In a world of increasing global interconnectedness, it has become increasingly critical for businesses to navigate the complex and ever-evolving landscape of geopolitical risk. Geopolitical risk refers to the potential for political, economic, and social instability in different regions of the world to impact the operations, investments, and overall well-being of organisations and individuals. As the global landscape undergoes significant shifts, the ability to anticipate and respond to these risks has become a critical skill for success in the modern business environment.

This article aims to provide a comprehensive guide to navigating geopolitical risk 2024, equipping readers with the knowledge and tools necessary to anticipate and mitigate the potential impacts of global trends on their operations and investments.

Geopolitical risk 2024: Anticipating global geopolitical trends

In an increasingly volatile and unpredictable world, the ability to anticipate global trends has become essential for businesses and individuals seeking to maintain a competitive edge and ensure long-term resilience. By staying ahead of the curve and proactively addressing potential geopolitical risks, organisations can better position themselves to capitalise on emerging opportunities, minimise disruptions, and safeguard their operations and investments.

Anticipating global trends also allows for more informed decision-making, enabling businesses to develop contingency plans, diversify their portfolios, and adapt their strategies to changing market conditions. This proactive approach can help organisations stay agile and responsive, ultimately enhancing their chances of success in an uncertain global landscape..

Key geopolitical tensions to watch in 2024

As the world continues to navigate the complexities of the post-pandemic era, several key geopolitical tensions are expected to shape the global landscape in 2024. These include:

US-China strategic competition

The ongoing rivalry between the United States and China, characterized by trade disputes, technological competition, and potential flashpoints over issues like Taiwan, remains a central driver in global affairs. This competition has far-reaching implications for economic relations, technological innovation, and geopolitical stability worldwide.

Conflicts in the Middle East

Continued tensions and instability in regions such as the Persian Gulf, the Levant, and North Africa, driven by factors like sectarian divisions, proxy wars, and the influence of regional powers, pose significant risks to global energy markets and security. Managing these conflicts requires careful diplomacy and strategic engagement to prevent further escalation and mitigate humanitarian crises.

European security challenges

The fallout from the Russia-Ukraine conflict, internal tensions within the European Union, and the ongoing implications of Brexit continue to shape the geopolitical landscape in Europe. These challenges highlight the importance of cooperation among European nations and their allies to address common security threats and promote stability in the region.

Emerging markets volatility

Developing economies, particularly in regions like Latin America, Africa, and parts of Asia, face increased political and economic volatility due to factors such as social unrest, resource scarcity, and the impact of global economic trends. Managing risks in these markets requires robust governance frameworks, proactive risk management strategies, and investments in sustainable development to foster resilience and stability.

Cyber and technological warfare

The growing importance of cybersecurity, the race for technological dominance, and the potential for digital conflicts to escalate into physical confrontations are significant concerns in the geopolitical landscape. As nations and non-state actors increasingly leverage technology for strategic purposes, addressing cyber threats and promoting responsible use of emerging technologies are critical for safeguarding global security and stability.

By closely monitoring these and other emerging geopolitical tensions, businesses and individuals can better anticipate and mitigate the potential impacts on their operations, investments, and overall well-being.

