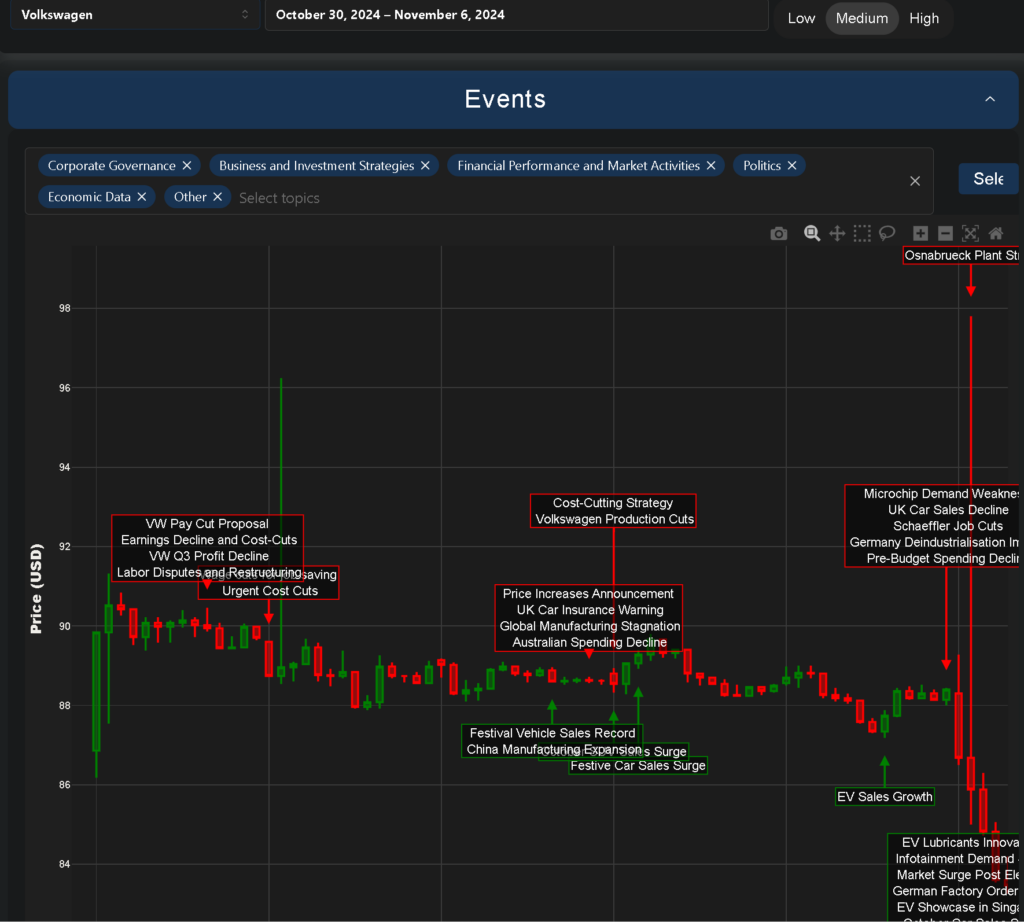

The alarm bells are ringing at Volkswagen headquarters as the company’s share price plunged as third-quarter earnings failed to meet analyst expectations. Let us rattle through the key factors explaining why Volkswagen stock is down, revealing a complex web of challenges facing Germany’s largest motor manufacturer. Let’s briefly look at the story trend from our Trading Co-Pilot, which paints a concerning picture of VW’s current situation.

This concerning trend has three components that explain why Volkswagen stock is down:

Why Volkswagen stock is down: Financial performance crisis

Not long ago, VW reported a staggering 42% drop in third-quarter profits. This dramatic decline has forced management to consider cost-cutting measures. The point here is that such a significant profit plunge signals deeper structural issues within the company. The Q3 results revealed not just a temporary setback but a fundamental weakness in VW’s cost structure and operational efficiency. With operating margins shrinking and production costs rising, the company faces an uphill battle to restore profitability to previous levels.

Labour relations challenges

So when it emerged that VW was considering a 10% wage cut, the reaction was swift and severe. The trouble is, workers at the Osnabrueck plant have already initiated warning strikes, and there’s a sense of foreboding that this could spread to other facilities. The same applies to other German plants, where trade unions are strongly resisting proposed cost-cutting measures. This labour dispute represents more than just a typical wage negotiation – it’s a fundamental clash between management’s need to reduce costs and workers’ determination to protect their livelihoods in an increasingly uncertain automotive landscape.

