In today’s fast-paced and ever-evolving market, Tesla Inc, headquartered in Austin, Texas, remains a hot topic of discussion and speculation. As investors and enthusiasts closely monitor the ebb and flow of Tesla’s stock price, it’s crucial to understand the key factors that shape its fluctuation. This article delves into the insider insights surrounding Tesla Inc stock price, providing you with a deeper understanding of the forces at play in the company that has become world-renowned that designs, manufactures, and sells electric vehicles.

From production numbers and vehicle deliveries to Elon Musk’s Twitter activity, technological advancements in energy storage and solar panels, not to mention its stance against ESG, there are several factors that influence Tesla’s valuation. The company operates across multiple sectors, including Tesla Motors for electric vehicles and its solar division for solar panels and solar roof products. By exploring these factors, we aim to unravel the complexities of Tesla Inc stock price and offer you valuable insights that can inform your investment decisions.

With the EV market gaining momentum and Tesla’s dominant position in the industry, understanding the key drivers behind its stock price is more important than ever. Investors should pay close attention to Tesla’s earnings dates, as these quarterly reports often cause significant movements in the stock price. Whether you’re a seasoned investor or simply curious about the inner workings of the automotive industry, this article is sure to provide you with the knowledge and analysis needed to navigate the turbulent waters of Tesla’s stock market performance.

Understanding stock prices and factors that influence them

The stock market is a complex and dynamic environment influenced by a myriad of factors. Understanding these factors is crucial to making informed investment decisions. When it comes to Tesla inc stock price, there are several key drivers that shape its valuation.

One of the primary factors that influence stock prices is the company’s financial performance and revenue growth. Investors closely analyze Tesla’s quarterly and annual financial reports to assess its profitability and growth potential. Positive revenue growth and strong financial indicators often lead to an increase in stock price, while poor financial performance can result in a decline.

Another significant factor is Tesla’s product innovation and technological advancements. As a leader in the electric vehicle industry, Tesla’s ability to introduce groundbreaking technologies and improve its product offerings has a direct impact on its stock price. The release of new models, updates to existing vehicles, and advancements in battery technology can all drive investor confidence and contribute to stock price appreciation.

Government regulations and policies also play a crucial role in shaping Tesla Inc stock price. As countries around the world embrace sustainable transportation, governments are implementing various incentives and regulations to promote the adoption of electric vehicles. These policies can have a significant impact on Tesla’s sales and market share, thereby influencing its stock price. Additionally, changes in government regulations related to emissions standards and subsidies can impact the overall demand for electric vehicles, indirectly affecting Tesla’s stock performance.