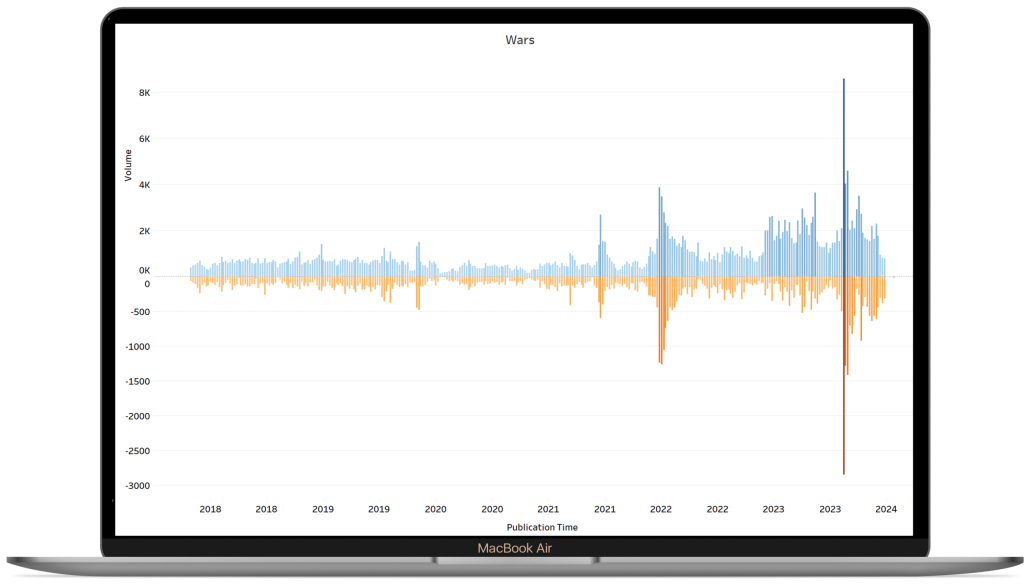

Above: Permutable AI’s global conflict sentiment tracker

Assessing the impact of geopolitical risk on businesses

Geopolitical risks can have far-reaching consequences for businesses, impacting a wide range of areas, including:

Supply chain disruptions

Geopolitical risks, including political instability, trade disputes, and logistical challenges, can disrupt the smooth flow of goods, materials, and services along supply chains. These disruptions may result in delays in production, increased costs associated with alternative sourcing or transportation, and challenges in meeting customer demands. Businesses reliant on global supply chains are particularly vulnerable to such disruptions, which can ultimately impact their overall efficiency and competitiveness in the market. Implementing strategies such as diversifying suppliers, establishing contingency plans, and investing in supply chain visibility technologies can help mitigate these risks and enhance supply chain resilience.

Market access and investment restrictions

Changing political dynamics, economic sanctions, and regulatory shifts can pose significant challenges for businesses seeking to access new markets or expand their operations internationally. Such restrictions may limit the ability of businesses to establish presence in lucrative markets, make strategic investments, or engage in cross-border trade. Navigating these complexities requires businesses to stay abreast of evolving geopolitical developments, engage in proactive risk assessments, and diversify their market portfolios to reduce dependency on high-risk regions. Additionally, forging partnerships with local entities, leveraging diplomatic channels, and advocating for favorable trade policies can help mitigate the impact of market access restrictions and foster sustainable growth opportunities.

Financial volatility

Geopolitical tensions often contribute to financial market volatility, including fluctuations in currency exchange rates, stock prices, and commodity markets. These fluctuations can have significant implications for businesses, affecting revenue streams, profit margins, and investment decisions. Businesses with exposure to international markets must carefully monitor geopolitical developments and their potential impact on financial markets. Implementing robust risk management strategies, such as hedging against currency risks, diversifying investment portfolios, and maintaining adequate liquidity, can help mitigate the adverse effects of financial volatility and safeguard financial stability.

Operational continuity

Geopolitical risks, such as civil unrest, terrorist attacks, extreme weather events and natural disasters, can pose threats to a business’s physical assets, personnel, and overall operational continuity. Ensuring business continuity in the face of such threats requires the implementation of comprehensive risk management plans and contingency measures. This may include establishing emergency response protocols, enhancing physical security measures, and diversifying operational facilities to minimize single-point-of-failure risks. Additionally, investing in technologies such as remote monitoring systems, cloud-based infrastructure, and disaster recovery solutions can help businesses maintain operational resilience and minimize disruptions during times of crisis.

Reputational risks

Businesses operating in geopolitically sensitive regions or engaging in controversial activities may face reputational risks stemming from associations with political controversies, human rights violations, or unethical practices. Protecting brand reputation and maintaining stakeholder trust is essential for long-term success and sustainability. Businesses must prioritize corporate social responsibility initiatives, uphold ethical business practices, and demonstrate transparency and accountability in their operations. Proactively engaging with stakeholders, including customers, investors, and regulatory authorities, and addressing concerns through open dialogue and timely actions can help mitigate reputational risks and preserve brand integrity in the face of geopolitical challenges.

