This commodities market news roundup is aimed at institutional investors, commodity traders, and market analysts seeking to better understand the forces driving this week’s volatile commodity markets – from geopolitical tensions to weather disruptions – and how advanced AI tools like Permutable AI’s Trading Co-Pilot can provide a critical edge in navigating them.

This week’s commodities markets have presented a fascinating complex of conflicting forces, with geopolitical tensions, weather disruptions, and evolving supply dynamics creating significant price volatility across multiple asset classes. Drawing from our Trading Co-Pilot’s comprehensive analysis there have been several key themes that dominated market sentiment and price discovery mechanisms throughout the trading period.

The overarching narrative this week centered on the delicate balance between supply-side disruptions and demand-side uncertainties, with geopolitical risk premiums playing an increasingly prominent role in price formation. Notably, the interplay between U.S.-China trade dynamics, OPEC+ production decisions, and weather-related supply concerns created a complex web of interdependencies that our analytical models flagged as particularly significant for near-term price trajectories.

Commodities market news: Energy

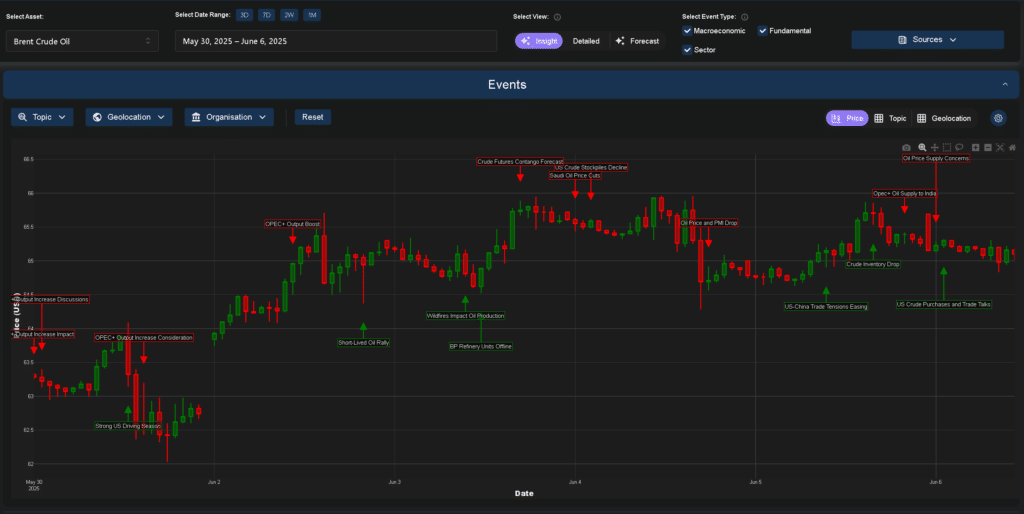

The energy sector exhibited remarkable resilience this week, with crude oil markets demonstrating their characteristic sensitivity to both fundamental supply-demand metrics and geopolitical developments. OPEC+’s confirmed 411,000 barrel per day production increase for July served as a cornerstone event, providing markets with much-needed clarity regarding supply expectations. However, this bullish supply signal was consistently tempered by ongoing concerns about global demand trajectories, particularly following the OECD’s revised growth forecasts.

What proved particularly noteworthy was the market’s reaction to news this week of refinery disruptions, most prominently the outages at BP’s Rotterdam facility, which our algorithms identified as a critical supply-side catalyst driving intraday volatility. Concurrently, the Canadian wildfire situation, which knocked out approximately 350,000 barrels per day of production, highlighted the persistent vulnerability of North American supply chains to weather-related disruptions.

Above: Our Trading Co-Pilot’s tracking of commodities market news for Brent Crude Oil sentiment (30 May – 6 June 2025), highlighting key geopolitical, macroeconomic, and fundamental events illustrating the significant impact of OPEC+ decisions, refinery outages, and US-China trade developments on intraday price volatility.

The heating oil market reflected similar dynamics, with geopolitical tensions maintaining elevated risk premiums throughout the week. The Ukrainian drone attacks on Russian airbases and ongoing conflict-related supply concerns provided consistent upward pressure, though this was partially offset by bearish supply signals and inventory builds that emerged mid-week.

Natural gas markets experienced particularly dynamic price action, driven primarily by weather forecasts and their implications for seasonal demand patterns. The emergence of above-normal summer temperature projections across key U.S. consumption regions created a bullish undercurrent that persisted despite larger-than-expected inventory builds, with the significance of the 19% rise in May’s gas price index as a key fundamental indicator supporting the bullish thesis.

