To say the world has become an increasingly volatile place to do business is no exaggeration. With that being the case, it’s absolutely no wonder that geopolitical risk data has become the unsung hero of many of today’s critical decisions. From assessing the stability of a country to predicting the impact of social unrest, geopolitical risk data provides a treasure trove of insights for businesses, investors, and policymakers. The fact is that thanks to the advancements in technology such a LLM transformers – which is the foundation of what we use at Permutable AI – this data revolution means that the provision of real-time in-depth geopolitical risk sentiment analysis can make or break strategic decisions.

Why geopolitical risk data matters

One thing above all is certain. understanding geopolitical risks isn’t just an option in the current business climate; it’s a necessity. Imagine you’re a business executive eyeing an expansion into a new market. Geopolitical risk data can shed light on the political, economic, and social dynamics at play, helping you make informed decisions. It’s like having a crystal ball that highlights potential pitfalls and opportunities.

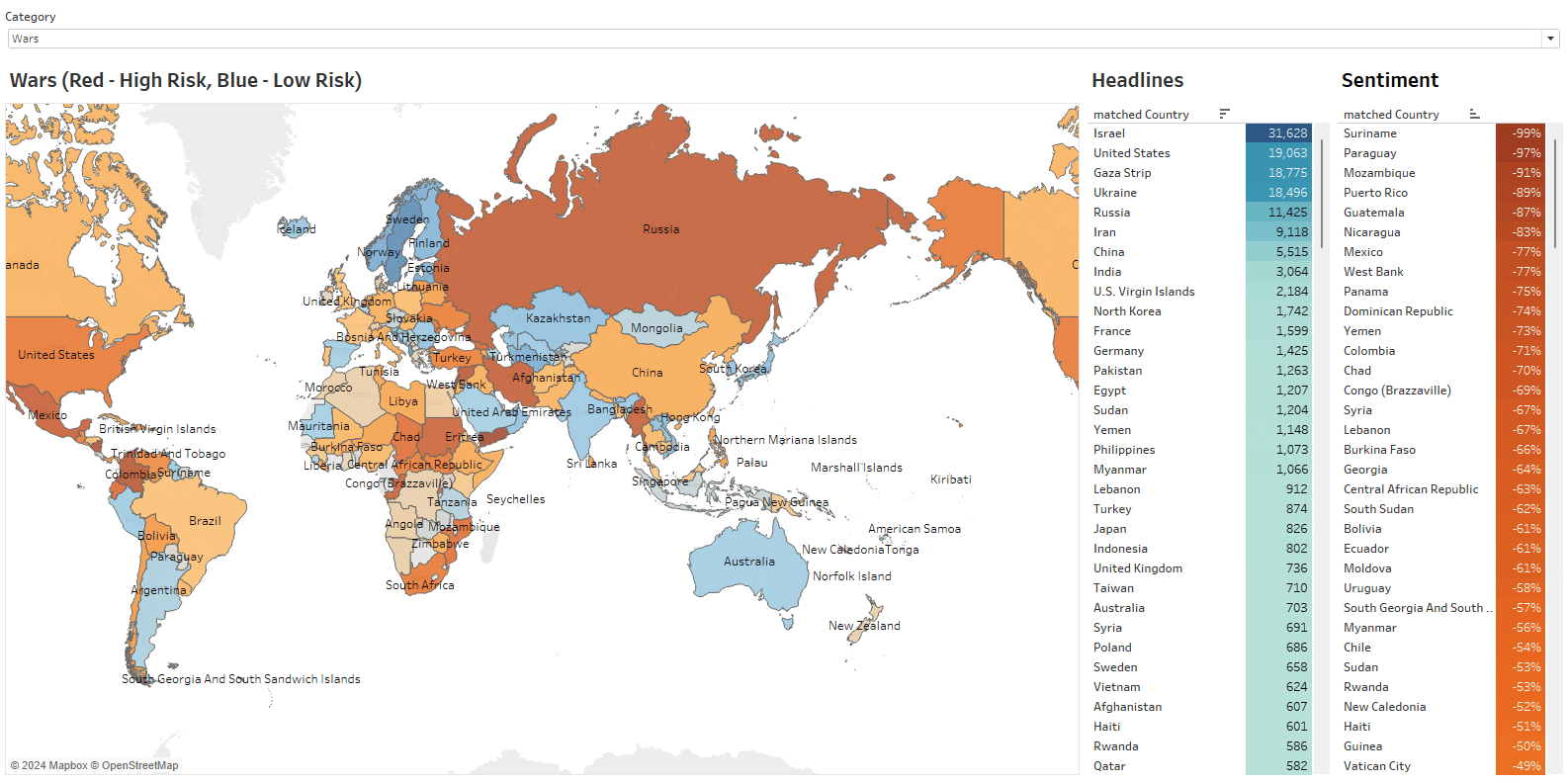

Take, for example, Permutable AI’s geopolitical risk sentiment analysis. By tapping analysing vast amount of news data related to geopolitical risk in real-time data, we’re able to provide businesses with actionable insights that can guide everything from market entry strategies to supply chain adjustments. The point is, this isn’t just about avoiding risks; it’s about seizing opportunities that others might miss.

The power of informed decision-making

Business is harder than ever and competition is fierce. But geopolitical risk data can give decision-makers competitive edge in several ways. For instance, our geopolitical analysis digs into the political and economic factors that could impact operations, giving businesses a clearer picture of the landscape.