By comprehensively understanding the potential impact of geopolitical risks on their operations, businesses can proactively identify vulnerabilities, develop contingency plans, and implement risk mitigation strategies. Building resilience in the face of geopolitical uncertainties enables businesses to navigate turbulent environments more effectively and sustain long-term growth and success.

By understanding the potential impact of geopolitical risks on their operations, businesses can develop more effective strategies for mitigating these challenges and building resilience in an uncertain global landscape.

Strategies for navigating geopolitical risk in 2024

As businesses and individuals navigate the complexities of geopolitical risk 2024, several key strategies can be employed to enhance their resilience and adaptability:

Diversification

Spreading operations, investments, and supply chains across multiple regions and markets can help mitigate the impact of localized geopolitical disruptions. By diversifying geographic presence, businesses reduce their exposure to risks in any single location. This strategy provides resilience against sudden changes in political, economic, or social conditions in specific regions, allowing businesses to maintain continuity and stability in their operations.

Scenario planning

Developing and regularly updating contingency plans for a range of potential geopolitical scenarios can enable more agile and responsive decision-making. Scenario planning involves identifying and analyzing various geopolitical risks, such as political instability, trade conflicts, or natural disasters, and developing strategies to mitigate their impact. By simulating different scenarios and their potential consequences, businesses can anticipate challenges, adapt their strategies, and implement proactive measures to safeguard their interests.

Stakeholder engagement

Maintaining open communication and collaboration with key stakeholders, including government agencies, industry partners, and local communities, can help organizations better anticipate and respond to geopolitical risks. Engaging with stakeholders allows businesses to gather valuable insights, exchange information, and build mutually beneficial relationships. By understanding the perspectives and interests of different stakeholders, organizations can identify potential risks early, address concerns effectively, and leverage collective expertise to navigate complex geopolitical environments.

Technological adoption

Leveraging emerging technologies, such as data analytics, artificial intelligence, and blockchain, can enhance an organization’s ability to monitor, analyze, and respond to geopolitical developments in real-time. Advanced analytics tools can process vast amounts of data from diverse sources, allowing businesses to identify patterns, trends, and potential risks more effectively. Artificial intelligence algorithms can automate risk assessments, predict future scenarios, and provide actionable insights to support decision-making. Additionally, blockchain technology offers secure and transparent data sharing capabilities, enabling better coordination and collaboration among stakeholders in complex geopolitical environments.

By adopting a multifaceted approach to geopolitical risk management, businesses and individuals can increase their chances of weathering the challenges and capitalising on the opportunities presented by the evolving global landscape.

Case studies: How companies have successfully managed geopolitical risk

To illustrate the practical application of geopolitical risk management strategies, let’s examine a few case studies of companies that have navigated complex geopolitical environments effectively:

Unilever’s diversification in emerging markets

Unilever, the multinational consumer goods company, recognized the growth potential of emerging markets such as Africa, Asia, and Latin America. To mitigate the impact of localized political and economic instability in these regions, Unilever strategically diversified its operations and supply chains. By establishing production facilities, distribution networks, and local partnerships in multiple countries, Unilever spread its risk across different geographic regions, reducing its dependence on any single market. This diversification strategy not only helped the company navigate geopolitical challenges but also allowed it to capitalize on the opportunities presented by rapidly evolving consumer demographics and preferences in emerging markets.

Volkswagen’s scenario planning in China

Faced with the uncertainties of the US-China trade dispute and other geopolitical tensions, Volkswagen, the leading automotive manufacturer, implemented a robust scenario planning process to anticipate and respond to potential geopolitical developments. By evaluating multiple scenarios, including trade restrictions, tariffs, and regulatory changes, Volkswagen gained insights into the potential impacts on its production, supply chain, and market demand in China. Armed with this foresight, the company was able to adjust its strategies accordingly, such as optimizing production schedules, diversifying its supplier base, and exploring alternative market opportunities. This proactive approach enabled Volkswagen to maintain its competitiveness and profitability in the Chinese market despite geopolitical uncertainties.

