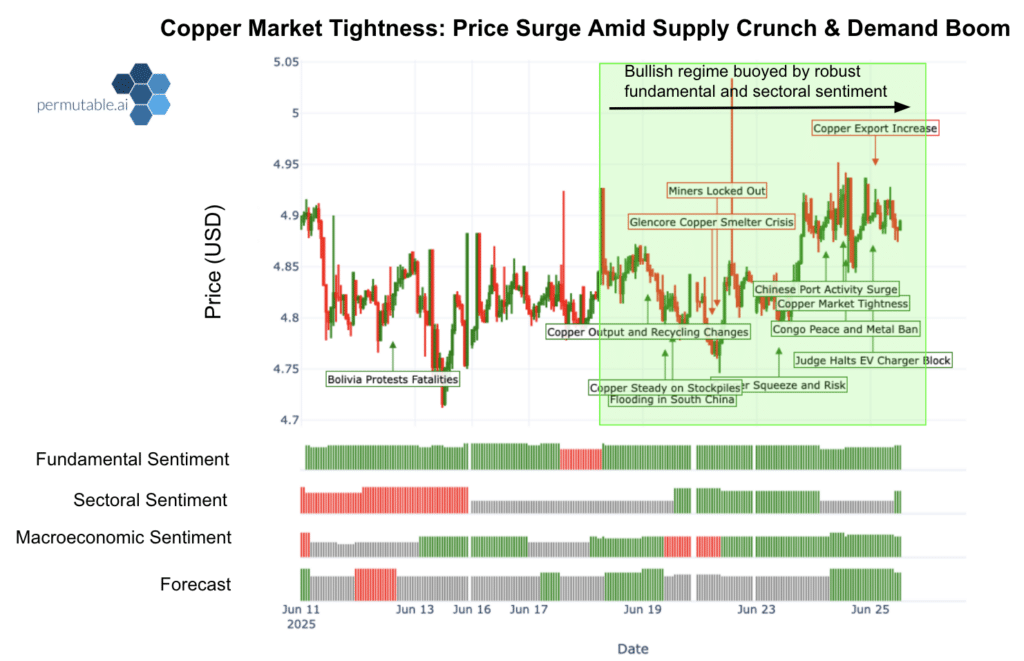

The story behind the copper market outlook in recent weeks has transformed dramatically, driven by escalating supply shortages and persistent demand that show no signs of abating. This supply crunch has propelled prices higher and created a distinctly bullish environment that our Trading Co-Pilot’s AI-driven analysis has accurately captured in real-time.

Copper prices have surged throughout June, propelled by an acute supply shortage with no signs of abating. The red metal’s upward trajectory has been pronounced, climbing from $4.82 on June 23rd to $4.91 the following day, before settling at $4.89 on June 25th. This rally reflects deepening market tightness caused by dwindling inventories and persistent structural supply constraints. The supply-demand imbalance has intensified over the past week , with rising demand forecasts amplifying the squeeze on available copper stocks. Our Trading Co-Pilot’s analysis confirms strong bullish sentiment underpinning these price movements, with the sustained upward pressure validating expectations of continued market momentum. The convergence of supply shortfalls and robust demand signals suggests this bullish trend may persist as the copper market remains stretched.

