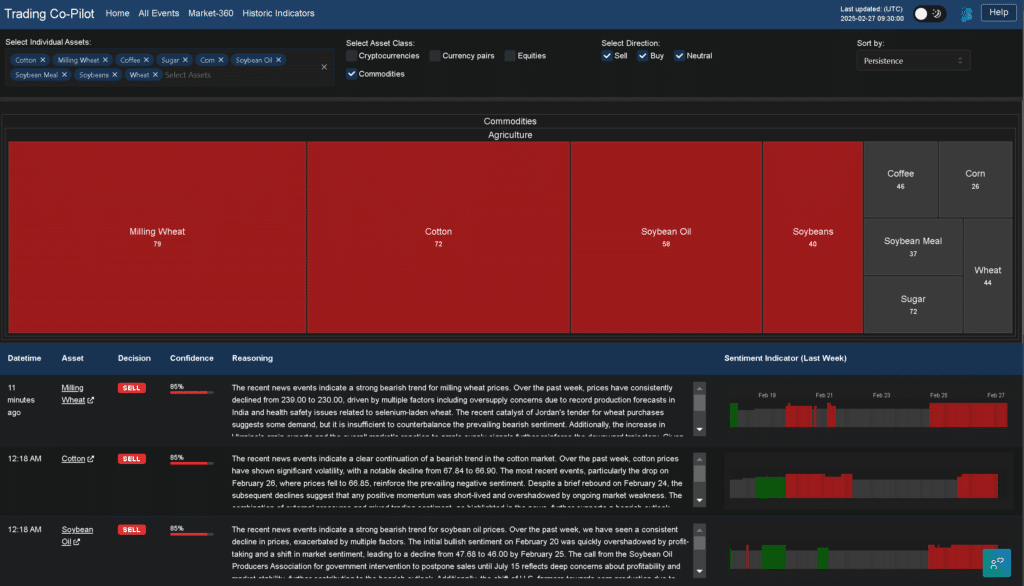

First, the obvious observation in this week’s agricultural commodities market sentiment is the predominance of bearish signals across multiple key products. Our Trading Co-Pilot analysis reveals consistent downward pressure on milling wheat, cotton, soybean oil, and soybeans, while sugar, coffee, wheat, soybean meal, and corn demonstrate more mixed indicators warranting a neutral stance.

There is no doubting that external pressures continue to mount playing out in agricultural commodities market sentiment. Record production forecasts in India have contributed to oversupply concerns for wheat, while health safety issues related to selenium-laden wheat have further dampened sentiment. The hardest part is determining whether these downward trends represent temporary market conditions or signal a more prolonged bearish cycle.

Above: Agricultural commodities market sentiment from our Market 360 feature of our Trading Co-Pilot, as of 27 Feb 2025.

Grain market sentiment

You can make the argument that Jordan’s recent tender for wheat purchases offers a glimmer of hope amid the bearish landscape. However, this isolated demand signal appears insufficient to counterbalance the prevailing negative sentiment. In a way, the increase in Ukraine’s grain exports further reinforces the downward trajectory for wheat prices, which have declined from 239.00 to 230.00 over the past week.

The question is whether these pressures will persist into the coming months. We can be reasonably confident that supply-side dynamics will continue to dominate near-term price movements, particularly as markets digest the implications of India’s production forecasts.

As for corn, the market presents a more complex picture. The truth is more complicated than a simple bullish or bearish assessment would suggest. Initial positive sentiment quickly gave way to export concerns and declining export inspections. Then there is the challenge of trade tensions and controversies surrounding genetically modified corn, further clouding the outlook.

Oilseed complex market sentiment

The present outlook for soybeans and their derivatives appears decidedly bearish. We must reject the argument being made that temporary supply disruptions will significantly alter this trajectory. The Soybean Producers Association’s call to delay sales until July 15 reflects significant anxiety among producers, suggesting they anticipate further price drops.

You can’t argue with the fact that U.S. farmers are shifting towards corn production due to unfavorable tariffs on soybeans, indicating a potential long-term structural change in production patterns. This is not to say that occasional price rebounds won’t occur, but the underlying sentiment remains negative.

In addition, the potential strike by the Argentine oilseed union adds another layer of uncertainty to the market. However, this development primarily highlights existing market pressures rather than introducing a genuinely bullish catalyst.

Softs market variations market sentiment

Everywhere you look in the cotton market, bearish signals predominate. The recent volatility, characterised by a decline from 67.84 to 66.90, reinforces the negative sentiment. Despite a brief rebound, subsequent declines suggest any positive momentum was short-lived.

Meanwhile, the sugar market presents a more mixed picture. While supply concerns initially supported price increases, the latest projections of record output in Brazil have introduced significant bearish pressure. We live in an age of highly volatile geopolitics, where production forecasts can change rapidly in response to weather events or policy shifts.

The coffee market similarly demonstrates complex dynamics, with downward pressure from recovering ICE inventories balanced against positive signals like increased demand from Uganda. If experience tells us anything, it’s that coffee prices can be particularly sensitive to weather-related supply disruptions, making the current neutral stance prudent.

Strategic implications of this agricultural commodities market sentiment

Of course, there are things that can be done to mitigate risks in this predominantly bearish environment. Diversification across commodities with different fundamentals may offer some protection, as would careful consideration of hedging strategies.

But the game changer will be how producers and major consuming nations respond to these market conditions. Will we see coordinated shifts in planting decisions? And at least let’s debate it openly: could policy interventions alter the trajectory of these markets?

Our Trading Co-Pilot’s current agricultural commodities market sentiment analysis points toward continued bearish sentiment in the near term for most agricultural commodities, however we must acknowledge that external factors like weather events or geopolitical developments could rapidly alter this outlook.

Navigating agricultural market with real-time market sentiment analysis

In a world where agricultural commodities market sentiment shifts rapidly, making sense of interconnected markets has never been more challenging. The question is: how can you consistently make optimal trading decisions when faced with complex market signals like those we’re seeing across the grain, oilseed, and softs sectors?

Our Trading Co-Pilot cuts through market noise to deliver clear, actionable intelligence and analysis on agricultural commodities market sentiment. Imagine the advantage of having AI-powered analysis that identifies emerging trends before they become obvious to the market, 24/7. What is needed is precisely what our platform delivers – comprehensive market intelligence that processes vast amounts of data to uncover hidden correlations and provide confidence-weighted recommendations.

To find out how our Trading Co-Pilot can help you navigate agricultural commodity markets with greater confidence and precision using the latest LLM-driven technology and AI-driven market sentiment analysis, get in touch with our team to request a personalised demo by emailing enquiries@permutable.ai or simply fill in the form below to apply for an enterprise trial.