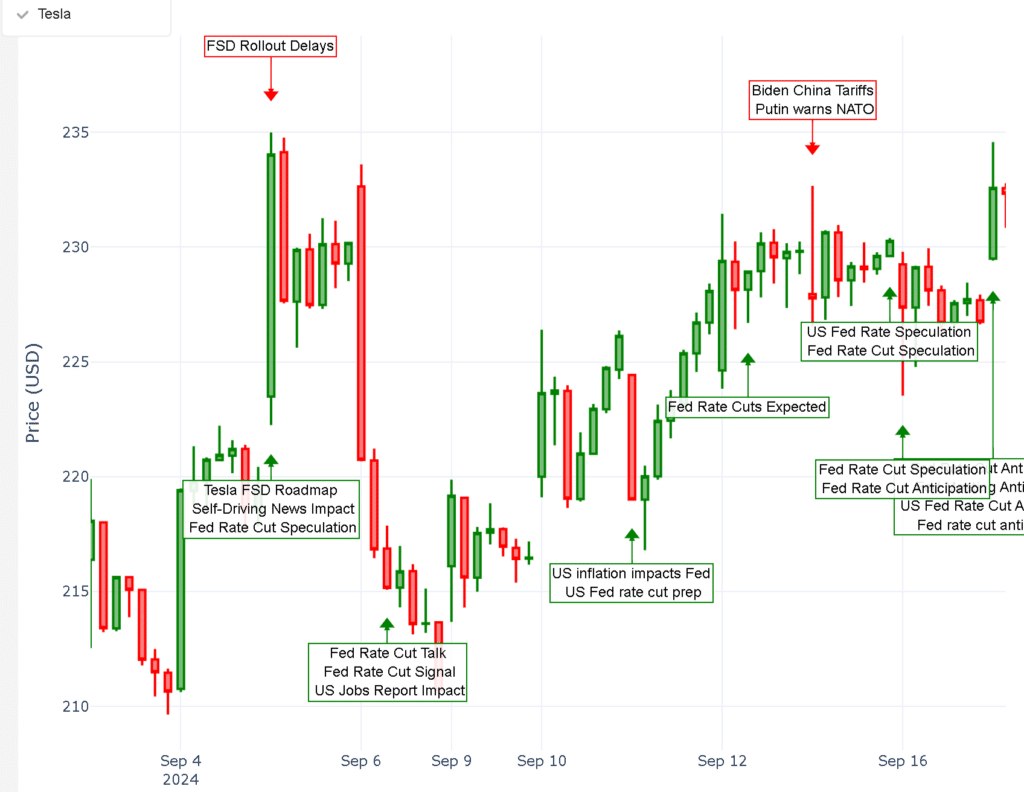

Macro and asset events affecting Tesla stock price performance – insights from our Trading Co-Pilot (BETA)

Tesla inc stock price: Financial performance and revenue growth

Tesla’s financial performance is a key aspect that investors closely monitor to gauge its growth potential and stock price trajectory. In recent years, Tesla has experienced significant revenue growth, driven by increased vehicle deliveries and expansion into new markets.

In 2020, Tesla reported total revenue of $31.5 billion, a 27% increase compared to the previous year. This growth was primarily fueled by a record number of vehicle deliveries, with Tesla delivering 499,550 vehicles in 2020, surpassing its target of half a million vehicles. The increase in vehicle deliveries indicates strong demand for Tesla’s products and has a positive impact on its stock price.

Tesla’s ability to generate consistent revenue growth is also influenced by its expansion into new markets. The company has been actively expanding its presence in international markets, including Europe and China, which has contributed to its revenue growth. For example, Tesla’s revenue from China increased by 124% in 2020, highlighting the company’s success in tapping into the world’s largest automotive market.

Investors closely analyze Tesla’s financial performance to assess its profitability and cash flow. While Tesla has reported positive net income in recent quarters, it is worth noting that the company’s profitability has been influenced by various factors, including regulatory credits and the sale of Bitcoin. As such, investors need to carefully evaluate Tesla’s financials to gain a comprehensive understanding of its financial performance and its potential impact on stock price.

Tesla’s product innovation and technological advancements

Tesla’s relentless focus on product innovation and technological advancements has been a key driver of its success and stock price appreciation. The company continually pushes the boundaries of electric vehicle technology, introducing industry-leading features and capabilities that set it apart from competitors.

One of Tesla’s notable innovations is its Autopilot system, which enables semi-autonomous driving. This feature has garnered significant attention and praise from both consumers and industry experts. The continuous improvement and expansion of the Autopilot system not only enhance the driving experience but also position Tesla as a leader in autonomous vehicle technology. The advancements in autonomous driving technology are closely watched by investors and can have a substantial impact on Tesla’s stock price.

In addition to Autopilot, Tesla has made significant strides in battery technology. The company’s development of high-capacity batteries with improved energy density and longer range has been instrumental in driving the widespread adoption of electric vehicles. Tesla’s Gigafactories, which produce batteries at scale, have played a critical role in reducing production costs and increasing efficiency. These advancements in battery technology have positioned Tesla as a frontrunner in the industry and have a direct positive impact on its stock price.

Furthermore, Tesla’s product lineup continues to evolve, with new models and updates being introduced regularly. The introduction of the Model Y, a compact SUV, has been met with great enthusiasm from consumers and investors alike. The expansion of Tesla’s product portfolio not only increases its market reach but also diversifies its revenue streams, further contributing to its stock price growth.

Government regulations and policies affecting Tesla

Government regulations and policies have a significant impact on the electric vehicle industry as a whole and directly influence Tesla’s stock price. As countries strive to reduce greenhouse gas emissions and transition to sustainable transportation, governments have implemented various incentives and regulations to promote the adoption of electric vehicles.