Commodities market news: Agriculture

The agricultural complex presented an interesting narrative this week, with weather-related supply concerns intersecting with evolving trade relationships to create significant price volatility. Wheat markets, in particular, demonstrated exceptional sensitivity to geopolitical developments, with Russian strikes on Ukrainian ports providing consistent upward momentum that our analytical systems flagged as a sustained bullish catalyst.

The emergence of agroterrorism-related fungus concerns added an entirely new dimension to agricultural risk premiums, representing a novel supply-side threat that markets are still learning to price appropriately. This development, combined with drought conditions affecting Chinese wheat harvests, created a compelling bullish narrative that sustained price advances throughout the latter half of the week.

Corn markets exhibited their characteristic responsiveness to weather patterns, with Central Illinois rainfall providing relief to drought-stressed crops. However, this positive weather development was consistently balanced against ongoing trade uncertainties and the specter of tariff escalations that continued to weigh on export prospects.

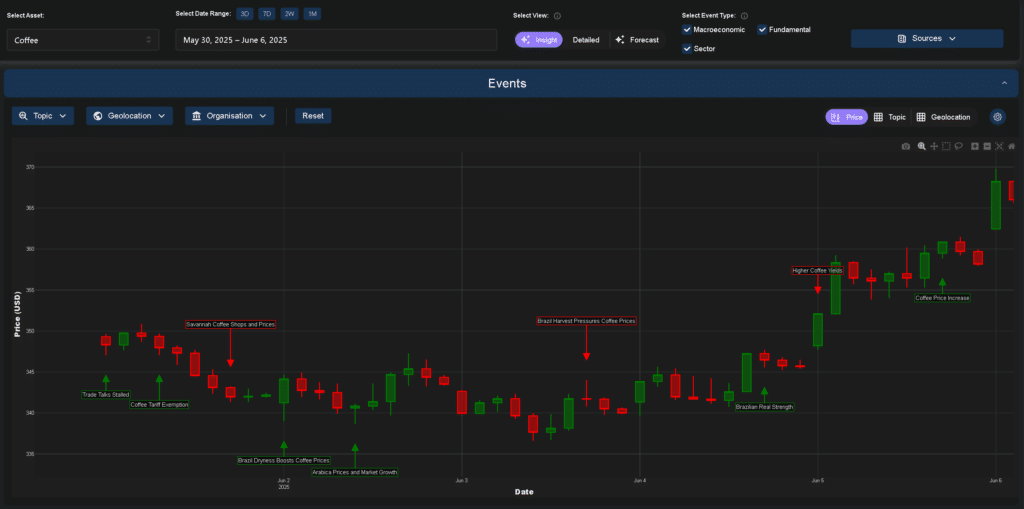

Meanwhile, coffee markets demonstrated remarkable resilience, with Brazilian weather concerns and currency dynamics creating a potent combination of bullish factors. The strengthening of the Brazilian real provided crucial support for producer pricing power, while weather-related supply concerns in key growing regions maintained elevated risk premiums throughout the trading period.

Above: Coffee price drivers over the week, with key macroeconomic and fundamental events tracked by our Trading Co-Pilot. This snapshot of commodities market news sentiment for coffee highlights notable drivers include Brazilian weather conditions, currency fluctuations, trade developments, and harvest yield updates – all contributing to intraday volatility and directional momentum.

Looking now to soybeans, which reflected the broader trade narrative, with U.S.-China relations serving as a primary driver of sentiment and price discovery. The announcement of a $2 billion U.S.-Vietnam agricultural agreement provided a counterbalance to ongoing trade tensions, highlighting the market’s increasing focus on supply chain diversification strategies.

Cotton markets demonstrated their sensitivity to both weather patterns and trade dynamics, with monsoon forecasts for key producing regions creating significant intraday volatility. The closure of the ‘de minimis’ trade loophole represented a structural shift that our analytical models identified as potentially significant for longer-term price trends.

Concurrently, sugar markets continued to grapple with the fundamental challenge of abundant global supplies, with production forecasts consistently pointing toward oversupply conditions that weighed on price discovery mechanisms throughout the week. However, weather-related supply concerns in key producing regions provided periodic relief rallies that demonstrated the market’s ongoing sensitivity to production disruptions.

Commodities market news: Metals

The precious metals complex delivered some of the week’s most impressive performances, with gold reaching new highs above $3,400 per ounce as central bank dovishness and geopolitical uncertainties combined to create powerful bullish momentum. The European Central Bank’s 25 basis point rate cut served as a catalyst for renewed institutional interest, while the Federal Reserve’s increasingly dovish rhetoric provided sustained support for dollar-denominated safe-haven assets.