Needless to say, identifying potential risks is half the battle. Armed with this knowledge, companies can develop strategies to manage and mitigate these risks. Whether it’s diversifying supply chains or adjusting market entry plans, geopolitical risk data is invaluable. Additionally, in the fast-paced business world, staying ahead of the curve is crucial. Companies that effectively leverage geopolitical risk data can anticipate market changes and identify new opportunities before their competitors.

Real-world applications of geopolitical risk data

Risk assessment and mitigation for international businesses

When it comes to businesses operating internationally, geopolitical risk data is a game-changer. It can help to identify potential risks and develop strategies to manage them. For instance, our data and analysis can highlight political instability or economic downturns in specific regions, allowing companies to adjust their strategies accordingly. The key here is a proactive approach, which not only ensures business continuity but also protects investments and assets.

Investment decision-making

We know from our clients that investors rely heavily on geopolitical risk data to make informed decisions. By evaluating the stability and growth potential of different markets, they can allocate their capital more wisely. Our sentiment analysis helps investors makes strides when assessing the risks and rewards associated with various opportunities, leading to higher risk-adjusted returns. Not only that, it also enables companies to stay ahead of regulatory changes and adapt to evolving geopolitical landscapes.

Supply chain management

There’s no question that in today’s global supply chain network, understanding geopolitical risks is crucial. First and foremost, geopolitical risk data can map and assess risks associated with supply chains, such as trade disputes or natural disasters. Ultimately, geopolitical risk insights provide organizations with valuable information to help diversify and optimize supply chains, ensuring resilience and continuity. Additionally, this data helps companies identify potential bottlenecks and develop contingency plans to mitigate disruptions effectively.

Insurance underwriting and risk assessment

For insurers, accurately pricing risks is vital. So where does geopolitical risk data come into play? This type of data allows them to understand the risks associated with different regions and industries. In this case, geopolitical risk data helps insurers develop tailored products and enhance their overall risk management strategies, ensuring they are well-prepared for any eventuality. It also enables insurers to improve their portfolio diversification and make more informed decisions about reinsurance arrangements.

Government and policy-making

Increasingly, governments and policymakers are also benefitting from geopolitical risk data, aiding in national security assessments, economic policy formulation, and disaster preparedness. That means governments can develop more effective policies and allocate resources more efficiently. It also supports international cooperation and diplomacy efforts by providing a clearer understanding of global dynamics and potential threats.

Corporate Social Responsibility initiatives

There’s no question that geopolitical risk data can significantly impact how companies design and implement their CSR initiatives. First and foremost, understanding the social and political dynamics of a region allows companies to tailor their CSR efforts to address local needs more effectively. For example, our data can highlight areas where environmental or social issues are particularly pressing, enabling businesses to focus their resources where they can make the most significant impact. This not only benefits the community but also enhances the company’s reputation and stakeholder relations.

Crisis management and emergency response planning

In an era where crises can bubble up unexpectedly – from political upheavals to natural disasters – having robust emergency response plans is essential. Geopolitical risk data provides critical insights into potential crisis hotspots and helps organizations prepare for various scenarios. As a result, companies using this data can develop comprehensive crisis management strategies, ensuring they are ready to respond swiftly and effectively when a crisis occurs. Case in point – our real-time geopolitical data and analysis can be particularly valuable in monitoring developing situations and providing up-to-date information to guide response efforts.

Key considerations when using geopolitical risk data

While the benefits of geopolitical risk data are clear, it’s crucial to use this data judiciously. First and foremost, ensure the data is sourced from reputable and credible providers like Permutable AI, known for their accurate and insightful analysis. It’s also vital that the data is regularly updated to reflect the latest developments and changes in the global landscape.

Interpreting geopolitical risk data within the broader context of the relevant region, industry, or organization is essential. This means considering historical trends, cultural nuances, and socio-political factors that might influence the data. A holistic approach to interpretation leads to more accurate assessments and strategic decisions. Combining quantitative data, such as economic indicators and political stability indexes, with qualitative insights like expert analysis and on-the-ground intelligence provides a more comprehensive understanding of geopolitical risks. This mixed-methods approach can uncover deeper insights and nuances that numbers alone might miss.

Transparency and objectivity in the data are also crucial. Look for providers that offer clear and unbiased assessments, as data influenced by biases or political agendas can skew analysis. An objective provider ensures that the data is presented without undue bias, offering a clear and accurate picture of the risks. Additionally, regular monitoring and updating of geopolitical risk assessments are vital because geopolitical landscapes can change rapidly. This ensures that decisions and strategies remain relevant and effective, allowing for adaptation to new information and trends, which is key to maintaining a proactive stance in risk management.

Finally, integrating geopolitical risk data into broader strategic planning processes ensures that it informs all aspects of decision-making. This integration helps align risk management strategies with overall business or policy objectives, maximizing the value of the data and making it a powerful tool for navigating the complexities of the global landscape.

Navigating the global landscape

In today’s complex world, effectively managing geopolitical risks is crucial. The bottom line is this: by leveraging geopolitical risk data, organizations, investors, and policymakers can make strategic decisions that mitigate threats and capitalize on opportunities. Companies like Permutable AI are leading the way, developing the tools needed to surface geopolitical insights in real-time in the ever-changing global landscape.

Ready to see how AI-driven geopolitical risk intelligence can transform your decision-making? Contact us for a demo of our AI-driven news sentiment analysis which is available through our Trading Co-Pilot subscription, or to request a free trial. You can also access top-line geopolitical insights through our Real-Time Geopolitical Insights & AI Market Sentiment Analysis Dashboard which is publicly available to view.