One such example is the tax credits and subsidies offered by governments to encourage consumers to purchase electric vehicles. These incentives can significantly reduce the cost of owning an electric vehicle, making them more affordable and appealing to a broader consumer base. Tesla, as one of the leading electric vehicle manufacturers, benefits from these incentives and experiences increased demand for its vehicles, positively impacting its stock price.

Additionally, government regulations related to emissions standards can have a direct impact on Tesla’s stock price. Stricter emissions regulations often favour electric vehicles over traditional internal combustion engine vehicles, creating a more favorable market environment for Tesla. By aligning its product offerings with these regulations, Tesla can capitalize on the growing demand for electric vehicles and experience stock price appreciation.

However, it is worth noting that changes in government policies and regulations can also pose risks to Tesla’s stock price. Shifts in political landscapes or policy priorities can lead to the withdrawal or modification of incentives, potentially impacting the demand for electric vehicles. Investors need to closely monitor the evolving regulatory environment to assess potential risks and opportunities for Tesla’s stock price.

Tesla inc stock price: Competitor analysis and market trends

As the electric vehicle market continues to grow, competition among manufacturers intensifies. Tesla faces competition from both established automakers and emerging startups, each vying for a share of the rapidly expanding market.

Established automakers such as General Motors, Ford, and Volkswagen have been ramping up their electric vehicle offerings, aiming to challenge Tesla’s dominance in the market. These companies have the advantage of existing manufacturing infrastructure and established brand recognition, which can pose a threat to Tesla’s market share and stock price.

At the same time, a growing number of startups are entering the electric vehicle space, focusing on niche markets and innovative technologies. These startups often bring fresh perspectives and unique value propositions, attracting investor attention and potentially disrupting the market. While some of these startups may fail to gain significant market traction, others could emerge as formidable competitors to Tesla, impacting its stock price.

Market trends and consumer preferences also influence Tesla’s stock price. As sustainability becomes increasingly important to consumers, the demand for electric vehicles is expected to grow. Tesla’s early entry into the market and its strong brand recognition position the company well to benefit from this trend. However, changing consumer preferences or the emergence of new technologies could alter the market dynamics, impacting Tesla’s stock price.

Tesla inc stock price: Investor sentiment and market speculation

Investor sentiment and market speculation play a significant role in shaping Tesla’s stock price as is the case with other major corporates like Apple and Microsoft, for example. Tesla, led by its charismatic CEO Elon Musk, has garnered a dedicated following of investors and enthusiasts who closely follow the company’s developments and announcements.

Elon Musk’s Twitter activity has been known to impact Tesla’s stock price. Whether it’s a tweet about new product features, production targets, or controversial statements, Elon Musk’s tweets often generate significant market reactions. Investors carefully analyze these tweets, attempting to gauge their impact on Tesla’s future prospects and stock price.

Tesla’s stock price has also been influenced by short-term market speculation. The volatility of Tesla’s stock has attracted both retail and institutional traders looking to capitalize on short-term price movements. This speculative activity can lead to sharp fluctuations in Tesla’s stock price, driven by factors unrelated to the company’s fundamental performance.

Investors need to be mindful of the potential impact of investor sentiment and market speculation on Tesla’s stock price. While these factors can create short-term opportunities for traders, long-term investors should focus on the company’s financial performance and underlying fundamentals to make informed decisions.

Looking for more stock market insights? See our articles on the factors that determine Advanced Micro Devices stock price, Lucid stock price, Berkshire Hathaway stock price, Tencent Holdings stock price, Nvidia stock price, Google stock price, Walmart stock price, Apple stock price, Microsoft stock price and Amazon stock price with more added weekly.

TESLA STOCK PRICE FAQ

What are the main factors influencing Tesla's stock price?

Tesla’s stock price is influenced by a complex interplay of factors:

- Production and delivery numbers: Quarterly vehicle production and delivery figures often cause significant price movements.

- Technological advancements: Innovations in battery technology, autonomous driving, and manufacturing processes.

- Elon Musk’s public statements: CEO communications can lead to short-term volatility.

- Global EV market trends: Including competitor actions and market share shifts.

- Regulatory environment: Changes in government incentives for EVs or emissions regulations.

- Company financial performance: Profitability, revenue growth, and cash flow.

- Macroeconomic factors: Interest rates, inflation, and global economic conditions.

How often does Tesla release its earnings reports?