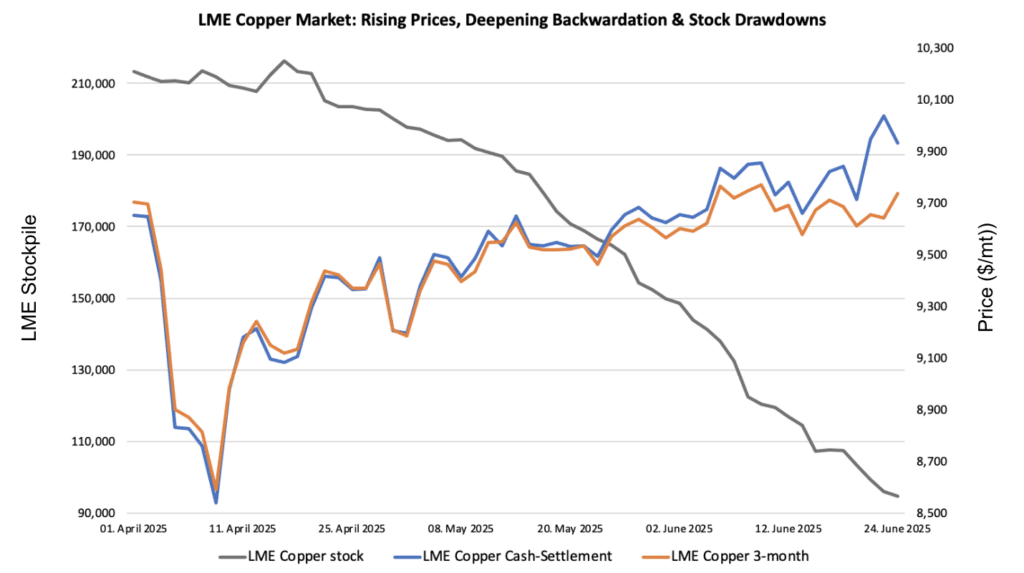

Warehouse stocks plummet

The most drastic evidence of copper’s supply crisis has emerged through collapsing warehouse inventories, creating scarcity that’s pushing the market into backwardation. This is by no means a temporary dip, but represents a fundamental shift toward critical shortage levels that are reshaping global copper market dynamics. The clearest sign of copper’s supply crisis emerged on June 23rd when London Metal Exchange (LME) inventories posted another sharp decline. Key indicators include:

- Stock depletion: Accessible copper stocks have plummeted 80% this year, representing a severe depletion in global supply.

- Price spike: LME spot copper prices surged above $10,000/mt, while the COMEX hovers around $4.90 mark.

- Market backwardation: Steep premium for immediate delivery over future contracts.

- Premiums soar: The backwardation has spurred the three-month contract premium to reach nearly $280 above the cash-settlement.

Tariff-driven demand compounds shortage

The price spike reflects more than speculative trader interest and has had a compounding effect on an already tight supply situation:

- The scramble in U.S. copper buying is driven by tariff threats on metal imports, with the redirection of global supply creating shortages and undersupply in markets elsewhere.

Smelting bottlenecks worsen supply constraints

Beyond the immediate inventory crisis, copper faces deeper structural fractures in its supply chain that threaten medium-term availability. The smelting sector, the crucial bridge between raw ore and refined metal, is experiencing unprecedented stress at treatment level as smelting fees collapse and capacity mismatches create systemic bottlenecks.

Structural supply chain disruptions

Beyond falling inventories, copper supply chain faces deeper structural headwinds:

- Australian smelter closures: Announced due to raw material shortages and collapsing treatment charges.

- Treatment charge collapse: Fees miners pay to process copper ore have collapsed, with some smelters now effectively paying miners to convert raw materials into refined metal. An unheard of occurrence.

Chinese capacity expansion vs. mining shortages

While Chinese smelters show some positive developments it has amplified the supply bottleneck as mining output shortages persist causing a mismatch between smelting capacity and raw material output.

- Capacity expansion: Chinese smelters expanding and negotiating longer-term contracts with marginally positive fees.

- Fundamental imbalance: Building smelting capacity takes far less time than developing new mines, with the shortage of raw material a prevailing headwind for smelters.

Geopolitical complexity

Global political developments continue to influence supply chains and the copper price outlook:

- DRC peace agreement: Initial hopes for supply stability stemming from the Democratic Republic of Congo’s peace deal, has subsequently fallen off as the Congolese government announced an extension on its ongoing metals export ban, reintroducing greater market uncertainty surrounding mining output.

- Mixed signals: Positive developments like Teck Resources securing Kamloops mine extension and expansion permits are offset by development timelines being unable to meet the near-term supply deficit.

Demand endures despite price gains

While supply constraints dominate headlines, copper demand continues to demonstrate remarkable resilience in the face of higher prices. This sustained appetite, particularly from key consuming nations, suggests the market’s tightness reflects genuine consumption strength to absorb the available metal at elevated price levels.

Chinese market dynamics

Copper demand has remained surprisingly resolute despite higher copper price outlook:

- Port activity surge: Chinese port activity increased, signaling enduring appetite from the world’s largest copper consumer. While copper imports dipped slightly month-on-month in May, year-on-year figures show resilient momentum and growth.

- Strategic positioning: China continues to expand its smelting capacity while accumulating strategic stockpiles for industrial use.

Copper market outlook via Trading Co-Pilot: Tightness to persist

The copper market faces a deepening supply crisis that underpins a compelling bullish outlook. Rapidly depleting LME stocks, persistent smelting bottlenecks, and mining constraints have created acute market tightness, while global demand, driven by electrification and renewable energy transitions, remains robust despite geopolitical headwinds. Our Trading Co-Pilot captured this dynamic with strong bullish forecast and a “Buy” signal issued on June 24th, accurately reflecting positive sentiment across fundamental and sectoral indicators. Recent smelter disruptions and continued inventory drawdowns reinforce the structural nature of current supply constraints. While new mining projects promise eventual relief, their impact remains years away, leaving the market vulnerable to sustained tightness. With copper’s critical role in the global energy transition and limited near-term supply solutions, the fundamentals rank among the strongest in industrial commodities. The whirlwind of structural supply deficits and resilient demand creates a foundation for continued upward price pressure, positioning copper favourably amongst commodity market traders.

To explore how real-time commodity market sentiment data can enhance your trading strategies and risk models, contact us at enquiries@permutable.ai to request a tailored demonstration.