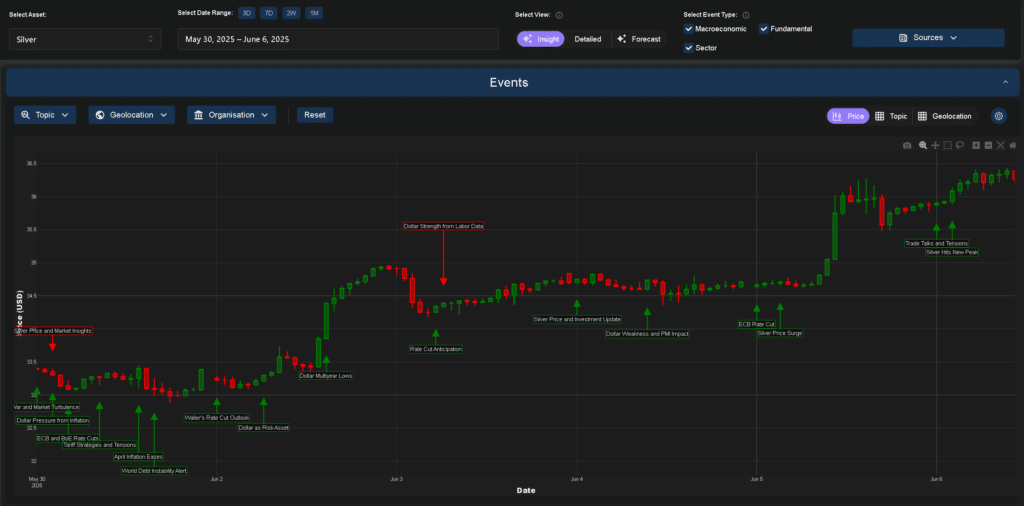

Silver’s breakout above $35 per ounce represented a particularly significant technical development, with our momentum algorithms identifying this move as potentially sustainable given the underlying fundamental drivers. The combination of tight physical inventories and renewed industrial demand created a compelling supply-demand imbalance that institutional flows have begun to exploit.

Above: Silver price movements over the week, highlighting key macroeconomic and fundamental events uncovered by our Trading Co-Pilot. In this snapshot of commodities market news for silver, central bank rate cuts, labour data, dollar volatility, and trade developments all contributed to silver’s breakout to a new peak – demonstrating the value of real-time intelligence in volatile market conditions.

Platinum and palladium markets reflected the complex interplay between industrial demand patterns and safe-haven considerations, with both metals benefiting from the broader risk-off sentiment while maintaining their sensitivity to automotive sector developments. The emergence of supply disruption concerns, particularly related to geopolitical tensions affecting key producing regions, added an additional layer of complexity to price formation mechanisms.

Meanwhile, copper’s performance this week highlighted the metal’s unique position at the intersection of industrial demand expectations and monetary policy considerations. The combination of infrastructure spending optimism and central bank easing created a supportive backdrop, though concerns about Chinese demand growth continued to provide periodic headwinds.

Commodities market news outlook and implications

Looking ahead, commodities markets will continue to navigate the complex interplay between geopolitical developments, weather patterns, and evolving trade relationships. The persistence of central bank dovishness across major economies provides a supportive backdrop for commodity prices generally, while specific sectoral dynamics will likely continue to drive relative performance differentials.

Here, the integration of our real-time news intelligence feeds with advanced algorithmic analysis positions market participants to capitalise on emerging trends and navigate the increasingly complex landscape of global commodity markets. As we continue to monitor developments across all major asset classes using our state-of-the-art commodity market intelligence tools, the importance of this calibre of comprehensive data integration and sophisticated analytical capabilities becomes ever more apparent.

Turn market complexity into clarity with real-time AI-powered insights

In today’s volatile and data-saturated commodity markets, staying ahead of rapidly shifting dynamics is harder than ever. Many traders struggle to cut through the noise and identify actionable signals with enough speed and clarity to make confident decisions. That’s where Permutable AI’s Trading Co-Pilot comes in.

Our Auto Analyst and global macroeconomic data feeds are designed to solve this by turning complexity into clarity – delivering real-time insights you can trust. If you’re ready to move from reactive trading to strategic foresight, get in touch with our enterprise sales team to schedule a personalised demo and see how our platform can help you gain a decisive edge. Simply email enquiries@permutable.ai to speak to our team.