Navigating geopolitical challenges: Coca-Cola’s strategic resilience

Coca-Cola, the global beverage giant, has adeptly managed geopolitical challenges, particularly in regions like the Middle East, where political instability poses significant risks. Adopting a multifaceted approach, the company decentralizes its supply chain by establishing manufacturing plants and distribution centers across various countries in the region. This strategy not only enhances supply chain resilience but also fosters stronger relationships with local communities and governments. Additionally, Coca-Cola has invested in stakeholder engagement and corporate diplomacy, collaborating with local authorities and NGOs to address socio-political challenges and build trust. Leveraging advanced data analytics, Coca-Cola proactively monitors geopolitical developments to anticipate and mitigate risks, enabling the company to adapt its strategies and operations swiftly.

These case studies demonstrate the value of adopting a proactive and multifaceted approach to geopolitical risk management, leveraging strategies such as diversification, scenario planning, and risk transfer mechanisms to navigate complex global environments.

The role of geopolitical risk analysis in decision-making

Geopolitical risk analysis plays a crucial role in informing the decision-making processes of businesses, governments, and individuals. By providing a comprehensive understanding of the global landscape and the potential impacts of geopolitical events, geopolitical risk analysis can help guide a wide range of strategic decisions, including:

Investment decisions

Geopolitical risk analysis provides essential data and insights for evaluating potential investment opportunities. By assessing the political, economic, and social stability of different regions or markets, organizations can identify and mitigate risks associated with specific investments. This analysis informs decisions regarding asset allocation, portfolio diversification, and risk management strategies, ensuring prudent investment decisions that align with long-term objectives.

Market entry and expansion strategies

Insights from geopolitical risk analysis inform organizations’ decisions about entering new markets or expanding their operations. By understanding the geopolitical dynamics of target markets, including regulatory environments, geopolitical tensions, and cultural factors, businesses can develop informed market entry and expansion strategies. This analysis guides decisions regarding market selection, entry timing, localization strategies, and partnerships, minimizing risks and maximizing opportunities for success.

Supply chain and logistics planning

Geopolitical risk analysis supports the development of resilient and adaptable supply chain and logistics strategies. By assessing geopolitical risks such as political instability, trade disputes, and natural disasters, organizations can identify vulnerabilities in their supply chains and proactively implement risk mitigation measures. This analysis informs decisions regarding supplier selection, distribution network design, inventory management, and contingency planning, ensuring continuity of operations and minimizing disruptions.

Crisis management and contingency planning

Anticipating potential geopolitical crises is essential for organizations to develop robust crisis management and contingency plans. Geopolitical risk analysis enables organizations to identify potential triggers for crises, assess their potential impact, and develop response strategies to mitigate risks and minimize disruptions. This analysis informs decisions regarding crisis communication, resource allocation, stakeholder engagement, and business continuity planning, ensuring effective response and resilience in the face of geopolitical challenges.

Policy and regulatory compliance

Geopolitical risk analysis helps organizations navigate complex regulatory environments and ensure compliance with evolving policies and sanctions. By monitoring geopolitical developments, organizations can anticipate changes in regulations, sanctions regimes, and political dynamics that may impact their operations. This analysis informs decisions regarding risk assessment, regulatory compliance strategies, legal due diligence, and reputational risk management, safeguarding organizations from legal and reputational consequences.

