A shift of historical significance is under way in the world of commodities trading. The integration of artificial intelligence is transforming how market analysis and risk management are approached, and how trading strategies are executed. Many of our readers may remember a time when commodities trading relied heavily on human intuition and manual data analysis. Today, AI in commodities trading is reshaping the landscape, offering unprecedented insights and capabilities. At Permutable, we’re proud to be at the forefront of this transformation with our Trading Co-Pilot. Let’s explore the top 10 ways AI is transforming commodities trading.

How AI in commodities trading is changing the game

1. Enhanced predictive analytics

Why is this significant? The commodities market, known for its volatility and complexity, has always presented unique challenges to traders. Problems arise when traditional methods fail to capture the nuanced interplay of global events, supply chains, and market sentiment in a timely fashion. You can perhaps see the challenge in predicting the impact of a natural disaster on crop yields or anticipating shifts in energy demand here.

What’s remarkable is that AI algorithms, like those powering our Trading Co-Pilot, can now process vast amounts of data from diverse sources, including weather patterns, geopolitical events, and economic indicators, to provide more accurate price forecasts. Even small fluctuations in predictions can lead to significant advantages in trading decisions.

2. AI in commodities trading: Automated risk management

The evidence of AI’s transformative power in risk management is becoming increasingly clear. AI systems, including our Trading Co-Pilot, can continuously monitor market conditions, assess potential risks, and automatically adjust trading strategies to mitigate losses. And you see the same root cause behind many of these advancements: the ability of AI to process vast amounts of data at speeds impossible for human traders.

3. High-frequency trading optimisation

So why are more companies not jumping on this bandwagon? The answer lies in the complexity of implementation and the need for specialised expertise – and then there’s those that prefer to keep to the old way of doing things as opposed to reaping the benefits of new technologies and advancements. Nonetheless, high-frequency trading firms have now for some time been leveraging AI to execute trades at unprecedented speeds, capitalising on minute price discrepancies across different markets.

4. Sentiment analysis and news integration

This point offers a deep lesson in the importance of real-time information processing. When seeking to ascertain market sentiment, AI can analyse news articles, social media posts, and other textual data sources to gauge public opinion and predict its impact on commodity prices. Our Trading Co-Pilot’s natural language processing capabilities allow it to sift through vast amounts of textual data, providing traders with timely insights.

5. Algorithmic trading strategies

This is clearly an important moment in the evolution of trading strategies. Many of the traditional approaches are being enhanced or replaced by AI-driven algorithms. The discovery that machine learning models can adapt to changing market conditions in real-time has led to more robust and flexible trading strategies.

6. AI in commodities trading: Advanced pattern detection

What’s remarkable is that AI can now detect intricate trading pattern formations that are often imperceptible to the human eye. Even on the most chaotic trading days, AI-powered trading pattern detection can uncover hidden opportunities and risks.

At Permutable AI, we’ve achieved a breakthrough that’s transforming the landscape of commodities trading. The evidence of this is clear: in 2020, we solved a one-shot learning classification problem to recognise trading pattern formations—a capability that remains unmatched by modern charting services. This discovery has led to the development of our R2 system, a powerful solution that deploys real-time, lightweight machine learning models across a cloud-based web server matrix.

