In today’s rapidly changing world, sustainability has unquestionably become a top priority for businesses and investors alike. Despite what the naysayers like to peddle, there is no denying that ESG integration continues to gain significant traction as companies strive to align their operations with sustainable practices. Unfortunately, accessing and analyzing ESG data can be a complex and time-consuming task. This begs the question – how can artificial intelligence play an important role in democratizing data and revolutionizing the way sustainability insights are generated? Let’s take a closer look in this article.

Understanding ESG integration and sustainability analytics

ESG integration involves incorporating environmental, social, and governance factors into investment and corporate decision-making processes. It enables investors to assess the long-term sustainability and impact of their investments and corporates to assess their impacts, looking beyond traditional financial metrics.

However, the reality is that analyzing vast amounts of ESG data can be overwhelming and resource-intensive. This is where sustainability analytics, powered by AI, steps in. By using advanced algorithms and machine learning techniques, AI can efficiently process and analyze ESG data, providing valuable insights into a company’s sustainability performance.

By the same token, AI-driven sustainability analytics can also highlight potential risks and opportunities that might not be immediately obvious through traditional analysis methods. This level of insight allows investors and corporates to make more informed decisions, aligning their portfolios and operations with their sustainability goals and risk tolerance. Building on this, as regulatory requirements around ESG disclosures become more stringent, the ability to swiftly navigate and interpret this complex landscape becomes even more crucial. AI not only simplifies this task but also enhances the accuracy and reliability of ESG assessments, empowering investors to contribute positively to global sustainability efforts while potentially enhancing returns.

ESG and the significance of artificial intelligence in democratizing data

There is absolutely no question that AI can play a crucial role in processing ESG data efficiently and effectively. Traditional methods of data analysis often involve manual collection and interpretation, which can be time-consuming and prone to errors. AI, on the other hand, can automate data collection from various sources, such as annual reports, news articles, and social media, ensuring comprehensive coverage. Additionally, AI algorithms can identify patterns and correlations within the data that humans may overlook, allowing for more accurate and insightful analysis.

Given these points, it is clear that AI is not just an auxiliary tool but a transformative force in ESG. At Permutable, we know that the integration of AI technologies enhances the depth and breadth of ESG data analysis, facilitating a more nuanced understanding of environmental, social, and governance issues. To put it another way, this can empower investors and corporates to make decisions that are not only financially sound but also aligned with broader sustainability objectives. Consequently, as the global emphasis on ESG criteria continues to grow, the agility and precision offered by AI in navigating this evolving landscape will become increasingly indispensable for investors and corporates looking to stay ahead.

AI-driven ESG insights for sustainable investment

Sustainable investing has gained tremendous popularity in recent years, with investors increasingly seeking to align their portfolios with environmentally and socially responsible companies. AI-driven ESG insights such as ours enable investors to make more informed decisions by providing a comprehensive understanding of a company’s sustainability performance. By leveraging AI capabilities, investors can identify companies that demonstrate strong ESG practices and avoid those that engage in greenwashing – the practice of presenting a false or misleading impression of a company’s sustainability efforts.

For instance, AI algorithms can sift through vast amounts of data to detect inconsistencies between a company’s sustainability reports and its actual practices – something we are in the process of applying our AI to in our GreenProof greenwashing identification solution . This means investors can spot potential red flags in real-time, such as discrepancies in carbon emission reports or inconsistencies in labour practices across different sources. This dovetails with the fact that AI-driven analysis can predict future sustainability trends, allowing investors to anticipate shifts in regulatory policies or consumer preferences and adjust their investment strategies accordingly. In essence, AI is able to empower investors not only to assess current ESG performance but also to forecast future sustainability trajectories, making sustainable investment more dynamic and forward-looking. Through advanced ESG insights such as our own, investors are better equipped to support truly sustainable companies, contributing to a more responsible and ethical global market.

The ethical considerations of using AI in sustainability reporting

While AI offers enormous potential for democratizing data sustainability insights, it also raises ethical concerns. One of the key challenges is ensuring the transparency and accountability of AI algorithms. It is crucial to develop ethical guidelines and regulatory frameworks to prevent biased or discriminatory outcomes. Additionally, the responsible use of AI in sustainability reporting requires careful consideration of data privacy and security. Safeguarding sensitive information is paramount to maintain trust and ensure the integrity of sustainability reporting.

To that end, developing clear protocols for data handling, storage, and processing is essential. These protocols should comply with international data protection regulations and be transparent to all stakeholders involved. In addition, the use of AI in sustainability reporting should be guided by principles of fairness and inclusivity, ensuring that insights derived do not inadvertently marginalize or disadvantage any group. Stakeholder engagement is also key; companies must involve communities, employees, and consumers in conversations about how AI is used in their sustainability efforts. This collaborative approach not only enhances the ethical application of AI but also promotes a broader understanding and acceptance of its role in driving sustainable practices. Ultimately, by addressing these ethical considerations head-on, we can harness the power of AI to contribute positively to the global sustainability agenda, while maintaining the highest standards of ethics and responsibility.

Leveraging AI for social impact and achieving Sustainable Development Goals

Beyond financial returns, many investors are increasingly focused on generating positive social and environmental impacts. AI can be a powerful tool in achieving sustainable development goals (SDGs) by identifying investment opportunities that align with specific impact investing goals such as social and environmental objectives. By analyzing diverse data sources, including social media sentiment and news articles, AI algorithms can identify companies and projects that contribute to SDGs, such as poverty alleviation, climate action, and gender equality. This enables investors to direct their capital towards initiatives that have a meaningful and measurable impact.