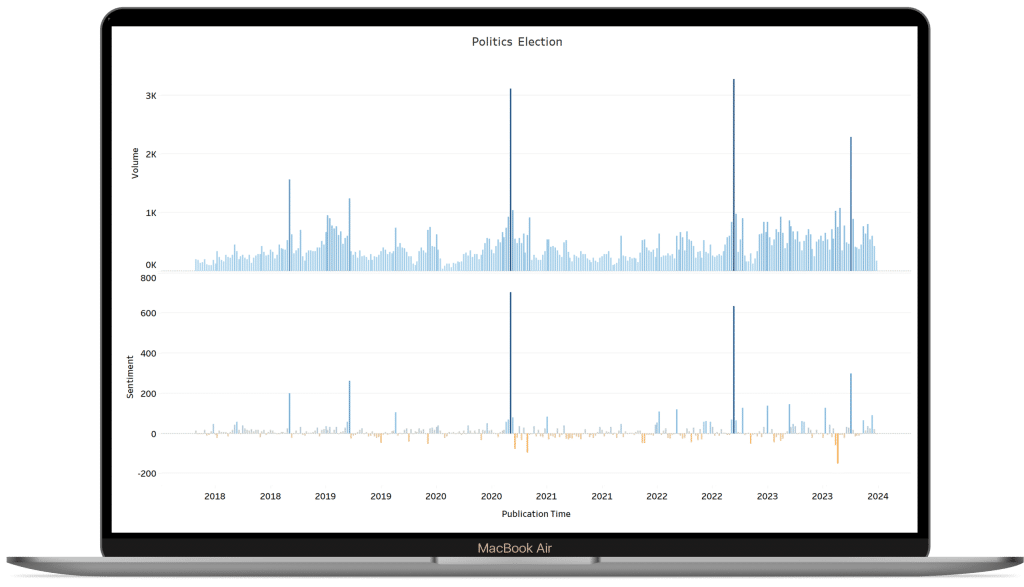

Above: Permutable AI’s global elections sentiment tracker

Real-time geopolitical risk monitoring with Permutable AI’s Political Data Intelligence

At Permutable AI, our Political Data Intelligence leverages advanced algorithms and machine learning techniques to provide real-time analysis of geopolitical risks, empowering businesses, governments, and individuals to make informed decisions in an ever-changing global landscape.

Real-time monitoring

Permutable AI continuously monitors a vast array of data sources, including news articles, social media feeds, government reports, and expert analyses, to track geopolitical developments as they unfold. By aggregating and analyzing this real-time data, Permutable AI identifies emerging trends, geopolitical hotspots, and potential risk factors, enabling users to stay ahead of the curve and react swiftly to changing circumstances.

Sentiment analysis

At Permutable AI, we employ sentiment analysis techniques to assess the tone and context of geopolitical events and discussions. By analyzing public sentiment expressed in public sources, our algorithms can gauge the level of optimism, concern, or unrest surrounding specific geopolitical issues. This sentiment analysis provides valuable insights into the potential impact of geopolitical events on public opinion, market sentiment, and stakeholder perceptions.

Risk assessment

Our technology is able to analyze various factors, including political stability, economic indicators, social unrest, and regulatory developments in order to generate risk scores and heatmaps that highlight areas of heightened geopolitical risk, allowing users to prioritize attention and resources where they are most needed. Additionally, our technology is able to identify potential cascading effects and interconnected risks, enabling users to anticipate and mitigate the broader implications of geopolitical events.

Predictive analytics

Leveraging predictive analytics capabilities, we are currently developing the capability to forecast upcoming geopolitical trends and scenarios based on historical data, trend analysis, and scenario modeling. By identifying patterns and correlations in past events, our algorithms can predict potential outcomes and trajectories for geopolitical developments, helping users anticipate risks and opportunities well in advance. This predictive intelligence enables proactive decision-making and strategic planning, enabling users to adapt their strategies and allocate resources effectively in anticipation of future geopolitical challenges.

Geopolitical risk 2024: Building resilience in an uncertain world

As the world continues to grapple with the challenges and uncertainties of the post-pandemic era, the ability to anticipate and navigate geopolitical risk has become increasingly vital for businesses, governments, and individuals alike. By leveraging a comprehensive understanding of global trends, data-driven risk analysis, and proactive mitigation strategies, organisations can build resilience and adaptability in the face of an ever-evolving geopolitical landscape.

Ready to see how AI-driven geopolitical risk intelligence can transform your decision-making? Contact us for a demo of our AI-driven news sentiment analysis which is available through our Trading Co-Pilot subscription, or to request a free trial. You can also access top-line geopolitical insights through our Real-Time Geopolitical Insights & AI Market Sentiment Analysis Dashboard which is publicly available to view.

Request demo

Ready to see how AI-driven geopolitical risk intelligence can transform your decision-making? Contact us for a demo of our AI-driven news sentiment analysis which is available through our Trading Co-Pilot subscription, or to request a free trial. You can also access top-line geopolitical insights through our Real-Time Geopolitical Insights & AI Market Sentiment Analysis Dashboard which is publicly available to view.