Tesla typically releases earnings reports quarterly, usually in the months of January, April, July, and October. The exact dates can vary and are announced a few weeks in advance. These reports provide crucial information on financial performance, production numbers, and future guidance, often leading to significant stock price movements.

How does Tesla's performance compare to other EV manufacturers?

Tesla currently leads the global EV market in terms of sales volume and brand recognition. In 2022, Tesla delivered over 1.3 million vehicles worldwide. However, competition is intensifying:

- Traditional automakers like Volkswagen, GM, and Ford are rapidly expanding their EV offerings.

- Chinese manufacturers like BYD and NIO are gaining market share, especially in Asia.

- Startups such as Rivian and Lucid are targeting the luxury EV segment. Tesla’s technological lead, particularly in battery efficiency and autonomous driving, remains a key differentiator.

What impact does Elon Musk's Twitter activity have on Tesla's stock?

Elon Musk’s tweets can have a significant and immediate impact on Tesla’s stock price:

- Product announcements or teasers can drive positive sentiment.

- Controversial statements may lead to negative press and stock selloffs.

- Comments on Tesla’s financial performance can influence investor expectations. The SEC has previously taken action against Musk for tweets deemed to be material to Tesla’s stock price, highlighting the importance of his social media activity.

How does Tesla's energy business affect its stock price?

Tesla’s energy business, while smaller than its automotive segment, is increasingly important:

- Solar panel and Solar Roof installations contribute to revenue diversification.

- Energy storage products like Powerwall and Megapack are seeing growing demand.

- The energy segment’s growth rate and margin improvements are closely watched by investors.

- Synergies between the energy and automotive businesses (e.g., battery technology) add to Tesla’s overall value proposition.

What role do global economic factors play in Tesla's stock price?

Global economic factors significantly impact Tesla’s stock:

- Interest rates: Higher rates can reduce demand for Tesla’s products and increase borrowing costs.

- Inflation: Can affect production costs and consumer purchasing power.

- Exchange rates: Fluctuations impact Tesla’s international sales and profits.

- Supply chain disruptions: Can affect production capacity and delivery timelines.

- Geopolitical events: Trade tensions or conflicts can disrupt Tesla’s global operations.

Is Tesla's stock considered overvalued or undervalued?

Opinions on Tesla’s valuation vary widely among analysts and investors:

- Bulls argue that Tesla’s growth potential in EVs, energy, and AI justifies a high valuation.

- Bears contend that the stock price assumes unrealistic future market dominance.

- Traditional valuation metrics like P/E ratio are often very high for Tesla compared to other automakers.

- The company’s valuation often includes expectations of future revenue streams from areas like autonomous robotaxis. It’s important to consider multiple perspectives and conduct thorough due diligence when assessing Tesla’s valuation.

How does Tesla's stance on ESG (Environmental, Social, and Governance) affect its stock?

Tesla’s ESG profile is complex:

- Environmental: Tesla’s EV and renewable energy products contribute positively to environmental goals.

- Social: Labour practices and workplace conditions have faced scrutiny.

- Governance: Concerns about board independence and Elon Musk’s outsized influence. ESG-focused funds have both included and excluded Tesla, reflecting this complexity. The company’s ESG performance can influence institutional investment decisions and, consequently, the stock price.

How might future developments in autonomous driving affect Tesla's stock?

Advancements in autonomous driving could significantly impact Tesla’s stock:

- Full Self-Driving (FSD) capability could open new revenue streams (e.g., robotaxis).

- Regulatory approval for higher levels of autonomy could give Tesla a competitive edge.

- Safety performance of autonomous features influences public perception and potential liability.

- Success or setbacks in this area can lead to major stock price movements due to its potential to reshape Tesla’s business model.

Revolutionize your trading strategy with Permutable’s Trading Co-Pilot

Experience the power of instant analysis with our Trading Co-Pilot (BETA). This cutting-edge tool allows you to see the factors influencing Tesla’s stock price in real time, providing you with a competitive edge in the market. Currently available for trial to select enterprise clients, our Trading Co-Pilot offers unparalleled insights into Tesla and other high-profile stocks. Don’t just follow the market – stay ahead of it. Contact us today to learn how you can be among the first to leverage this game-changing technology in your investment strategy.