For instance, AI can spotlight renewable energy projects that not only promise financial returns but also contribute significantly to reducing carbon emissions, aligning with SDG 13 (Climate Action). Similarly, AI can uncover companies pioneering in affordable and clean energy technologies, supporting SDG 7 (Affordable and Clean Energy). Building on this., through advanced data analytics, AI can assess the gender diversity of a company’s workforce and leadership, helping investors to invest in firms that champion gender equality, thus contributing to SDG 5 (Gender Equality). As a result, AI’s predictive capabilities can enable investors to assess the long-term sustainability and social impact of their investments, ensuring that their capital supports projects with long-lasting benefits for communities and the environment.

Enhancing ESG transparency through AI

There is no question that transparency is crucial for building trust and promoting sustainable practices. AI has the ability to enhance ESG transparency by automating the collection and analysis of ESG data, making it more accessible and understandable for investors, corporates and other key stakeholders. Through the use of interactive dashboards and visualizations that present complex ESG information in a user-friendly manner, investors to make more informed decisions and encourages companies to improve their sustainability performance by providing clear benchmarks and comparisons.

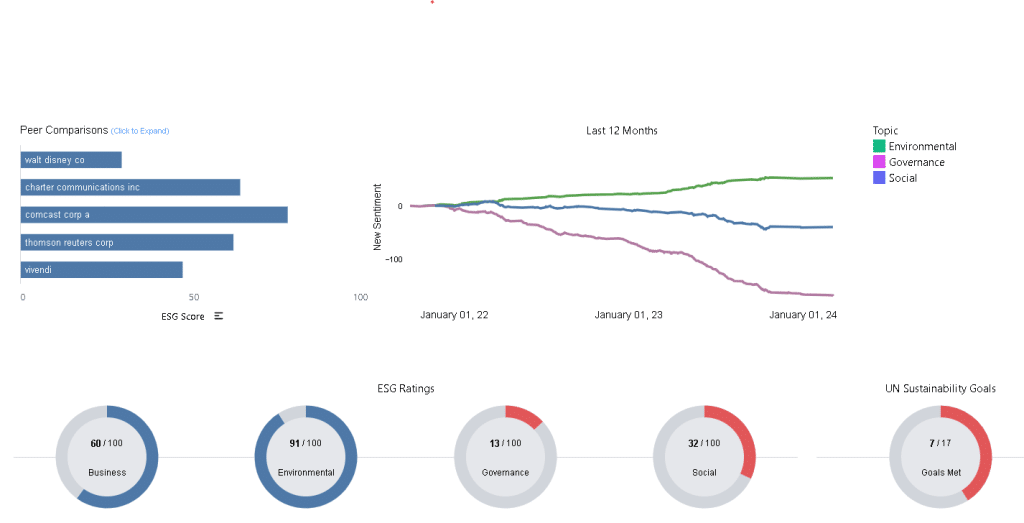

By the same token, AI-driven insights can push companies towards more honest and accurate reporting – something we are very much aiming towards by making our free company ESG reports available to all. The exciting thing about using AI to provide ESG transparency is its ability to scrutinize vast datasets allowing for the identification of discrepancies and potential greenwashing. At Permutable, we very much see this as a catalyst to encourage firms to adhere more strictly to their sustainability commitments. Additionally, by automating the tracking of a company’s ESG progress over time which we do on all our ESG reports, AI can facilitate a dynamic view of sustainability efforts, enabling stakeholders to witness real-time improvements or declines. This can be perfectly demonstrated by looking at our Disney ESG score report where the numerous governance issues that have plagued the entertainment giant to date can be seen clearly in the fall in the governance line in the chart below.

Above: Disney ESG score timeline

Bridging the gap: Permutable AI’s commitment to democratizing data

At Permutable AI, we are dedicated to bridging the gap between complex ESG data and those who need it most. By harnessing the power of artificial intelligence, Permutable AI is not only simplifying the analysis of sustainability metrics but is also making these insights more accessible to a broader audience, irrespective of their technical expertise or resources through our free ESG reports.

Our quest to democratize ESG data stems from the understanding that informed decision-making is the cornerstone of sustainable investment and corporate practices. However, the sheer volume and complexity of data can deter stakeholders, especially small to medium-sized enterprises and individual investors, from integrating ESG considerations into their strategies. Permutable AI’s advanced AI-driven platforms tackle this issue head-on, and our free ESG reports are just the start, with more to come.

Our vision is to create user-friendly dashboards, interactive visualisations, and automated reporting tools that will empowers users to navigate the complexities of ESG data with ease that is within reach of all. With this approach, we will enhance transparency and accountability but also level the playing field, allowing entities of all sizes to participate in the global movement towards sustainability. By providing easy access to critical sustainability insights, our aim is to fostering a culture of informed decision-making, where sustainable practices are not just ideals but actionable objectives.

Our mission to make ESG data accessible and understandable is part of a vision where AI is used for good to create a sustainable future powered by informed decision-making. Behind the scenes, we are working on breaking down the barriers to ESG data accessibility, enabling a more inclusive approach to sustainability, where every investment and corporate decision can be guided by comprehensive, reliable, and actionable ESG insights. Watch this space.

Find out more

Are you looking to understand more about the transformative role of AI in revolutionizing sustainability insights and democratizing data? At Permutable AI, we’re dedicated to making ESG data more accessible and understandable, empowering informed decision-making for a sustainable future. If you’re keen to explore how our solutions can enhance your sustainability strategies or if you have any questions about integrating ESG considerations into your investment decisions, we’re here to help. Get in touch to learn more by emailing enquiries@permutable.ai or fill in the form below.