. Here, you can use our Trading Co-Pilot’s red sentiment alerts to time entries ahead of broader market reactions.

2. Election volatility: USD/CAD options straddle

Straddle options can profit from large swings regardless of outcome. Open positions weeks before the election while implied volatility remains moderate. Adjust based on polling sentiment shifts detected by our Trading Co-Pilot.

3. Interest rate divergence: Tactical USD/CAD positions

React to central bank tone. Go long USD/CAD during dovish BoC messaging, or short on unexpected dovishness from the Fed. Our Trading Co-Pilot’s real-time tracking of official communications supports agile positioning.

4. CAD vs. oil-sensitive peers

Pair CAD longs against currencies less affected by oil (e.g., EUR). Reinforce trade with positive oil sentiment signals from our TradingCo-Pilot.

5. Risk-off protection: Short CAD vs. safe-haven currencies

During global instability, short CAD vs. USD or CHF to protect portfolios. Use early risk-aversion alerts from Co-Pilot to scale hedges appropriately.

6. Relative value & cross-asset opportunities

Pair CAD with AUD when oil sentiment is strong, reflecting differing commodity exposures. Alternatively, hedge long Canadian equities with short CAD to isolate equity upside.

Short-term and long-term strategies

Short-term (Intraday to weeks):

Focus on immediate catalysts like central bank updates, trade headlines, and campaign events. Co-Pilot’s high-frequency sentiment tracking helps detect market-moving developments quickly. Breaks in technical levels combined with negative sentiment often precede sharp price moves.

Long-term (6–12+ months):

Incorporate political outcomes, trade balances, global growth projections, and macro valuation models. Long-term investors monitor housing market weakness, government debt, and broader economic resilience through Co-Pilot’s continuous mood signals.

Institutional portfolios typically maintain core long or short CAD positions, supplementing with tactical hedges to respond to evolving sentiment. Option overlays and cross-asset correlations are used to reduce exposure to shocks and improve portfolio stability.

Ongoing trade tensions, fluctuating commodity markets, diverging central bank policies, and Canada’s evolving political landscape ensure continued volatility in the USD/CAD exchange rate. In this environment, real-time sentiment intelligence tools like Permutable AI’s Trading Co-Pilot offer a critical edge.

By anticipating shifts before they ripple through markets, our Trading Co-Pilot helps investors turn macroeconomic uncertainty into strategic opportunity. Through disciplined execution and adaptive positioning, institutional investors can better manage risk and capitalise on dislocations—whether driven by tariffs, elections, or commodity cycles.

To learn more about how our Trading Co-Pilot can enhance your FX strategy with real-time macro and sentiment intelligence, get in touch with our team today.

This article has been written by our in-house market analyst at Permutable AI and reflects our ongoing research into macroeconomic trends and currency dynamics. It is intended for institutional investors, asset managers, and FX professionals seeking data-driven insights into the factors influencing USD/CAD volatility. The content is for informational purposes only and does not constitute financial advice. Permutable AI accepts no liability for any loss arising from reliance on the information provided.