BUILDING THE WORLD'S MOST POWERFUL REAL-TIME MARKET INTELLIGENCE SYSTEM

AI-driven intelligence for commodities, macro and multi-asset trading. Trusted by institutional desks who need speed, scale and explainability.

WHAT WE DELIVER

At Permutable AI, we provide real-time intelligence across commodities, energy, metals, agriculture and currencies, supported by expert-level macro interpretation and transparent signal generation.

Our data intelligence feeds give institutional traders and investment teams instant visibility into narrative shifts, cross-commodity dynamics, sentiment trends and policy-driven risk.

With enterprise-grade deployment across API and UI, SOC-2 aligned isolation and seamless integration, our system is trusted by major institutions including Tier 1 investment banks, hedge funds and leading energy trading desks.

Systematic Trading

Leverage structured event data, sentiment scores, and backtestable signals from news, forecasts, and sector sentiment to drive alpha.

Plug & Play Insights

Track market shifts, supply-demand trends, and asset forecasts via News Intelligence, Sector Trends, Forecasting, and Auto Analyst.

Platform Technology

Track market shifts, supply-demand trends, and asset forecasts and visualise critical data via our Trading Co-Pilot and R2 technology.

TRUSTED BY

Permutable AI's innovative Trading Co-Pilot helps us to identify trends early upfront and gain deeper insight into the news driving markets.

Head of Commodities and Portfolio Manager, Vontobel Asset Management

EXPLORE OUR LATEST INSIGHTS

Permutable AI shortlisted for two Hedgeweek European Awards 2026

Permutable AI has been shortlisted at the Hedgeweek European Awards 2026 in the categories New…

How can workflow provide an edge in volatile markets and reduce opportunity cost of limited clarity?

This article examines how structured workflow provides a competitive edge in volatile markets by reducing…

Best platforms for integrating alternative macro signals into hedge fund strategies

This institutional guide explores how hedge funds can integrate alternative macro signals into systematic and…

Permutable AI launches institutional Asset Indices, turning global narrative flow into execution-grade asset intelligence

Permutable AI’s Institutional Asset Sentiment Indices transforms millions of global narratives into structured, execution-ready asset…

Permutable has been an exceptional partner. The macroeconomic data is incredibly insightful, and has significantly improved the performance of our live quantitative strategies over time

Animus Technologies

AS SEEN IN

SEE HOW THIS WORKS IN YOUR MARKET

Systematic and Quant

Trading

Outpace market noise. Leverage real-time sentiment signals to optimise execution, reduce lag, and maximise alpha across systematic strategies.

Commodities and Macro

Desks

Predict market moves with sentiment data that catches inflection points in oil, metals, and agriculture – before fundamentals confirm them.

Investment Strategy and Asset Management

Equip strategy teams with predictive insights. Stay ahead of macro shifts and market volatility with real-time sentiment across asset classes.

Permutable enables us to convert vast volumes of unstructured information into structured, testable signals that integrate directly into our quantitative research making it an integral part of how we scale systematic market analysis.

Hertshten Group Limited

FAQ

How can I use your tech To identify and act on global market shifts especially in volatile sectors like energy, macro, and geopolitics?

Our Trading Co-Pilot platform and data feeds are built for professionals who need to stay ahead of fast-moving global markets.

When energy shocks, macro shifts, or geopolitical events hit, delayed insight leads to missed trades and increased risk.

Our real-time, AI-powered intelligence decodes structured news, macroeconomic indicators, and sentiment signals – so you can anticipate price movements and uncover trading opportunities before the market reacts.

Available via plug-and-play feeds or our intuitive terminal, Trading Co-Pilot integrates seamlessly into your workflow – delivering clarity, speed, and actionable insight where it matters most

With so many assets and signals in motion, how confident are you that your team is catching the events that actually move markets?

Permutable AI’s Trading Co-Pilot platform and data feeds offer real-time coverage across the asset classes that move global markets – energy commodities, agriculture, metals, FX, and macroeconomic indicators – with equities coming soon.

Yet with thousands of signals hitting every second, identifying what really matters is a growing challenge for investment teams.

That’s where we come in. Our AI filters the noise, delivering structured insights from global and regional sources – tracking events like crude oil price shocks, sovereign credit risk, and political unrest with speed and precision.

Fully structured and optimised for research, live monitoring, and quant integration, our data is designed for professionals who need both depth and agility – without the manual overhead.

How do you currently capture the impact of market sentiment and narrative momentum before they show up in prices?

Our Trading Co-Pilot platform and data feeds deliver sentiment intelligence and narrative signals designed for market movers who can’t afford to wait for consensus.

