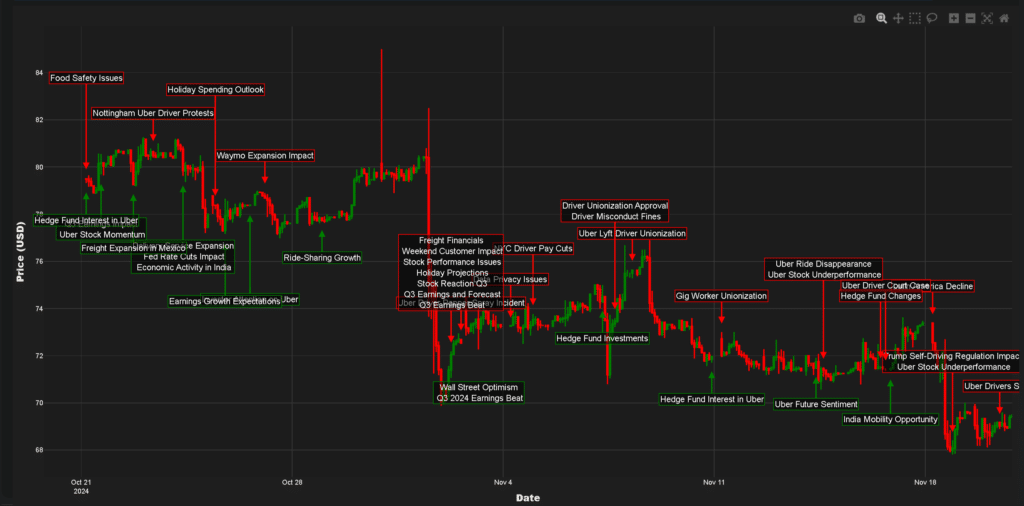

If you’re currently looking for answers to the question “Why is Uber stock down“, then our Trading Co-Pilot has highlighted a concerning pattern which has created this faltering stock performance over the past month, with shares declining significantly despite broader market resilience. The realisation that multiple factors are contributing to this downturn has sparked intense debate across the markets. As this sprawling set of events has unfolded, our AI-driven analysis has identified key drivers behind the decline, from regulatory shifts to operational challenges. What we are seeing is a complex interplay of factors, and in this article, we’ll explore the data-driven insights our Trading Co-Pilot has uncovered offering an answer to the question – why is Uber stock down? – and what it means for investors.

Why is Uber stock down: Market context

The prospect of the relaxation of self-driving regulations has materialised following Trump’s recent election victory, leading to an immediate decline in Uber’s stock after Trump’s announcement regarding self-driving car regulations (while Tesla’s stock rose) . This knotty situation highlights the complex interplay between politics and market dynamics. By unhappy coincidence, this came just as the company was navigating other operational challenges.

Regulatory headwinds in the mix

Then came the Massachusetts voter approval for driver unionisation. Speaking of which, this development has created uncertainty around Uber’s labour costs and operational model. This isn’t new – the gig economy has faced ongoing regulatory challenges, but the recent unionisation victories represent a significant shift in the company’s labour relations landscape.

Why is Uber stock down: Multiple pressure points

One explanation is that Uber’s Q3 earnings, whilst beating estimates, revealed disappointing gross bookings growth. But alongside a muted holiday forecast, these factors have contributed to investor concern. Adding insult to injury, hedge funds like Third Point have begun divesting from Uber in favour of competitors, signalling a broader shift in institutional sentiment.

A look at regional challenges

Day by day, the real world consequences of driver protests are becoming apparent. Consider the recent strikes in Newcastle and Nottingham over pay transparency. Though it’s also important to keep things in perspective, these localised issues point to broader operational challenges facing the company’s workforce management strategy.

Why is Uber stock down: Competitive landscape

The question, then, is how Waymo’s rapid expansion impacts Uber’s market position. What we are seeing is intensifying competition in the autonomous vehicle space. The realisation that multiple competitors are making significant strides in self-driving technology has raised questions about Uber’s long-term competitive positioning.

Financial performance analysis

Our Trading Co-Pilot has highlighted several concerning metrics in the latest quarterly results. The Q3 earnings report revealed a peculiar dichotomy: whilst the company achieved record profits, the rate of bookings growth fell short of market expectations, triggering investor anxiety. Moreover, the weekend customer impact has shown troubling patterns in consumer behaviour, suggesting potential shifts in core market dynamics. Perhaps most worryingly, Uber Freight’s widening EBITDA losses point to ongoing challenges in the company’s logistics diversification strategy.

Why is Uber stock down: Market sentiment shift

Still this, along with hedge fund repositioning, suggests a broader shift in market sentiment. There is a case for viewing this as a temporary correction, but the realisation that multiple factors are converging has dampened investor enthusiasm. This, we suspect, could lead to continued pressure on the stock until clear catalysts emerge.

Good news and growth opportunities

The good news is that significant growth potential remains, particularly in markets like India. It has been predicted that Uber’s Auto and Moto services could generate Rs 36,000 crore in economic activity in India for 2024. Optimists like to say that these international expansion opportunities could offset domestic challenges, and our analysis suggests there’s merit to this perspective.

Why is Uber stock down: Technical analysis

Our Trading Co-Pilot paints a concerning picture of market dynamics. We’ve observed a significant breach of key support levels that previously underpinned the stock’s stability. This has coincided with notably weakening momentum indicators across multiple timeframes, suggesting diminishing buying pressure. Furthermore, our institutional flow analysis reveals increased selling pressure from large investors, potentially indicating a shift in long-term positioning strategies.

Uber stock performance: Looking ahead

What this situation requires is an appreciation of the complexity and context. As this set of events play out, several notable themes have emerged. The regulatory environment is becoming increasingly challenging. Simultaneously, competition in the autonomous driving sector has intensified dramatically, with new entrants and established players alike making significant technological advances. Then, the labour relations landscape requires novel approaches as workers increasingly demand better conditions and representation. However, emerging growth markets, particularly in Asia, offer potential counterbalance to these domestic headwinds, providing opportunities for strategic expansion.

History has shown time and again that market leaders can navigate regulatory and competitive challenges. If you think the above is worrying, remember that Uber maintains significant market share and operational advantages. These dips happen whenever there is uncertainty, but the company’s fundamental business model remains intact for the time being, despite the current headwinds.

Transform your trading strategy with AI-driven insights

What this situation clearly demonstrates is the power of AI-driven market analysis. The question, then, is: how many similar opportunities or risks might you be missing in your portfolio right now by not accessing these insights in real-time?

Our Trading Co-Pilot doesn’t just analyse market movements – it transforms complex market dynamics into actionable intelligence, delivered in real-time to your dashboard. From detecting early warning signs to identifying hidden opportunities, our AI works tirelessly like a team of analysts 24/7 to give you the edge in today’s volatile markets.

Experience the power of AI-driven market analysis for yourself. Email us at enquiries@permutable.ai to request a free trial or complete the form below for a personalised demo. The market isn’t waiting. Neither should you.