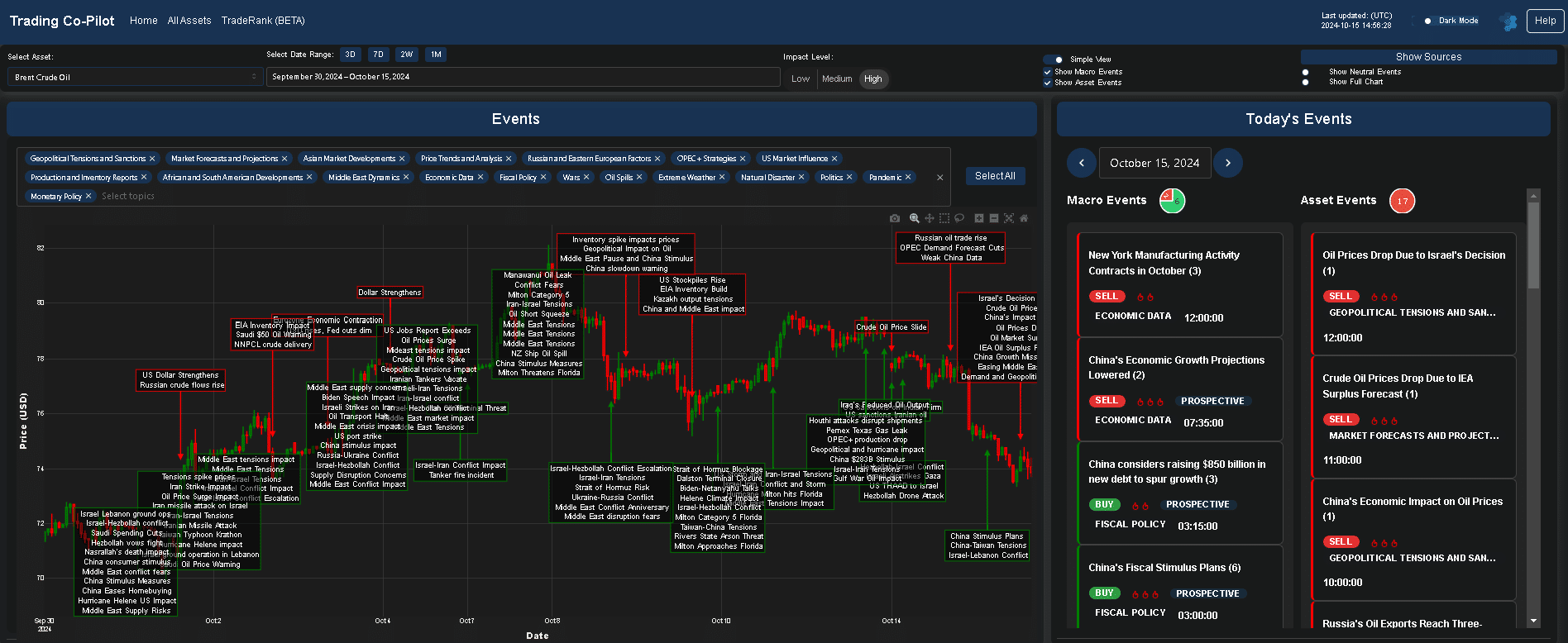

Permutable’s Trading Co-Pilot

At Permutable, we’ve developed our Trading Co-Pilot as a response to the growing need for intelligent, AI-driven trading assistance. This tool exemplifies how AI in commodities trading can be harnessed to provide real-time market insights, risk assessments, and trading recommendations across these ten transformative areas.

In turn, this has led to a growing demand for professionals who understand both the intricacies of commodities markets and the potential of AI technologies. What we’re seeing from commodities traders who are already using our Trading Co-Pilot is that our data scientists with domain expertise in commodities who have worked on developing this cutting edge tool are becoming as valuable as traditional traders. What’s incredibly exciting is that our team at Permutable reflects this shift, combining expertise in both AI and commodities trading.

There is a step-change happening and its thanks to the implementation of AI in commodities trading – which is now well underway – offering unprecedented opportunities for those willing to embrace this technology. From enhanced market analysis to sophisticated risk management strategies, AI is transforming every aspect of the trading process..

As we continue to explore the possibilities of AI in commodities trading, one thing is clear: those who adapt to this new paradigm will be best positioned to succeed in the ever-evolving world of commodities trading. With tools like our Trading Co-Pilot and our newly released API for commodities trading, traders can navigate this new landscape with confidence.

Interested in testing out our Trading Co-Pilot. Email enquiries@permutable.ai or fill in the form below and we’ll get back to you.