Why Volkswagen stock is down: Strategic transformation challenges

Almost everyone in the industry acknowledges that Volkswagen’s transition to electric vehicles is proving more complicated than anticipated. And this is why understanding the broader context is crucial – whilst VW grapples with internal restructuring, competitors are rapidly gaining ground in the EV market. The company’s ID series, while technically competent, hasn’t captured market share as quickly as hoped, and the development costs for new EV platforms have been higher than projected. This sluggish transition is particularly concerning given the rapid advances by both traditional competitors and new EV-focused entrants.

Why Volkswagen stock is down: Structural headwinds

So far, perhaps so predictable, but there’s plenty of evidence that the challenges run deeper. For when you look again the story painted by our Trading Co-Pilot data, several concerning patterns emerge explaining why Volkswagen stock is down:

German deindustrialisation

The other element in the mix? Germany’s broader industrial challenges. Ultimately, VW’s struggles are symptomatic of a larger trend of deindustrialisation affecting German manufacturing. Insights from our Trading Co-Pilot show this isn’t isolated to Volkswagen – it’s part of a broader pattern affecting the entire German industrial sector, with particularly acute impacts on automotive manufacturing. The combination of high energy costs, increasing global competition, and regulatory pressures is creating a perfect storm for German industry and the economy as a whole.

Consumer spending decline

Except that it’s not just a manufacturing issue. Our Trading Co-Pilot shows a clear pattern of declining consumer spending, potentially impacting future sales. This spending decline is particularly worrying as it coincides with a period when VW needs strong sales to fund its transition to electric vehicles. Consumer confidence metrics across key markets show increasing reluctance to commit to major purchases, directly affecting VW’s bottom line.

Global market pressures

So there it is – a perfect storm of internal and external pressures. It is claimed that the combination of these factors has created unprecedented challenges for the automotive giant. From supply chain disruptions to geopolitical tensions affecting key markets, VW faces multiple headwinds that are eroding investor confidence and impacting operational performance.

Why is Volkswagen stock down: Management response and market reaction

And if it is the case that management’s response has been appropriate, why is Volkswagen stock down so consistently? The answers lie in the market’s reaction to several key announcements:

Cost-cutting strategy

In this light, VW’s announcement of urgent cost cuts appears more reactive than proactive. The trouble is, these measures might not be enough to restore investor confidence. The market appears unconvinced that the proposed cuts will address the underlying structural issues facing the company, particularly given the resistance from labour unions and the high costs associated with the EV transition.

Production adjustments

It’s worth noting that VW’s decision to cut production plans, and in particular closing three factories in Germany, has sent ripples through the market. And the bad news is that all of this is likely to continue impacting regional economies and supplier networks. The scaling back of production represents not just a temporary adjustment but potentially a longer-term shift in VW’s manufacturing strategy.

Future outlook

Insights from our Trading Co-Pilot’s points to several positive developments that could help stabilise why Volkswagen stock is down:

Growing EV market opportunities

Despite current challenges, the electric vehicle market continues to expand rapidly, particularly in key markets like China and Europe. VW’s established brand presence and manufacturing capabilities could still position it well to capture a significant share of this growth, provided it can accelerate its EV development and production capabilities to match market demand.

Innovation in automotive technology

Volkswagen’s investment in software development and autonomous driving technology, though currently weighing on costs, still positions the company for future growth. The company’s partnership with leading tech firms and its internal software division, CARIAD, despite initial setbacks, shows promise in developing next-generation automotive technologies.

Potential market recovery in key regions

Economic indicators suggest possible improvements in consumer spending patterns, particularly in Asian markets where VW has traditionally maintained a strong presence, with our data indicating a growing demand for premium vehicles in these regions, which could benefit VW’s higher-margin models.

However, these opportunities must be balanced against continuing challenges including labour negotiations, global economic headwinds and competitive pressures in the EV space.

To that end, whilst Volkswagen faces significant challenges, its response to these pressures will be crucial in determining future stock performance. Investors watching why Volkswagen stock is down should pay particular attention to progress on labour negotiations, EV transition execution, and cost-cutting effectiveness in the coming months.

Stay ahead of Volkswagen’s market movements with our Trading Co-Pilot

Don’t miss critical trading opportunities. Our Trading Co-Pilot provides real-time insights into the complex factors and market trends affecting Volkswagen’s stock price:

- Instant alerts on company announcements, labour developments, and EV initiatives

- Real-time analysis of macro events impacting the automotive sector

- Comprehensive event tracking of key announcements and market catalysts

If you’re a corporate trader, start your free 14-day trial today and get immediate access to real-time event tracking, price impact analysis, sector correlation insights and more. Simply contact us by filling in the form below to experience how the Trading Co-Pilot can enhance your trading decisions with sophisticated real-time market intelligence.