In a landscape shaped by headlines, volatility, and shifting narratives, traditional tools can miss the emotion and momentum driving price.Our AI models process millions of global news articles, market reports, and official statements in real time – quantifying sentiment, tracking narrative evolution, and surfacing early signals that impact positioning.

Whether you’re trading energy, managing macro risk, or running models, our insights plug directly into your strategy – structured, scalable, and always current.

Who are our solutions designed for?

Our solutions are purpose-built for professionals who rely on speed, structure, and context in volatile markets:

Asset Managers managing exposure to macroeconomic and geopolitical risk

Quant Funds & Hedge Funds needing structured, backtestable data for alpha generation

Investment Banks integrating real-time thematic and news-driven signals into trading and research workflows

Energy & Commodity Traders navigating complex supply-demand shifts and pricing volatility from global events

All users benefit from live and historical data feeds – designed to plug into both systematic models and discretionary analysis frameworks.

How does your system currently track fast-moving macroeconomic and geopolitical risks and how quickly can that intelligence be fed into your models or risk systems?

Permutable AI’s data feeds are designed to turn global complexity into structured intelligence – ready for immediate action.

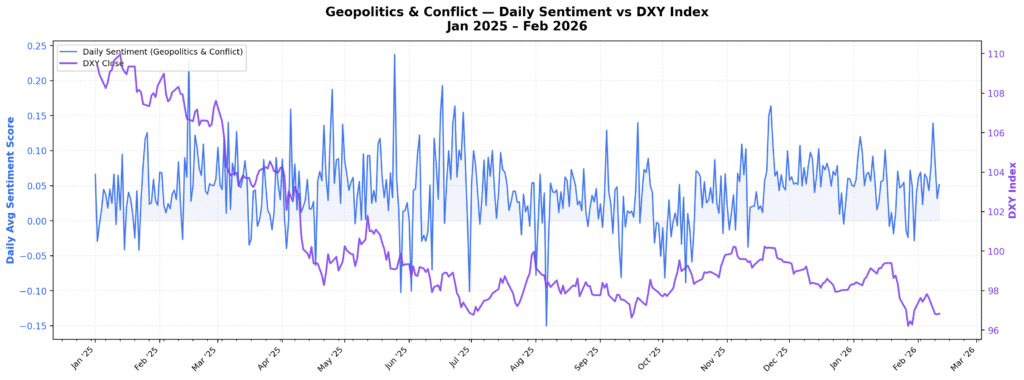

We monitor and score developments including:

-

Economic releases & inflation surprises

-

Central bank decisions & policy shifts

-

Elections, trade wars & geopolitical tensions

-

Natural disasters & systemic shocks

These signals are structured into clean, machine-readable feeds – empowering financial institutions to integrate real-time macro and geopolitical insights directly into systematic trading models, portfolio risk frameworks, or real-time alerting systems.

In fast-moving energy and commodity markets, how quickly can your system detect narrative shifts or sentiment build-up that influence price before the rest of the market reacts?

Permutable AI delivers deep, real-time intelligence across the entire energy and commodities landscape – including crude oil, natural gas, LNG, distillates, metals, and agriculture.

We go beyond surface-level data by combining:

-

Structured global news

-

Supply and demand dynamics

-

Sentiment from pricing reports

-

Geopolitical impact tracking

Our AI-powered story signal detection identifies early narrative changes and sentiment momentum that often precede major price movements – giving your team a strategic edge.

These insights are delivered via real-time APIs and systematic data feeds, making them ideal for commodity traders, hedge funds, and institutions that need to act on global developments with speed and precision.

How are your insights delivered, and can they be integrated?

Our insights are built for seamless integration into institutional systems – so your team doesn’t waste time on manual data wrangling.

We deliver:

-

Live APIs for real-time ingestion into trading platforms and alerting tools

-

Historical datasets for backtesting and systematic strategy design

-

Interactive dashboards for rapid exploratory analysis and decision support

Our feeds support low-latency, high-frequency workflows, making them ideal for algorithmic trading systems, quant research environments, and real-time risk engines.

Whether you’re building, testing, or executing – our delivery fits your workflow, not the other way around.

What sets Permutable AI apart from other market data providers?

Our next gen tech and data feeds have been built for today’s market complexity – not yesterday’s limitations.

Unlike legacy providers with rigid systems and stale datasets, we leverage a next-generation, LLM-powered technology stack to deliver sharper, faster, and more adaptive intelligence.

What sets us apart:

-

Real-time data processing for instant insight

-

Advanced natural language understanding to decode global narratives

-

Scalable, constantly updated infrastructure to stay ahead of market shifts

-

Continuous upgrades with the latest LLM capabilities to future-proof your edge

Whether you’re running quantitative strategies or discretionary analysis, Permutable AI gives you cutting-edge insight at the speed modern markets demand.